Understanding and Analyzing Financial Statements

(Training seminars)

Potential investors that are considering investing their available funds into prospective businesses are

interested in how they can assess their performance. A major tool in assessing business performance is

through the analysis of their financial statements of previous years, thus being able to interpret the

messages of financial statements is invaluable tool for potential investors. On successful completion of the

seminar the participants will be able to understand the different information derived from financial

statements, analyse the financial statements and use the information gained in taking a decision whether to

invest in the business or not.

www.bakertillyklitou.com

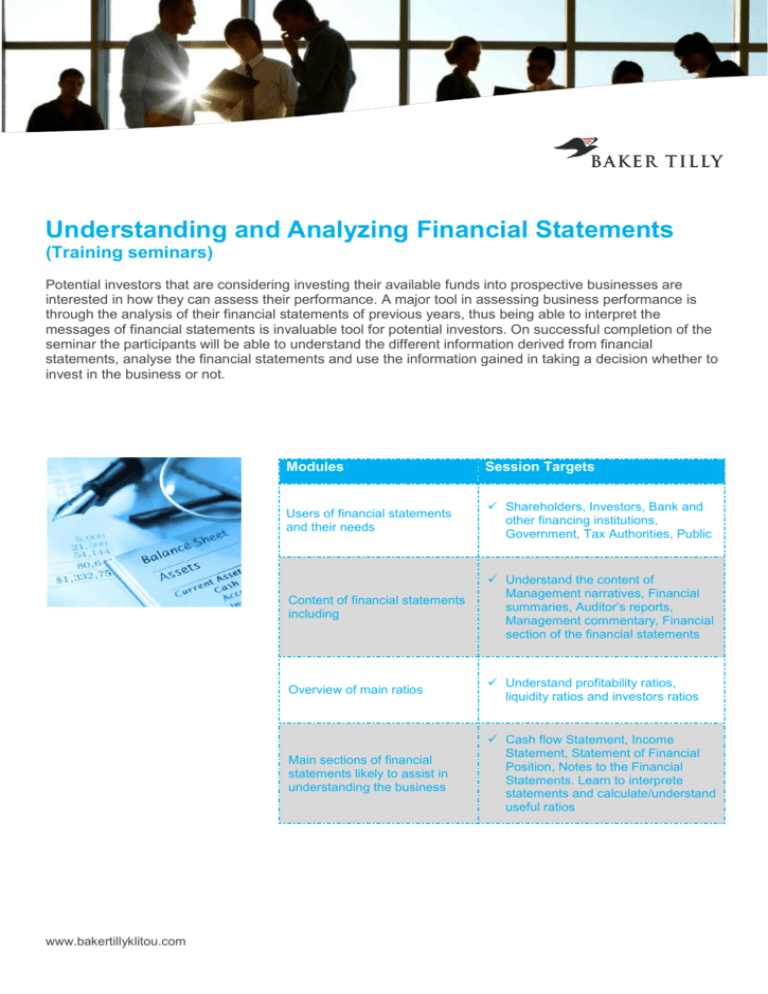

Modules

Session Targets

Users of financial statements

and their needs

Shareholders, Investors, Bank and

other financing institutions,

Government, Tax Authorities, Public

Content of financial statements

including

Understand the content of

Management narratives, Financial

summaries, Auditor’s reports,

Management commentary, Financial

section of the financial statements

Overview of main ratios

Understand profitability ratios,

liquidity ratios and investors ratios

Main sections of financial

statements likely to assist in

understanding the business

Cash flow Statement, Income

Statement, Statement of Financial

Position, Notes to the Financial

Statements. Learn to interprete

statements and calculate/understand

useful ratios

Target audience

This course is mainly intended for Accounts Managers, Accountants,

Auditors, Bank and Cooperative Credit Officers who might deal with

personal and corporate loans and/or financing, Managers of

Investment Portfolios. Other officers who work with financial

statements will benefit from this seminar.

Contacts for

Consulting matters:

Your benefits

Our expertise and experience allows us to assist clients in the

following:

Assessing their real repayment ability

Refinancing and restructuring existing facilities

Preparing and monitoring the restructuring plan and its

implementation

Considering ways of alternative financing like share capital

raising, bonds issue etc.

Forming strategic alliances with external investors in order to

recapitalize distressed balance sheets.

Relevant expertise

Trainers with over 15 years of professional training experience

in the areas of NPLs, Working Capital Management,

Performance Management and Management Accounting

Delivered a number of Independent Business Reviews in the

Cyprus market

Advising one of the major banks in Cyprus for setting up their

NPLs Management Division

Antonis Vasiliou, FCCA, ACIB

Senior Manager

Consulting & Business

Advisory Services

an.vasiliou@bakertillyklitou.com

Baker Tilly

Corner C. Hatzopoulou &

30 Griva Digheni Avenue

CY-1066 Nicosia, Cyprus

T: +357 – 22458500

F: +357 – 22751648

www.bakertillyklitou.com

©2014 Baker Tilly Klitou and Partners Limited. All rights reserved. In this document, “Baker Tilly” or “Baker Tilly Klitou” refers to Baker Tilly Klitou and Partners Limited,

registered in Cyprus, which is an independent member of Baker Tilly International, a worldwide network of accounting firms. “Baker Tilly” is a trademark of the UK firm,

Baker Tilly UK Group LLP, used under licence.