DocumentDisplay

Page1 of2

CheckpointContents

FederalLibrary

I f4aterials

FederalEditoria

PracticeAids

ClientLetters

SampleExplanatoryClientLetters

2439 N4edical

expensedeductionfor specialeducationcosts

Client Letters

.il2439 Medical expense deduction for special education costs

To the practitioner:

The subjectis discussedin FederalTax Coordinatorfl K-2150UnitedStatesTax Reporterll 2134.10.

DearClient:

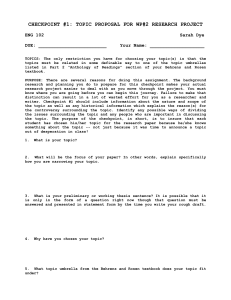

You haveaskedme whetheryou may deductthe specialeducationcostsyou are incurringon behalfof

yourchildas medicalexpenses.

Expensesthat you incur in orderto enableyour childto compensatefor or overcomedisabilitiesor to

prepareyour childfor future normaleducationor normallivingare deductiblemedicalexpenses.Thus,

any expensesfor therapythat helpsyour child'sadaptationare deductiblemedicalexpenses.In

addition,the expenses

of your child'sschooling

at a "specialschool"for mentallyor physically

disabled

individualsare deductible(includingthe cost of an ordinaryeducation)if the resourcesof the school

are the reasonfor your child'spresenceand the educationalservicesprovidedare renderedonly as an

incidentto the medicalcare provided.

The qualification

curriculum.

Thus,a school

of a schoolas a specialschooldependson the school's

qualifiesas a specialschoolonly if the primaryfocusof its currlculumis to enablestudentsto

compensatefor or overcomedisabilities,and to preparethem for future normaleducationor normal

living.For instance,schoolsthat providesspecialservicesfor childrenwith mentaland/or physical

disabilities,suchas schoolsfor the teachingof brailleor lip readingare specialschoolsbecausethe

primarypurposeof the schoolsis alleviating

or treatinga physicalhandicap.

Similarly,

schoolswith

specialprogramsfor treatingseverelearning.mental,psychological

or emotionaldisordersor dyslexia

are soeciaI schools.

In contrast,a schoolthat doesnot providea specialprogram/but is beneficialbecauseof its small

classsizeor becauseit providesaddedserviceswithin a normaiacademicsetting,is not a special

school,sincethe primarypurposeof the schoolis academic.However,if an ordinaryschoolis willingto

developa specialprogramthat meetsyour child'sneeds,the schoolwill qualifyas a specialschool,

of whethera schoolis a specialschoolis madeon the basisof your child's

sincethe determination

not the curriculum

of the schoolas a whole.

curriculum,

Of course,you cannotdeductany specialeducationexpensesto the extent the expensesare borneby

the state or localitv.In addition,the medicalexpensedeductionis limitedto the amountthat exceeds

7.5o/oof your adjustedgrossincome.

If you have any questionsregardingyour abilityto deductyour specialeducationcostsor any other

expensesthat you incuron behalfof your child,pleasefeel free to give me a call.

Very truly yours,

ENDOFDOCUN4ENT

O 2009 ThomsonReuters/RlA.All rights reserved.

2/1512009

https://checkpoint.riag.com/app/servlet/com.tta.checkpoint.servlet.CPJSPServlet?usid:12f...

PageI of 2

DocumentDisplay

CheckpointContents

FederalLibrarv

FederalEditorialMaterials

FederalTax Coordinator2d

ChapterK Deductions:Taxes,Interest,Charitable,Medical,Others

That Qualifyas MedicalExpenses-OtherThanTraveland Transportation

K-2100Expenditures

Exoenses.

institutions-when

K-2150Educational

full tuitioncostis deductible.

Federal Tax Coordinator 2d

flK-2150. Educational institutions-when

deductible.

full tuition cost is

lYedicalcare deductionsfor paymentsto educationalinstitutionsare subjectto the institutionrulesof

a1

tl K-2143. In additionto meetingthose rules,for all of the costsof attendinga schoolto be

deductible,the schoolmust be a specialschool( ll K-2153) for a mentallyor physicallyhandicapped

individual( fl K-2151). Also,that person'sconditionmust be suchthat the resourcesof the institution

for alleviatingsuch mentalor physicalhandicapare a principalreasonfor his presencethere ( 1l K2152). In sucha case,the costof attendingsucha specialschoolwill includethe costof mealsand

lodging,if supplied,and the cost of ordinaryeducationfurnishedby the schoolif that educationis

incidentalto the specialservicesfurnishedby the school(see tl K-2154), eventhoughordinary

is not medicalcare.a2

education

f/ *to observation: Thus,for the full tuition payableto an educationalinstitutionto be

deductible,taxpayersmust meet a tougherstandardthan they need meet to deductthe

full fee payableto other non- hospitalinstitutions.

i/ sa-ple €lient letter: Sampleclientletterson the medicalexpensedeductionfor

specialeducationcostsappearin ClientLettersfl 2439 .

47

RevRul70-285,1970-1CB 52 ; R e v R u l 5 8 - 2 8 0 . 1 9 5 8 - 1 C B 1 5 7 .

42

R e gI 1 . 2 1 3 - l ( e x l x v x a.)

Forthe deductibility

coststhat don'tmeetthe abovetests,seefl K-2155et seq.

of education

.T

E N DO F D O C U I V I E N

All rightsreserved.

O 2009ThomsonReuters/RlA.

2/1512009

https://checkpoint.riag.comiapplservlet/com.tta.checkpoint.servlet.CPJSPServlet?usid:12f...

DocumentDisplay

Page1 of3

CheckpointContents

FederalLibrary

FederalEditorialMaterials

FederalTax Coordinator2d

ChapterK Deductions:Taxes/Interest,Charitable,Medical,Others

That Qualifyas lvledical

K-2100Expenditures

Expenses-OtherThanTraveland Transpotation

ExDenses.

seriousenoughunderthe medicalexpensededuction

special

K-2151Whenis a condition

schoolrules.

Federal Tax Coordinator 2d

tlK-2151. When is a condition serious enough under the medical

expense deduction special school rules.

In the following cases, the condition involved was serious enough to qualify under the rules for the

deductibility, as a medical expense, of the costs of special schools, discussedat !l K-2150

... a neurological

disorder,consisting

of impairmentin the areasof visualmemoryand visual

in

a

severe

learning

with respectto reading.aa

matching,and resulting

disability

suchas (a) thoseresultingfromthe divorceof a child'sparentsand the

... emotionalproblems,

suicideof her father, manifestingthemselvesin a refusaito do schoolwork,tempertantrumsand

abuseas a resultof

vomiting,4s(b) a child'slow selfesteem,maladjustment

and psychological

ab and (c) an

with his mother,resultingin a learningdysfunction,

his detrimental

relationship

"adjustmentreactionof adolescence,

severe,with depressivefeatures."47

problemsas a resultof habitualdrug use.48

... severebehavioral

... dyslexiathat was sufficientlysevereto be a handicap.The dyslexiamust have beendiagnosed

by a physicianor other qualifiedprofessional

as a medicalconditionthat requiresspecial

l

education

to be corrected.48

44

Rev Rul 78-340, L978-2CB t24

45

creisdorf,Lawrence,(7970) 54 Tc 1684

Pazos,Jose,(1987)TC Memo1987-131, P H T C N 4f l 8 7 1 3 1 , 5 3 C C HT C M 3 3 7

47

IRS Letter Ruling 8447014

4B

Urbauer,Charles,(1992)TC Memo1992-170, RIATC Memo!192170

, 63 CCHlCM 2492

44.1

2115/2009

https://checkpoint.riag.com/app/servlet/com.tta.checkpoint.servlet.CPJSPServlet?usid:12f...

Document

Display

Page1 of2

CheckpointContents

FederalLibrarv

I N4aterials

FederalEditoria

FederalTax Coordinator2d

ChapterK Deductions:Taxes,Interest,Charitable,Medical,Others

K-2100Expenditures

That Qualifyas MedicalExpenses-OtherThanTraveland Transportation

Expenses.

K-2152Whenare the specialschool'sresourcesthe principalreasonfor its use.

Federal Tax Coordinator 2d

flK-2152. When are the special school's resourcesthe principal

reason for its use.

In the followingcases,the patient'sconditionwas suchthat the resourcesof the institutionfor

alleviatinghis mentalor physicalhandicapswere a principalreasonfor his presencethere, underthe

rulesdiscussed

at fl K-2150:

... a mentallyretardedboy enrolledin a specially

curriculum

designed

to meetthe needsof

handicapped

childrenwhoseI.Q. scoresrangedbetween50 and 75. The programwas designed

to educatestudentswho were not ableto profit from the educationthat was beingoffered

throughordinaryclassroominstruction,but whoseintellectualabilityindicatedthe possibilityof a

degreeof scholasticattainmentwith the help of speciallytrainedteachersand specialmethods

49

and materials.

... a childwho did not cooperate

at all in schooland who was oftenphysically

sick,apparently

as

resultsof her parentsdivorcingand her father committingsuicide.Shetransferredto a school

to providetrainingto studentswith learningdisabilities,particularly

that was established

psychological

ones.She attendedthe schoolat the recommendation

of the psychiatristwho had

beengiving her therapy.Althoughit was difficultfor her motherfrom a financialstandpoint,she

enrolledthe child upon his recommendation

in the expectationthat the childwould be helpedto

overcomeher emotionaldifficultiesand resultantlearninghandicap.Whenprogresswas made in

this regard,the child was withdrawnfrom the schooland beganattendingpublicschool.s0

problemsas a resuitof habitualdrug useenrolledin a

with severebehavioral

... a 17-year-old

ratoryschooldesignedto addressboth the educationaland emotionalneedsof its

college-prepa

students.The schoolfacilitatedstudents'emotionaldevelopmentthrougha holisticprogramthat

includedcommunityinteraction,peersupportand weeklytherapysessions.The schoolalso used

a multifamilytherapyprogramcalled"Parent/ChjldCommunication

Groups"to treat students'

emotionalneeds.1

49

Rev Rul 70-285, 1970-1 CB 52 .

50

Greisdort Lawrence,(1970) 54 TC 1684 .

1

Urbauer,Charles,(1992)TC Memo1992-L7O,RIATC f4emofl92170, 63 CCHTCM2492

ENDOFDOCUMENT

O 2009 ThomsonReuters/RlA.All rights reserved.

2/1512009

https://checkpoint.riag.com/app/servlet/com.tta.checkpoint.servlet.CPJSPServlet?usid:12f...

Document

)ocument Display

Page 1 of 5

CheckDoint

Contents

FederalLibrarv

FederalEditorialMaterials

FederalTax Coordinator2d

ChapterK Deductions:Taxes,Interest,Charitable,Medical,Others

That Qualifyas MedicalExpenses-OtherThanTraveland Transportation

K-2100Expenditures

Expenses.

K-2153What is a specialschoolfor purposesof the medicalexpensededuction.

Federal Tax Coordinator 2d

flK-2153. What is a special school for purposes of the medical

expense deduction.

The distinguishing

characteristic

of a specialschool,for purposesof the rulesat 1l K-2150, is the

substantivecontentof its curriculum.The curriculumof a specialschoolmay includesomeordinary

education,but this must be incidentalto the primarypurposeof the school,whichis to enablestudents

to compensatefor or overcomehandicaps,to preparethem for future normaleducationor normal

living.2

2

Reg5 1.213-1(e)(1)(v)(a)

; RevRul7O-2a5,7970-LCB 52 ; Pfeifer,DonaldR., (1978)TC l4emo

1978-189, PHTCMfl78189, 37 CCHTCM816 , affd(1979,CAr0) 79-2 USTCfl9518 .

The regsstatethat schoolsfor the teachingof brailleor lip readingare specialschoolsbecausethe

r Similarlya schoolwith a

primarypurposeof the schoolis alleviating

or treatinga physicalhandicap.

disorder4 or dyslexiaa 1 is

specialprogramfor treatingseverelearningdisordersdue to a neurological

a specialschool.And a schoolthat was specifically

establishedto assiststudentsin overcomingvarious

neurological

and that only acceptsstudentswith thoseconditions

is a specialschool.42

conditions

However,overcomingthe learningdisabilitiesmust be a principalreasonfor attendingthe school.Any

ordinaryeducationreceivedmust be incidentalto the specialeducationprovided.4 3

3

Reg5 1.213-1(e)(1XvXa)

4

Rev Rul 78-340, 1978-2 CB I24

4.7

IRS LetterRuling200521003; IRS Letter Ruling A4O|O24

4.2

IRS LetterRuling200704001

IRS LetterRuling200521003

https://checkpoint.riag.com/app/servlet/com.tta.checkpoint.servlet.CPJSPServlet?usid=12f...2/1512

DocumentDisplay

Page2 of 5

The regsalsostate that schoolsthat train the mentallyretardedare specialschoolsbecausethe

s Thus,a school

primarypurposeof the schoolis alleviating

or treatinga mentalor physicalhandicap.

providinga curriculumdesignedto meet the needsof handicapped

childrenwhoseI.Q. scoresranged

between50 and 75, in orderto educatestudentswho are not ableto profit from the educationthat was

beingofferedthroughordinaryclassroominstruction,but whoseintellectualability indicatethe

possibilityof a degreeof scholasticattainment,with the help of speciallytralnedteachersand special

methodsand materialsis a specialschoolbecausethe primarypurposeof the schoolis to alleviatea

6

mentalhandicap.

5

RegS 1.213-1(e)(1)(v)(a)

; RevRul7t-347, 797r-2CB rr4

6

RevRul70-285,f97O-I CB 52 .

Similarly,a schoolwhosestatedand actualpurposeis to providean environmentwhereaverageand

(usuallyemotionalor psychological)

above-average

studentswith speciallearningdisabilities

can learn

to adjustand functionnormallyin a competitiveclassroomsituationis a specialschoolwhere its

resourcesfor alleviatingthe child'sdisabilityare the principalreasonfor the child'spresencein the

schooland its educationalprogramis incidentalto its medicalfunction.7 Thus,a schoolwhichdoesn't

providecollegecoursesor livingfacilities,

but insteadprovides

tutoringand specialized

social,academic

and independent_living

skilldevelopment

to studentswith medically-related

learningdisabilities,

is a

cna.ial

c.h^^l

'

1

7

Greisdorf,LawrenceD., (1970) 54 TC 1684

IRS LetterRuling200729019.

Also,a psychiatrically

orientedboardingschooldesignedto meet the needsof studentswho havefailed

to make a satisfactoryadjustmentin their homes,schools,or socialrelationships

was a specialschool.

guidance

The school's

chiefemphasis

wason mentalhygieneand psychological

and it stressed

the

development

of soundgroupliving,recognizing

the needto dealwith eachchildon the basisof his

o

individual

Droblems.

B

IRS Letter Ruling 8447014 .

There is no requirement that a special school admit only students that are suffering from a mental or

physical diseaseor defect. The determination as to whether a school is a special school is made with

reference to the nature of the services received by the individual with respect to whom a deduction is

sought, not with reFerenceto the general nature of the institution as a whole. 9

I

Sims,AlvinJ., (1979) TC N4emo

1979-499, PHTCM1179499

,39 CCHTCM700 .

https://checkpointriag.comlapplservleVcom.tta.checkpoint.servlet.CPJSPServlet?usid:12f...

2/1512009

DocumentDisplay

Page3 of5

Thus,the deductibilityof the tuition as a medicalexpensedependson what the schoolprovidesto an

individual,

and not on whetherthe schoolis a "specialschool."A schoolcan havea normaleducation

programfor most students,and a specialeducationprogramfor thosewho need it. In other words,a

schoolcan be "special"for one studentbut not for another.9 1 Thus,a specialcurriculumin a regular

school,that is a severablepart of the regularschool,can meet the RevRul 70-285 (footnote2)

definitionand thus be considereda specialschool.10Similarly,wherea directorof militaryscnool

and mentallyabnormaison as a personal

agreedto acceptthe taxpayer'sphysicallyhandicapped

instruction

in orderto alleviatethe child'sshortattentionspan,the

and providedone-on-one

challenge

school.1l

schoolwasa sDecial

9.1

IRS LetterRuling200521003

10

RevRul70-285,l97o-l CB 52

11

Olson,RollandT., (1964)TC lvlemot964-325, PHTCM.[t64325,23 CCHTCM2008 .

The courtshaverarelyconsidereda "regular"privateschoolto be a specialschool.Althoughthe

individualattention,smallclasssize,and strict discipli,ne

characteristic

of good privateschoolsoften

are beneficialto studentssufferingfrom mentalor physicaldefectsor illnesses,theseschoolsrarelyare

able to meet the tests of Rev Rul 7O-285(footnote2). 12Thus,wherea child is sent to a regular

privateschoolon a doctor'sadvicethat his speechproblemscouldbe alleviatedby beingwith normal

childrenat a regularschool,the schoolis not a specialschool,sinceno specialservicesare provided.13

wherea studentwas placedin a schoolwhoseapproach

wasto placespecialemphasis

on the

Similarly,

potential

yet

not

and

development

of

students

whose

had

been

reachedand whoseprogress

training

had beenimpededby weak study habitsor an inadequatescholasticbackground,the schoolwas not a

facilitiesand did not provide

specialschool.The schooldid not haveany psychiatricor psychological

ra

any counselingor therapyfor mentaland/or emotionalproblems.

Sims, Alvin J., (1979) TC l4emo L979-499 , PH TCM 1179499,39 CCHTCM 700 ; Reiff, Jack W., (1974)

T C M e m o L 9 7 4 - 2 O , P HT C M l t 7 4 0 2 1 , 3 3 C C HT C N 49 1 ; S h i d l e r ,D e v o r aR . , ( 1 9 7 1 ) T C M e m o 1 9 7 1 L26 , PH TCM T71126 , 30 CCH TCN4529 .

13

Weinberg,

IsraelJ., (1969)TC Memo1969-3, PHTCMfl69003, 28 CCHTCM10 .

14

P a z o s ,J o s e F . , ( 1 9 8 7 ) T C M e m o 1 9 8 7 - 1 3 1, P H T C M 1 8 7 1 3 1 , 5 3 C C HT C M 3 3 7 .

Where blind or deaf students or students with epilepsy go to private schools becausethe private

schools allow the students to attend school in a normal setting, the schools are not special schools

becausethe purpose of the schools is academic, rather than therapeutic. 1s

https://checkpoint.riag.com/app/servlet/com.tta.checkpoint.servlet.CPJSPServlet?usid=

I 2f... 2/1512009

Page4 of 5

ArnoldP.,(1968)51 TC 108; lvlartin,

JamesR., (1975)TC Memo1975-362,PH TCM

Grunwald,

(1977,

CCH

TCN4

1564

affd

CA6)

39

AFTR2d 77-692 , 54A F2d 633 ,77-r usTc 119180

,

;

1175362

,34

Shidler,DevoraR., (1971)TC Memo1971-126,PHTCMlt7Lt26 ,30 CCHTCM529 .

Wherea learningdisabledor emotionallydisturbedstudentattendeda privateschoolon a doctor's

recommendation

becauseof the school'ssmallclasses,the schoolwas not a specialschool.The school

had no psychologists

or psychiatristson staff, its administrationdid not holdthe schoolout to be a

'o

specialschool,and the schoolhad a normalcurriculum.

Pfeifer,DonaldR., (1978)TC Memo1978-189, PHTCMf78189 , 37 CCHTCM816 , affd (1979,CA10)

91 .

79-2 USTCfl9518; Reiff,JackW., (1974)TC lllemo1974-20,PHTclvll74O2O,33 CCHTCN4

The fact that a schoolprovidesspecialservicesfor studentswith disabilitiesdoesn'tnecessarymake

the schoola specialschool.Thus,a privateschool,approximately25oloof the studentsof which have

learningdisabilities,

and whichhad (a) a learningcenterto test thosestudentsand improvetheir

psychological

programwas not a specialschool.

counseling

learningskiilsand (b) an on-campus

Althoughthe studentspentsubstantialtime availinghimselfof thesespecialservices,he alsoengaged

in a full load of regularclassesand extracurrjcular

activities,so the regularclassesand extracurricular

161 Similarly,

not

incidental

to

wherea

were

the

alleviation

of

his

learningdisabilities.

activities

learningdisabledstudenttook remedialand academiccoursesat a privateschool,the schoolwas a not

a specialschool,sincethe primarypurposeof the schoolwas academic.162

16.1

Sims,AlvinJ., (L979)TC Memo1979-499, PHTclvl1179499

,39 CCHTclvl700

16.2

Walton,BruceS., (1982)TC Memo1982-648, PHTCMfl82648,45 CCHTCM65 .

In anothercase,the Tax Courtfoundthat the fact that the studentdroppedout of the schoolbecause

he couldn'tmeet its academicstandards,was an indicationthat the purposeof the schoolwas

academic,rather than the allevjationof the student'sdisability.The court statedthat it didn't believe

that a specialschooldesignedto treat studentswith learningdisabilitieswoulddrop a studentbecause

madehim incapable

his iearningdisabilities

of competingwith ordinarystudents.163

16.3

P f e i f e r ,D o n a l dR . , ( 1 9 7 8 ) T C M e m o t 9 7 8 - r 8 9 , P H T C M f l 7 8 1 8 9 , 3 7 C C HT C N 48 1 6 , a f f d ( 1 9 7 9 , C A 1 0 )

79-2 USTC!t9518 .

E N D O F D O C U M E N -T

All rightsreserved.

O 2009ThomsonReuters/RlA.

https://checkpoint.riag.com/app/servleVcom.tta.checkpoint.servlet.CPJSPSerwlet?usid12f... 2115/2009

DocumentDisplay

Page1of2

CheckpointContents

FederalLibrary

FederalEditorialMaterials

FederalTax Coordinator2d

ChapterK Deductions:Taxes,Interest,Charitable,lYedical,Others

That Qualifyas MedicalExpenses-OtherThanTraveland Transportation

K-2100Expenditures

ExDenses.

K-2154Whetherexpenditureswere for ordinaryeducationincidentalto a school'sspecial

services.

Federal Tax Coordinator 2d

flK-2154. Whether expenditures were for ordinary education

incidental to a school's special services.

The cost of ordinaryeducationfurnishedby a specialschool( f K-2153) is a medicalexpenseif that

educationis incidentalto the specialservicesfurnishedby the school,see 1l K-2150.

A 17-year-oldwith severebehavioralproblemsas a resultof habitualdrug use enrolledin a school

designedto addressboth the educationaland emotionalneedsof its students.Tuitionat the schoolwas

deductible.The schoolrequiredhis parentsto maintaina "personalaccount"and "allowanceaccount"

failureto maintainthe accountswould have resultedin the son'sdismissalfrom the school.Becauseof

theseconditionsput on the two accounts.paymentsmade into them were ordinarycostsof education.

And they were incidentalto the specialservicesprovidedby the school.17

77

Urbauer,Charles,(1992)TC lvlemo1992-170, RIATC Memot192170, 63 CCHrCM 2492 .

ENDOF DOCUMENT

@ 2009 ThomsonReuters/RlA.All rights reserved,

https://checkpoint.riag.corn/applservlet/com.tta.checkpoint.servlet.CPJSPServiet?usid:12f...

211512009

Year2008Tax Benefitsfor Parentsof ChildrenWith LD - GreatSchools.net

Page1 of6

,ll

i.li€{-:l'SC6OOISlnvolvet parenis. S!.cesstli tiiJ5.

Year 2008Tax Benefitsfor Parentsof Children With LD

By Grade

Parentsof kidswith a severetear0ingdisabiLitymay be eligibtefor vatuabletax benefits.Readour annual

update.

l\

Nllrhrcl O (l{nii.

lvo'rloe Sedi! ,nd Ju6. P.lato

lf you havea chitd with a severelearningdisabitity(LD),you may quatifyfor valuabtetax benefits.lf your

chitd hasAD/HDor other physicat,mentator emotionalimpairments,you may atsoquatlfyfor tax benefits.

Eecausetax [awsare comptexand manytax preparersoften do not haveocca5ionto usetheseuniquetax

benefits,familiesare at risk of tosingrefundsworth thousandsof dottars.tt's (ike(ythat 15%to 30%of

famitieswith a disabtedchild haveone or more unclaimedtax benefits.

Thisguideprovidesa summaryof the most significantfederal incometax benefitsand shoutdnot be

consideredtegatadvice.Tax decisionsshouLdnot be madegimptyon the basisof the informationprovided

here. Youare advisedto print out this guideand give a copy to your tax advisor.Youshoutdatsoexplore

potentiatstate incometax benefits,which are too numerousto reviewin this gujde.

L.a.njng Djsabitjties

Irav.t dnd Learnrng

Media lrd Your Child

Learnnrg5tandards

(

lnternal RevenueService(lRs) PubLicationsrepresentthe most accessibteform of guidanceto the tax rutes

for the generalpublic, and relevantJRSpublicatjonsare cjted for eachof the tax benefitslisted betow.The

IRSatsoissuesinterpretationsof the code and reguLations

catted RevenueRulings.Theseinteeretations

are formaL,bindingpolicystatements.Tax professionats

rety on revenuerulingsin advisingcLientsaboutta-x

tiabilitiesand tax benefits.For exampte,RevenueRuting78-340,discussedLater,authorizesa medicat

expensedeductionfor tuition or tutoring fees paid for a chitd with a severetearningdisabititywho is

attendinga specialschootat the recommendation

of the chitds doctor.

Tax Benefits: Deductions ys. Creditt

Its importantto distinguishbetweentwo categofiesof tax benefits.Onecategoryi9 a deductionfrom

taxableincome orsimply a "deduction. The vatueof a deductionis basedon t he margjnal tax rate of the

taxpayer.lf a personhasa tax deductionworth Sl,000, the actualvatueof the deductionwitt be

determinedby the taxpayer'stax rate. Soa taxpayerin the lowesttax rate bracket, 10%,witl havehis

taxabteincomereducedby 51,000and save5100(10%of 51,000).However,a taxpayerin a higherbracket,

for exampLe,28%,witt havehis taxabteincomereducedby 51,000and save5280(28%of 51,000).

The secondtax benefit is a tax credit, which is a dottar-for-dottarreductionin tax tiability. An individuat

with a tax credit worth 51,000witt havehis tax bitLreducedby 51,000.This meansthat the actuatamount

of taxesis reducedby the amountof the tax credit- However,becausetax lawsand proceduresare very

compticated,othef factorscan influencethe ultjmate valueto the taxpayer.

The fottowingsummarizes

the principaltax benefitsthat may be avaitabteto famitiescaringfor chitdren

with severetearningdisabilities.

Retroactive Claims for Refunds

The IRSallowstaxpaversto fite amendedreturnsand coftectrefundsfor unctaimedtax benefits

retroactiveLy

up to three years.This meansa taxpayercan fite an amendedreturn for the 2005tax year

(andatsofor the 2005and 2007tax years)and ctaim a refundif the return is fiLednot tater than Aprit 15,

2009.(see IRSPubtication17, Your FederatIncomeTax, 2008,pages18-20.)

http://www.greatschools.net/cgi-bin/showarticle/1

187?cpr=200802141d

2/14/2009

Year 2008 Tax Benefitsfor Parentsof ChildrenWith LD - GreatSchools.net

Page2 of 6

BesidesParents, Who Can Claim a Child as a Dependent_1

A reLativecaretaker(e.g., a gmndparentor aunt) or a nonretativecaretaker(e.9., a fosterparentor tegalg ardian)rnay

be abLeto ctaima chitd asa dependentandqualifyfor retatedtax benefits.A retativeca.etakerandthe cnild are not

Standard

requiredto live in the samehorsehotd.^loreinformationjs availabtein IRSPublication501;"Exemptions,

Deductionand FitingInformation; pages9-19: http:/ rwww.irs.qov/pub/Aspdflp501.p{lt.

Eliqibitityjs determinedby a fiv€-parttest. The mostcfiticaLrequirementis that the caretakermust provjdemofe than

hatf of overat(financialsupportfor the child. For example,there may be caseswh€rethe caretakerjs rnakinga

financialconvibutiontoward LD-rclatedexpenses(e.8., privateschoottuition) that repfesentsmorethan

subsrantiat

hatf of the overaLt

costof supportfo. the chitd. ln thosesituations,the caretakefcoutd{At the chitd asa dependentand

A.

.taim the tuition asa medicatexpensedeductionon Schedute

Medical ExDense Deductions

A taxpayermay ctaim a deductionfor medicate/,penses

of the taxpayeror the taxpaye/sdependentslsee

boxformoreinformationondependents).section1.213-1(e)(1)(v)(a)oftheDepartmentoftheTreasury

regulationsprovides,in part, that while ordinaryeducationis not medicalcare, the cost of medicalcare

inctudesthe cost of attendjnga speciatschoolfor a mentatlyor physicattyhandicappedindividuat,if his

conditionis suchthat the resourcesof the institution for atleviatingsuchmentalor physicalhandicapare a

principatreasonfor his presencethere. As such,the lRshas rutedthat tuition and transportationcostsfor a

speciaLschooLthat hasa programdesignedto educatechi[drenwith tearningdisabititiesand amountspaid

for a chitdr tutoring by a teacherspecialtytrained and quatifiedto deat with severelearningdisabjtities

may aLsobe deducted.(RevenueRuling78'340, 1978-2C.B. 124.) Speciat inst.uction,trai ningor therapy,

5uchas Braille, lipreading,signlanguageinstruction,speechtherapyand .emedialaeadinginstruction,

woutd atsobe deductibte.Retatedbooksand materiatscan quaLifyfor the medicatexpensededuction.lRs

PrivateLetter RuLing

8616069(1985PLRL 41) discusses

what typesof conditionsand instructionmay not

quatify.

Generatty,for famiLiesto quaLifyfor the deduction,the chitds doctor must recommendthe speciatschool,

therapyor tutoring, and there must be a medicatdiagnosisof a neu.otogicatdisorder,suchas a severe

leamingdisabitity,madeby a medicatprofessionat.Transportationexpensesfor the speciaLschoolor the

tutor alsoquatifyfor a medicalexpensededuction.lf transportationis by car, the atlowabteexpensein

200Eis 19 cents per miLe(for mjlesdriven from January1 to June 30) and 27 cents per mite (from Juty 1 to

December31), or the actuatcost of operatjngthe vehicte.

Furthermore,deductibtemedicaLexpensesincludeexpensesfor the diagnosisand treatment of physica(

disorders,and traveLand todgingcostsretatedto suchdiagnogisand treatment expenses.Thiscan include

pathotogist,psychotogist,

testing by a speech'Language

neurotogistor other personwith professionat

qualifications.

Note: Expeffes claimed os a medical expensededuction and lotet rcimbursed by on insurance componyor

schooldistri.t (e.9., the serviceis adopteddspart of the child'slndividualizedEducationPtogram,or IEP)

must be reported os taxable income lor the year in which the reimbursements ote rcceived. lf parents

hovepaid for the servicesbut haven'tcloimedthem os a medicolexpense,they shouldaskthat the tchool

district not issoea 1099Jorm in connectionwith the reimbursement.If the schooldistrict does issueo

1099,consultwith a tax adisor dbout how to proceed.

Not everyonewho hasmedicatexpensescan usethem on their tax return. Medicalexpensesmust be

ctaimedon ScheduteA, ltemizedDeductions,and are subjectto certain timitations.First, the famity must

haveitemizeddeductionsthat exceedtheir standarddeductionin order to useScheduteA (about65%of

taxpayersdo not itemizefor this reason).Second,medicalexpensesare atlowedas a deductiononty to the

extent that they exceed7.5%of adjustedgrossjncome,a significantthreshotdfor manyfamities.(SeetRS

PubLication

502, Medicaland DentatExpenses.)

WhatExpenses

Qualifvfor a Tax Deduction?

http://www.greatschools.neVcgi-bin/showarticle/

1187?cpn=2008021

41d

2n4/2009

Year2008Tax Benefitsfor Parentsof Children With LD - GreatSchools.net

Page3 of6

Thefoltowingexpenses

re{ommendsthe serviceor treatnent for

mayqualifyfor the deductionif a medicalproiessionat

disorder,slch asa severetearningdisabiLity:

the chitdand there is a medicatdiagnosis

of a neuroLogjcat

. Tuitionfor a privateschoot

. Specialjzed

matenals(e.g., book, softwareandlnstructionatmateriaLs)

. Diagnostic

evatuations(by a privatepractitioner)

. T.ansportation

exp€nses

for a privateschoolor tutof

Health Savings Accounts and Flexible Savings Arrangements

Atternativeapproachesto obtainingtax benefitsin connectionwith medicaLexpensesmay invotveuseof a

medicatexpenses

heatthsavingsaccount(HSA)or a flexible savingsarrangement(FSA).Att the LD-reLated

reviewedabovecan be pajd throughan HSAor FsA\4/ithpretax dottars.An HsAaltowsa workerto useup to

55,800in 2008for famjty coverage,jn pretax incomefor medicalexpenses.An HSAmay onty be opened

when the emptoyeehasa "highdeductible"health insuranceplan. Amountsptacedin an HSAmay be carried

over to folLowingyeaB if not used.

An FSAcan be part of a cafeteria ptan of atternativefringe benefitsoffered by an emptoyer.An employee

can attocatepretax incometo the accountand then withdrawit duringthe year to pay for medicat

expenses.Employersmay atsomakecontributionsto the FSA,and the maximumamountis set by the terms

of the emptoyerptan.Two importantconditlonsare:

1. The amountto be ptacedin the accountmust be determinedby the emptoyeeat the beginningof the

year'

2. Fundsin the FSAthat are not usedby the end of the year are Lost.However,a recent amendment

atlowsa onetimetransferof FsAfundsto an HSA.

humanresourcesoffice can providemore information.At5o,see IRSPubtication969, Heatth

The empLoyer's

SavingsAccountsand OtherTax FavoredHealthPtans.

Deduction for Disability-Related Conferences

(

\

In May2000the IRSissuedRevenueRuting2000-24,which offers guidance and goodnews- for pa.entsof

chitdrenwith djsabitities.Parentswho attend conferencesto obtain medicalinformationconcerning

treatment for and care of their chitd may deductsomeof the costsof attendinga medicalconference

retatedto a dependentschronichealth condition.The jmportant pointsto rememberare:

. Medicalexpensesare deductibleonty to the extent that they exceed7.5%of an individuatsadJusted

grosSincome,and that timitation apptiesto this deductionas wett;

. Costsof admissionand transportatjonto a medica(conferenceretatedto your dependentschronic

heatthconditionare now deductibte,if the costsare primarityfor and essentiaL

to the care of the

dePendent.

. Costsof meatsand lodgingretatedto a conference,however,are not deductibte.(Note,however,

that todging- up to 950per night is deductjbleif you must travel and stayat a hotet white your

dependentis receivingmedicattreatment from a ticensedphysicianin a hospitator a retatedor

equivatent

setting.)

. Costsare primarityfor and ersentialto the care of the dependent"(andthereforedeductibte)if:

. The parent attendsthe conferenceuponthe recommendation

of a medicalprovidertreating

the child:

. The conferencedisseminates

medicalinformationconcerningthe chitds conditionthat may be

htto://www.ereatschools.neVcsi-bin/showarticle/1

187?con:200802

14ld

2/14n009

Year2008Tax Benefitsfor Parentsof ChildrenWith LD - GreatSchools.net

Page4 of 6

usefuIin makingdecisionsaboutthe treatment or care of the child;

. The primarypurposeof the visit is to attend the conference.Whiteat the conference,the

parentssociatand recreationalactivitiesin the city he or sheis visitingare secondaryto

attendanceat the conference:

. The conferencedeatswith specificissuesrelatedto a medicaLconditjonand doesnot just

relate to generalheatthand wett-being.

Child and DeDendent Care Credit

The Childand DependentCareCredit is attowedfor work-retatedexpensesincurredfor dependentsof the

taxpayer.Generattythe dependentmust be underthe ageof 13. However,if the chitd hasa disabilityand

requiressupervision,the age timit is waived. For exampte,a 16-year-otdwith severeAD/HDand a behavior

disorderwho cannotbe Leftatonewithout adult 5upervision

woutd be a quatjfyingchild for this credit.

Expenses

up to 53,000per year for one quatifyingdependentand up to 56,OOO

for two or more qualifyjng

dependentsare atlowed.Expenses

for regutarchild care services,after,schootprogramsand summercamps

quatify,atthoughovernightsummercampexpensesdo not. paymentsto a aetativeto care for a chitd aLso

qualify, as long as the retativeis not a dependentof the taxpayer.The credit is calcutatedatZ1%to 30%

percentof a(lowabLe

expenses,ba5edon the famitysadiustedgrossincome.The averagecredit js about

5600but can be as highas 52,100.(SeeIRSPubtication503, Chitdand DependentCareExpenses,.)

Exemption for Dependents

A taxpayeris entitled to clalrnan exemptionfor eachquatifieddependent.This may appearreLativety

straightforward,but caretakers,suchas grandparents,auntsor even foster parents,may overtook

exemptions.Atso,in somecasesfoiLowinga divorce,a noncustodiaIparent who providesthe majority of

supportfor a qhitdwith a severelearningdisabitity,and paysfor medical/educatjonat

expensesrelated to

the chitd5 learningdisabitity,may tikewisequalify for both the exemptionand medicatexpensedeductjons.

A new definition of quatifyingchitd took effect in the 2005tax year; the most significantchangeis that

the taxpayerneednot showsupportfor a quatifyingchiLd,but the child must tive with the taxpayerfor

morethan six months.Fo. eachdependent,there is an exemptionfrom taxableincome,worth Sj,500 for

the 2008tax year. For a taxpayerwith a marginattax rate of 25%,eachexemptionwilt reducethe tax

tiabitity by 5875.Equatlyimportant,the dependencystatusis requiredfor sometax benefitssuchas the

child and dependentcare credit hstedabove.Atso,dependentsunderage 17 quatjfyfor the ChjtdTax

Credit, worth up to 51,000 per chitd. (see IRSPubtication501, Exemptions,StandardDeductionand Fiting

Information, and Instructionsto Form 1040.")

Note: The gift tox * which imposesa tax on the donot fot gifts over 513,0(n - genetu(y doesnt appty to

tnyments for medicalexpensesot education-Thisis a complextopic ond shouldbe discussed

with a tox

advisorwhen a taxpayerprovidet, or plansto provide, an amountgreatet that S13,OOO

to onyonenot a

Earned Income Tax Credit

FamiLies

with at leastone chitd fiting a retum as singLeor headof househotdwith adjustedgrossincome

under533,995(536,995for maried taxpayersfiting a joint return) may quaLifyfor the EarnedlncomeTax

Credit (EITC)basedon the presenceof one or two quatr'fying

chitdrenin the taxpaye/shome. For EITC

purposes,a quatifyingchitd i5 a biotogicatchltd, adoptedchitd, stepchitdor foiter chjld who resjdedwith

the taxpayerfor more than six monthsduringthe catendaryear and ls underage 19 at the end of the year.

A quatifyingchild is atsoa chitd ages19 to 23 who js a futt-time studentfor at leastone semester.Finatty,a

severetydisabLed

child is a quaLifyingchitd without regardto age, even into adutthood,as tongas the chitd

contrruesto tive with his parent(s).Notethat a quatifyjngchitd for EITCdoesnot haveto meet the

requirementsfor a dependencyexemption.EITCbenefitsare as high as 54,g24for famitieswith two or

morequdlifyingchiLdren,atthoughthe credit comptetetyphasesout at 541,646.(see tRSpubtication596,

"Earnedlncomelax Credit,'for moreinformation.)

http://www.greatschools.neVcgi-bin/showarticle/

1187?cpn:200802

14ld

2/14t2009

Year2008Tax Benefitsfor Parentsof ChildrenWith LD - GreatSchools.net

Page5 of6

Where to Get More lnformation

The IRSprovidesfree booktetsthat covereachof the topics tistedabove.The tittes tisted betow may be

orderedby cattingthe IPStotlfree number:(800)829-3676.Generalty,taxpayersmay order up to three

copiesof any pubticationor form. The followingbookletsmay be hetpfut:

. IRSPublicatlon17. Your FederallncomeTax (a comprehensive

guide)

3oo-ptus-page

. IRSPubiication501, Exemptions,ttandard Deductionand Fi{ingInformation'

. IRSPubtication502,'MedjcaIand oentat Expense5

. IRSPublication503, Childand DependentCareExpenses'

. IRSPubticatioa596, farned IncomeTax Credit

. IRSPubticatjon969, HealthSavingsAccountsand Other Tax-FavoredHeatthPlan5'

Extensiveinformationcan alsobe obtainedfrom the lRS.The AmericanBarAssociation5

TaxationSection

containstinksto scoresof tax'felated sites,

Tax Counseling and Tax Preparation Assistance

Certifjedpubljc accountants(CPAs)representone sourceof tax advisors,atthoughnot att CPA5have

expertisein this area. Enrolledagentsare individualslicensedby the IRSto representtaxpayers,and this

groupgeneratlyhasa high degreeof expertise.

Typicatly,chargesfor a tax retuanwith multiptedeductionsand creditswitt cost 5150to 5400.Severat

nationalcompaniesprovidetax preparationand tax counsetingservices.Manyoperateonty duringthe tax,

filing season,but a smatlnumberin targerurbanareasare openyear,round.Feeschargedby the5e

companiesare tower than the fees typicattychargedby CPAS

and enroltedagents.

someparentsmay not be abte to afford fees chargedby professionat

tax prepareas,who genehtty seek

paymentin advance.An option for lower-incomectientsis the VolunteerIncomeTax Assistance(VITA)

program.However,becauseof the votunteersbroadrangeof skittsand expertise,cautionis recommended.

SomeLargecities haveone or more VITAprograhsthat offeaprofessionat-levet

services.A university

accountingdepartmentor the to.at tegaLservicesprogrammay be abte to hetp you identify a high,quatity

VITAprogram.

DlsDutes Mth the IRS

Disputeswith thQ IRSare relativelyrare; tessthan 1.5%of aLlindividualincometax returnsare subiectto

an lRsaudit. However,if the IRSquestionsyour return and you teel an tRSagentis not respondingproperty,

contactthe TaxpayerAdvocatefor assistancetotl,lrcet \877) 777-4778. Low IncomeTaxpayerCtinicsare

anothersourceof help. The IRSfundsmore than 100clinicsto represent{ower,incometaxpayersin disputes

wjth the IRSor state revenuedepartments.CLinicsassisttaxpayersMth incomeunder250%of the poverty

leveL- about 550,000for a famity of four. Someclinics,especiatlythoseattachedto Lawschools,wiLt

representhigher-jncomefamiues.Informationon the neare5tclinic can be obtainedfrom the generatlRs

tolL-freeinquiry number:(800)829-1040.Familiesabovethis inrome (evetshouLdcatt their countyor state

bar association.

Final Thoughts

Thisguideoffers a brief summaryof someof the potentiattax benefitsthat may be avaitabteto you. You

shoutdobtain copiesof the IRSpubticationscited aboveand djscusswith your tax advisorwhether these

benefitsapptyto you. Again,you shoutdnot rely on this guidealoneto determinewftetheryou shouldclaim

any of the tax benefitsreviewedhere.

MichaelA. O Cohnori5 an attorney who promotesawarenessof tax poticiesthat benefit famities.ln

http://www.greatschools.net/cgibin/showarticle/1

I 87?cpn=200802

14ld

2tI4/2009

Year2008Tax Benefitsfor Parentsof ChildrenWith LD - GreatSchools.net

Page6 of 6

addition,as a memberof the firm Mauk& Oconnor, LLP,he representsparentsin disputeswith toca[school

districtsconcerningspecialeducationservicesfor leamingdisabtedchitdren.He is a boardmemberof the

Courcil of ParentAttorneys& Advocates(COPAA).

Mon.oe Seifer is a tax attorney 5pecializingin all aspectsof personatincometaxation, inctudingincometax

return preparation.As a former lnternal RevenueServiceagent, he is uniquetyquatifiedto representctients

beforethe UnitedStatesTax Court and assistclientswith auditsand appeats.Monroeis the senior

sharehotderwith the law firm Seifer,Murken,Despina,Jamesand Teichman,ALC,in SanFranciscoand is a

memberof the taxationsectionsof both the State Barof Californiaand AmericanBarAssociation.

Juan Pelayois a tax attorney speciatizingin att aspectsof personatincome,trust and estate, and gift

taxatjon,includingincofte tax return preparation.He is admitted to practicebeforethe UnitedstatesTax

Courtand hasrepresentedand assistednumerousctientswith auditsand appeals.Petayopracticestax law

with the law firm seifer, Murken,Despina,James& Teichman,ALC,in san Franciscoand is a rtember of the

taxationsectionsof both the state Barof Catiforniaand AmericanBarAssociation.

O 2008Greotschoolslnc. All RightsReserved.Originally creoted by SchwobLeoming, lormerly o program

of the Charlesand Helen SchwabFoundotion (i4odified Jonuoty 2009).

Get more great tips to keepyour chitd on track! Signup for our newsletters,

Related Links

Fiiancrai

Aidfor Education

tor Student!

wrthLD- cLrides

andResoumes

Financiat

Arsistarrce

for Pa.ents

of KidswithLDandAD/HD

gi-bin/showarticle/1I 87?cpn:200802I 4ld

http://www.greatschools.neVc

2/14/2009