US v Anderson - The American Health Lawyers Association

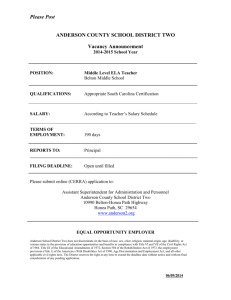

advertisement

Legal Ethics and Managing the Risks of Corporate Representation A Case Study: United States v. Anderson S. Craig Holden Ober Kaler 1 Relevant Rules of Ethics • “A lawyer shall not counsel a client to engage, or assist a client in conduct that the lawyer knows is criminal or fraudulent …” – ABA Model Rule of Professional Conduct 1.2(d) 2 1 Relevant Rules of Ethics (cont’d) • “…but a lawyer may discuss the legal consequences of any proposed course of conduct with a client and may counsel or assist a client to make a good faith effort to determine the validity, scope, meaning or application of the law.” – ABA Model Rule of Professional Conduct 1.2(d) 3 Relevant Rules of Ethics (cont’d) • A lawyer shall withdraw if: – “the representation will result in violation of the Rules of Professional Conduct or other law” • A lawyer may withdraw if: – “the client persists in a course of action involving the lawyer’s services that the lawyer reasonably believes is criminal or fraudulent…” – ABA Model Rule of Professional Conduct 1.16 4 2 Relevant Rules of Ethics (cont’d) • A lawyer may disclose information related to the representation of a client if the lawyer reasonably believes it necessary to: – “prevent the client from committing a crime or fraud that is reasonably certain to result in substantial injury to the financial interests or property of another and in furtherance of which the client has used or is using the lawyer’s services” – “to establish a …..defense to a criminal charge or civil claim against the lawyer…” ABA Model Rule of Professional Conduct 1.6 5 United States v Anderson, et al • Alleged criminal violations of Medicare/Medicaid Anti-Kickback Statute arising from relationship between Hospital and two referring physicians with a large nursing home practice. – Conduct occurred prior to the effective date of the Stark self-referral prohibitions 6 3 United States v Anderson, et al • Alleged Unlawful Transactions – Hospital “loan” of employee to physicians’ practice – Alleged “sham” consulting agreement – Hospital purchase of physicians’ laboratory – Hospital line of credit to physicians 7 U.S. v Anderson (cont’d) • Defendants – Two Physicians – Three Hospital Executives – Two Attorneys • Three unindicted co-conspirators 8 4 U.S. v. Anderson timeline • 1985 Gerontology Directorship Agreement/ Hospital employee placed in practice • 1986 Consulting Agreements with physicians • 1991 Baptist Hospital/Research Medical Center merger due diligence • 11/92 Investigation begins 9 U.S. v. Anderson Timeline (cont’d) • • • • • • 3/93 4/93 11/93 3/94 6/94 7/98 Employee withdrawn from practice New consulting agreement signed Agreement terminated New consulting agreement signed Agreement terminated Indictment 10 5 U.S. v Anderson (cont’d) • Trial outcome – – – – – Directed verdict of acquittal for both attorneys Both doctors convicted One hospital executive convicted One executive acquitted by jury One executive convicted by jury, later acquitted by Judge, conviction reinstated by Court of Appeals • Co-conspirator references expunged – U.S. v. Anderson, 55 F. Supp. 2d 1163 (D. Kan. 1999) 11 U.S. v. Anderson Case Against the Attorneys • Origins: – Grand Jury Subpoenas to attorneys – Litigation regarding the crime fraud exception to the attorney client privilege • In re: Grand Jury Subpoenas, Jane Roe and John Doe Intervenor v.U.S., 144 F 3d 653 (1998)(granting ex parte motion of government) – Production of attorney records pursuant to subpoena 12 6 U.S. v. Anderson Case Against the Attorneys • Problematic attorney comments in due diligence and other documents: – “Absolutely essential that there be no documentation of any intent to refer patients” – A “clean up” deal – Doctors’ motive in deal with other hospital was to “sell old folks referrals” – “They are scum” 13 U.S. v. Anderson Case Against the Attorneys • Tactical benefits to the government of naming attorneys – Prove knowledge and intent through use of “privileged” communications – Neutralize advice-of-counsel defense – Drive a wedge between attorney and client – Force withdrawal of attorney from defense – Evidentiary benefit re admissibility of coconspirator statements 14 7 U.S. v Anderson Case Against the Attorneys • Government Theory of Attorney Liability – Attorneys acted solely in the capacity of attorneys – Crafted “sham” agreements to “paper over” a fraud – Knew services not rendered & payments not at fair market value 15 U.S. v Anderson Case Against the Attorneys • “Original Sin” doctrine • Modification of existing problematic arrangement • Arrangement originally presented with improper intent – Impact of Safe Harbor regulations – Impact of Advisory Opinion process 16 8 U.S. v Anderson (cont’d) • Directed Verdict of Acquittal for Attorneys – “[T]he only reasonable inference a jury could draw is that the lawyers, each in their own turn, attempted to advise their clients to engage in legal transactions and that [the lawyers] did not prepare sham agreements to paper over a fraud, but rather tried their best to prepare agreements that would reflect…. legal transactions…The state of the law was in flux and the lawyers adapted their advice to it as it changed.” 17 U.S. v Anderson (cont’d) • Court response to Government allegation of Attorney knowledge that services were not rendered – “[T]he lawyers relied on their clients, were not engaged to monitor the activities of the consultants, and each time it came to their attention that there was a potential compliance problem, they urged their clients to make sure that fair market value for real services was 18 being required.” 9 Some Recent Developments • U.S. v. Sulzbach (SD FL) – Falsification of reports under CIA • U.S. ex rel. Drakeford v. Tuomey (D SC) • U.S. v. Lauren Stevens (D. MD) – Obstruction – Falsification of documents – False statements 19 Some Recent Developments • U.S. ex rel. Fair Laboratory Practice Associates v. Quest Diagnostics, 2011 WL 1330542 (April 5, 2011)(appeal pending) • Suit by former general counsel of an acquired subsidiary of defendant based on confidential/privileged information dismissed due to taint of ethical violations. 20 10 Some Do’s and Don’ts • Do: – Document the information received from your client and your advice • avoid loose language: “it’s a clean-up deal” “I don’t look good in stripes”, etc. – Advise your client of your legal analysis including good faith defenses and their likelihood of success – Make clear the need to monitor compliance and 21 who will do the monitoring Some Do’s and Don’ts • Don’t – Advise on the risk of detection/prosecution – Be an Ostrich – Create documents to obscure or conceal the true nature of a transaction – Counsel or assist in the concealment of evidence 22 11