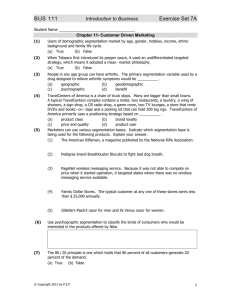

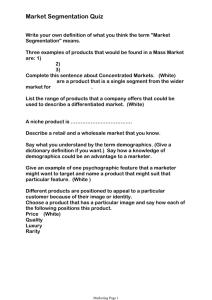

Market Segmentation, Targeting, and Positioning

advertisement