Income Tax Accounting and Reporting

advertisement

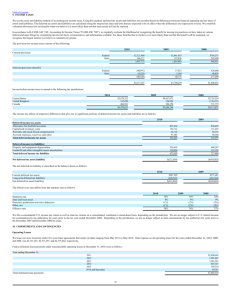

Income Tax Accounting and Reporting Equipment Leasing Association Lease Accountants Conference September 21, 2004 Alan L. Moose William J. Bosco Division Controller, U.S. Consultant John Deere Credit 1 . Topics Covered • Overview of Accounting for Income Taxes • Terms and Definitions • Tax Provision Calculation • Income Tax Provision Calculation Examples • Presentation and Disclosure • Sample Tax Footnotes • Recent Developments in Accounting for Income Taxes 2 Overview - History The Standards for Accounting for Income Taxes are as follows: – APB 11- Issued in December 1967 – an income statement oriented approach – FAS 96 – Issued in December 1987 – a balance sheet oriented approach - effective date was for the years beginning after 12/15/1988 • FASB 100 delayed the effective date one year until 12/15/1989 • FASB 103 delayed the effective date two more years until 12/15/91 • FASB 108 delayed the effective date one more year until 12/15/92 – FAS 109 – Issued in February 1992 – a simplified balance sheet oriented approach • Implementation Guide issued in March 1992 – revised in December 1998 and September 2001 3 Overview – FASB 109 - Scope Statement defines the financial accounting and reporting for income taxes that are currently payable and for the tax consequences of the following: – Revenues, expenses, gains, or losses that are included in taxable income of an earlier or later year than the year in which they are recognized in financial income – Other events that create differences between the tax bases of assets and liabilities and their amounts for financial reporting – Operating loss or tax credit carrybacks for refunds of taxes paid in prior years and carryforwards to reduce taxes payable in future years. (FAS 109 ¶ 3) 4 Overview – FASB 109 - Scope Statement is applicable to the following: – Domestic federal (national) income taxes (U.S. federal income taxes for U.S. enterprises) and foreign, state, and local (including franchise) taxes based on income – An enterprise's domestic and foreign operations that are consolidated, combined, or accounted for by the equity method – Foreign enterprises in preparing financial statements in accordance with U.S. generally accepted accounting principles. (FAS 109 ¶ 4) 5 Overview – FASB 109 - Scope Items that are outside of the Statement’s scope are as follows: – The basic methods of accounting for the U.S. federal investment tax credit (ITC) and for foreign, state, and local investment tax credits or grants – Discounting – Accounting for income taxes in interim periods (other than the criteria for recognition of tax benefits and the effect of enacted changes in tax laws or rates and changes in valuation allowances). (FAS 109 ¶ 5) 6 Overview – FASB 109 - Objectives The two major objectives of the Statement are to recognize the following items: – the amount of income taxes payable or refundable in the current period (the current provision) – deferred tax liabilities and assets for the future tax consequences of events that have been recognized in an enterprise’s financial statements or tax returns. (the deferred provision) (FAS 109 ¶ 7) 7 Overview – FASB 109 - Principles Following are the basic principles applied at each financial statement date: – A current tax liability or asset is recognized for the estimated taxes payable or refundable on tax returns for the current year. – A deferred tax liability or asset is recognized for the estimated future tax effects attributable to temporary differences and carryforwards. – The measurement of current and deferred tax liabilities and assets is based on provisions of the enacted tax law; the effects of future changes in tax laws or rates are not anticipated. – The measurement of deferred tax assets is reduced, if necessary, by the amount of any tax benefits that, based on available evidence, are not expected to be realized. (FAS 109 ¶ 8) 8 FASB 109 - Terms Temporary Differences – A difference between the tax basis of an asset or liability and its reported amount in the financial statements that will result in taxable or deductible amounts in future years when the reported amount of the asset or liability is recovered or settled, respectively. • Revenues or gains that are taxable after they are recognized in financial income – i.e. – tax gains deferred through like-kind exchange • Expenses or losses that are deductible after they are recognized in financial income – i.e. – increases in the allowance for credit losses charged to the provision • Revenues or gains that are taxable before they are recognized in financial income – i.e. – advance rents • Expenses or losses that are deductible before they are recognized in the financial statements – i.e. – accelerated tax depreciation 9 FASB 109 - Terms Current Tax Expense or Benefit – The amount of income taxes paid or payable (or refundable) for a year as determined by applying the provisions of the enacted tax law to the taxable income or excess of deductions over revenues for that year. (FAS 109 ¶ 289) Deferred Tax Asset – A difference between the tax basis of an asset or liability and its reported amount in the financial statements that will result in taxable or deductible amounts in future years when the reported amount of the asset or liability is recovered or settled, respectively. (FAS 109 ¶ 289) 10 FASB 109 - Terms Deferred Tax Liability – The deferred tax consequences attributable to taxable temporary differences. A deferred tax liability is measured using the applicable enacted tax rate and provisions of the enacted tax law. (FAS 109 ¶ 289) Carrybacks and Carryforwards – Deductions or credits that cannot be utilized on the tax return during a year that may be carried back to reduce taxable income or taxes payable in a prior year. – Deductions or credits that cannot be utilized on the tax return during a year that may be carried forward to reduce taxable income or taxes payable in a future year. (FAS109 ¶ 289) 11 FASB 109 - Terms Valuation Allowance – The portion of a deferred tax asset for which it is more likely than not that a tax benefit will not be realized. Scheduling – Preparing a proforma income tax return for future years to determine the reversal of temporary differences and the ability to utilize carryforwards. Used to determine if a valuation allowance is necessary. Applicable Tax Rate – the enacted tax rate(s) expected to apply to taxable income in the periods in which the deferred tax liability or asset is expected to be settled or realized (FAS 109 ¶18) – In the U.S. federal tax jurisdiction, the applicable tax rate is the regular tax rate, and a deferred tax asset is recognized for alternative minimum tax credit carryforwards (FAS 109 ¶ 19) – A combined federal and state rate can be used if there is little variation between the tax laws. (Implementation Guide) 12 FASB 109 - Terms Net Operating Loss • A tax position where a company has negative taxable income. Under US rules an NOL can be carried back to offset previous years’ taxable income to generate a refund. If an NOL still exists it is carried forward to offset future years’ taxable income. • Customers often lease when they have an NOL to lower their after-tax cost of financing equipment. If a customer has a large NOL carry forward it means it can’t take advantage of tax benefits such as the accelerated depreciation write offs (MACRS deductions) in the current year. 13 FASB 109 - Terms Alternative minimum tax • US tax provisions to cause companies with significant tax benefits preferences or credits to pay a minimum tax. The AMT is calculated by adding adjustments for preference items to regular taxable income and applying a 20% AMT rate to the AMT income. • Paying the AMT generates a credit (excess of AMT over regular tax). AMT credits can be carried forward and applied to reduce regular tax in the future when it exceeds AMT. Accelerated depreciation is a preference item, thus leasing equipment rather than buying equipment helps reduce AMT. 14 FASB 109 – Tax Provision Calculation Total income tax expense or benefit for the year is the sum of i) deferred tax expense or benefit and ii) income taxes currently payable or refundable. Income taxes currently payable or refundable is the amount of income taxes paid or payable (or refundable) for a year as determined by applying the provisions of the enacted tax law to the taxable income or excess of deductions over revenues for that year. 15 Deferred Tax Provision Calculation Steps to calculate the deferred tax provision • Identify (1) the types and amounts of existing temporary differences and (2) the nature and amount of each type of operating loss and tax credit carryforward and the remaining length of the carryforward period • Measure the total deferred tax liability for taxable temporary differences using the applicable tax rate • Measure the total deferred tax asset for deductible temporary differences and operating loss carryforwards using the applicable tax rate 16 Deferred Tax Provision Calculation Continued • Measure deferred tax assets for each type of tax credit carryforward • Reduce deferred tax assets by a valuation allowance if, based on the weight of available evidence, it is more likely than not (a likelihood of more than 50 percent) that some portion or all of the deferred tax assets will not be realized. The valuation allowance should be sufficient to reduce the deferred tax asset to the amount that is more likely than not to be realized. (FAS 109 ¶17) 17 Tax Provision - Operating Lease Example An example comparing book income to taxable income for an operating lease: 1. Assume an operating lease for GAAP purposes and a true lease for income purposes. Lessor enters into a 6060-month FMV lease of material handling equipment, having a cost of $1 million, monthly rent of $18,500, a residual of $200,000, and an implicit interest rate of 10%. The first basic rent date is April 1, 1996. There is no automatic transfer of ownership. There is no bargain purchase option. The equipment has an economic life of 10 years, therefore the lease lease term of 5 years is less than 75% of the economic life. The PV of the rents at the implicit rate of 10% is $878,000, which is less than 90% of the cost the equipment. Therefore, the lease is an operating lease for financial financial reporting purposes. 2. Material handling equipment (generally) is fivefive-year class property. MACRS depreciation rates (from the IRS table) are (excludes 50% bonus depreciation): % Year 1996 20.00 1997 32.00 1998 19.20 1999 11.52 2000 11.52 2001 5.76 18 Tax Provision - Operating Lease Example From the standpoint of the lessor, the lease will have the following earnings pattern: Tax Books Rental Income Year ended December 31 1996 1997 1998 1999 $166,500 $222,000 $222,000 $222,000 2000 $222,000 Sale Proceeds 2001 $55,500 Total $1,110,000 200,000 200,000 Depreciation Expense 200,000 320,000 192,000 115,200 115,200 57,600 1,000,000 Tax Income (Loss) (33,500) (98,000) 30,000 106,800 106,800 197,900 310,000 40% 40% 40% 40% 40% 40% 40% ($13,400) ($39,200) $12,000 $42,720 $42,720 $79,160 $124,000 $166,500 $222,000 $222,000 $222,000 $222,000 $55,500 $1,110,000 200,000 200,000 Tax Rate 40% (Combined Federal & State Rate) Tax Liability (Savings) GAAP Books Rental Income Sale Proceeds Depreciation Expense 120,000 160,000 160,000 160,000 160,000 240,000 1,000,000 Income before Tax 46,500 62,000 62,000 62,000 62,000 15,500 310,000 Tax Expense @ 40% 18,600 24,800 24,800 24,800 24,800 6,200 124,000 $27,900 $37,200 $37,200 $37,200 $37,200 $9,300 $186,000 13,400 39,200 (12,000) (42,720) (42,720) (79,160) (124,000) (32,000) (96,000) (108,000) (90,880) (72,960) Net Income Current Tax Liability Deferred Tax Balance 19 0 0 Tax Provision – Operating Lease Example The deferred tax provision is calculated by identifying the temporary differences and carryforwards. Operating Lease Tax Provision Calculation 1996 1997 1998 1999 2000 2001 Equipment Tax Basis 800,000 480,000 288,000 172,800 57,600 - Equipment Book Basis 880,000 720,000 560,000 400,000 240,000 - Taxable Temporary Difference (80,000) (240,000) (272,000) (227,200) (182,400) Applicable tax rate Deferred tax liability Current tax receivable/(payable) Change in the Deferred Tax Liability 40% (32,000) 40% - 40% 40% 40% 40% (96,000) (108,800) (90,880) (72,960) - 13,400 39,200 (12,000) (42,720) (42,720) (79,160) (32,000) (64,000) (12,800) 17,921 17,920 72,960 (18,600) (24,800) (24,800) (24,800) (24,800) (6,200) (Deferred Tax Expense) Total Income Tax Provision 20 Tax Provision - Operating Lease Example A simple GAAP balance sheet presentation of the lease: GAAP Books Cash Equipment under lease Accumulated depreciation Equipment under lease, net Total Assets Deferred Taxes Stockholder’s Equity Total Liabilities & Equity 1996 Year ended December 31 1997 1998 1999 $179,900 $441,100 $651,100 $830,380 1,000,000 1,000,000 1,000,000 1,000,000 2000 2001 $1,009,660 $1,186,000 1,000,000 0 (120,000) (280,000) (440,000) (600,000) (760,000) 0 880,000 720,000 560,000 400,000 240,000 0 $1,059,900 $1,161,100 $1,211,100 $1,230,380 $1,249,660 $1,186,000 32,000 96,000 108,800 90,880 72,960 0 1,027,900 1,065,100 1,102,300 1,139,500 1,176,700 1,186,000 $1,059,900 $1,161,100 $1,211,100 $1,230,380 21 $1,249,660 $1,186,000 Tax Provision – Direct Finance Lease Example An example comparing book income to taxable income for direct finance lease: 1. Assume an direct finance lease for GAAP purposes and a true lease for income purposes. – Lessor enters into a 60 month FMV lease of material handling equipment, equipment, having a cost of $1 million, monthly rent of $20,087, a residual of $100,000, and an implicit interest rate of 10.25%. The first basic rent date is April 1, 1996. – There is no automatic transfer of ownership. – There is no bargain purchase option. – The equipment has an economic life of 10 years, therefore the lease lease term of 5 years is less than 75% of the economic life. The PV of the rents at the implicit implicit rate of 10% is $939,970, which is more than 90% of the cost of the equipment. Therefore, the lease is a direct finance lease for financial reporting purposes. 2. Material handling equipment (generally) is fivefive-year class property. MACRS depreciation rates (from the IRS table) are (excluding 50% bonus depreciation): 50% Bonus Year 1996 20.00% 1997 32.00% 1998 19.20% 1999 11.52% 2000 11.52% 2001 5.76% 22 Tax Provision - Direct Finance Lease Example From the standpoint of the lessor, the direct finance lease will have the following earnings pattern: Tax Books Rental Income Year ended December 31 1996 1997 1998 1999 $180,786 $241,049 $241,049 $241,049 2000 $241,049 Sale Proceeds 2001 $60,263 Total $1,205,245 100,000 100,000 Depreciation Expense 200,000 320,000 192,000 115,200 115,200 57,600 1,000,000 Tax Income (Loss) (19,214) (78,951) 49,049 125,849 125,849 102,663 305,245 40% 40% 40% 40% 40% 40% 40% ($7,686) ($31,580) $19,620 $50,340 $50,340 $41,065 $122,098 $73,253 $84,247 $67,398 $48,738 $28,074 $3,534 $305,244 0 0 0 0 0 0 0 Income before Tax 73,253 84,247 67,398 48,738 28,074 3,534 305,244 Tax Expense @ 40% 29,301 33,699 26,959 19,495 11,230 1,414 122,098 $43,952 $50,548 $40,439 $29,243 $16,844 $2,120 $183,146 Current Tax Receivable (Liabili 7,686 31,580 (19,620) (50,340) (50,340) (41,065) (122,098) Deferred Tax (liability) balance (36,987) (102,266) 23 (109,065) (78,760) (39,650) Tax Rate 40% (Combined Federal & State Rate) Tax Liability (Savings) GAAP Books Rental Income Sale Proceeds Depreciation Expense Net Income 0 0 Tax Provision – Direct Finance Lease Example The deferred tax provision is calculated by identifying the temporary differences and carryforwards. Direct Finance Lease Tax Provision Calculation 1996 1997 1998 1999 2000 2001 Equipment Tax Basis 800,000 480,000 288,000 172,800 57,600 - Lease Book Basis 892,467 735,665 562,014 369,703 156,728 - Taxable Temporary Difference (92,467) (255,665) (274,014) (196,903) (99,128) - Applicable tax rate Deferred tax liability Current tax receivable/(payable) Change in the Deferred Tax Liability 40% 40% 40% 40% 40% 40% (36,987) (102,266) (109,605) (78,760) (39,650) - 7,686 31,580 (19,620) (50,340) (50,340) (41,065) (36,987) (65,279) (7,339) 30,845 39,110 39,650 (29,301) (33,699) (26,959) (19,495) (11,230) (1,414) (Deferred Tax Expense) Total Income Tax Provision 24 Tax Provision - Direct Finance Lease Example A simple GAAP balance sheet presentation of the lease: Cash $188,472 $461,101 $682,530 1,024,457 783,409 542,360 301,311 60,262 0 (231,990) (147,744) (80,346) (31,608) (3,534) 0 Residual 100,000 100,000 100,000 100,000 100,000 0 Net Investment, Leases 892,467 735,665 562,014 369,703 156,728 0 Gross Receivable Unearned Income Total Assets Deferred Taxes Stockholder’s Equity Total Liabilities & Equity $873,239 $1,063,948 $1,183,146 $1,080,939 $1,196,766 $1,244,544 $1,242,942 $1,220,676 $1,183,146 36,987 102,266 109,605 78,760 39,650 0 1,043,952 1,094,500 1,134,939 1,164,182 1,181,026 1,183,146 $1,080,939 $1,196,766 $1,244,544 $1,242,942 $1,220,676 $1,183,146 25 FASB 109 – Presentation Balance Sheet Presentation • In a classified balance sheet, the deferred tax liabilities and assets are separated into a current amount and a noncurrent amount. Deferred tax liabilities and assets will be classified as current or noncurrent based on the classification of the related asset or liability for financial reporting. (FAS 109 ¶ 41) • For a particular tax-paying component of an enterprise and within a particular tax jurisdiction, (a) all current deferred tax liabilities and assets shall be offset and presented as a single amount and (b) all noncurrent deferred tax liabilities and assets shall be offset and presented as a single amount. However, an enterprise shall not offset deferred tax liabilities and assets attributable to different tax-paying components of the enterprise or to different tax jurisdictions.(FAS 109 ¶ 42) 26 FASB 109 – Disclosure The components of the net deferred tax liability or asset recognized is disclosed as follows: – The total of all deferred tax liabilities – The total of all deferred tax assets – The total valuation allowance recognized for deferred tax assets The net change during the year in the total valuation allowance also shall be disclosed. The approximate tax effect of each type of temporary difference and carryforward that gives rise to a significant portion of deferred tax liabilities and deferred tax assets. (FAS 109 ¶43) 27 FASB 109 – Disclosure - Continued The significant components of income tax expense from continuing operations, such as: – Current tax expense or benefit – Deferred tax expense or benefit (exclusive of the effects of other components listed below) – Investment tax credits – The benefits of operating loss carryforwards – Tax expense that results from allocating certain tax benefits either directly to contributed capital or to reduce goodwill or other noncurrent intangible assets of an acquired entity – Adjustments of a deferred tax liability or asset for enacted changes in tax laws or rates or a change in the tax status of the enterprise – Adjustments of the beginning-of-the-year balance of a valuation allowance because of a change in circumstances that causes a change in judgment about the realizability of the related deferred tax asset in future years. 28 FASB 109 – Disclosure - Continued • A reconciliation using percentages or dollar amounts (a) the reported amount of income tax expense attributable to continuing operations for the year to (b) the amount of income tax expense that would result from applying domestic federal statutory tax rates to pretax income from continuing operations. (FASB 109 ¶47) • The amounts and expiration dates of operating loss and tax credit carryforwards. • The portion of the valuation allowance allocated to goodwill or intangible assets. (FASB 109 ¶ 48) 29 ABC Corporation Note I — Income Taxes The provision (benefit) for income taxes is comprised of the following: Current: Federal(a) State Foreign Deferred(b): Federal State 2003 2002 2001 ($5,710) 743 993 (3,974) ($169,073) -1,575 1,145 (169,503) ($154,680) -1,122 -42 (155,844) 234,580 4,755 239,335 $235,361 426,398 7,884 434,282 $264,779 405,287 2,376 407,663 $251,819 (a) Including U.S. tax on foreign income (b) Deferred taxes were also provided (charged) to other comprehensive income of $(77,572) (2003), $47,380 (2002) and $(32,661) (2001), respectively, and for cumulative effect of accounting change of $4,653 (2003) and $8,180 (2001). The deferred tax liability consists of the following deferred tax liabilities (assets): 2003 2002 Accelerated depreciation on flight equipment $2,671,813 $2,301,339 Excess of state income taxes not currently deductible for Federal income tax purposes (11,216) (9,227) Tax versus book lease differences 125,450 — Provision for overhauls (24,464) (41,984) Capitalized overhauls (33,779) (29,340) Rentals received in advance (56,775) (50,995) Straight line rents 23,306 26,412 Derivatives 3,781 3,793 Other comprehensive income 2,930 (74,642) Other (13,028) (492) $2,562,568 $2,250,314 30 ABC Corporation Note I — Income Taxes (Continued) A reconciliation of the computed expected total provision for income taxes to the amount recorded is as follows: Computed expected provision based upon a federal rate of 35% State income taxes, net of Federal income taxes Foreign sales corporation and extraterritorial income benef Foreign taxes(a) Other 2003 2002 2001 $262,594 3,574 (29,598) -1,242 33 $235,361 $277,656 4,101 (18,517) 2,564 -1,025 $264,779 $263,802 816 (6,590) -6,080 -129 $251,819 (a) Includes realized foreign tax credits in 2003 and realized Canadian tax credits in 2001 for taxes paid in prior years. During 2002, the Company settled an open audit issue with the Internal Revenue Service which required the Company to capitalize for tax purposes certain overhaul reimbursements made between 1991 and 2001. The adjustment had no impact on the total provision but required the Company to establish a current tax liability and a corresponding deferred tax asset of $25,663 in 2002. Such amount is reflected in the Company’s 2002 current and deferred provision. Federal tax benefits provided by the Extraterritorial Income Exclusion (“ETI”) and the Foreign Sales Corporation (“FSC”) may not be available in 2004. The World Trade Organization has ruled that these are unfair export subsidies, and the European Union has begun to impose trade sanctions as a result of these subsidies not being repealed by the United States. The United States has proposed legislation to repeal the ETI and FSC export benefits and possibly provide other tax benefits to domestic corporations. The effect this proposed legislation will have on the Company will not be determinable until the legislation is finalized. 31 XYZ Corporation Note 15 — Income Taxes The effective tax rate varied from the statutory federal corporate income tax rate as follows: Percentage of Pretax Income Year Ended December 31, 2003 Federal income tax rate Increase (decrease) due to: State and local income taxes, net of federal income tax benefit. Foreign income taxes Goodwill impairment Interest expense — TCH Goodwill amortization Other Effective tax rate (successor) 35.0% Three Months Year Ended June 2 through Ended December September 30, September 30, 31, 2002 2002 2001 (successor) (successor) 35.0% 35.0% 3.7 1.0 — — — (0.7) 39.0% 2.6 1.6 — — — (0.2) 39.0% (0.3) (0.4) (36.1) (4.2) — 0.1 -5.9% January 1 through June, 2001 (successor) (predecessor) 35.0% 35.0% 2.2 2.2 — — 6.2 0.2 45.8% 2.2 2.2 — — 7.8 2.6 49.8% The provision for income taxes is comprised of the following ($ in millions): Current Federal income tax provision Deferred Federal income tax provision Total Federal income taxes State and local income taxes Interest expense — TCH Foreign income taxes Total provision for income taxes Year Ended Three Months Year Ended June 2 through January 1 December 31, Ended December September September 30, through June, 2003 31, 2002 30, 2002 2001 2001 (successor) (successor) (successor) (successor) (predecessor) $$$$$71.9 276.9 113.6 63.7 265.1 265.1 71.9 276.9 113.6 63.7 53.5 9.4 30.4 11.7 5.7 — — (4.2) — — 46.4 10.7 66.7 32.1 15.4 $365.0 $92.0 $374.0 $157.4 $84.8 32 XYZ Corporation The tax effects of temporary differences that give rise to significant portions of the deferred income tax assets and liabilities are presented below ($ in millions). Percentage of Pretax Income December 31, 2003 (successor) Assets: Net operating loss carryforwards Provision for credit losses Alternative minimum tax credits Purchase price adjustments Goodwill Other comprehensive income items Accrued liabilities and reserves Other Total deferred tax assets Liabilities: Leasing transactions Securitization transactions Market discount income Total deferred tax liabilities Net deferred tax (liability) December 31, 2002 (successor) September 30, 2002 (successor) $834.1 202.4 142 67.9 65.6 47.6 43.8 14.1 1,417.5 $849.9 254.8 142 176.9 91.5 84.3 46.5 — 1,645.9 $834.4 282.1 142.0 207.7 98.4 86.0 59.9 — 1,710.5 (1,311.7) (633.0) — (1,944.7) ($527.2) (1,189.6) (614.4) (1.4) (185.4) ($159.5) (1,215.6) (590.0) (1.5) (1,807.1) ($96.6) The presentation of deferred tax assets and liabilities in prior years has been modified to reflect amounts included on completed and amended income tax returns. At December 31, 2003, the Company was continuing to develop an analysis of deferred tax assets and liabilities. Future income tax return filings and the completion of the aforementioned analysis of deferred tax assets and liabilities could result in reclassifications to the deferred tax assets and liabilities shown in the preceding table. At December 31, 2003, the Company had U.S. federal net operating losses of approximately $1,937.7 million, which expire in various years beginning in 2011. In addition, the Company has various state net operating losses that will expire in various years beginning in 2004. Federal and state operating losses may be subject to annual use limitations under section 382 of the Internal Revenue Code of 1986, as amended, and other limitations under certain state laws. Management believes that the Company will have sufficient taxable income in future years and can avail itself of tax planning strategies in order to fully utilize these losses. Accordingly, the Company does not believe a valuation allowance is required with respect to these net operating losses. 33 Recent Developments During July 2004, as part of the FASB project to harmonize US GAAP with International accounting standards, the following exceptions to recording deferred taxes are being reviewed and may be eliminated: – Foreign subsidiaries or joint ventures that are permanent in nature – Intercomany asset transfers – Certain foreign currency adjustments If any changes are proposed, an exposure draft is not expected until late 2004 or early 2005. 34 Questions? Huh? 35