CHAPTER 7 THE FOUR STEPS IN THE ACCOUNTING CYCLE THE

advertisement

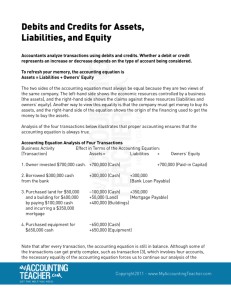

CHAPTER 7 THE ACCOUNTING INFORMATION SYSTEM 1 THE FOUR STEPS IN THE ACCOUNTING CYCLE 1 Analyze transactions 2 Record the effect of transactions in a journal entry 3 Summarize the effects of transactions a Post journal entries to the ledger b Prepare a trial balance 2 THE FOUR STEPS IN THE ACCOUNTING CYCLE 4 Prepare reports a Make adjusting entries b Prepare financial statements c Close the books 3 TRANSACTION ANALYSIS USING DEBITS AND CREDITS Recall the accounting equation: Assets = Liabilities + Owners’ Owners’ Equity 4 DEBITS AND CREDITS FOR BALANCE SHEET ACCOUNTS • All increases in • All increases in assets are liabilities and represented as equities are debits (left side of represented as the account) credits (right side of the account) 5 DEBITS AND CREDITS FOR REVENUES, EXPENSES, AND DIVIDENDS • Revenues increase with credits • Expenses increase with debits • The dividends account is increased with a debit 6 DEBITS AND CREDITS FOR ALL ACCOUNTS Assets Dr. Cr. + - = Liabilities + Dr. - Owners’ Owners’ Equity Dr. - Cr. + PaidPaid-in Capital Dr. - Cr. + Retained Earnings Dr. - Cr. + Expenses Dr. + Cr. + Revenues Dr. - Cr. - Cr. + Dividends Dr. + Cr. - 7 RECORDING THE EFFECTS OF TRANSACTIONS • The journal is a book in which all transactions are recorded in chronological order • Each journal entry has its debit amounts equal to its credit amounts to ensure that the accounting equation remains in balance 8 RECORDING THE EFFECTS OF TRANSACTIONS • A journal entry involves a threestep process: 1 Identify which accounts are involved 2 For each account, determine if it is increased or decreased 3 For each account, determine by how much it changed 9 RECORDING THE EFFECTS OF TRANSACTIONS • The account debited is always listed first, followed by the account credited • Also, the credit entry is indented • Some selected transactions from Veda Landscape Solutions are presented next as examples… 10 Transaction 1 • Investment of $700,000 cash into the business for 10,000 shares of stock. Cash ? 700,000 700,000 11 Transaction 2 • Borrowed $300,000 cash from the bank. Cash 300,000 Bank Loan Payable 300,000 12 Transaction 3 • Purchased land costing $50,000 and buildings costing $400,000. Paid $100,000 in cash and signed a mortgage for the balance. Land 50,000 Buildings 400,000 Cash Mortgage Payable 100,000 350,000 13 Transaction 4 • Purchased equipment for $650,000 in cash. Equipment Cash 650,000 650,000 14 Transaction 7 • Purchased inventory costing $90,000 for $10,000 in cash and the remaining $80,000 on account. Inventory 90,000 Cash Accounts Payable 10,000 80,000 15 Transaction 8 • Paid $15,000 cash for an insurance policy. Prepaid Insurance Cash 15,000 15,000 16 Transaction 10 • Sold inventory costing $800,000 to customers for $1,100,000. the customers paid $200,000 in cash and the remaining $900,000 was put on the customers’ accounts. Cash 200,000 Accounts Receivable 900,000 Sales Cost of Goods Sold Inventory 1,100,000 800,000 800,000 17 Transaction 11 • Performed landscaping consulting services and billed clients $200,000 for these services. Accounts Receivable 200,000 Consulting Revenue 200,000 18 Transaction 14 • Collected $820,000 cash from customers as payment on their accounts. Cash 820,000 Accounts Receivable 820,000 19 Transaction 15 • Paid $1,200,000 in cash to suppliers as payment on account. Accounts Payable 1,200,000 Cash 1,200,000 20 Transaction 18 • Paid cash of $150,000 for advertising, utilities, and office supplies. Selling, General, and Administrative Expense Cash 150,000 150,000 21 Transaction 23 • Paid cash dividends of $5,000. Dividends Cash 5,000 5,000 22