ACCT 20100 Review

advertisement

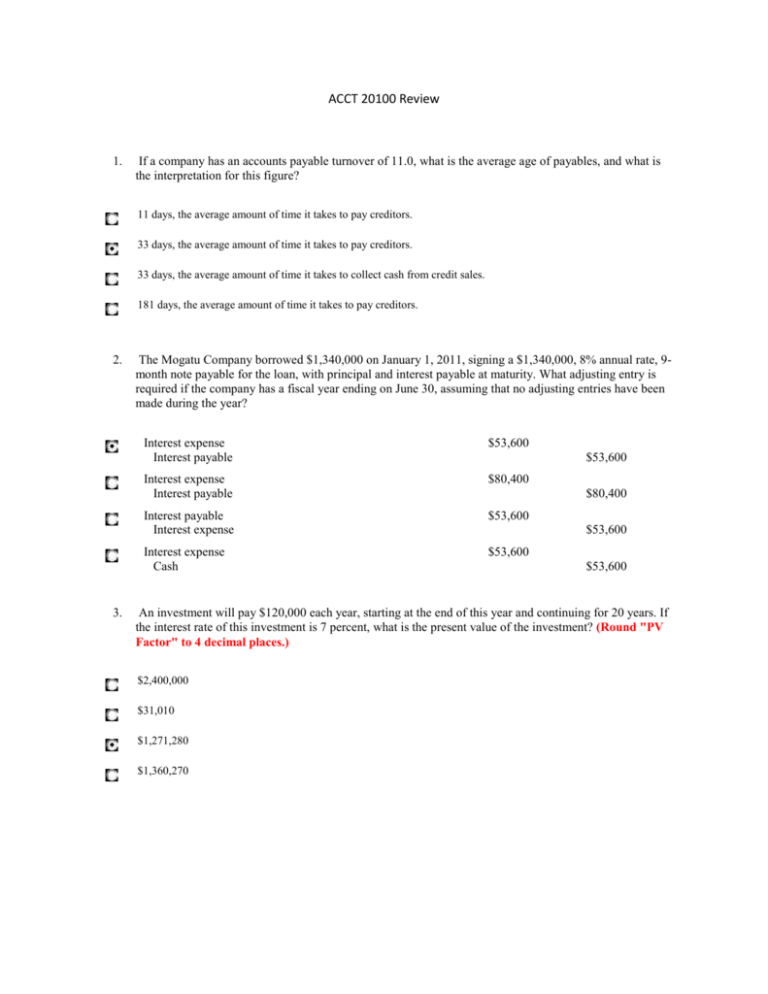

ACCT 20100 Review 1. If a company has an accounts payable turnover of 11.0, what is the average age of payables, and what is the interpretation for this figure? 11 days, the average amount of time it takes to pay creditors. 33 days, the average amount of time it takes to pay creditors. 33 days, the average amount of time it takes to collect cash from credit sales. 181 days, the average amount of time it takes to pay creditors. 2. 3. The Mogatu Company borrowed $1,340,000 on January 1, 2011, signing a $1,340,000, 8% annual rate, 9month note payable for the loan, with principal and interest payable at maturity. What adjusting entry is required if the company has a fiscal year ending on June 30, assuming that no adjusting entries have been made during the year? Interest expense Interest payable $53,600 Interest expense Interest payable $80,400 Interest payable Interest expense $53,600 Interest expense Cash $53,600 $53,600 $80,400 $53,600 $53,600 An investment will pay $120,000 each year, starting at the end of this year and continuing for 20 years. If the interest rate of this investment is 7 percent, what is the present value of the investment? (Round "PV Factor" to 4 decimal places.) $2,400,000 $31,010 $1,271,280 $1,360,270 4. San Antonio Outdoor Furniture issues bonds with a face value of $1,000,000 having an 11 percent coupon rate of interest. The market rate for similar bonds is 8 percent. The bonds were issued: At coupon. At par. At a premium. At a discount. 5. A company issues bonds with a face value of $11,000,000 having an 8 percent coupon rate of interest. The market rate for similar bonds is 8 percent. What were the proceeds from the bond issue? $11,000,000 $11,880,000 $12,000,000 $10,120,000 6. A company issues bonds with a face value of $5,000,000 having a 10 percent coupon rate when the market rate for similar bonds is 10 percent. What journal entry would the company make to record interest when it is paid every six months (assuming that no adjusting entries have been made)? Cash Interest expense $200,000 Interest expense Cash $500,000 Bonds payable Cash $250,000 Interest expense Cash $250,000 $200,000 $500,000 $250,000 $250,000 7. What type of account is the discount on bonds payable? A contra-liability account. A contra-equity account. An expense account. A loss account. 8. DC Waste uses the effective interest method to amortize the bond discount on $3,600,000 of bonds issued with a coupon rate of 5%, when the market rate was 7%. The bonds mature in 10 years and pay interest every six months. If the discount at the time the bonds was issued was $511,646 what amount of interest expense is recognized by the company on the first interest payment? $108,092 $90,000 $126,000 $143,908 9. When bonds with a face value of $6,280,000 having a 7 percent stated rate of interest are issued at $5,940,000, the journal entry to record the transaction would be: Cash Discount on bonds payable Bonds payable $5,940,000 $340,000 Cash Loss on bonds payable Bonds payable $5,940,000 $340,000 Cash Bonds payable $5,940,000 Cash Interest payable Bonds payable $5,940,000 $340,000 $6,280,000 $6,280,000 $5,940,000 $6,280,000 10. A company issued $1,060,000 of 15 year bonds, having a coupon rate of 8%. If the bonds are issued at a premium, the total interest expense of the bond issue over the entire 15 years is equal to: $1,272,000 $1,272,000 minus the amount of bond premium on the date of the sale. $1,590,000 $1,272,000 plus the amount of bond premium on the date of the sale. 11. Owning stock of a corporation has certain benefits. Which of the following is not one of those benefits? The right to receive interest revenue at a stated rate. The ability to vote on major issues concerning management of the corporation. The right to receive a proportional share of profits distributed. A residual claim to assets remaining upon distribution of the company. 12. River City Publications incorporated on February 1, 2011. The following information related to their common stock during the first month of the company's operations: Feb-1 Feb-5 Feb-16 Feb-20 Feb-24 Shares authorized Shares issued Shares issued Treasury stock purchased Shares issued 5,160,000 1,580,000 774,000 217,600 312,800 How many shares of stock are outstanding at the end of February 2011? 2,449,200 shares 2,884,400 shares 7,609,200 shares 8,044,400 shares 13. Northwest Stove Company issued 11,100 shares of $5 par value common stock for $321,900. Recording this transaction will require: Retained earnings to be credited for $321,900. Cash to be credited for $321,900. Common stock to be credited for $321,900. Capital in excess of par to be credited for $266,400. 14. Which of the following is correct about treasury stock transactions? Treasury stock is an asset. Companies purchase shares of stock so that they can obtain the voting rights and vote on important issues. Companies will repurchase their stock for employee bonus plans. Selling treasury stock for more than the purchase price allows the company to experience gains that increase net income. 15. Tubajo Manufacturing purchased 61,600 shares of its own $7 par stock on the open market when it had a price of $33.6 per share. If these shares of stock were sold for $21.3 per share, what would the journal entry be to record this transaction? Cash Capital in excess of par Treasury stock $1,312,080 $757,680 Cash Retained Earnings $2,069,760 Cash Treasury stock $2,069,760 Cash Loss on the sale of treasury stock Treasury stock $1,312,080 $757,680 $2,069,760 $2,069,760 $2,069,760 $2,069,760 16. Some corporations have a relatively high dividend yield and others have a relatively low dividend yield. Which of the following companies is likely to have a relatively low dividend yield? A growth-oriented technology company with a rising stock price. A mature consumer goods manufacturer and distributor. A mature wireless telecommunication provider. A banking and financial services company that has been in existence 70 years. 17. What effect does a stock dividend have on a corporation's balance sheet? Total liabilities increases and shareholders' equity decreases by the same amount. Retained earnings increases and common stock decreases by the same amount. Shareholders' equity remains unchanged. Assets increase and shareholders' equity decreases by the same amount. 18. Which of the following statements regarding a 3-for-1 split of common stock is not correct? The total contributed capital increases by 3 times. A shareholder owning 500 shares prior to the split will own 1,500 shares after the split. The effect on Retained Earnings will not be the same as if a stock dividend was issued. If the par value prior to the split was $3.00 per share, it will be $1.00 per share after the split. 19. Hunt Foods has the following stocks outstanding: 50,300 shares cumulative, 6% preferred stock, $20 par value, and 101,500 shares of $1 par, common stock. The company has not been able to pay dividends the last two years, however this year the company declared and paid a cash dividend of $206,500. How much were the common shareholders paid? $138,075 $146,140 $85,780 $25,420 REQUIRED: 1. Prepare a statement of cash flows using the INDIRECT METHOD. 2. Prepare the Cash Flows from Operating Activities using the DIRECT METHOD. Bankhead, Inc Statement of Cash Flows For the year ending December 31, 2012 Cash flows from operating activities Net Income $159 Plus: Depreciation $17 Adjustments for changes in operating assets and liabilities Change in Accounts Receivable ($8) Change in Inventory $735 Change in Accounts Payable ($196) Net Cash Flows from Operating Activities Cash flows from investing activities Purchase of Land Net Cash flows from investing activities ($150) Cash flows from financing activites Dividends Paid Payment of short-term notes payable Payment of long-term bonds Net Cash flows from finaning activities ($25) ($161) ($200) ($150) ($386) Change in Cash Beginning Cash Balance Ending Cash Balance $171 $612 $783 Bankhead, Inc Statement of Cash Flows For the year ending December 31, 2012 Cash flows from operating activities Cash Received from customers $1,442 Cash Paid to Suppliers ($491) Cash paid for Selling & admin Expenses ($110) Cash paid for other expenses ($81) Cash paid for taxes ($53) Net Cash flows from Operating Activities $707 $707