Non-Filer Statement 2015-2016 - Office of Student Financial Aid

advertisement

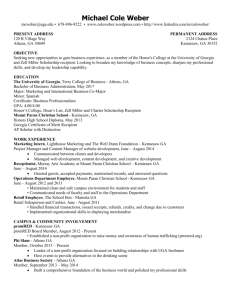

Non-Filer Statement 2015-2016 Student Name _______________________________________ KSU ID# _________________________ Relationship to student: Student Spouse Parent The following documents must be provided with this form: Verification of nonfiling (Request using IRS Form 4506-T) – This document is proof from the IRS that you did not file a tax return for the year. Form can be ordered at: http://www.irs.gov/pub/irs-pdf/f4506t.pdf or by calling 1-800-908-9946 W-2 (Wage and Tax Statement) – if any wages were earned during 2014 your employer must provide this document to you. I did not and will not file a Federal Tax Return for the year 2014. _____ I did not earn income from work in 2014. (initial) OR I earned $___________ income from work in 2014. All copies of 2014-W2 forms are attached. By signing this form, you agree to provide accurate 2014 income and tax return information. Knowingly giving false or misleading information (which is determined by the IRS documentation received) may result in the termination of your Federal Aid eligibility. Such action will result in you becoming responsible for the payment (out of pocket) of any expenses owed to Kennesaw State University. WARNING: IF YOU PURPOSELY GIVE FALSE OR MISLEADING INFORMATTION, YOU MAY BE FINED, SENTENCED TO JAIL, OR BOTH. Signature___________________________________________ Date__________________________ (Person indicated above) You must return this form, along with the required documentation to the Office of Student Financial Aid, located in Kennesaw Hall. Office of Student Financial Aid, 585 Cobb Avenue NW, MD 0119, Kennesaw, GA 30144 Phone (770) 423-6074 Fax (470) 578-9096 Revised: February 2015