Chapter 1

»

Types and Characteristics of Credit

Credit is the loan department’s

product. Like any product, credit has

features that define it. And, just as anyone who offers a product should know

its features, you as a loan professional

should know the features of credit. You

should also know how these features

benefit members.

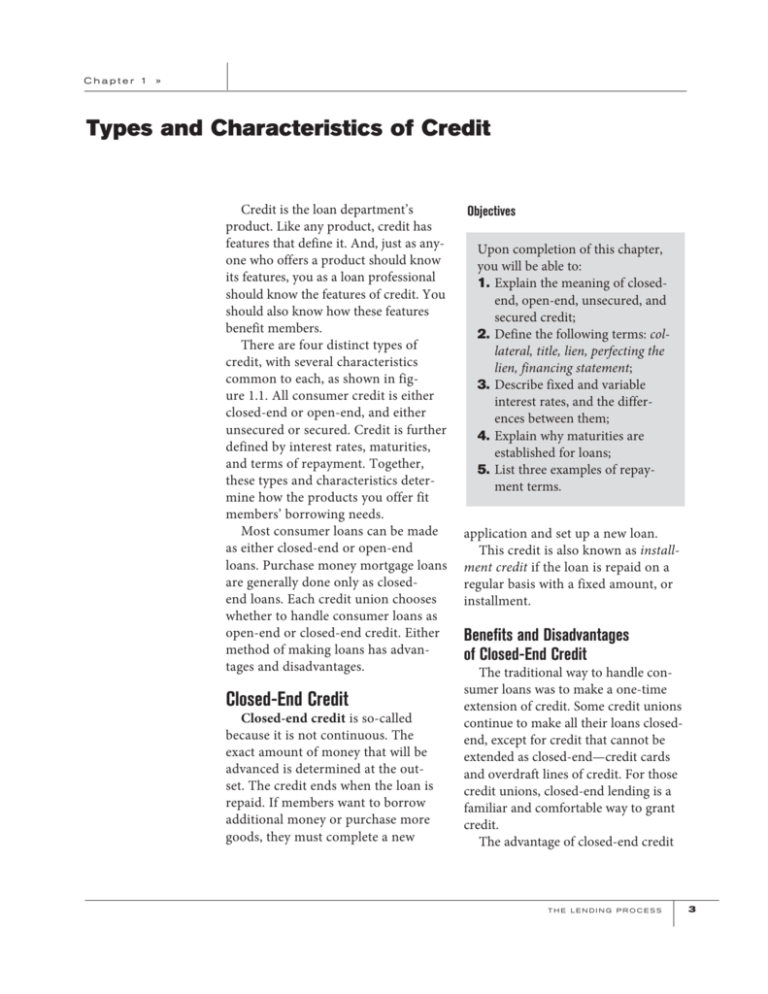

There are four distinct types of

credit, with several characteristics

common to each, as shown in figure 1.1. All consumer credit is either

closed-end or open-end, and either

unsecured or secured. Credit is further

defined by interest rates, maturities,

and terms of repayment. Together,

these types and characteristics determine how the products you offer fit

members’ borrowing needs.

Most consumer loans can be made

as either closed-end or open-end

loans. Purchase money mortgage loans

are generally done only as closedend loans. Each credit union chooses

whether to handle consumer loans as

open-end or closed-end credit. Either

method of making loans has advantages and disadvantages.

Closed-End Credit

Closed-end credit is so-called

because it is not continuous. The

exact amount of money that will be

advanced is determined at the outset. The credit ends when the loan is

repaid. If members want to borrow

additional money or purchase more

goods, they must complete a new

Objectives

Upon completion of this chapter,

you will be able to:

1. Explain the meaning of closedend, open-end, unsecured, and

secured credit;

2. Define the following terms: collateral, title, lien, perfecting the

lien, financing statement;

3. Describe fixed and variable

interest rates, and the differences between them;

4. Explain why maturities are

established for loans;

5. List three examples of repayment terms.

application and set up a new loan.

This credit is also known as installment credit if the loan is repaid on a

regular basis with a fixed amount, or

installment.

Benefits and Disadvantages

of Closed-End Credit

The traditional way to handle consumer loans was to make a one-time

extension of credit. Some credit unions

continue to make all their loans closedend, except for credit that cannot be

extended as closed-end—credit cards

and overdraft lines of credit. For those

credit unions, closed-end lending is a

familiar and comfortable way to grant

credit.

The advantage of closed-end credit

THE LENDING PROCESS

3

Chapter 1

»

Types and Characteristics of Credit

Figure 1.1

Types of Credit

Closed-End Credit

Characteristics

Benefits

Examples

Not continuous

May apply to

unusual loans

(single payment,

balloon payments)

Home purchase

Inflexible

Has one purchasing

purpose

Generally repaid on

regular basis with a

fixed amount

Defined repayment

schedule

Continuous

Open-End Credit

Ongoing use of

credit

One-time

application

Finance charge

(interest)computed

on outstanding balance

May borrow

repeatedly

Personal loans

Single payment

loans

Revolving charge

accounts

Lines of credit

Multi-featured plans

Saves time and

paperwork

Payments may vary

Convenient

with outstanding

balance

Both open-end and closed-end credit may be (a) secured by collateral or cosigners, or

(b) unsecured by collateral and based solely on the member’s promise to pay.

is that disclosures are required only

when the loan is made. One disadvantage is that the required disclosures are

very detailed; it’s easy to make mistakes that may result in penalties for

the credit union. Each time a member

borrows from the credit union, he or

she must complete a new application

and the credit union must provide new

closed-end disclosures. With each new

loan comes the risk of errors that may

result in penalties.

Open-End Credit

As its name implies, open-end

credit is continuous. Under an openend plan, members make a one-time

application and may obtain credit from

time to time. Some open-end plans,

such as a credit card or overdraft line,

have a specified credit limit; members

can use up to the limit without further

4

THE LENDING PROCESS

approval from the credit union. Other

open-end plans offer various credit features, some of which have credit limits

and others that do not. These openend plans are referred to as multi-featured open-end plans.

Open-end credit must meet three

conditions:

1. The creditor must contemplate

repeated transactions under a

credit plan.

2. The creditor may impose a

finance charge from time to time

on the outstanding balance.

3. The credit available to the consumer must generally be replenished to the extent that earlier

credit extensions are repaid.

Payments on credit cards and overdraft lines are generally a percentage of

the outstanding balance. With multi-

Chapter 1

»

Types and Characteristics of Credit

featured plans, each credit feature has a

separate payment. If the credit feature

is a line of credit, payments may vary

as the balance for the credit feature

changes. If the credit feature is for a

car loan, the payment is generally a set

amount that remains the same until the

amount is repaid.

Common examples of openend credit include revolving charge

accounts and lines of credit.

Benefits of Open-End Credit

• Revolving Charge Accounts

Open-end credit offers several benefits to members. It saves time and

paperwork because each loan request

does not require a new application. It

is also more convenient. Members can

obtain advances simply by calling the

credit union or requesting an advance

online. With some open-end systems

even secured loans can be made without having the member sign any additional papers. Another benefit is that

These accounts provide access to

credit with use of a credit card. The

card is issued either by a retailer or, in

cases such as VISA® or MasterCard®,

by a financial institution. Cardholders

may charge purchases up to a specified

limit. They are obligated to repay at a

minimum amount each month—typically three to five percent of the balance. In some cases, there is a “free

ride” period on new purchases. A typical credit card application is shown in

figure 1.2.

open-end disclosures are much easier

for the credit union to process, so there

is less risk of making mistakes.

Types of Open-End Credit

• Lines of Credit

Although some open-end plans can

be accessed with credit cards, convenience checks, or share drafts, it is not

necessary for an open-end plan to have

an access device. Some plans require

that the member call or visit the credit

union to obtain advances. Open-end

plans are not required to have a specific

credit limit. However, there must be a

reasonable expectation that the credit

union will lend to the member from

time to time, and that credit will be

extended if the member remains creditworthy. Large-ticket items, such as

automobiles, can be financed on openend plans.

Another type of open-end credit is

THE LENDING PROCESS

5

Chapter 1

»

Types and Characteristics of Credit

Figure 1.2

Sample Credit Card

Application

Reprinted with permission © CUNA Mutual Group, form 12345V3. All rights reserved.

6

THE LENDING PROCESS

Chapter 1

»

Types and Characteristics of Credit

overdraft protection. Members with

share draft accounts use this to ensure

funds are available whenever they write

drafts. The credit union approves their

overdraft protection up to a certain

limit. Then, when they write drafts for

more than their accounts can cover, the

credit union creates a loan to make up

the difference. It treats this as a loan

advance, and the member repays it

with interest.

What types of credit are offered

by your credit union? To answer this

question, complete activity 1.1.

signature loans, since the member

simply signs an agreement to pay.

Unsecured, or signature loans,

increase the credit union’s risk. When

a member defaults on an unsecured

loan, a credit union may not be able

to collect by claiming any of the

member’s personal property (except for

shares on deposit at the credit union)

unless the member consents or a court

orders it. Usually court costs are more

expensive than the loss itself, so credit

unions often write off such loans without pursuing legal remedies.

Unsecured Loans

Secured Loans

Credit is not only closed-end or

open-end—it must be either unsecured

or secured, as well.

Unsecured loans are made without

collateral. The member’s promise to

pay is only guaranteed by the member’s

signature. Such loans are often called

Secured loans require the member

to provide collateral for the loan. Collateral, also known as security, is a possession of tangible value which secures

the loan until the loan is repaid. Collateral limits the credit union’s risk in two

ways. First, members are more likely to

Activity 1.1

Types of Credit

Talk to a loan officer, or appropriate staff person, to gather information about the types of

credit offered by your credit union.

What is the total amount of credit that is outstanding at your credit union?

____________________________________________________________________________

What percentage is closed-end credit?

____________________________________________________________________________

What percentage is open-end credit?

____________________________________________________________________________

Of the open-end credit, what is the amount of revolving charge accounts?

____________________________________________________________________________

What is the amount of overdraft protection, another type of open-end credit?

____________________________________________________________________________

____________________________________________________________________________

____________________________________________________________________________

THE LENDING PROCESS

7

Chapter 1

»

The way in

which a lender

perfects its

security interest

in property

depends on

the type

of property.

Types and Characteristics of Credit

repay loans when their possessions are

at stake. Second, if a member defaults

on a loan, the credit union may repossess the security, sell it, and apply the

proceeds to the loan balance. In the case

of a share-secured loan, the shares are

offset against the loan balance.

Security Interests

To repossess collateral, the credit

union must prove it has a legal claim

to the property. This claim is called a

lien, or security interest. A credit union

obtains a security interest in property

by having the owner of the property

sign a security agreement. To repossess, a credit union only needs a security interest in the property.

• Perfecting the Security Interest

Although a credit union has rights

to property in which it has security

interest, other creditors may also have

rights in the same property. When this

happens, a lender that has perfected

its security interest generally will have

superior rights to the property. The way

in which a lender perfects its security

interest in property depends on the type

of property. Security interests in motor

vehicles are perfected by having the

Acceptable and unacceptable collateral include…

Acceptable

Unacceptable

• Shares

• Future wages

• Stocks

• Shares not in member’s account

• Personal property

• Certain household goods for

loans other than their purchase

• Real estate

• Guarantor signature

8

THE LENDING PROCESS

credit union’s security interest noted on

the title for the vehicle. The process for

doing this varies in each state.

If the property doesn’t have a title

(for example, some boats, travel trailers, and satellite dishes), the credit

union’s security interest usually can

be perfected by filing a financing statement, also known as a UCC-1, with the

state. Security interests in some property can be perfected without filing.

If you are making secured loans, it’s

important that you learn how to perfect the credit union’s security interest

in each type of property taken as collateral.

In order for collateral to fully secure

a loan, its value must equal or exceed

the loan amount. Otherwise, when

repossessed and sold, the collateral may

not cover the loan balance.

• Financing Statements

Figure 1.3 shows a financing statement. Check at your credit union to

learn how financing statements should

be filed in your state and complete

activity 1.2.

Unidentifiable Collateral

Items with no title or serial number

are difficult to use as collateral. These

include jewelry, furs, and precious metals. The difficulty lies in determining

their loan value, and disposing of them

if the member defaults.

To ensure its claim on such items,

the credit union may want to take possession of them. This means finding

a place to store them and accepting

responsibility for their safe-keeping.

They are also difficult to resell at a fair

Chapter 1

»

Types and Characteristics of Credit

Figure 1.3

UCC Financing

Statement Sample

Form

Source: www.ss.ca.gov. Click on the California Business Portal then Uniform Commercial Code, then Forms and Fees to

access the national financing statement, form UCC-1.

THE LENDING PROCESS

9

Chapter 1

»

Types and Characteristics of Credit

Activity 1.2

Financing

Statements

Talk to a loan officer, or appropriate staff person, to learn how financing statements should

be filed in your state. List the procedure.

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

price or their market value may change.

Therefore, many credit unions discourage or prohibit the use of these items as

collateral.

Types of Acceptable Collateral

Credit unions do accept a variety of

collateral. Some common types include:

• Shares. Members may pledge

the money on deposit in their

credit union share or investment

accounts, but not IRAs. This type

of security offers the least risk to

the credit union.

• Stocks. These may be used if they

are assignable and their value is

determined but it’s risky because

stock value fluctuates.

• Personal property. Personal property includes a wide variety of

items—new and used automobiles

and trucks; new and used boats,

motors, and trailers; new and used

mobile homes; new and used travel

trailers and campers; and aircraft.

10

THE LENDING PROCESS

Certain household goods such as

furniture and appliances may only

be used to secure loans for their

purchase.

• Real estate.

• Guarantor. Guarantors and cosigners are not the same, although

both may agree to pay the debt of

another. A cosigner (sometimes

referred to as a comaker) usually

signs the credit agreement, but a

guarantor signs a separate guaranty agreement. Guarantors are

secondarily liable; cosigners are

primarily liable.

Both guarantors and cosigners agree

to be liable for a member’s loan if the

member defaults, but neither receive

the loan proceeds. There is a Federal

Trade Commission rule which requires

that a guarantor or cosigner be given

a disclosure about his or her responsibilities. Figure 1.4 shows the Notice to

Cosigner. Figure 1.5 is an example of

an agreement a guarantor might sign.

Chapter 1

»

Three

characteristics

common to credit

are interest

rates, maturities,

and terms of

repayment.

Types and Characteristics of Credit

Cosigners sign the actual loan agreement. They are considered jointly liable

for the loan. Normally, all who sign a

loan document are jointly liable, which

means the lender can look to any of

them for payment. This means the borrower would not have to be in default

for the other party to be required

to pay. Members who cosign a loan

should be aware of the legal undertaking they are committing themselves

to. Using guarantors or cosigners is an

excellent way to help young members

with no established credit. Guarantors

or cosigners should never be used to

overcome a member’s credit problems.

Types of Unacceptable Collateral

Federal Trade Commission rules

prohibit certain credit practices. In

regard to collateral, lenders are prohibited from taking household goods

as security for any loan other than

the loan that purchases the household

goods. They are also prohibited from

taking future wages as security. The

credit union may, however, arrange for

loan payment through a voluntary payroll deduction plan without violating

the credit practices rule.

Characteristics of Credit

Three characteristics common to

credit are interest rates, maturities,

and terms of repayment. Each of them

affects how the credit will be repaid.

Interest Rates

Interest is a charge (there may be

other charges and fees) members pay

to use the credit union’s funds. Federal

credit unions and most state-chartered

credit unions compute interest using

the “U.S. Rule” which is a simple

interest method of calculating interest.

Interest is charged on the daily balance

or average monthly balance of the loan.

Most credit unions offer two types of

interest rates—fixed and variable.

Fixed Rates

The distinction between a fixed and

variable rate is that a variable changes

according to changes in an index.

Fixed interest rates remain the same

for the length of a closed-end loan. For

example, if a member borrowed $1,000

for one year at 12 percent, the monthly

payment would be $88.85. Because

the interest rate is fixed, the interest

rate remains the same until the loan is

repaid. This is not necessarily true for

open-end loans.

For open-end loans, an interest rate

that varies according to an index or

formula is a variable rate. Credit unions

may also change the interest rate on an

open-end plan, such as a credit card,

by giving their members prior notice

of the change. This is considered a

fixed rate, because the rate is fixed until

the credit union has given notice of

an increase and the member uses the

account after receiving the notice.

• Benefits and Disadvantages

of Fixed Rates

Fixed interest rates benefit members

by offering certainty. For closed-end

loans, members can count on their loan

payments remaining the same and can

budget accordingly. In effect, they are

locked in to the rate, so they are not

negatively affected if rates climb during

THE LENDING PROCESS

11

Chapter 1

»

Types and Characteristics of Credit

Figure 1.4

Sample Notice

to Cosigner*

Notice to Cosigner

You are being asked to guarantee this debt. Think carefully before you do. If the borrower

doesn’t pay the debt, you will have to. Be sure you can afford to pay if you have to, and

that you want to accept this responsibility.

You may have to pay up to the full amount of the debt if the borrower does not pay. You

may also have to pay late fees or collections costs, which increase this amount.

The creditor can collect this debt from you without first trying to collect from the borrower.

The creditor can use the same collections methods against you that can be used against

the borrower, such as suing you, garnishing your wages, etc. If this debt is ever in default,

that fact may become a part of your credit record.

This notice is not the contract that makes you liable for the debt.

_____________________________________________________________________________

I hereby acknowledge receipt of the “Notice to Cosigner.”

Dated this __________________ day of ___________, 20_____.

___________________________

Cosigner

*From FTC Credit Practices Rule. State laws may require a separate additional notice.

12

THE LENDING PROCESS

their loan. At the same time, however,

they cannot benefit from a decreased

payment if rates drop. They can refinance the remaining balance, but this

involves some paperwork and may

involve additional costs.

Members may also pay a higher rate

for fixed interest. Charging a higher

fixed rate is the credit union’s way of

protecting itself against unforeseen,

sharp rate increases.

By using variable rates, credit unions

limit their interest rate risk. They avoid

committing the credit union to earning

low interest rates. If the market interest

rates should increase, the credit union’s

earnings on variable-rate loans can also

be increased. Consequently, the credit

union can offer variable rates that, at

least initially, are lower than fixed,

since it can adjust these rates along

with the market.

Variable Rates

How Variable Rates Are Set

Rates that adjust up and down

throughout the loan term based on an

index or formula are called variable.

A credit union sets variable rates by

using an index or formula. It selects as

its index either its own cost of funds

Chapter 1

»

Types and Characteristics of Credit

Figure 1.5

Sample Promises

and Guaranty

Agreement

Promises and Guaranty Agreement

Account # ______________________

TO: __________________________________________________________ Credit Union

FOR: __________________________________________________________

Borrower

In order to encourage the Credit Union to extend credit to the borrower, and to cause

the Credit Union to be more secure on any money now owing to the Credit Union by the

borrower, I agree to guarantee and pay the Credit Union all money now loaned to the

borrower and which may afterward be loaned to the borrower on terms as agreed to by

the borrower.

POWER OF ATTORNEY

I hereby authorize the borrower to act as my agent for the purpose of

(1) making payments on this agreement,

(2) renewing this agreement by part payment,

(3) Making agreements for renewal by additional oral or written promises to pay the

obligations contracted pursuant to this agreement,

(4) receiving any written or oral notices,

(5) authorizing making changes of (a) interest rates, (b) payment amounts, and (c) by

extending or shortening the number of payments to retire these debts which I am

guaranteeing,

(6) agreeing to the repossession and sale of collateral,

(7) agreeing to the releasing of collateral,

(8) agreeing with the Credit Union for a variable interest rate on the borrowing, and

(9) extending the statute of limitations in which each payment by the borrower shall be

considered as payment by me.

The failure of the Credit Union to exercise any rights shall not later be considered a giving

up of any rights on any future transactions or acts of the borrower, myself, or the Credit

Union.

A release of the borrower or another person guaranteeing for this borrower shall not

release me except for any amount actually paid by the borrower and any other guarantor.

You need not first proceed against the borrower named above before resorting to me for

payment. I agree that I may be sued for payment, although the person named as borrower

above may be able to pay.

This guaranty is not conditioned upon the pursuit of any remedies against the borrower or

against any other person or persons or the pursuit of any other remedies the Credit Union

may have.

I as guarantor further waive notice of acceptance of this guaranty; of the respective

maturities of any charges or extensions of time hereunder; and further waive presentment

for payment, notice of payment, protest and notice thereof.

I, as guarantor, may be relieved of liability for future advances of money only upon receipt

by the Credit Union as a signed, written statement that I will not be liable for further and

future advances. Such notice shall not limit my obligations for money loaned prior to

receipt of my notice.

FOR THIS PURPOSE I ADMIT THAT I HAVE RECEIVED A FORM FOR USE FOR

SUCH REVOCATION OF GUARANTEE AT THE TIME OF SIGNING THIS GUARANTY

AGREEMENT.

I hereby agree that I have read both sides, and received the separate document entitled

“Notice to Cosigner.”

See reverse side for additional agreement.

DATED and signed this ____________ day of ________________, 20 __

________________________________________________________

Guarantor

THE LENDING PROCESS

13

Chapter 1

»

Types and Characteristics of Credit

Figure 1.6

Formula for Setting

Variable Rates

Index + Spread = Variable Rate

or an outside index. Cost of funds is

a percentage derived from what the

credit union pays in interest on money

it borrows and dividends it pays on

members’ share account. However,

using cost of funds is not allowed for

home equity loans. Outside indexes

include Treasury bill rates, the bank

prime rate, and the Federal Reserve

Board’s discount rate.

To whatever index it uses, the credit

union may add a spread. A spread is a

percentage that covers the operational

costs of providing credit and generating a return used to pay dividends on

savings accounts.

Figure 1.6 shows the formula for setting variable rates. As the cost of funds

or outside index changes, credit unions

can adjust their variable rates according to any limits in each loan contract.

How does your credit union set variable rates? To answer this question,

complete activity 1.3.

Variable-Rate Limits

Some credit unions set limits on the

amount variable rates may increase or

decrease and some states may set limits

on variable-rate increases. The federal

Truth-in-Lending Act and Regulation

Z doesn’t require a cap, or ceiling, on

interest rates for variable-rate loans

secured by any dwelling of the borrower. However, if a cap is imposed by

the creditor, it must be disclosed. Caps

help relieve members’ concerns about

unplanned increases. For example, a

credit union may offer an initial variable rate of 8.9 percent with 2 percent

annual caps and a 5 percent cap for

the life of the loan. This means the rate

cannot be raised more than two percentage points in a year, and can never

go higher than 13.9 percent. If set too

strictly, however, such limits defeat the

purpose of variable rates.

Effects of Variable Rates

When the variable rate changes, the

change will affect either the payment

amount, the number of payments, or

the outstanding balance.

On a short-term loan it is best to

leave the payment the same and extend

the loan, because the extension will

probably be for only a few months.

Members can count on budgeting the

same amount each month, and credit

unions are free from changing payroll

deductions or giving advance notice of

14

THE LENDING PROCESS

Chapter 1

»

Types and Characteristics of Credit

Activity 1.3

Variable Interest

Rates

What is the current variable rate at your credit union?

___________________________________________________________________________

What index does your credit union use to set variable rates?

___________________________________________________________________________

What is the spread that is added to the index?

___________________________________________________________________________

How has the variable rate at your credit union fluctuated over the past three years?

Current Year___________ Year II_____________ Year III ___________

payment changes.

However, this type of adjustment

could cause the collateral’s value to

decrease faster than the outstanding

balance. If the member defaulted on

such a loan, the credit union would not

be able to recover the full loan balance

from the collateral. Or, on closed-end

loans, the loan could exceed its maturity limit under state or federal law.

And on large, long-term loans, negative amortization could result. This

happens when the rate increases and

the loan payment no longer covers the

interest. Unpaid interest accrues each

month. In such cases, the member’s

loan balance would increase and the

principal might never be repaid unless

payments are increased or the interest

rate goes down again. To avoid such a

problem on long-term loans it is usually better to increase payments rather

than extend the term.

The option of increasing the balance

rather than the payments or extending

the term is not very attractive because

it results in a balloon payment due at

the end of the loan.

Benefits and Disadvantages

of Variable Rates

For members who are willing to

assume some risk, variable rates can be

beneficial. With them, members save

money on the initial rate of interest.

Depending on the adjustments, they

could save money over the life of the

loan. On a mortgage, a variable rate

may help people who might currently

have trouble with higher fixed rates,

but who can expect their incomes to

increase in the future. However, members may also end up paying larger

amounts over the life of the loan, or

paying for longer periods. In any case,

by offering both fixed- and variablerate programs, credit unions give members a choice.

Summarize the advantages and disadvantages of fixed and variable rates

of interest in activity 1.4.

Maturities

A loan’s maturity is the date when

it will be fully repaid. Credit unions

determine maturities based on the

type of loan, the amount, and the collateral. For example, a $6,000 loan for

a three-year-old used car may have a

THE LENDING PROCESS

15

Chapter 1

»

Types and Characteristics of Credit

Activity 1.4

Fixed and

Variable Rates

List the advantages and disadvantages of fixed and variable rates from both the credit

union’s and the member’s perspectives.

Fixed Rates of Interest

Advantages

Disadvantages

for the credit union

____________________________________

__________________________________

____________________________________

__________________________________

____________________________________

__________________________________

____________________________________

__________________________________

for the member

____________________________________

__________________________________

____________________________________

__________________________________

____________________________________

__________________________________

____________________________________

__________________________________

Variable Rates of Interest

Advantages

Disadvantages

for the credit union

___________________________________

_________________________________

___________________________________

_________________________________

___________________________________

_________________________________

___________________________________

_________________________________

for the member

16

THE LENDING PROCESS

___________________________________

_________________________________

___________________________________

_________________________________

___________________________________

_________________________________

___________________________________

_________________________________

Chapter 1

»

Types and Characteristics of Credit

maximum maturity of three years. At

that time, the car would be six years

old and considerably depreciated. With

a longer maturity, the loan might reach

a point where the car’s value did not

cover the outstanding balance. Then

the loan would no longer be fully

secured.

Offering members a choice of

maturities up to an established maximum helps credit unions tailor their

loan programs to members’ needs.

With new car loans, for example,

credit unions may offer a three-, four-,

five-, or six-year maturity. Members

then have the option of a shorter loan

commitment with larger monthly payments, or a longer loan commitment

with a greater total interest, but more

affordable payment.

Terms of Repayment

The terms of repayment are the conditions under which members pay back

their loans. Credit unions establish

terms based on the members’ income

and ability to repay, as well as the

loan’s amount, purpose, and collateral.

The most common term of repayment is monthly installments. Many

members use payroll deduction or

automatic account withdrawals to

make their monthly payments. Another

type is the single payment. Members

employed seasonally may need single

payment loans. For example, farmer

may pay off a loan after the crop is harvested. A third type of repayment is the

balloon note. Under its terms, members pay smaller monthly installments

and one large final amount.

Members who have difficulty meeting their original terms of repayment

may request help from their credit

unions. In such cases, credit unions

have two options—either an extension

agreement or a refinanced loan. An

extension agreement delays the date

of payment, giving members time to

recover from an unexpected layoff or

illness. A refinanced loan pays off the

member’s original loan and creates a

new loan. If the term of the new loan

is extended, the loan payments will be

lower.

Summary

Credit exists in four types—either

open-end or closed-end, and either

unsecured or secured. Open-end loans

are more flexible than closed-end.

Unsecured loans are also called signature loans, because their repayment

is guaranteed solely by the member’s

signed promise. Secured loans are

guaranteed by any of several forms of

collateral, including shares, automobiles, stocks, and other personal or real

property (real estate).

Credit is also defined by interest

rates, maturities, and terms of repayment.

Interest rates are either fixed or variable. Variable rates adjust according to

changes in a chosen index.

By offering both fixed and variable

index rates, different maturities and

various terms of repayment, credit

unions tailor their lending programs to

meet members’ needs.

THE LENDING PROCESS

17