A Chrysler Preferred Lender

Santander Auto Finance

| A Chrysler Preferred Lender

Dealer Frequently Asked Questions

1.

Where can I find the program details?

Your SCUSA Area Sales Manager will distribute the Sell Sheet/Rate Sheet, which contains all the program details.

In addition, program information is available anytime – via the Chrysler

DealerConnect Portal under the

Santander Auto tab. You can also find many documents on our Web site

SantanderAuto.com/Chrysler under

“Dealer Resources.”

2.

What collateral is eligible for the program?

NEW cars (2011 and 2012 vehicles,

5,000 miles or less and never been titled) are eligible for the program.

Chrysler plans to update and change the model mix monthly. They will communicate the eligible vehicles through the DealerConnect Portal.

3.

Does collateral always have to be attached to an application?

YES. Dealers MUST submit a VIN number with every application. Applications without a VIN can’t be processed under the program.

4.

Will GMAC declines be passed through to SAF?

No. When applications are declined from GMAC, YOU MUST RESUBMIT the application to Santander

Auto Finance through RouteOne or DealerTrack. This will ensure that your deals will receive the special rates/terms provided to you through our program.

5.

What customers are eligible for this program?

The program is primarily designed for customers with FICO scores of 650 and lower.

6.

What are the funding requirements for this program?

Most tiers have no stips but you can refer to the document “Funding Checklist” available via your

DealerConnect Portal or the SantanderAuto.com/Chrysler Web site. Stips vary by risk tier.

7.

Is there a down payment requirement?

Many tiers have no minimum down payment, but the minimum amount changes by risk tier.

© 2010 Santander Consumer USA Inc. | Confidential and Proprietary | All Rights Reserved | Rev. 05/21/2010

Page 1 of 3

8.

How do I know that Santander Auto will give me the best deal for my 650 and lower business?

The arrangement we have with Chrysler virtually guarantees that our payment calls will be significantly more desirable than those offered by other lenders in the space. We will have more approvals, and far better rates and prices.

9.

Are back-‐end products available to add to the contract?

Yes, back-‐end is available as long as it fits within your LTV.

10.

Will there be dedicated buyers for this program?

If you currently work with an SC USA buyer, you will remain with that buyer. All new dealers will be assigned a Santander Consumer USA buyer.

11.

How long will it take deals to be funded?

Once these contracts are in-‐house, clean packages are generally funded within 24 hours.

12.

Are self-‐employed customers permitted?

Yes, we will accept self-‐employed customers with the most recent filed and professionally prepared

tax return and the last three months of personal bank statements.

13.

Can I rehash contracts?

Yes, you can negotiate deal terms with your buyer.

14.

What is the participation split and how is it calculated?

The split is 75/25 and is calculated in using the ratio method.

15.

If I don’t want participation can I get a flat instead?

Yes, flats vary based on tier, and will be stated on your callback.

16.

Is there look to book?

No. There is no look-‐to-‐book ratio.

17.

Are there up-‐front verifications?

No.

18.

How can I check my deal progress?

Check funding status through the Santander Consumer dealer extranet at https://dealer.SantanderConsumerUSA.com.

Your Area Sales Manager will give you your username and password.

© 2010 Santander Consumer USA Inc. | Confidential and Proprietary | All Rights Reserved | Rev. 05/21/2010

Page 2 of 3

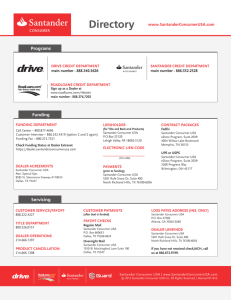

CONTACT INFORMATION

Credit Hours

We have extended underwriting hours Monday

– Friday until 6:30 p.m. (Central Time),

Saturdays 9:30 a.m – 6:00 p.m (Central Time), and most holidays.

Credit Analyst Toll-‐free Phone Number

(888) 540-‐5626, option 1

Credit Analyst E-‐mail

The best way to reach your buyer if you cannot reach them by phone is to e-‐mail them with the application ID number and the question you have. You can e-‐mail most buyers by typing in the buyer's first initial and their last name, followed by

"@santanderconsumerusa.com" (Example: jsmith@santanderconsumerusa.com)

Indirect Funding Contact Information

Phone (800) 877-‐4696

Fax (800) 215-‐7221

Back end Products Address

Santander Consumer USA

P.O. Box 25120

Lehigh Valley, PA 18002-‐5120

Lien holder Address

Santander Consumer USA

P.O. Box 25120

Lehigh Valley, PA 18002-‐5120

FedEx Overnight Mail and Contract Packages

Santander Consumer USA eDocs Program, Suite 2039

4054 Willow Lake Boulevard

Memphis, TN 38153

UPS and Regular U.S. Postal Service and

Contract Packages

Santander Consumer USA eDocs Program, Suite 2039

4070 Willow Lake Boulevard

Memphis, TN 38118

First Payment Address (before deal is funded)

Santander Consumer USA

5201 Rufe Snow Dr. Suite 400

North Richland Hills, TX 76180-‐6036

Regular mail

Customer payments (after deal is funded) and payoff checks

Santander Consumer USA

P.O. Box 660633

Dallas, TX 75266-‐0633

Overnight mail

Customer payments (after deal is funded) and payoff checks should be sent to

Santander Consumer USA

1010 W. Mockingbird Lane Suite 100

Dallas, TX 75247

Loss Payee Address (Insurance Only)

Santander Consumer USA

P.O. Box 47260

Atlanta, GA 30362-‐0260

© 2010 Santander Consumer USA Inc. | Confidential and Proprietary | All Rights Reserved | Rev. 05/21/2010

Page 3 of 3