PERSONAL FINANCE

advertisement

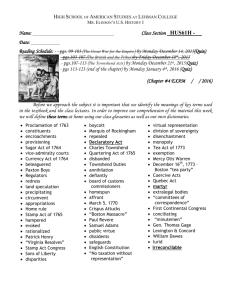

FINAL EXAM REVIEW Student Name: _____________________________________ Period: _________ PERSONAL FINANCE Course #6093 Mrs. Lee Hartman DATE OF FINAL EXAM TEST: ________________________________ 1. Please refer to your copy of each of the Chapter Reviews at the end of each chapter in your class workbook.. 2. Any Make-Up work must be turned in by 3:30 p.m. on ___________________________. 3. Please review the Chapter Objectives as listed on the first page of every chapter in the workbook and on your weekly syllabi’s viewable on my web page at www.vcstulsa.org They are also listed below by Chapter. 4. Please review the Chapter Key Terms as listed on the first page of every chapter in the workbook and on your weekly syllabi’s viewable on my web page at www.vcstulsa.org. They are also listed below by Chapter. CHAPTER OBJECTIVES (with cross-reference Workbook Pages notated) UNIT 1 – SAVING and INVESTING CHAPTER 1 – Savings (Pg. 9) 1. List Dave Ramsey’s “Baby Steps” covered in Foundations for Personal Finance. (Pgs. 11, 12, 13, 33, 39, 59,171) 2. Explain the 3 basic reasons for saving money. (Pg. 12) 3. Identify the benefits of having an Emergency Fund. (Pg. 13) 4. Demonstrate how compound interest works and understand the impact of rate of return. (Pgs. 15, 16, 17) CHAPTER 2 – Investment Options (Pg. 21) 1. Explain the KISS rule of investing. (Pg. 23) 2. Examine the relationship between diversification and risk. (Pgs. 23, 27) 3. Compare and contrast different types of investments including: money markets, bonds, single stocks, mutual funds, rental real estate, and annuities. (Pgs. 24, 25,26) CHAPTER 3 – Wealth Building and College Savings (Pg. 31) 1. Explain what is meant by tax-favored dollars: Money that is working for you, either tax-deferred or tax free, within a retirement plan. (Pg. 33) 2. List the different types of retirement plans: Roth IRA, Traditional IRA, SEPP, 401(k), 403(b), 457. (Pgs. 34, 35, 36, 37) 3. Differentiate between a Traditional and Roth IRA. (Pgs. 34, 35, 38) 4. Illustrate how a 401(k) company match works and prioritizes money into various investments. (Pg. 37) 5. Describe how pre-tax and after-tax savings work. (Pgs. 39, 40) UNIT 2 – CREDIT and DEBT CHAPTER 4 – Dangers of Debt (Pg. 47) 1. Analyze the history and evolution of credit. (Pgs. 49, 50) 2. Demonstrate various ways people get into debt. (Pgs. 51, 52, 53, 54, 55, 56,57, 58, 59) 3. Compare and contrast credit cards and debit cards. (Pg. 57) 4. Explain how the debt snowball works. (Pg. 60) 5. Evaluate and refute the myths associated with debt. (Pgs. 51, 52, 53, 54, 55, 56, 57, 58, 59) CHAPTER 5 – Consumer Awareness (Pg. 65) 1. List the ways companies compete for your money. (Pg. 67) 2. Evaluate the role “opportunity cost” plays in purchase decisions. (Pg. 69) 3. Distinguish what constitutes a significant purchase. (Pg. 68) 4. List the five steps to help you make a significant purchase buying decision. (Pg. 69) CHAPTER 6 – Credit Bureaus and Collection Practices (Pg. 73) 1. Evaluate the myth of building your credit score. (Pg. 75) 2. Describe precautions that will protect you from identity theft. (Pg. 77) 3. Explain how to correct inaccuracies on a credit report. (Pg. 76, 77) 4. Become familiar with the Federal Fair Debt Collection Practices Act and parameters regulating collectors. (Pgs. 80,81) PERSONAL FINANCE REVIEW Page Two CHAPTER OBJECTIVES (continued) UNIT 3 – FINANCIAL RESPONSIBILITY AND MONEY MANAGEMENT CHAPTER 7 – Budgeting 101 (Pg. 93) 1. Explain how money is active: Money is always moving and can be utilized in many ways. (Pg. 95) 2. Analyze reasons why people do not do a budget. (Pg. 95) 3. Examine common problems associated with budget failures. (Pg. 96) 4. Explain the benefits of a budget. (Pg. 96) 5. Demonstrate how to complete a zero-based budget. (Pg. 104) 6. Demonstrate how to correctly write a check. (Activity Sheets) 7. Demonstrate how to reconcile a bank statement. (Pg. 97 and Activity Sheets) 8. Explain the proper use of various budget forms in the chapter (Pgs. 100-115) 9. Demonstrate how to develop a zero-based Student Budget using the Student Budget Form. (Pg. 115) CHAPTER 8 – Bargain Shopping (Pg. 119) 1. Explain why you should be honest when negotiating. (Pg. 121) 2. Analyze and use the three keys to getting a bargain. (Pg. 121, 122) 3. Describe the seven basic rules of negotiating. (Pg. 121, 122) 4. List places to find a great deal. (Pgs. 123, 124) CHAPTER 9 – Relating with Money (Pg. 129) 1. Explain the difference between commissions and allowances. (Pg. 134) 2. Describe the general differences that exists between men and women as they relate to money. (Pg. 131) 3. Identify the characteristics of a “free spirit” and “nerd”, and explain how they relate to a budget differently. (Pg. 131) 4. Evaluate the importance of doing a budget together when married, and also when single. (Pg. 132) UNIT 4 – INSURANCE/RISK MANAGEMENT and INCOME/CAREERS CHAPTER 10 - Career Choices and Taxes (Pg. 141) 1. Identify your personal strengths and weaknesses. (“D”, “I”, “S”, “C”) (Pgs. 144, 145) 2. Evaluate the role of a cover letter, resume, and interview. (Pgs. 146, 147, 148) 3. Explain the various types of taxes withheld from your paycheck: Federal Income Tax, State Income Tax (where applicable), FICA (which includes Social Security and Medicare). (Pg. 151) CHAPTER 11 – Ins and Outs of Insurance (Pg. 155) 1. Explain why insurance is an essential part of a healthy financial plan and what the purpose of insurance is. (Pg. 157) 2. Identify and describe the seven basic types of insurance coverage needed including: Homeowner’s, Renter’s, Auto, Health, Disability, Life, Long-Term Care. (Pgs. 157, 158, 159, 160, 161, 162, 163, 164, 165) 3. Understand the importance of Disability Insurance. (Pgs. 159, 160) 4. Evaluate the reasons why Life Insurance is not an investment. (Pgs. 161, 162, 163, 164, 165) 5. Differentiate between Term and Cash Value Life Insurance. (Pg. 161) 6. List the various types of insurances to avoid. (Pgs. 164, 165) CHAPTER 12 – Real Estate and Mortgages (Pg. 169) 1. Describe the steps to maximize the sale of a home. (Pg. 171) 2. Examine what to look for when purchasing a home. (Pgs. 172, 173, 174) 3. Evaluate the various types of home mortgages including: Conventional, FHA, VA, Owner Financing. (Pgs. 177, 178) 4. Identify the pros and cons of renting versus owning. (Pg. 174) 5. Compare and contrast a 15-year mortgage to a 30-year mortgage. (Pg. 175) UNIT 5 – The Great Misunderstanding CHAPTER 13 – The Power of Giving (Separate Packet) 1. Examine the role of owners and managers with our finances. (Packet Pg. 3) 2. Explain why God has us on Earth to give. (Packet Pg. 4) 4. Discuss the Biblical instructions for giving. (Packet Pg. 5) STUDENT RESOURCES Forms – Pgs. 186-206 (Index on Pg. 185) Glossary – Pgs. 207-222 PERSONAL FINANCE REVIEW Page Three CHAPTER KEY TERMS (with cross-reference Glossary page notated) CHAPTER 1 Baby Steps (List on Pg. 11; 208) Compound Interest (209) Emergency Fund (212) Interest Rate (215) Money Market (216) Sinking Fund (219) CHAPTER 2 Diversification (211) Liquidity (215) Mutual Fund (216) Risk (218) Risk Return Ratio (218) Share (219) CHAPTER 3 401(k) (207) Education Savings Account (ESA) (212) Individual Retirement Arrangement (IRA) (214) Pre-Tax Retirement Plan (217) Rollover (218) Roth IRA (218) Tax-Favored Dollars (220) CHAPTER 4 Annual Fee (207) Annual Percentage Rate (APR) (207) Credit (210) Debt Snowball (211) Depreciation (211) Tax Deduction (220) CHAPTER 5 Buyer’s Remorse (208) Financing (213) Finite (213) Opportunity Cost (217) Significant Purchase (219) CHAPTER 6 Bankruptcy (208) Credit Bureau (210) Credit Report (210) Chapter 7 Bankruptcy (209) Garnishment (213) Pro-Rata (218) CHAPTER 7 Budget (208) Discipline (211) Envelope System (212) Impulse Purchase (214) Reconcile (218) Zero-Based Budget (222) PERSONAL FINANCE REVIEW Page Four CHAPTER KEY TERMS (continued) CHAPTER 8 Auction (208) Consignment Shop (209) Estate Sale (212) Foreclosure (213) Integrity (214) Markup (216) Negotiating (216) Patience (217) Walk-Away Power (222) Win-Win Deal (222) CHAPTER 9 Accountability (Pg. 133) Allowance (207) Commission (209) Fiscal (213) Free Spirit (213) Nerd (216) Work Ethic (222) CHAPTER 10 Career (209) Cover Letter (209) FICA (Federal Insurance Contributions Act) (212) Income Tax (214) Interview (215) Payroll Deduction (217) Resume (Sample Pg. 147; 218) CHAPTER 11 Cash Value Insurance (209) Collision (209) Comprehensive (209) Disability Insurance (211) Health Insurance (214) Homeowner’s Insurance (214) Renter’s Insurance (218) Term Insurance (220) CHAPTER 12 Appraisal (207) Appreciation (207) ARM (Adjustable Rate Mortgage) (207) Conventional Loan (209) Curb Appeal (210) Equity (212) Fixed Rate (213) Interest-Only Loan (215) MLS (Multiple Listing Service) (216) Mortgage (216) CHAPTER 13 Asset Manager (Packet Pg. 3) Charitable Giving (Packet Pg. 5) First Fruits (Packet Pg. 5) Offering (Packet Pg. 5) Stewardship (Packet Pg. 3) Tithe (Packet Pg. 5)

![Introduction [max 1 pg]](http://s3.studylib.net/store/data/007168054_1-d63441680c3a2b0b41ae7f89ed2aefb8-300x300.png)