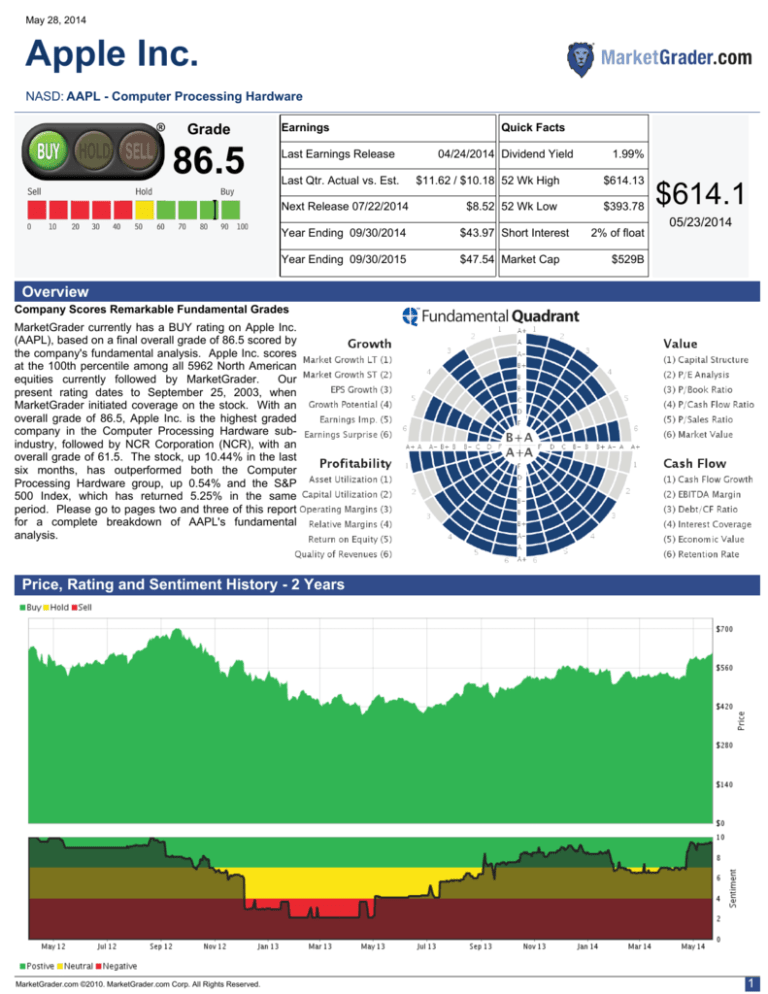

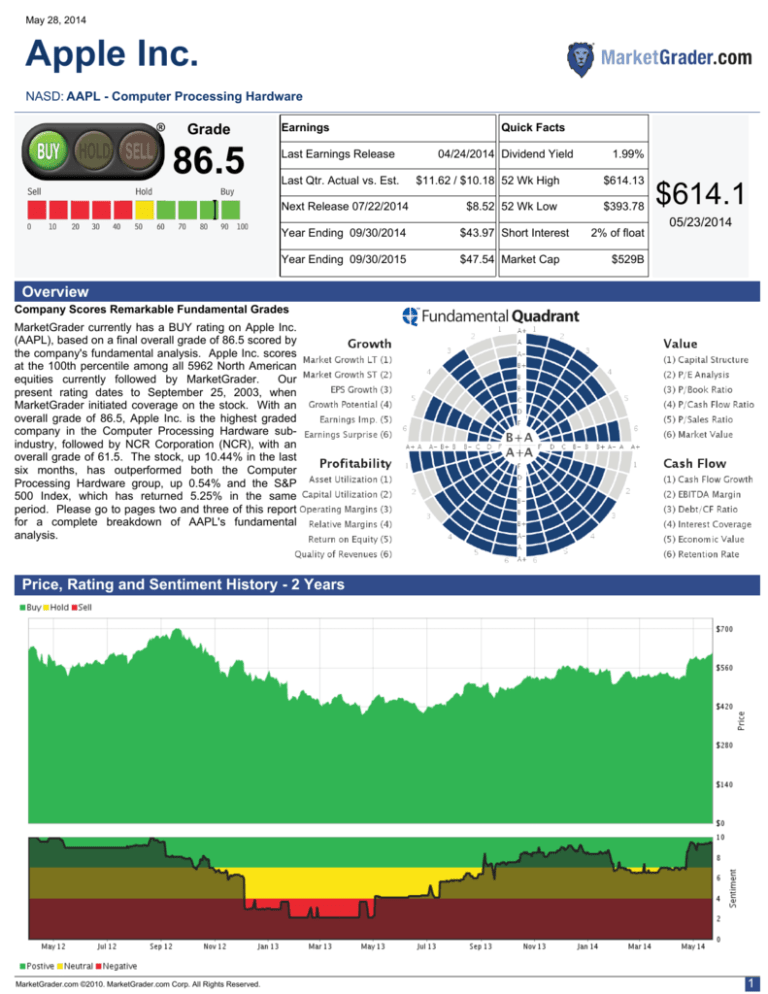

May 28, 2014

Apple Inc.

NASD: AAPL - Computer Processing Hardware

Grade

86.5

Earnings

Last Earnings Release

Last Qtr. Actual vs. Est.

Quick Facts

04/24/2014 Dividend Yield

1.99%

$11.62 / $10.18 52 Wk High

$614.13

Next Release 07/22/2014

$8.52 52 Wk Low

$393.78

Year Ending 09/30/2014

$43.97 Short Interest

Year Ending 09/30/2015

$47.54 Market Cap

2% of float

$614.1

05/23/2014

$529B

Overview

Company Scores Remarkable Fundamental Grades

MarketGrader currently has a BUY rating on Apple Inc.

(AAPL), based on a final overall grade of 86.5 scored by

the company's fundamental analysis. Apple Inc. scores

at the 100th percentile among all 5962 North American

equities currently followed by MarketGrader.

Our

present rating dates to September 25, 2003, when

MarketGrader initiated coverage on the stock. With an

overall grade of 86.5, Apple Inc. is the highest graded

company in the Computer Processing Hardware subindustry, followed by NCR Corporation (NCR), with an

overall grade of 61.5. The stock, up 10.44% in the last

six months, has outperformed both the Computer

Processing Hardware group, up 0.54% and the S&P

500 Index, which has returned 5.25% in the same

period. Please go to pages two and three of this report

for a complete breakdown of AAPL's fundamental

analysis.

Price, Rating and Sentiment History - 2 Years

MarketGrader.com ©2010. MarketGrader.com Corp. All Rights Reserved.

1

May 28, 2014

Apple Inc.

NASD: AAPL - Computer Processing Hardware

Growth

B+

The Company's Recent Reports Reflect Solid Top and Bottom Line

Growth

Apple's very strong long terms sales growth seems to have virtually

ground to a halt during its latest quarter. The $45.53 billion in revenue

reported by the company last quarter represents just 4.04% growth from

the $43.76 billion it sold during the same quarter a year earlier. However,

when looking at the longer term picture is is clear the company's sales

growth has been remarkable for a while. Apple booked $175.52 billion in

12-month trailing revenue up to--and including--last quarter, 100.36%

higher than what it sold in the equivalent period ended three years ago, a

very impressive increase. Therefore it seems that the company's

business deteriorated very rapidly most recently, stalling its otherwise

impressive growth record. The next couple of quarters will be very

important in determining if this marks a temporary slowdown as its 12-month trailing sales total calculation will

substitute earlier periods of strong growth with more recent lower sales figures. In its latest announcement it also

posted healthy profit gains both on a year-to-year basis and over a three year period when comparing full year

results, using four rolling quarters of net income for the latter comparison. It posted a First quarter profit increase

of 7.08% to $10.22 billion from $9.55 billion (excluding extraordinary items) a year earlier, compared to a 92.85%

full year profit increase to $37.71 billion in the 12 months ended last quarter from $19.55 billion three years

earlier. The company's margins have been shrinking steadily during the last three quarters, albeit at a slower rate

during the latest period. Its EBITDA, operating and net margins fell on average by 7.26% in the latest quarter

versus the year ago period.

Market Growth LT

Market Growth ST

EPS Growth

Growth Potential

Earnings Momentum

Earnings Surprise

86.5

AB+

A+

C

A

B-

Revenue Qtrly. 03/31/2014

Revenue Qtrly. Year Ago

Revenue 1 Yr. Chg.

Revenue 12 Mo. Tr. Latest

Revenue 12 Mo. Tr. 3Y Ago

Revenue 12 Mo. Tr. 3Y Chg.

$45.5B

$43.8B

4.04%

$175.5B

$87.6B

100.36%

After reporting earnings on April 24, 2014 that beat analysts' consensus estimates by 14.14%, the company's

stock jumped 8.99% as investors welcomed the report. Apple's most recent earnings announcement is consistent

with its solid long term earnings surprise record, having exceeded the street's consensus estimate by 4.55%, on

average, in its last six announcements.

Net Income Qtrly. 03/31/2014

Net Income Qtrly. Year Ago

Net Income 1 Yr. Chg.

Net Income 12 Mo. Tr. Latest

Net Income 12 Mo. Tr. 3Y Ago

Net Income 12 Mo. Tr. 3Y Chg.

Value

A

The Stock's Valuation is Attractive Based on the Company's Overall

Financial Strength

Trading currently at 13.42 times forward 12-month' earnings per share,

Apple's stock is priced at a 56.04% discount to the "optimum" P/E ratio of

30.53, calculated by MarketGrader. Our indicator looks at the 12-month

period ended in each quarter within the last two years and calculates the

company's annualized EPS growth rate, which in turn determines the

stock's optimum P/E. Based on this measure, Apple's earnings per share

have grown at an annualized rate of 1.02% during this period. This rate of

growth could decelerate soon given the company's recent margin

contraction, despite such good Profitability grades. This could in turn put

pressure on the stock price. The stock also trades at 13.42 times forward

earnings estimates for the next four quarters, lower than its trailing P/E

and the S&P 500 index's forward P/E of 15.20. By placing a lower multiple on the company's future earnings than

it does on the market as a whole, investors may see the company as financially strong but with relatively poor

growth prospects. This may offer a valuable opportunity for patient investors willing to wait for future earnings

reports.

Capital Structure

P/E Analysis

Price/Book Ratio

Price/Cash Flow Ratio

Price/Sales Ratio

Market Value

$10.2B

$9.5B

7.08%

$37.7B

$19.6B

92.85%

A+

A+

A+

A

BA

P/E Ratio 12 Mo. Tr. 03/31/2014

Optimum P/E Ratio

Forward P/E Ratio

S&P 500 Forward P/E Ratio

Price to (Tangible) Book Ratio

Price-to-Cash Flow Ratio

Price/Sales Ratio

14.67

30.53

13.42

15.20

4.50

10.09

3.02

Apple's current market value is 4.73 times its tangible book value, which excludes intangible assets such as

goodwill; this valuation seems attractive, especially considering that only 4.98% of the company's total

stockholders' equity is based on intangible assets. When the value of those assets is added back into total book

value, the price to book ratio is an even lower 4.50. Relative to the $60.84 in cash flow per share generated by

the company in the last twelve months, the stock is attractively priced at 10.09 times cash flow per share

considering its strengths across our fundamental indicators. Its price to sales ratio of 3.02 is slightly higher than

the Computer Processing Hardware's average of 1.67, both based on trailing 12-month sales. Finally, from a

value perspective, we look at how much bigger the company's market capitalization is than its latest operating

profits after subtracting taxes. From this perspective Apple's market cap of $529.00 billion , which is only 11.70

times larger than its latest quarterly net income (plus depreciation), seems like an attractive valuation.

MarketGrader.com ©2010. MarketGrader.com Corp. All Rights Reserved.

2

May 28, 2014

Apple Inc.

86.5

NASD: AAPL - Computer Processing Hardware

Profitability

A+

Company's Profitability Is Remarkable, Reflective of Excellent

Operating Conditions and Strong Management

Apple is a very profitable company with strong overall indicators in this

section of our analysis. The company's different measures of return to

shareholders and margins are typically above those of its peers. In the

last four quarters Apple earned a profit of $37.71 billion, equivalent to

21.48% of its sales in the period. The Computer Processing Hardware

industry had an average operating margin of 10.99% in the period. The

company's operating margin of 28.13% exceeded that average by

145.04%. Apple's return on equity, based on trailing 12-month earnings,

is not only outstanding at 31.38%, but it's higher than the 29.28% return

on equity from the year earlier period. This is an important metric of

management efficiency in our grading system, as it measures the amount

earned on an investment in the company's common stock.

Asset Utilization

Capital Utilization

Operating Margins

Relative Margins

Return on Equity

Quality of Revenues

A+

AA

A+

A+

A+

Given such strong returns the company's capital structure seems to conservative, especially assuming it could

raise debt capital to invest into what is a steady and profitable business. Apple's long term debt accounts for only

12.37% of total capital. Apple's core operations, as measured by the company's EBITDA, have generated $58.01

billion in earnings over the last twelve months, a modest -0.70% decline from the $58.42 billion earned in the

equivalent period ended a year ago. EBITDA is used as a way of measuring core earnings since it includes

money earned in its operations such as interest expense, income taxes paid and depreciation and amortization,

both of which are non-cash charges.

Cash Flow

A

Company's Cash Flow Is Very Well Managed as Our Analysis Reflects

a Very Healthy Operation

Apple showed a small improvement in its quarterly cash flow during the

latest period, in which it grew by 7.75% to $13.47 billion from the $12.50

billion reported in the same period last year. This is a marked

improvement from the 3.15% decline in cash flow in the last twelve

months versus a year before and could represent a turning point for the

company's operating profitability and its future earnings growth. Even

though the company has $16.96 billion in total debt, its net debt is virtually

zero since it has $41.35 billion in cash on hand; and since it generated

$15.85 billion in earnings before interest, taxes, depreciation and

amortization last quarter, it's safe to say its liquidity is remarkable.

Therefore the company's debt is not only very manageable with its own

cash flow but could be increased if it wanted to pursue strategic growth opportunities. The company also has the

ability to enhance shareholder returns through dividends or by repurchasing its own shares, boosting the future

value of its earnings. <b> ** </b>

Cash Flow Growth

EBIDTA Margin

Debt/Cash Flow Ratio

Interest Cov. Capacity

Economic Value

Retention Rate

BAA+

A+

A+

A+

An important indicator of management efficiency used by MarketGrader is Economic Value Added, or EVA,

which measures each company's true return to shareholders after accounting not only for the cost of running the

business (operating costs) but also the cost of the capital it employs. By measuring the real cost of capital, both

equity and debt, EVA measures the creation of true economic profit. In this case Apple had $137.14 billion in

invested capital in its most recent quarter, a combination of both equity and long term debt. However, the

company's weighted cost of equity of 5.70% is much larger than the weighted cost of debt, which is 0.16%. When

combined, the two result in a total cost of capital of 5.86%, quite low compared to the company's total return on

invested capital of 36.00% based on 12-month trailing operating income. The result is an excellent economic

value added of 30.13%, a very high return to investors after all capital costs are covered. The company hiked its

quarterly common dividend in its latest quarter, reported on December 31, 2013, to 3.29 cents a share from 3.05

cents, a 7.87% increase. It has now been paying dividends regularly since June 30, 2012 and the stock's current

yield is 1.99%. Apple paid out a total of $11.01 billion in common dividends in the 12 months ended last quarter,

or 20.57% of the cash flow it generated during the period, and 29.20% of total after-tax earnings. This payout

level, which seems sustainable given the company's generally healthy fundamentals, is actually lower than the

29.27% of earnings paid out in the year ended just a quarter ago. No further payout reductions seem necessary if

the company's grades remain at least at the current level or higher.

MarketGrader.com ©2010. MarketGrader.com Corp. All Rights Reserved.

Cash Flow Qtrly. 03/31/2014

Cash Flow Qtrly Year Ago

Cash Flow 1 Yr. Chg.

Cash Flow 12 Mo. Tr. Latest

Cash Flow 12 Mo. Tr. 3Y Ago

Cash Flow 12 Mo. Tr. 3Y Chg.

Free Cash Flow Last Qtr.

$13.5B

$12.5B

7.75%

$53.5B

$26.5B

102.12%

$9.4B

Economic Value

Total Invested Capital

Return on Inv. Capital

Weighted Cost of Equity

Weighted Cost of Debt

Total Cost of Capital

Economic Value Added

$137.1B

36.00%

5.70%

0.16%

5.86%

30.13%

3

May 28, 2014

Apple Inc.

86.5

NASD: AAPL - Computer Processing Hardware

Profile

Apple, Inc. designs, manufactures and markets personal computers and related personal computing,

and mobile communication devices. It is engaged in designing of Mac laptops, along with OS X, iLife,

iWork and professional software. Apple provides the digital music revolution with its iPods and

iTunes online store. The company's products and services include Macintosh computers, iPhone,

iPad, iPod, Apple TV, Xserve, a portfolio of consumer and professional software applications,

peripherals and iOS operating systems, third-party digital content and applications through the

iTunes Store and a variety of accessory, service and support offerings. It sells its products worldwide

through its retail stores, online stores, and direct sales force and third-party cellular network carriers,

wholesalers, retailers, and value-added resellers to the consumer, small and mid-sized business,

education, enterprise, government and creative markets. In addition, the company also sells a variety

of third-party Mac, iPhone, iPad and iPod compatible products, including application software,

printers, storage devices, speakers, headphones and various other accessories through its online

and retail stores. The company was founded by Steven Paul Jobs, Steve Wozniak and Ronald

Gerald Wayne on April 1, 1976 and is headquartered in Cupertino, CA.

MarketGrader Dilution Analysis

Impact of Change in Shares on EPS - Q2 2014

Dilution Summary

*EPS Latest

$11.62

*EPS Year Ago

$10.09

EPS Change 1 Yr.

880

C. Shares - Yr Ago(M)

946

C. Shares - 1Yr Chg.

(7%)

Smallest Company in Sub-Industry

XRS Corporation (XRSC)

Grade 31.6

Market Cap:$30.18 million

Income

Statement

Last Qtr

(03/2014)

Revenue

$45.5B

$175.5B

Op. Income

$13.6B

$49.4B

Net Income

$10.2B

$37.7B

*EPS

$11.62

0

12 Mo.

Trailing

*Earnings per share are based on fully diluted net income per share

excluding extrodinary items. This number may not match the

headline number reported by the company.

$10.81

EPS Chg. if Yr. Ago

EPS Loss from Dilution

Biggest Company in Sub-Industry

Apple Inc. (AAPL)

Grade 86.5

Market Cap:$529.00 billion

15%

C. Shares - Latest(M)

EPS if Yr. Ago Shares

Key Facts:

1 Infinite Loop

Cupertino ,CA 95014-2083

Phone:

www.apple.com

7%

$0.82

*Earnings per share are based on fully diluted net income per share excluding extrodinary items. This number may not match the headline number reported by the company.

Balance Sheet

Total Assets

Total Debt

Stockholders Eq.

Latest

$206.0B

$17.0B

$120.2B

All numbers in millions except EPS

Ratios

Price/Earnings (12 mo. trailing)

Price/Tangible Book

Price/Cash Flow

Price/Sales

Debt/Cash Flow

Total Assets

Intangible Assets

Long Term Debt

Total Debt

Book Value

Enterprise Value

$206.0B

$6.0B

$17.0B

$17.0B

$120.2B

($24.4B)

MarketGrader.com ©2010. MarketGrader.com Corp. All Rights Reserved.

'09

'10

'11

'12

'13

14.67

4.50

10.09

3.02

31.70

Return on Equity

31.38%

Gross Margin (12 mo. trailing)

39.47%

Operating Margin (12 mo. trailing)

28.13%

Net Profit Margin (12 mo. trailing)

21.48%

'14

Qtr 1

0.00 0.00 0.00 0.00 3.05 3.29

Qtr 2

0.00 0.00 0.00 2.65 3.05

Qtr 3

0.00 0.00 0.00 2.65 3.05

Qtr 4

0.00 0.00 0.00 2.65 3.05

4

May 28, 2014

Apple Inc.

86.5

NASD: AAPL - Computer Processing Hardware

Top Down Analysis

Technology

Stocks in Sector: 846

Buys: 138 (16.31%)

Holds: 118 (13.95%)

Sells: 590 (69.74%)

No. of stocks at:

52-Wk. High: 35

52-Wk. Low: 22

Above 50 & 200-day MA: 243

Below 50 & 200-day MA: 400

Computer Processing

Hardware

Stocks in Sub-Industry: 10

Buys: 2 (20.00%)

Holds: 1 (10.00%)

Sells: 7 (70.00%)

No. of stocks at:

52-Wk. High: 2

52-Wk. Low: 0

Above 50 & 200-day MA: 2

Below 50 & 200-day MA: 6

1. Price Trend.

#

Ticker

1

AAPL

86.48

P

Apple Inc.

2

PHO.CA

84.98

N

Photon Control Inc.

3

SFUN

84.81

N

SouFun Holdings Ltd.

4

MU

83.94

P

Micron Technology, Inc.

$27.33

06/18/2014

5

WAN.CA

82.68

N

WANTED Technologies Corporation

$1.11

10/21/2014

6

OLED

81.64

N

Universal Display Corporation

$24.57

08/11/2014

7

SYNT

81.35

N

Syntel, incorporated

$80.96

07/17/2014

8

XX.CA

80.68

N

Avante Logixx Inc.

$0.38

05/28/2014

9

AZPN

80.61

P

Aspen Technology, Inc.

$44.45

08/19/2014

10

AFOP

80.60

P

Alliance Fiber Optic Products, Inc.

$20.89

07/22/2014

#

Ticker

Price

Next EPS

1

AAPL

86.48

P

Apple Inc.

$614.13

07/22/2014

2

NCR

61.47

N

NCR Corporation

$32.46

07/24/2014

3

CCUR

55.28

N

Concurrent Computer Corporation

$8.06

04/30/2014

4

HPQ

46.84

P

Hewlett-Packard Company

$33.72

08/20/2014

5

XPLR

38.22

N

Xplore Technologies Corp.

6

CRAY

32.45

P

Cray Inc.

7

XRSC

31.62

N

8

PAR

25.38

9

ARUN

10

ADAT

A+

3. Earnings Guidance. A-

Grade

Grade

Sentiment

Sentiment

Name

Name

Price

Next EPS

$614.13

07/22/2014

$0.42

08/27/2014

$12.28

08/14/2014

$5.27

06/25/2014

$28.07

08/05/2014

XRS Corporation

$2.71

11/03/2011

N

PAR Technology Corporation

$4.57

07/30/2014

24.15

N

Aruba Networks, Inc.

$17.89

08/26/2014

21.50

N

Authentidate Holding Corp.

$0.79

09/27/2013

2. Price Momentum.

A-

4. Short Interest.

A+

9.5

Copyright 2010 MarketGrader.com Corp. All rights reserved. Any unauthorized use or disclosure is prohibited. Neither the information nor any opinion expressed constitutes an offer to buy or sell any securities or any options, futures or other derivatives related to

such securities ("related investments"). The information herein was obtained from various sources; we do not guarantee its accuracy or completeness. This research report is prepared for general circulation and is circulated for general information only. It does not

have regards to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors should seek financial advice regarding the appropriateness of investing in any securities or investment

strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that income from such securities, if any, may fluctuate and that each security's price or value may

rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. MarketGrader does not make markets

in any of the securities mentioned in this report. MarketGrader does not have any investment banking relationships. MarketGrader and its employees may have long/short positions or holdings in the securities or other related investments of companies mentioned

herein. Officers or Directors of MarketGrader.com Corp. are not employees of covered companies. MarketGrader or any of its employees do not own shares equal to one percent or more of the company in this report.

MarketGrader.com ©2010. MarketGrader.com Corp. All Rights Reserved.

5