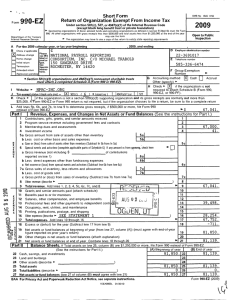

Form 990-EZ Short Form Return of Organization Exempt From

advertisement

Short Form Return of Organization Exempt From Income Tax Form Department of the Treasury ^ Sponsoring organizations of door advised funds , organizations that operate one or more hosp it al facilities , and certain controlling organizations as defined in section a5s1^2 ( bx13 )gmust file Form 990 All @other organizations with gross receipts less than $ 200,000 and total fu r thi 1 m o at i ri^ The organization ma /lavetouse a co o tllfs re ^ y A For the 2012 calendar year , or tax year beginning Check if B ap p cable 2012 Under section 501(c) 527, or 4947(a )( 1) of t e Internal Revenue Code (except blac k lung benefit trust or private foundation) 990-EZ Internal Revenue Service OMB No 1545-1150 JUL copy 1, o s^tis y s a e reporting requirements. and ending JUN 30, 2013 2012 C Name of organ iz ation D Employer identification number =Address change Name change Initial return =Terminated 73-1329693 TULSA UNITED SOCCER CLUB Number and street (or P.O. box, if mail is not delivered to street address ) Room /suite E Telephone number PO BOX 691752 918-665-2870 City or town, state or country, and ZIP + 4 F Group Exemption TULSA , OK 74169-1752 Number ^ 'A Ilcaton endin Cash Accrual Other ( specify ) ^ G Accounting Method : H Check ^ if the organization is not required to attach Schedule B I Website : ^ WWW . TULSAUNITEDSOCCERCLUB . COM )"4(Insert no .) L_J 4947(a)(1) or J Tax - exempt status ( check only one) 501 (c)(3) L_J 501( c) ( 527 ( Form 990, 990-EZ, or 990-PF). K Check ^ L_J if the organization is not a section 509(a )( 3) supporting organization or a section 527 organization and its gross receipts are normally not more than $50,000 . A Form 990 - EZ or Form 990 return is not required though Form 990-N ( e-postcard ) may be required ( see instructions ). But if the organization chooses to file a return , be sure to file a complete return. L Add lines 5b , 6c, and 7b, to line 9 to determine gross receipts. If gross receipts are $200, 000 or more, or if total assets (Part II, line 25 , column B below ) are $500, 000 or more , file Form 990 instead of Form 990-EZ ^ $ 199,386. anges in N et Assets or F un d B a l ances ( see the instructions for Part I) R evenue , Expenses , an d Part I =Amended return Check if the oraanlzatlon used Schedule 0 to resoond to any auestlon in this Part I c d 7a b c 8 9 10 11 12 13 14 15 16 Other expenses (describe in Schedule 0 ) 17 Total expenses . Add lines 10 through 16 Excess or (deficit ) for the year ( Subtract line 17 from line 9) _ Net assets or fund balances at beginning of year ( from line 27, column (A)) (must agree with end -of-year figure reported on prior year's return) Other changes in net assets or fund balances (explain in Schedule 0) Net assets or fund balances at end of year. Combine lines 18 through 20 b w X 7DR ca 2 I-P ^19 CL X W N Q M n Contributions , gifts, grants, and similar amounts received Program service revenue including government fees and contracts Membership dues and assessments Investment income Gross amount from sale of assets other than inventory 5a Less: cost or other basis and sales expenses 5b Gain or ( loss) from sale of assets other than inventory ( Subtract line 5b from line 5a) Gaming and fundraising events Gross income from gaming ( attach Schedule G if greater than $15,000) 6a Gross income from fundraising events ( not including $ of contributions from fundraising events reported on line 1) (attach Schedule G If the sum of such 6b gross income and contributions exceeds $ 15,000) 6c Less: direct expenses from gaming and fundraising events Net income or (loss ) from gaming and fundraising events (add lines 6a and 6b and sub tract line 6c) Gross sales of inventory, less returns and allowances 7a 7b Less: cost of goods sold Gross profit or ( loss) from sales of inventory ( Subtract line 7b from line 7a) ^ ^^ ^^^^ Other revenue (describe in Schedule 0) Total revenue . Add lines 1, 2, 3, 4, 5c , 6d, 7c, and 8 (^ ^ Grants and similar amounts paid (list in Schedule 0) MAY 201 4 Benefits paid to or for members Salaries , other compensation , and employee benefits Professional fees and other payments to independent contractors I E LEOccupancy , rent, utilities, and maintenance S Printing , publications , postage, and shipping 1 2 3 4 5a b c 6 a 18 19 20 21 SEE SCHEDULE 0 ^ ^ 1 2 199,386. 3 4 5c _ 6d 7c 8 9 10 11 12 13 14 15 199,386. 7,622. 26,905. 16 137,935. 17 18 172 19 20 21 LHA For Paperwork Reduction Act Notice , see the separate instructions. ,462 . 26 , 924 . 65 , 286 . 0 . 9 2 , 210 . Form 990-EZ (2012) 232171 69 01-11-13 15370513 757053 TUSC 1 2012.05080 TULSA UNITED SOCCER CLUB TUSC 1 rA Form 990-EZ (2012) TULSA UNITED SOCCER CLUB Balance Sheets (see the instructions for Part II) Part II 73-1329693 Check if the org anization used Schedule 0 to res p ond to any question in this Part II (A) Beginning of year 51 , 8 6 0 . 22 Cash, savings, and investments 12 , 0 0 0 . 23 Land and buildings SEE SCHEDULE 0 1,426. 24 Other assets ( describe in Schedule 0 ) 65,286. 25 Total assets 0 • 26 Total liabilities ( describe in Schedule 0 ) 65 , 286 . 27 Net assets or fund balances (line 27 of column ( B) must agree with line 21) Part III Statement of Program Service Accomplishments (see the instructions for Part III) Check if the organization used Schedule 0 to res pond to any q uestion in this Part III What is the organization 's primary exempt purpose2SEE STATEMENT BELOW. Page 2 0 ( B) End of year 79, 191. 12, 000 . 1 , 019. 92,210. 0 . 92, 210 . Expenses 22 23 24 25 26 27 ® (Required for section 501(c)(3) and 501(c)(4) organizations and section Describe the organization ' s program service accomplishments for each of its three largest program services , as measured by expenses In a clear and concise 4947(a)(1) trusts; optional manner , describe the services provided , the number of persons benefited, and other relevant information for each program title for others.) 28 SEE SCHEDULE 0 (Grants $ If this amount includes forei g n g rants, check here ^ L-J 28a (Grants $ If this amount includes forei g n g rants, check here 29a 159,015. 29 30 ^ If this amount includes forei g n g rants, check here (Grants $ 31 Other program services (describe in Schedule 0) pi, 0 If this amount includes forei g n g rants , check here Grants $ 32 Total pro ram service expenses (add lines 28a throu g h 31a ^ Part IV List of Officers, Directors, Trustees , and Key Employees List each one even if not compensated (see the C;het-k if tha nrnani7atinn I tcari Sr-hPrfl dp C) to rRCnnnri to anv rn wtstinn in this Part IV (b) Average hours ( C) Reportable compensation ( Forms per week devoted to w-211og9- Mist) ( a ) Name and title position DAVE MCFARLAND PRESIDENT BRIAN PARRIS TREASURER ROBIN COLBY REGISTRAR TIM FAUX OFFICE MANAGER JOHN EVANS REFEREE ASSIGNER (if not paid , enter -0- ) 30 31a 32 1759,015. instructions for Part nq n (d) Health benefits , contributions to employee benefit plans, and deferred compensation amount of other compensation 5.00 0. 0. 0. 1.00 0. 0. 0. 20.00 5,690. 0. 0. 20.00 4,915. 0. 0. 10.00 0. 0. 0. Form 990-EZ (2012) 232172 01-11-13 15370513 757053 TUSC ( e) Estimated 2 2012. 05080 TULSA UNITED SOCCER CLUB TUSC 1 Form990-EZ 2012 Part V 33 34 35a b c 36 37a b 38a b 39 a b 40a b c d TULSA UNITED SOCCER CLUB 73-1329693 Page3 Other Information (Note the Schedule A and personal benefit contract statement requirements in the instructions for Part V) Check if the organization used Sch. 0 to respond to any question in this Part V 0 Yes No Did the organization engage in any significant activity not previously reported to the IRS? If "Yes," provide a detailed description of each activity in Schedule 0 33 Were any significant changes made to the organizing or governing documents? If "Yes; attach a conformed copy of the amended documents if they reflect a change to the organization's name. Otherwise, explain the change on Schedule 0 (see instructions) 34 Did the organization have unrelated business gross income of $1,000 or more during the year from business activities (such as those reported on lines 2, 6a, and 7a, among others)? 35a If 'Yes," to line 35a, has the organization filed a Form 990-T for the year? If "No; provide an explanation in Schedule 0 35b Was the organization a section 501(c)(4), 501(c)(5), or 501(c)(6) organization subject to section 6033(e) notice, reporting, and proxy tax requirements during the year? If 'Yes; complete Schedule C, Part III 35c Did the organization undergo a liquidation, dissolution, termination, or significant disposition of net assets during the year? If 'Yes,' complete applicable parts of Schedule N 36 Enter amount of political expenditures, direct or indirect, as described in the instructions 37a ^ 0Did the organization file Form 1120-POL for this year? 37b Did the organization borrow from, or make any loans to, any officer, director, trustee, or key employee or were any such loans made in a prior year and still outstanding at the end of the tax year covered by this returns 38a If "Yes," complete Schedule L, Part II and enter the total amount involved 38b N/A Section 501(c)(7) organizations. Enter: Initiation fees and capital contributions included on line 9 39a N/A Gross receipts, included on line 9, for public use of club facilities 39b N/A Section 501(c)(3) organizations. Enter amount of tax imposed on the organization during the year under: section 4911 ^ 0 . ;section 4912 ^ 0 . ; section 4955 ^ 0. Section 501(c)(3) and 501(c)(4) organizations. Did the organization engage in any section 4958 excess benefit transaction during the = year, or did it engage in an excess benefit transaction in a prior year that has not been reported on any of its prior Forms 990 or 990-EZ7 If 'Yes," complete Schedule L, Part I 40b Section 501(c)(3) and 501(c)(4) organizations. Enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 ^ 0. Section 501(c)(3) and 501(c)(4) organizations. Enter amount of tax on line 40c reimbursed by the organization ^ X X N/ X X X J X -X 0. e All organizations. At any time during the tax year, was the organization a party to a prohibited tax shelter transaction? If 'Yes," complete Form 8886-T 41 List the states with which a copy of this return is filed ^ OK 42a The organization's books are in care of ^ TULSA UNITED SOCCER CLUB Located at ^ 9726 E 42ND ST, SUITE 147, TULSA, OK X X 40e Telephone no. ^ 918-665-2870 ZIP+4 ^ 74146 b At any time during the calendar year, did the organization have an interest in or a signature or other authority over a financial account in a foreign country (such as a bank account, securities account, or other financial account)? If 'Yes," enter the name of the foreign country. ^ See the instructions for exceptions and filing requirements for Form TD F 90-22.1, Report of Foreign Bank and Financial Accounts. c At any time during the calendar year, did the organization maintain an office outside of the U.S? If 'Yes; enter the name of the foreign country: ^ 43 Section 4947(a)(1) nonexempt charitable trusts filing Form 990-EZ in lieu of Form 1041 -Check here and enter the amount of tax-exempt interest received or accrued during the tax year ^ I 43 Yes No X 42b I 42c X ^ N/A 0 44a Did the organization maintain any donor advised funds during the year? If 'Yes; Form 990 must be completed instead of Form 990 - EZ b Did the organization operate one or more hospital facilities during the year? If 'Yes ; Form 990 must be completed instead of Form 990 - EZ c Did the organization receive any payments for indoor tanning services during the year? d If 'Yes' to line 44c , has the organization filed a Form 720 to report these payments? If 'No," provide an explanation in Schedule 0 - 44a X 44b 44c X X _ J 44d 45a Did the organization have a controlled entity within the meaning of section 512 ( b)(13)? 45b Did the organization receive any payment from or engage in any transaction with a controlled entity within the meaning of section 512(b)(13)? If 'Yes; Form 990 and Schedule R may need to be completed instead of Form 990-EZ ( see instructions) 45a X 45b Form 990-EZ (2012) 232173 01-11-13 15370513 757053 TUSC 3 2012.05080 TULSA UNITED SOCCER CLUB TUSC 1 Form 990-EZ (2012) TULSA UNITED SOCCER CLUB 73-1329693 Page4 Yes No Did the organization engage, directly or indirectly, in political campaign activities on behalf of or in opposition to candidates for public office? If "Yes; com p lete Schedule C, Part I Part VI Section 501(c)(3) organizations only 46 X 46 All section 501 (c)(3) organizations must answer questions 47-49b and 52, and complete the tables for lines 50 and 51 Check if the org anization used Schedule 0 to res pond to any q uestion in this Part VI 47 48 49a b 50 0 Yes No Did the organization engage in lobbying act i vities or have a section 501 ( h) election in effect during the tax year? If "Yes; complete Sch. C, Part 11 47 X Is the organization a school as described in section 170 (b)(1)(A)(n)^ If "Yes; complete Schedule E X 48 Did the organization make any transfers to an exempt non-charitable related organization? 49a X If 'Yes," was the related organization a section 527 organization? 49b Complete this table for the organization's five highest compensated employees (other than officers, directors, trustees and key employees) who each received more than $100 , 000 of compensation from the organization. If there is none, enter "N one." (a) Name and title of each employee ( d) Health benefits, ( e) Estimated ( b) Average hours (C) Reportable contributions to compensation ( Forms paid more than $100 , 000 p er week devoted to amount of other employee benefit p W-2/1099 - MISC) plans, and deferred position compensation compensation NONE f 51 U 52 Total number of other employees paid over $100,000 ^ Complete this table for the organization's five highest compensated independent contractors who each received more than $100,000 of compensation from the Iutai uunwoi UI uuicr rnucpmwcnI r,unuMwia caL,n IOLcrvuiy uvm y wu,uuu Did the organization complete Schedule A? Note: All section 501(c)(3) organ) charitable trusts must attach a completed Schedule A Declaration of prepar Sign ( than officer b ased on all information of which prepare' has any kn S igna t ure o officer Here Paid Preparer Use Only 232174 01-11-13 15370513 757053 TUSC 2012.05080 OMB No SCHEDULE A Public Charity Status and Public Support (Form 990 or 990-EZ) 20 Complete if the organization is a section 501(c)( 3) organization or a section 4947(a)(1) nonexempt charitable trust. Department of the Treasury Internal Revenue Service 12 Open to Public Inspection llp- Attach to Form 990 or Form 990 -EZ. lli^ See separate instructions. Employer identification number Name of the organization 73-1329693 TULSA UN ITED SOCCER CLUB Heason Tor Public Chanty Status (All organizations must complete this part.) See Instructions. Part I The 1 2 3 4 1545-0047 organization is not a private foundation because it is- (For lines 1 through 11, check only one box.) 0 A church, convention of churches, or association of churches described in section 170(b)(1)(A)(i). 0 A school described in section 170 (b)(1)(A)(ii). (Attach Schedule E.) A hospital or a cooperative hospital service organization described in section 170( b)(1)(A)(iii). 0 A medical research organization operated in conjunction with a hospital described in section 170(b)(1)(A)(iii). Enter the hospital's name, city, and state5 0 An organization operated for the benefit of a college or university owned or operated by a governmental unit described in section 170(b )(1)(A)(iv). (Complete Part II.) 6 0 A federal, state, or local government or governmental unit described in section 170(b)(1)(A)(v). 7 0 An organization that normally receives a substantial part of its support from a governmental unit or from the general public described in section 170(b )(1)(A)(vi). (Complete Part II.) 8 0 A community trust described in section 170( bx1)(A)(vi ). (Complete Part II ) 9 ® An organization that normally receives. (1) more than 33 1/3% of its support from contributions, membership fees, and gross receipts from activities related to its exempt functions - subject to certain exceptions, and (2) no more than 33 1/3% of its support from gross investment income and unrelated business taxable income (less section 511 tax) from businesses acquired by the organization after June 30, 1975. See section 509(a )(2). (Complete Part III.) 10 0 An organization organized and operated exclusively to test for public safety. See section 509(a)(4). 11 0 An organization organized and operated exclusively for the benefit of, to perform the functions of, or to carry out the purposes of one or more publicly supported organizations described in section 509(a)(1) or section 509(a)(2). See section 509(a)(3). Check the box that describes the type of supporting organization and complete lines 11 a through 11 h. a 0 Type I e E::] b 0 Type II d El Type III - Non-functionally integrated c El Type III - Functionally integrated By checking this box, I certify that the organization is not controlled directly or indirectly by one or more disqualified persons other than foundation managers and other than one or more publicly supported organizations described in section 509 ( a)(1) or section 509(a)(2) f g If the organization received a written determination from the IRS that it is a Type I , Type II, or Type III supporting organization , check this box Since August 17, 2006 , has the organization accepted any gift or contribution from any of the following persons? (i) A person who directly or indirectly controls , either alone or together with persons described in (ii) and ( III) below, the governing body of the supported organization? (ii) El A family member of a person described in (i) above'7 (iii) A 35% controlled entity of a person described in (I) or (n) above ? Yes 11 i 11 ii No 11g(iii) Provide the following information about the supported organization(s). (i) Name of supported organization (ii) EIN (vi) Is the (iii) Type of organization iv) Is the organization (v) Did you notify the organization in col. (vii) Amount of monetary (described on lines 1-9 in col. (i) listed in your organization in col. (i) organized in the support governing document? (i) of your support? above or IRC section U.S. (see i ns t ruc ti ons)) Yes No Yes No Yes No Total LHA For Paperwork Reduction Act Notice , see the Instructions for Schedule A (Form 990 or 990- EZ) 2012 Form 990 or 990-EZ 232021 12-04-12 15370513 757053 TUSC 5 2012.05080 TULSA UNITED SOCCER CLUB TUSC 1 Schedule A ( Form 990 or 990-E 2012 S upport Sch ed u l e for O rganizations D escri b ed in Sections 1 70 art Pa e 2 1 iv an d 170 vi (Complete only if you checked the box on line 5, 7, or 8 of Part I or if the organization failed to qualify under Part III If the organization fails to qualify under the tests listed below, please complete Part III.) Section A. Public Support Calendar year (or fiscal year beginning 1 (b) 2009 ( a ) 2008 (c) 2010 ( d) 2011 (e) 2012 Total ( c ) 2010 ( d ) 2011 ( e ) 2012 Total Gifts, grants, contributions, and membership fees received. (Do not include any "unusual grants.") 2 Tax revenues levied for the organization's benefit and either paid to or expended on its behalf 3 The value of services or facilities furnished by a governmental unit to the organization without charge 4 Total. Add lines 1 through 3 5 The portion of total contributions by each person (other than a governmental unit or publicly supported organization) included on line 1 that exceeds 2% of the amount shown on line 11, column (f) 6 • - - Public su pp ort . Subtract line 5 from line 4 Section B. Total Support Calendar year ( or fiscal year beginning in) ^ 7 Amounts from line 4 8 Gross income from interest, ( a ) 2008 ( b ) 2009 dividends, payments received on securities loans, rents, royalties and income from similar sources 9 Net income from unrelated business activities, whether or not the business is regularly carried on 10 Other income Do not include gain or loss from the sale of capital assets (Explain in Part IV) 11 Total support . Add lines 7 through 10 12 12 Gross receipts from related activities, etc. (see instructions) 13 First five years . If the Form 990 is for the organization ' s first , second , third, fourth , or fifth tax year as a section 501(c)(3) Section c:. c:omputatlon OT vuDllc support rerceniage 14 Public support percentage for 2012 (line 6, column (t) divided by line 11, column (f)) 14 % 15 Public support percentage from 2011 Schedule A, Part II, line 14 15 % 16a 33 1 /3% support test - 2012. If the organization did not check the box on line 13, and line 14 is 33 1/3% or more, check this box and stop here . The organization qualifies as a publicly supported organization b 33 1 /3% support test - 2011 . If the organization did not check a box on line 13 or 16a, and line 15 is 33 1/3% or more, check this box and stop here . The organization qualifies as a publicly supported organization ^ ^0 17a 10% - facts - and-circumstances test - 2012 . If the organization did not check a box on line 13, 16a, or 16b, and line 14 is 10% or more, and if the organization meets the "facts-and-circumstances" test, check this box and stop here . Explain in Part IV how the organization meets the 'facts-and-circumstances' test. The organization qualifies as a publicly supported organization ^0 b 10% -facts - and-circumstances test - 2011 . If the organization did not check a box on line 13, 16a, 16b, or 1 7a, and line 15 is 10% or 18 more, and if the organization meets the "facts-and-circumstances' test, check this box and stop here . Explain in Part IV how the organization meets the 'facts-and-circumstances" test The organization qualifies as a publicly supported organization ^ El Private foundation . If the organization did not check a box on line 13, 16a, 16b, 1 7a, or 1 7b, check this box and see instruct ions ^ El Schedule A (Form 990 or 990-EZ) 2012 232022 12-04-12 15370513 757053 TUSC 6 2012.05080 TULSA UNITED SOCCER CLUB TUSC 1 Schedule A Form 990 or 990-E 2012 TULSA UNITED SOCCER CLUB rF!3rt ,lll S upport S c h e d u l e for O rganizations D escri be d in S ection 509(a)(2) 73-1329693 Pag e 3 (Complete only if you checked the box on line 9 of Part I or if the organization failed to quality under Part II If the organization fails to qualify under the tests listed below, please complete Part II ) Section A. Public Support Calendar year ( or fiscal year beginning in) 001 Gifts, grants, contributions, and membership fees received. (Do not include any "unusual grants.") (b) 2009 (a) 2008 ( c) 2010 ( e) 2012 ( d) 2011 Total 2 Gross receipts from admissions, merchandise sold or services performed, or facilities furnished in any activity that is related to the organization's tax-exempt purpose 151,737. 183,708. 335,445. 151,737. 335,445. 3 Gross receipts from activities that are not an unrelated trade or business under section 513 4 Tax revenues levied for the organization's benefit and either paid to or expended on its behalf The value of services or facilities 5 furnished by a governmental unit to the organization without charge Total . Add lines 1 through 5 6 183,708. 7a Amounts included on lines 1, 2, and 3 received from disqualified persons 0 b Amounts included on lines 2 and 3 received from other than disqualified persons that exceed the greater of $5,000 or 1% of the amount on line 13 for the year 0 0 . c Add lines 7a and 7b 8 335, Z45. Public su pp ort (subtractline 7c from line 61 Section B. Total Support Calendar year (or fiscal year beginning 9 Amounts from line 6 ( a) 2008 (b) 2009 (c) 2010 (e) 2012 ( d) 2011 Total 151,737. 183,708. 335,445. 151,737. 183,708. 335,445. 10a Gross income from interest, dividends, payments received on securities loans, rents, royalties and income from similar sources b Unrelated business taxable income (less section 511 taxes) from businesses acquired after June 30, 1975 c Add lines 1 Oa and 1 Ob 11 Net income from unrelated business activities not included in line 10b, whether or not the business is regularly camed on 12 Other Income. Do not include gain or loss from the sale of capital assets (Explain in Part IV.) 13 Total Support . (Add lines 9. 10c, 11, and 12) 14 First five years . If the Form 990 is for the organization's first, second, third, fourth, or fifth tax year as a section 501 (c)(3) organization, check this box and stop here Section C . Computation of Public Support Percentage 15 Public support percentage for 2012 (line 8, column (f) divided by line 13, column (f)) 15 10 0 • 0 0 % 16 Public support percentage from 2011 Schedule A, Part III, line 15 16 99 • 64 % Section D. Computation of Investment Income Percentacie 17 Investment income percentage for 2012 (line 10c, column (f) divided by line 13, column (f)) 17 • UU % 18 Investment income percentage from 2011 Schedule A, Part III, line 17 18 .36 % 19a 33 1 /3% support tests - 2012. If the organization did not check the box on line 14, and line 15 is more than 33 1/3%, and line 17 is not more than 33 1/3%, check this box and stop here . The organization qualifies as a publicly supported organization b 33 1/30/6 support tests - 2011 . If the organization did not check a box on line 14 or line 19a, and line 16 is more than 33 1/3%, and line 18 is not more than 33 1/3%, check this box and stop here . The organization qualifies as a publicly supported organization 20 Private foundation . If the organization did not check a box on line 14, 19a, or 19b, check this box and see instructions 15370513 0 Schedule A (Form 990 or 990-EZ) 2012 232023 12-04-12 757053 TUSC 7 2012.05080 TULSA UNITED SOCCER CLUB TUSC 1 Supplemental Information to Form 990 or 990-EZ SCHEDULE 0 (Form 990 or 990 - EZ) Employer identification number 3 Name of the organization PART I, - T' SOCCER CLUB TULSA UNITED FORM 990-EZ, 2012 Open to Public Inspection Complete to provide information for responses to specific questions on Form 990 or 990-EZ or to provide any additional information. 10- Attach to Form 990 or 990 - EZ. Department of the Treasury Internal Revenue Service LINE 14, OCCUPANCY, OMB No 1545-0047 RENT, UTILITIES, AND MAINTENANCE: AMOUNT: DESCRIPTION OF EXPENSES: 407. DEPRECIATION 26,498. OTHER EXPENSES FORM 990-EZ, PART I, 26,905. LINE 14 TOTAL TO FORM 990-EZ, LINE 16, OTHER EXPENSES: AMOUNT: DESCRIPTION OF OTHER EXPENSES: SUPPLIES 1,782. TELEPHONE 1,954. EQUIPMENT RENTAL 4,459. 11,322. MISCELLANEOUS EDUCATION 1,665. BANK FEES 576. 40,611. FIELD EXPENSES 8,345. TROPHIES 61,803. REFEREE EXPENSE REFUNDS 3,322. INSURANCE 2,096. TOTAL TO FORM 990-EZ, FORM 990-EZ, PART II, 137,935. LINE 16 LINE 24, OTHER ASSETS: BEG. DESCRIPTION OTHER DEPRECIABLE ASSETS FORM 990-EZ, PART III, LINE 28, OF YEAR END OF YEAR 1,426. 1,019. PROGRAM SERVICE ACCOMPLISHMENTS: LHA For Paperwork Reduction Act Notice , see the Instructions for Form 990 or 990- EZ. 232211 Schedule 0 (Form 990 or 990- EZ) (2012) 01-04-13 15370513 757053 TUSC 8 2012.05080 TULSA UNITED SOCCER CLUB TUSC 1 OMB No Supplemental Information to Form 990 or 990- EZ SCHEDULE 0 (Form 990 or 990-EZ ) Complete to provide information for responses to specific questions on Form 990 or 990-EZ or to provide any additional information. ^ Attach to Form 990 or 990-EZ. Department of the Treasury Internal Revenue Service 1545-0047 2012 -Open tofutilic Ins p ection Employer identification number 73-1329693 Name of the organization TULSA UNITED SOCCER CLUB TULSA UNITED SOCCER CLUB PROVIDES THE ADMINISTRATION AND ORGANIZATION FOR YOUTH SOCCER TEAMS AND LEAGUES IN TWO AREAS OF TULSA INCLUDING SUPPORT FOR THE PARENT PLAYERS AND REFEREE DEVELOPMENT, ORGANIZATION, DEVELOPMENT, COACHES TRAINING, FORM 990-EZ, PART V, DURING THE YEAR, RECEIVE ANY FUNDS, DIRECTLY, TO PAY PREMIUMS ON A PERSONAL BENEFIT CONTRACT. THE ORGANIZATION, OR INDIRECTLY, ETC. INFORMATION REGARDING PERSONAL BENEFIT CONTRACTS: THE ORGANIZATION DID NOT, OR INDIRECTLY, FIELD UPKEEP AND DID NOT, DURING THE YEAR, PAY ANY PREMIUMS, DIRECTLY, ON A PERSONAL BENEFIT CONTRACT. LHA For Paperwork Reduction Act Notice , see the Instructions for Form 990 or 990- EZ. 232211 Schedule 0 (Form 990 or 990-EZ) (2012) 01-04-13 15370513 757053 TUSC 9 2012.05080 TULSA UNITED SOCCER CLUB TUSC 1 Form Application for Extension of Time To File an Exempt Organization Return 8868 (Rev. January 2013) Department of the Treasury Internal Revenue Servioe File a I OMB No. 1545-1709 for each return. • If you are filing for an Automatic 3-Month Extension , complete only Part I and check this box ^ • If you are filing for an Additional (Not Automatic ) 3-Month Extension , complete only Part II (on page 2 of this form) Do not complete Part ll unless you have already been granted an automatic 3-month extension on a previously filed Form 8868 Electronic filing (e-file). You can electronically file Form 8868 if you need a 3-month automatic extension of time to file (6 months for a corporation required to file Form 990-T), or an additional (not automatic) 3-month extension of time. You can electronically file Form 8868 to request an extension of time to file any of the forts listed in Part I or Part II with the exception of Form 8870, Information Return for Transfers Associated With Certain Personal Benefit Contracts, which must be sent to the IRS in paper format (see instructions) For more details on the electronic filing of this form, visit www.irs. v/efile and click on e-file for Charities & Nonprofits. f0 Automatic 3-Month Extension of Time. Only submit original (no copies needed). A corporation required to file Form 990-T and requesting an automatic 6-month extension - check this box and complete Part I only - -- All other corporations (including 1120-C filers), partnerships, REMICs, and trusts must use Form 7004 to request an extension of time to rile income tax returns. Type or print File by the due close for filing your return See instructions . ^ 0 Name of exempt organization or other filer, see instructions. Employer identification number (EIN) or TULSA UNITED SOCCER CLUB Number, street , and room or suite no. If a P 0 box, see instructions PO BOX 691752 73-1329693 Social security number (SSN) City, town or post office, state , and ZIP code For a foreign address , see instructions. mTTT.en nu 7A1 90-1757 Enter the Return code for the return that this application is for (file a separate application for each return) Return Code 01 02 03 04 05 06 Application Is For Form 990 or Form 990-EZ Form 990-BL Form 4720 (individu al) Form 990-PF Form 990-T (sec 401 a or 408(a) trust) Form 990-T (trust other than above) . .... . 0 1 Return Code 07 08 09 10 11 12 Application Is For Form 990-T (corporation) Form 1041-A Form 4720 Form 5227 Form 6069 Form 8870 TULSA UNITED SOCCER CLUB • Thebooksare lnthecareof ^ 9726 E 42ND ST, TelephoneNo ^ 918-665 - 2870 SUITE 147 - TULSA , OK 74146 FAXNo ^ 918-665-2859 _ - _ ^ 0 • If the organization does not have an office or place of business in the United States , check this box If this is for the whole group , check this • If this is for a Group Return , enter the organization 's four digit Group Exemption Number (GEN) box ^ [] . If it is for part of the group , check this box ^ El and attach a list with the names and EINs of all members the extension is for. I request an automatic 3-month (6 months for a corporation required to file Form 990-T) extension of time until 1 , to file the exempt organization return for the organ ization named above . The extension FEBRUARY 15, 2014 is for the organization 's return for: or ^ Q calendar year ^ tax year beginning JUL 1, 2012 , and ending JUN 30 , 2013 2 If the tax year entered in line 1 is for less than 12 months, check reason : El Change in accounting penod EDInitial return El Final return 3a If this application is for Form 990-BL, 990-PF. 990-T, 4720. or 6069. enter the tentative tax, less any nonrefundable credits . See instructions. b c If this application is for Form 990-PF, 990-T, 4720, or 6069 , enter any refundable credits and estimated tax payments made. Include any prior year overpayment allowed as a credit. Balance due. Subtract line 3b from line 3a. Include your payment with this form, if required, Caution . If you are going to make an electronic fund withdrawal with this Form 8868. see Form 8453-EO and Form 8879-EO for payment instructions. Form 8868 (Rev. 1-2013) LHA For Privacy Act and Paperwork Reduction Act Notice, see instructions. 223841 01-21-13 9 n o'3 a 1 1 1 r 7 r,7 n c'3 'Prier' o n l ') nAnA n myTT. C a TTATT rT'V'n cni-f'T: D (T.TT1M mTTQ P' Form 8868 Rev. 1-2013 • It you are filing for an Additional (Not Automatic) 3-Month Extension , complete only Part 11 and check this box .... .. Note . Only complete Part II if you have already been granted an automatic 3-month extension on a previously filed Form 8868. • If you are filin g for an Automatic 3-Month Extension , complete onl y Part I (on p age 1). Part,ll Additional (Not Automatic) 3-Month Extension of Time. Only file the original (no copies needed). Type or I Name of exempt organization or other filer, see instructions print File by the due date for filing your return. See instructions. Page 2 ^ I Employer identification number (EIN) or Number, street , and room or suite no. If a P.O . box, see instructions. Social security number (SSN) City, town or post office , state, and ZIP code. For a foreign address , see instructions. ULSA. OK 74169-1752 Enter the Return code for the return that this application is for (file a separate application for each return) Return Code 01 02 03 04 05 06 Application Is For Form 990 or Form 990-EZ Form 990-BL Form 4720 individua Form 990-PF Form 990-T (sec. 401 a or 408(a) trust) Form 990-T (trust other than above) 0 1 Application Is For Return Code Form 1041-A Form 4720 Form 5227 Form 6069 Form 8870 08 09 10 11 12 STOPI Do not complete Part II if you were not already granted an automatic 3-month extension on a previously filed Form 8868. TULSA UNITED SOCCER CLUB • Thebooksareinthecareof ^ 9726 E 42ND ST, SUITE 147 - TULSA, OK 74146 FAX 918-665-2859 Telephone No ^ 918-665-2870 ^ Q • If the organization does not have an office or place of business in the United States, check this box . ,,,,... . If this is for the whole group, check this • If this is for a Group Return, enter the organization's four digit Group Exemption Number (GEN) box ^ Q . If it is for part of the group, check this box ^ = and attach a list with the names and ElNs of all members the extension is for. I request an additional 3-month extension of time until AUGUST 15, 2014 4 , or other tax year beginning , and ending JUN 30, 2013 For calendar year JUL 1, 2 012 5 Q Final return for less 12 months, reason: Q Initial return If the tax year entered in line 5 is than check 6 period Change in accounting = State in detail why you need the extension 7 MORE TIME IS NEEDED TO COMPLETE THE RETURN 8a b c If this application is for Form 990-BL, 990-PF, 990-T, 4720, or 6069, enter the tentative tax, less any nonrefundable credits. See instructions. If this application is for Form 990-PF, 990-T, 4720, or 6069. enter any refundable credits and estimated tax payments made. Include any prior year overpayment allowed as a credit and any amount paid previous ly with Form 8868. Balance due. Subtract line 8b from line 8a. Include your payment with this form, if required, by using 8a 0. 8b 0. ec EFTPS (Electronic Federal Tax Payment System) . See instructions. Signature and Verification must be completed for Part II only. $ 0. Under penalties of perjury, I declare thak I have examined this form, including accompanying schedules and statements, and to the best of my knowledge and belief, completed ttlay am authorized to prepare this form. it is true, correct, Signature ^ 17LJw' iGj d Date ^ le ^ CPA al-711 `.f Form 8868 (Rev. 1.2013) 223842 01-21-13 10 15360207 757053 TUSC 2012.05030 TULSA UNITED SOCCER CLUB TUSC 1