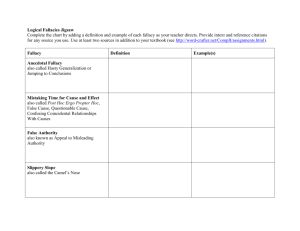

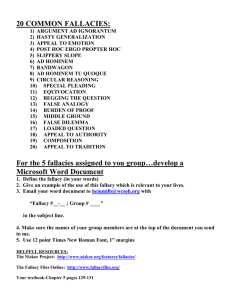

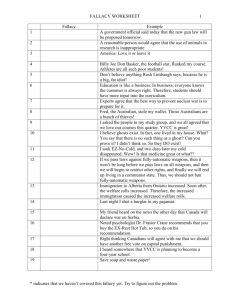

Harmful Fallacies in Economic Discourse

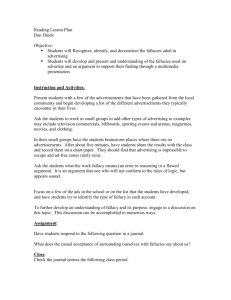

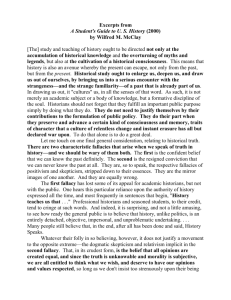

advertisement