3rd Quarter Report

June 2001

Nomura Research Institute, Ltd.

Asian Economic Research Unit

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

Contents

Forecasts on Growth Rates, Foreign Exchange Rates, and Interest Rates ................2

Overview: Asia (ex-Japan): Economic situation in the NIEs and the ASEAN-4 continues to

worsen...............................................................................................................3

South Korea: Worsening IT industry and enduring old-economy..........................................14

Taiwan: Gathering the pace of slow down ..........................................................................20

Hong Kong: Growth Forecasts lowered.............................................................................25

Singapore: Economy Faces Downward Pressure ..............................................................30

Malaysia: Expectation of Ringgit Devaluation Remains in the Market..................................34

Indonesia: MPR to reconvene on August1 to impeach president..........................................38

Philippines: Philippine politics start to settle down...............................................................42

Thailand: Economic Situation Continues to Worsen ............................................................46

China: Recovery Momentum Maintained............................................................................51

Cut-off date for calculations and forecasts was June 15, 2001.

Nomura Research Institute, Ltd.

Asian Economic Research Unit

Tomo Kinoshita

Hiroyuki Nakai

Suiyo Li

Tetsuji Sano

Head of Asian Economic Research,

Indonesia, Phlippines

South Korea, Taiwan

China, Hong Kong

Malaysia, Singapore, Thailand

While all reasonable care has been taken in the preparation of this publication, no liability is accepted by the publishers nor by any of the authors

of the contents of the publication, for any loss or damage caused to any person relying on any statement or mission in the publication.

All rights reserved; no part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means,

electrical, mechanical, photocopying, recording, or otherwise without the prior written permission of the publisher.

1

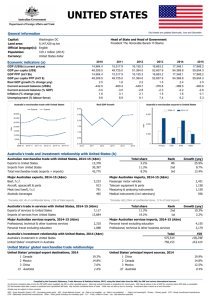

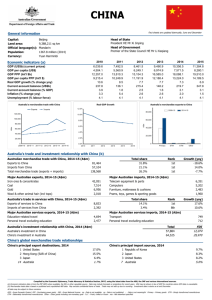

Short-term Economic Outlook for Northeast Asia and ASEAN Economies

1998

Northeast Asia

South Korea

Taiwan

Hong Kong

Real economic growth(%)

1999

2000 2001(

F)2002(F)

1998

Inflation rate(CPI) (%)

1999

2000 2001(

F)2002(F)

1998

Current account balance (US$ billion)

1999

2000

2001(

F) 2002(F)

-2.6

-6.7

4.6

-5.3

7.7

10.7

5.4

3.1

8.3

8.8

6.0

10.5

3.5

3.6

2.8

3.5

5.2

5.0

4.1

4.8

4.8

7.5

1.7

2.8

-0.2

0.8

0.2

-4.0

1.0

2.3

1.3

-3.7

2.5

4.4

0.2

-0.4

1.9

2.5

0.5

1.7

43.5

40.4

3.4

-3.0

41.4

24.5

8.4

8.5

27.6

11.0

8.9

7.7

27.3

10.3

11.6

7.5

26.8

10.1

11.1

8.2

-8.2

-13.1

-7.4

-0.6

0.1

-10.8

3.5

0.8

6.1

3.4

5.9

4.2

5.7

4.8

8.3

4.0

9.9

4.3

3.0

3.8

3.0

3.3

3.0

1.2

4.6

5.2

5.7

3.9

5.2

3.3

22.5

58.4

5.3

9.7

-0.3

8.1

7.8

20.5

2.7

6.7

0.5

0.3

2.6

3.7

1.6

4.3

1.4

1.6

4.6

8.9

1.4

6.5

2.0

2.3

3.0

4.7

1.5

4.6

2.1

2.6

50.2

4.1

9.6

1.3

20.3

14.3

59.3

5.8

12.6

7.2

21.8

12.5

56.6

7.8

8.4

9.4

21.8

9.2

44.0

3.3

8.0

6.6

18.1

7.4

39.3

2.7

7.5

5.4

15.9

7.0

China

Total

7.8

-1.0

7.1

6.4

8.0

7.5

7.7

4.7

8.1

5.9

-0.8

7.9

-1.4

1.6

0.4

1.3

1.5

2.7

2.0

2.2

29.3

123.0

15.7

116.4

20.5

104.7

17.2

88.5

15.8

81.9

Asian NIEs + ASEAN4

Asian NIEs

ASEAN4

Japan

United States

-4.8

-2.4

-9.5

-1.1

4.4

6.1

7.6

3.2

0.8

4.2

7.3

8.4

5.1

1.5

5.0

3.3

3.5

3.0

0.8

1.6

5.0

5.2

4.5

1.4

2.5

11.6

4.4

25.9

0.6

1.6

2.9

-0.1

8.9

-0.3

2.2

1.6

1.0

2.8

-0.6

3.4

3.3

2.4

4.9

-0.3

3.3

2.3

1.9

3.1

-0.4

2.8

93.7

64.5

29.2

120.7

-217.1

100.7

62.6

38.0

106.9

-331.5

84.2

49.4

34.8

116.9

-435.4

71.3

45.0

26.4

88.6

-435.9

66.1

42.1

23.9

93.5

-447.8

ASEAN5

Indonesia

Malaysia

Philippines

Singapore

Thailand

Notes: (1)Each economies weight in the aggregate figures for real economic growth was calculated on the basis of its GDP for 1992 in US

dollars; (2)"Asian NIEs" refers to South Korea, Hong Kong, Taiwan, and Singapore ,while "Asean4"refers to Malaysia, Indonesia, Thailand, and

the Philippines; (3)Data and forecasts as of June 15, 2001

Source: Nomura Research Institute, from official statistics of the economies concerned. Forecasts are by Nomura Research Institute.

Foreign Exchange Rates against USD

Japanese Yen

2001/6/12

121.7

South Korean Won

1,290

7.80

Hong Kong Dollar

3.8

Malaysian Ringgit

1.82

Singapore Dollar

Indonesian Rupiah

11,238

Thai Baht

Chinese Renminbi

Taiwan Dollar

Philippine Peso

45.3

8.28

34.1

51.3

2001/Q2

122.0

(116.0〜128.0)

1,300

(1,250〜1,350)

7.80

(7.77〜7.90)

3.8

2001/Q3

125.0

(119.0〜131.0)

1,275

(1,225〜1,325)

7.80

(7.77〜7.90)

3.8

2001/Q4

125.0

(119.0〜131.0)

1,275

(1,225〜1,325)

7.80

(7.77〜7.90)

3.8

2002/Q1

125.0

(119.0〜131.0)

1,275

(1,225〜1,325)

7.80

(7.77〜7.90)

3.8

1.80

(1.78〜1.82)

11,200

(10,425〜12,000)

45

(43.0〜47.0)

8.28

(8.25〜8.30)

33.5

(32.0〜34.5)

50.5

(49.6〜52.5)

1.80

(1.78〜1.82)

10,500

(9,500〜13,000)

45.0

(43.0〜47.0)

8.28

(8.22〜8.33)

34.5

(33.5〜35.5)

49.3

(47.3〜51.8)

1.80

(1.78〜1.82)

10,000

(9,000〜13,000)

45.0

(43.0〜47.0)

8.28

(8.22〜8.33)

34.5

(33.5〜35.5)

48.0

(45.0〜51.0)

1.80

(1.78〜1.82)

10,000

(9,000〜13,000)

45.0

(43.0〜47.0)

8.28

(8.20〜8.35)

34.5

(33.5〜35.5)

47.8

(44.8〜50.8)

Note: Upper figures refer to period-average

Source: Forecasts are by Nomura Research Institute

Interest Rates

USA(FF Rate)

2001/6/12

2001/Q2

2001/Q3

2001/Q4

2002/Q1

4.0

3.5〜4.0

3.5〜4.0

3.5〜4.0

3.5〜4.0

South Korea

(

Overnight Call)

5.1

4.5〜5.25

4.5〜5.25

4.5〜5.25

4.5〜5.25

Hong Kong (3M HIBOR)

3.85

3.25〜3.75

3.25〜3.75

3.25〜3.75

3.25〜3.75

Malaysia(3M KLIBOR)

3.3

3.0〜3.5

3.0〜3.5

3.0〜3.5

3.0〜3.5

Singapore (3M SIBOR)

2.3

2.00〜2.50

1.75〜2.50

1.75〜2.50

1.75〜2.50

Indonesia(Overnight JIBOR)

14.8

14.0〜15.3

14.0〜15.5

13.0〜14.5

13.0〜14.5

Thailand (14D Repo)

2.5

1.5〜2.5

2.5〜3.0

2.5〜3.0

2.5〜3.0

China

(

1Y Lending Rate for Working Capital)

5.85

5.85

5.85

5.9

5.85〜6.0

Taiwan(3M CP Rate)

3.90

3.5〜4.5

3.5〜4.5

3.5〜4.5

3.5〜4.5

8.5〜9.5

8.5〜9.5

8.5〜9.5

8.5〜9.5

Philippines (91D T Bill Rate)

9.2

Note: Rates refer to end-period.

Source: Forecasts are by Nomura Research Institute

2

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

Asia(ex-Japan): Economic situation in the NIEs and

the ASEAN-4 continues to worsen

The unexpectedly sharp fall in US demand for IT-related goods and equipment

obliges us to take a more pessimistic view of the economic outlook for Asia in 2001.

We are therefore lowering our forecast of real GDP growth in the NIEs economies

(Taiwan, Hong Kong, Korea and Singapore) in 2001 from 4.4% to 3.5%, and in the

ASEAN-4 (Malaysia, Indonesia, Thailand and the Philippines) from 3.9% to 3.0%.

According to the latest figures, exports have declined sharply. For the NIEs and

the ASEAN-4 as a whole, year-on-year export growth in April was negative (see table

below). In May the decline in export growth continued, as can be seen from the

figures for Korea and Taiwan (Korea: -6.9%; Taiwan: -22.6%).

The decline in exports continues to be led by electronics-related goods and equipment. Although inventory adjustment of computer-related goods is now expected to

be completed quite soon, there is a growing consensus that inventory adjustment of

wireless communications-related items (such as mobile phones) and network-related items will take longer than expected. As Asia is the main production center for

IT hardware, it is particularly vulnerable to the effects of such inventory adjustment. The increasing use of supply chain management by manufacturers of elec-

Real GDP growth rates

(YOY,%)

2000

2001

Q1

12.6

7.9

14.1

9.8

11.7

5.3

4.2

3.3

8.1

Korea

Taiwan

Hong Kong

Singapore

Malaysia

Thailand

Indonesia

Philippines

China

Q2

9.7

5.4

10.7

8.4

8.0

6.4

5.2

4.3

8.3

Q3

9.2

6.6

10.8

10.4

7.6

2.9

4.4

4.6

8.2

Q4

4.6

4.1

6.9

11.0

6.3

3.2

5.2

3.8

7.4

Q1

3.7

1.1

2.5

4.5

3.2

1.8

4.0

2.5

8.1

Source:Nomura Research Institute, official statistics

YOY increase in exports from Asia

Korea

Taiwan

(YOY in USD, %)

Singapore Malaysia

Thailand

Indonesia Philippines

China

Total exports

Jan-01

Feb-01

Mar-01

Apr-01

May-01

4.6

5.2

-1.8

-9.9

-6.9

-17.2

11.9

-1.9

-11.3

-22.6

9.1

5.2

-3.5

-4.1

-4.8

10.3

4.6

-6.9

-5.0

NA

-3.8

-3.0

3.9

-6.7

NA

11.3

-1.3

5.5

-4.2

NA

6.3

-3.3

-4.0

-15.8

NA

0.9

29.9

14.9

11.1

3.5

Jan-01

Feb-01

Mar-01

Apr-01

May-01

-5.1

0.4

-7.9

-18.6

NA

-13.0

13.7

-2.3

-17.2

-25.7

1.2

-0.6

-10.3

-10.4

NA

14.3

3.2

-10.5

-10.8

NA

-4.1

-1.5

6.6

-13.7

NA

71.3

NA

NA

NA

NA

2.1

-7.0

-10.2

-28.0

NA

18.1

54.6

17.1

23.4

NA

11.7

8.1

1.9

-4.5

NA

-19.5

10.9

-1.7

-7.8

-20.9

18.4

12.1

4.6

3.5

NA

5.4

6.5

-1.9

3.2

NA

-3.6

-3.7

2.6

-3.2

NA

4.5

NA

NA

NA

NA

12.9

1.9

5.5

0.0

NA

-4.3

22.8

14.2

7.4

NA

Exports of electronics goods

Exports of non-electronics goods

Jan-01

Feb-01

Mar-01

Apr-01

May-01

Source:Nomura Research Institute, official statistics

3

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

tronic goods and equipment is another major factor in the decline in export growth—

particularly in the current environment of falling demand. Given the pressure supply chain management puts on manufacturers of final goods to minimize inventories, manufacturers of electronic parts have not only had to rapidly increase their

production capacity in order to meet any future increase in demand, but they have

also had to carry larger inventories.

As a result, while parts manufacturers are able to maintain their inventories at

a certain level when demand is growing steadily, they find themselves holding very

large inventories once demand begins to fall off. Therefore those economies where

components(such as semiconductors) account for a large proportion of electronics

exports are particularly affected in terms of both volume and price. This is presumably why the latest figures for exports of electronic goods and equipment from the

Philippines, Korea and Taiwan show a year-on-year decline of about 20%.

The decline in exports of non-electronics-related goods and equipment has been

more moderate. As a result, the decline in overall export growth in countries (such

as Korea) where non-electronics-related items such as autos, steel and ships account

for a relatively large proportion of exports has been quite modest and demonstrates

the advantages of export diversification.

The slowdown in exports of electronics-related goods and equipment has made

manufacturers of such items more cautious about investing in plant and equipment. Gone are the hopes for a V-shaped recovery in US demand for IT goods and

equipment that some observers were expressing three months ago, and there has

been an increase in cancellations of orders for equipment—especially by semiconductor manufacturers. Prices for basic materials such as steel and chemicals have

also been under pressure, and this has depressed domestic demand. In order to

ascertain how strongly the economies of Asia are currently growing, we produced an

index that compares quarterly real (seasonally adjusted) GDP with the average

figure for real GDP for the preceding four quarters.

The share of semiconductors out of the exports of electronics goods in

various Asian countries (2000)

China

Philippines

Thailand

Malaysia

Singapore

Taiwan

Korea

0%

20%

40%

60%

80%

Semiconductor

Electronics exports of other than

semiconductors

Source:Nomura Research Institute, official statistics

4

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

100%

For example, when the average GDP for 2000 is rebased to 100, the index for the

first quarter of 2001 equals the GDP for 2001 as a whole if the average GDP for the

second, third and fourth quarters is at the same as that for the first quarter. The

index (see graph below) shows that all the NIEs economies and the ASEAN-4 (except

for Indonesia) are rapidly losing momentum. If there is no economic recovery and

their average GDP for the next three quarters remains unchanged, growth will be a

meager 0%-2% except in Indonesia.

"Economic momentum" index

Index at period t

=

(

Real GDP at period t

Avarage real GDP from period (t-1) through period (t-4)

)*

100

110.0

105.0

100.0

95.0

マレーシア

インドネシア

フィリピン

タイ

90.0

1Q01

3Q00

1Q00

3Q99

1Q99

3Q98

1Q98

3Q97

1Q97

85.0

110.0

105.0

100.0

95.0

Korea

Taiwan

Singapore

HongKong

90.0

1Q01

3Q00

1Q00

3Q99

1Q99

3Q98

1Q98

3Q97

1Q97

85.0

Note:Index at 1Q2001 equals to the level of GDP in 2001 when the level of GDP in 2000 is 100

in case average GDP from Q2 to Q4 stays at the same level as in Q1.

Source:Nomura Research Institute from official statistics. Seasonally adjustment of real

GDP in Indonesia, Malaysia, and Taiwan is made by Nomura Research Institute.

5

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

Economic growth to recover gradually by the end of 2001

Although the economies of Asia have slowed more than we expected, we still expect them to bottom out and recover gradually by the end of 2001. This is because we

expect the benefits of fiscal spending to feed through and US demand for IT goods to

bottom out by then. In 2002 we expect higher asset prices to have a positive secondary effect on private demand as business confidence in the United States continues

to improve and economic recovery in Asia becomes more apparent.

However, the pace of economic recovery in Asia is likely to be slower than we

expected three months ago. This is because it is likely to take longer than we expected for demand and supply to adjust in the semiconductor industry. According to

a 31 May report by the Nomura Securities, demand for semiconductors generally

will not exceed its supply until the fourth quarter of 2002. This is a negative factor

for exports, corporate earnings and capital investment in Korea and Taiwan, which

have a strong semiconductor production base for wafer process.

2003 is likely to see a full-scale economic recovery in Asia. First, there is likely to

be a robust recovery in demand for electronics-related goods and equipment with all

the positive knock-on effect and, second, private consumption should benefit from

pent-up demand from 2001-2002.

China maintains high level of economic growth

In contrast to the economic slowdown in the economies of NIEs and the ASEAN4 in the first quarter of 2001, real GDP in China has held up extremely well, growing by 8.1% in the first quarter. China’s customs-cleared exports for January-April

were up 13.6% year on year—in marked contrast to the slowdown in exports in the

rest of the region. This was driven mainly by a 26.4% increase in exports of electronics-related goods and components during this period; but even exports of non-electronics-related goods and components were up 9.7%. Customs-cleared exports for

May were up only 3.5% on the previous year; but this was still much better than the

sharp slowdown in export growth experienced by Korea and Taiwan. There would

appear to be two main factors behind the strength of China’s exports of electronicsrelated goods and components: first, direct investment in this area has been

Forecasts on world-wide semiconductor market

00

34.6

61.5

49.2

32.4

10.6

1.1

30.5

9.8

17.6

204.4

37.0%

MOS Logic

MOS Micro

MOS Memory

DRAM

Flash

Digital Bipolar

Analog

Optoelectronics

Discrete

Total

Growth Rate

01(F)

30.0

52.3

35.0

17.9

11.5

0.6

26.6

9.7

15.1

169.3

-17.0%

(US$bil)

02(F)

35.2

57.9

33.1

17.0

10.7

0.5

32.9

10.9

17.6

188.0

11.0%

Source: Nomura Securities.

6

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

03(F)

44.7

69.2

36.9

19.5

11.5

0.5

42.1

13.6

21.7

228.6

22.0%

accelarated recently and new capacity has come on stream; second, the fact that

final goods account for a higher proportion of exports than in the NIEs and the

ASEAN-4 (where semiconductors and other electronics-related parts dominate) means

that China has not been seriously affected by excess inventories of parts. Although

export growth will almost inevitably slow, we expect it to remain still at quite a high

level since, first, direct investment in China’s electronics industry have accelarated

on a contracted basis and the realized investment is expected to rise and, second,

there has been a tendency for foreign manufacturers of electronic goods and components to invest more in China and less in the rest of the region.

Meanwhile, domestic demand is still robust as a result of the government’s expansionary fiscal policy and heavy residential investment. Although we expect slower

export growth and a weaker impact from fiscal spending to lead to slower economic

growth in the second half of 2001, growth of 7.7% for the year as a whole should still

be possible. In 2002 China’s economy should grow by 8.1% as the US economy recovers gradually and the Chinese government maintains its stimulative fiscal policy.

Changing inflationary pressures: global deflation and a

realignment of regional currencies

There has been a major change in the inflationary pressures on the region since

the beginning of 2001. This is the result, first, of global deflation produced by the

slowdown in the United States and, second, of a realignment of regional currencies.

The first has exerted strong deflationary pressures throughout the region. The

global economic slowdown stemming from the slowdown in the United States has

hit demand, thereby producing deflationary pressures on a global scale. In Asia,

prices have been falling across the board (not just for electronics-related products),

and commodity prices (excluding electronics-related products) have fallen by more

than 20% since last autumn (see graph next page).

Direct investments toward China in the area of electronics and

communication related equipments

(

US$mil)

4,500

4,000

3,500

3,000

Contracts

to be

realized

2,500

Investments contracted

2,000

1,500

1,000

Investments

realized

500

Source:Nomura Research Institute from official statistics

7

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

1Q01

4Q00

3Q00

2Q00

1Q00

4Q99

3Q99

2Q99

1Q99

0

The second is the result of a weakening by those Asian currencies that float against

the dollar in response to the weakness of the yen that lasted until the beginning of

April and the increasingly uncertain political outlook for a number of countries in

Price of non-electronics raw materials

130

120

110

100

90

Apr-01

Jan-01

Oct-00

Jul-00

Apr-00

Jan-00

Oct-99

Jul-99

Apr-99

Jan-99

Oct-98

Jul-98

Apr-98

80

Notes:Average price in USD for the following 22 items: Polyethylene resin, Polypropylene

resin, Polystyrene, Styrene-acrylonitrile, Vinyl chloride resins, Wide flange beam, Stainless

steel, Hot-rolled coil, Steel scrap, Pig iron, Styrene monomer, Ethylene, Tetrachloroethylene,

Benzene, Acrylonitrile, Fine paper, Fine coated paper, Pulp for paper, Polyester filament fibers, Polyester staple fibers, Acrylic staple fibers,Pakistani Cotton. Apr 98=100.

Values of Asian currencies against USD

(Indexed at Jan,2000=100)

110.00

Korean won

New Taiwan dollar

100.00

Singapore dollar

90.00

Japanese yen

80.00

Indonesian rupiah

Philippine peso

70.00

Thai baht

Note:Index decreases as the currency weakens against USD.

Source:Nomura Research Institute from official statistics.

8

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

May-01

Apr-01

Mar-01

Feb-01

Jan-01

Dec-00

Nov-00

Oct-00

Sep-00

Aug-00

Jul-00

Jun-00

May-00

Apr-00

Mar-00

Feb-00

Jan-00

60.00

the region. The currency that weakened most against the dollar has been the rupiah, which (as of 12 June) has declined 25.7% from its average rate against the

dollar for 2000 (see table below), while the Korean won, Thai baht and Philippine

peso have weakened to roughly the same extent as the yen (i.e., 11.5%). On the other

hand, Chinese renminbi, Hong Kong dollar and the ringgit remain pegged to the US

dollar.

In order to measure the impact of such changes in foreign exchange rates on

inflation, we calculated the percentage change in total domestic supply costs (defined as “the change in import values generated by the change in the foreign exchange rate as a percentage of GDP”) (see graph below). For the sake of convenience,

we have assumed (1) that all these countries’ imports from Japan are in yen terms

and all their imports from elsewhere in US dollar terms and (2) that the percentage

Comparison of the exchange rate against USD from last year

Korean Won

New Taiwan Dollar

Hong Kong Dollar

Singapore Dollar

Malaysia Ringgit

Thailand Bahts

Indonesia Rupiah

Philippine Peso

Chinese RMB

Japanese Yen

The forex rate against USD

The latest rate

Average in 2000

(

June 12, 2001)

1,130

1,290

31.2

34.1

7.76

7.80

1.73

1.82

3.80

3.80

40.2

45.3

8,346

11,238

44.2

51.3

8.3

8.3

107.8

121.7

Declining

Rate(%)

12.4

8.5

0.5

4.8

0.0

11.3

25.7

13.8

0.0

11.5

Note:In the Philippines, the rate on June 11is applied since June 12 is a holiday.

Source:Nomura Research Institute

Change in total domestic cost of supply relative to GDP resulting from

exchange rate movements

(%)

3.0

2.5

2.0

1.5

1.0

0.5

0.0

-0.5

-1.0

China

Philippines

Indonesia

Thailand

Malaysia

Singapore

HongKong

Taiwan

Korea

-1.5

Notes:(1)Fugures are computed on the basis of 2000 statistical fugures.(2)For a definition,

refer to the text.

Source:Nomura Research Institute

9

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

changes in the exchange rates are as in Table ??. In calculating the change in total

domestic supply costs, we exclude the effects of change in the foreign exchange on

the price of intermediate goods used to produce exports since the effects are assumed

to pass onto the export price. The increase in supply costs has to be borne by someone in the country concerned. If the entire increase is passed on in the form of higher

prices for finished goods, the consumer will bear most of the costs; but any increase

that cannot be passed on will have to be borne largely by the corporate sector. Whether

or not this inflationary (or deflationary) pressure manifests itself will depend on how

effective the price adjustment mechanism of the country concerned is.

The combined pressure of these two factors (global deflation and the percentage

change in total supply costs) can be regarded as the price pressure currently faced

by the economies of Asia. As can be seen in table below, this pressure is inflationary

in Indonesia, Korea, Thailand and the Philippines but deflationary in Hong Kong,

China and Malaysia, and largely neutral in Singapore and Taiwan.

Effect of these changes in inflation and foreign exchange rates on

corporate earnings and monetary policy

This realignment of foreign exchange rates and subsequent changes in inflationary pressure have a distinct impact on corporate earnings and monetary policy in

these countries. The graph (see graph next page) shows where each country stands

in terms of currency depreciation (horizontal axis) and inflationary pressure (vertical axis). The rate of depreciation of a currency can be taken as a proxy of the

country’s export competitiveness: the higher the rate, the more competitive that

country’s exports are likely to be. The figure can be used to gauge the impact of

these changes in inflation and foreign exchange rates on corporate earnings and

monetary policy. The current phase of the business cycle indicates that the actual

level of earnings for the corporate as a whole is likely to deteriorate significantly.

However, in relative terms, a company’s earnings (whether it is an exporter or a

domestic demand-oriented company) will depend on what is happening to the currency and inflation. The following observations assume that factors other than inflation and the foreign exchange rate are unchanged.

Inflationary pressures in Asian region

Pressure on the

Pressure on the

prices by the change Combined pressure

prices by the global

in domestic total

on the prices

supply-demand gap

cost of supply

(A+B)

(A)

(B)

Korea

Taiwan

HongKong

Singapore

Malaysia

Thailand

Indonesia

Philippines

China

Deflationary

Deflationary

Deflationary

Deflationary

Deflationary

Deflationary

Deflationary

Deflationary

Deflationary

Inflationary

Weakly inflationary

Deflationary

Weakly inflationary

Deflationary

Inflationary

Strongly inflationary

Inflationary

Deflationary

Source:Nomura Research Institute

10

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

Inflationary

Almost neutral

Deflationary

Almost neutral

Deflationary

Inflationary

Inflationary

Inflationary

Deflationary

In the first group of countries (Korea, Thailand and the Philippines: “Group A”),

currency depreciation is likely to benefit exporters in relative terms. During a cyclical downturn, however, domestic demand-oriented companies will find it difficult to

pass on all of their increased import costs in the form of higher prices and are likely

to find their margins being squeezed. As Group A countries are quite vulnerable to

inflation, a tight monetary policy seems to prove effective at first sight. However,

that is not the case. As most of this inflationary pressure comes from the supply

Movements of price indices (December 2000 = 100)

105

104

Thailand

103

Indonesia

102

Philippines

101

Korea

100

HongKong

99

Singapore

98

Malaysia

97

96

Taiwan

95

Dec-00

Jan-01

Feb-01

Mar-01

Apr-01

May-01

Notes:Price indices used are following: Malaysia, Thailand:PPI, Hong Kong, Indonesia,

Philippines:CPI, Taiwan:WP, Singapore:DSPI.

Source:Nomura Research Institute from official statistics

Changing export competitiveness and pressure on the prices

Downward Pressure←

Prices

→Upward pressure

3.0

Korea

2.0

Thailand

1.0

Indonesia

Group A

Singapore

Philippines

0.0

Group C

China

-1.0

Taiwan

Hong Kong

Malaysia

-2.0

Group B

-3.0

0.0

5.0

10.0

15.0

20.0

25.0

Rate of decline in exchange rates against USD

Down← Export competitiveness

→Up

Source:Nomura Research Institute

11

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

30.0

(

%)

side, a tight monetary policy would be unlikely to stem inflation. In this respect, the

monetary policy being pursued by the Philippine government (i.e., of cutting interest rates in line with US monetary policy) should be just appropriate.

In Korea, there appears to be a difference of opinion between the government,

which would like to ease monetary policy to assist economic recovery, and the Bank

of Korea, which has adopted a neutral policy in order to keep inflation at bay. The

fact that inflationary pressures in Korea are greater than in either of the other two

countries in Group A might be taken as giving credence to the Bank’s neutral policy.

However, the problems facing the financial system mean that a more accommodative monetary policy would not necessarily lead to more bank lending. As a result,

the things would not change substantially between having an accommodative monetary policy and a neutral monetary policy.

In Thailand, a weak demand would, under normal circumstances, call for the

kind of low interest rates seen recently. However, under its new governor, the Bank

of Thailand has adopted a tight stance in order (1) to stem capital outflows and

thereby stop the baht from weakening, and (2) to push up deposit rates and thereby

transfer income to depositors. There is a risk that higher interest rates may have a

negative effect on the economy.

The second group of economies (Hong Kong, China and Malaysia: “Group B”),

which effectively peg their currencies to the US dollar, is unquestionably at a disadvantage compared with Group A countries, whose currencies have depreciated, in

terms of export competitiveness, and exporters’ earnings are vulnerable. Also, the

fact that wages are rising while prices are falling means that the earnings of domestic-oriented companies are also vulnerable, although as the price adjustment mechanism in all three economies appears to function imperfectly, there is probably a limit

to how far prices can fall. Nevertheless, in a deflationary situation where some

prices are falling, there is a risk that an increase in non-performing assets could

exacerbate the problems facing the financial system. In such a situation, an accommodative monetary policy is best, and, in fact, all three economies have maintained

low-interest-rate policies. However, in Malaysia, it would be difficult to reduce rates

further because of strong fears of capital outflows, so any advantages from monetary

policy are probably limited.

In the third group of economies (Singapore and Taiwan: “Group C”), the fact that

inflation is quite low suggests that the earnings of domestic demand-oriented companies are unlikely to be seriously affected. In terms of export competitiveness, however, they are unlikely to benefit as much as Group A countries. The fact that inflation is quite low also means that there is probably little need to change monetary

policy. However, it would appear that the Taiwanese authorities are prepared to

contemplate a certain degree of depreciation in order to boost export competitiveness, which has declined. As a result, they will probably maintain their accommodative stance. In contrast, the Singapore authorities’ traditional emphasis on combating inflation means that they will probably continue to allow the currency to appreciate gradually.

Finally, Indonesia. Indonesia has enjoyed the biggest improvement in export competitiveness, but has also been the most affected by higher import prices. The weakness of the currency is the main reason that Bank Indonesia is pursuing a tight

monetary policy. However, the fact (1) that inflation is caused mainly by supply-side

factors and (2) that higher interest rates have a serious effect on public finances and

12

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

bank margins indicates that tightening of the monetary policy is not necessarily the

best option and could even act as a drag on economic growth.

Risk factors—-US demand for IT goods remains a main risk factor

The main risk factor remains the possibility that US demand for IT goods may

take longer to recover than expected. As far as the political issue is concerned, one

key political issue will be whether Sino-American relations improve under the Bush

administration. If Asia is to enjoy stability, it is important that China joins the

World Trade Organization and plays a more active role in the international community. In Thailand, confidence in the Thaksin administration is declining among

foreign invest ment community—which might result in negative consequences. Finally, although Indonesia is still a risk factor in the region, the course of action that

will lead to President Wahid’s dismissal in August is gradually becoming clearer.

Tomo Kinoshita

13

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

South Korea:Worsening IT industry and enduring

old-economy

The Korean economy still has to contend with a large number of negative factors.

Prices for electronics goods and components (especially semiconductors and mobile

phones) are still falling, and reform of Korean industry has stalled. The focus here

has been on Hyundai Engineering and Construction (HEC). Although a debt-equity

swap has been carried out, a start has only just been made on changing the way

company is run. In addition, the number of corporate bond redemptions is due to

South Korea: Summary table of forecasts

1999

2000

Real GDP (YoY, %)

Private Consumption

Govt. Consumption

Fixed Capital Formation

(Private Facility Investment)

Change in stock (Contribution)

Export

Import

CPI (YoY, %)

Current A/C Balance (bil. US$)

(weight to GDP, %)

Unemployment Rate (%)

Overnight Call Rate (%)

Won/US$ (Average)

10.9

10.7

1.3

4.2

38.6

5.4

17.0

29.7

0.8

24.5

6.0%

6.3

5.0

1,188

8.8

7.0

1.2

9.8

31.1

-0.9

20.5

19.6

2.3

11.0

2.4%

4.1

5.1

1,130

2001

(F)

3.6

3.4

1.6

-0.3

-2.5

0.6

2.3

0.7

4.4

10.2

2.3%

4.1

5.0

1,281

2002

(F)

5.0

5.6

2.0

4.3

4.4

0.5

4.6

5.7

2.5

10.1

2.1%

4.0

4.9

1,275

Source: Department of Statistics, Nomura Research Institute

Industrial Production Indexes

80%

(YOY of

3mths MAV)

Total

Computers related

Auto

Machineries

70%

60%

50%

40%

30%

20%

10%

0%

Source:Nomura Research Institute, from official statistics

14

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

Apr-01

Mar-01

Feb-01

Jan-01

Dec-00

Nov-00

Oct-00

Sep-00

Jul-00

-20%

Aug-00

-10%

rise sharply during the second half of this year, and there is still speculation that

some companies may experience funding difficulties.

In contrast, traditional industries such as machine manufacturing are enjoying

relatively better export demand and have been spared the kind of large-scale decline

experienced by manufacturers of electronic goods and components. Moreover, business and consumer confidence continues to improve. This, together with financial

assistance to companies to minimize unemployment, is helping to support private

consumption in some degree.

We are lowering our forecast of real GDP growth for 2001 from 4.1% to 3.6% to

reflect the above factors. Although we have lowered our forecasts for nearly all components of GDP (except for imports), the downward revision for private consumption

was less than those for exports and private capital investment.

Finally, the prices of electronic goods and components, and economic developments in the United States and Japan continue to be the focus of attention as downside risk factors.

Inflation and the currency

The fact that oil prices have been persistently high and that there has been a

drought until recently indicates that upward pressure on consumer prices is likely

to continue for time being. Because of this persistent inflationary pressure, we

expect consumer inflation to be 4.4% in 2001 (compared with our earlier forecast of

4.5%). Being pressed by requests from industries and the government, BOK cut

policy rate for 25bp in July 5 with suggestion that another action might be possible.

If inflation would be tamed as we foresee (our forecast for 1st half is +4.8% while

+4.0% is for 2nd half), we expect another cut might be achievable. But, considering

poor external demand or malfunction of financial system, positive effect of rate cut

would be limited.

The won’s foreign exchange rate is likely to remain sensitive to the stock market.

Breakdown of inflation

6.0%

(YOY)

Others

Fuel

Education

Transportation

Medical

5.0%

4.0%

3.0%

2.0%

1.0%

Source:Nomura Research Institute, from official statistics

15

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

Apr-01

Jan-01

Oct-00

Jul-00

Apr-00

Jan-00

0.0%

Although there are a few factors that are positive for the won (e.g., the country’s

current account surplus and the fact that the interest rate differential with the

United States now favors the won), the fact that foreign investors own 30.2% of the

value of the stock market (as of March 2001) means that portfolio investment flows

are the main factor determining the exchange rate and that there is a close correlation between the stock market and the foreign exchange rate. There is also a close

correlation between the won and the yen. Given NRI’s view that there is unlikely to

be any major change in the yen’s exchange rate (apart from minor short-term fluctuations), we believe that the yen’s potential to influence the won’s exchange rate is

limited.

North Korean economy continued to grow in 2000

According to estimates released by the Bank of Korea on 28 May, North Korea’s

GDP grew by 1.3% year on year in 2000—the second year in a row that it has

achieved positive growth. Although the agricultural sector suffered a slump because

of bad weather, sectors such as mining, services and construction expanded, and, as

a result, overall GDP growth is estimated to have been positive.

Moreover, figures released by the Korea Trade-Investment Promotion Agency

(KOTRA) for North Korean imports and exports in 2000 indicate that, whereas

imports surged year on year by 46.5%, exports increased by only 8.0%. An analysis

of imports shows that, in addition to a sharp increase in imports of cereals as a

result of the slump in the agricultural sector, imports of capital goods such as machinery and automobiles also increased. Taken together with the fact that the construction sector expanded, this indicates that North Korea is in the process of rebuilding its industrial infrastructure. Commercial trade between China and North

Korea also appears to be expanding, and there were media reports that the trade fair

North Korea's real GDP growth rate (YOY)

Total

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

1990-2000

accumulated

growth

-3.7%

-3.5%

-6.0%

-4.2%

-2.1%

-4.1%

-3.6%

-6.3%

-1.1%

6.2%

1.3%

Agriculture

-10.2%

2.8%

-2.7%

-7.6%

2.7%

-10.4%

0.5%

-3.8%

4.1%

9.2%

-1.9%

Manufacturing

-1.5%

-13.4%

-17.8%

-1.9%

-3.7%

-5.2%

-8.9%

-16.8%

-3.1%

8.5%

0.9%

-24.5%

-17.7%

-49.5%

Source:Nomura Research Institute, from Bank of Korea statistics

16

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

in Pyongyang at the beginning of May attracted several hundred participants from

China.

Taking these facts into account, the North Korean economy has overcome its

phase of negative growth and is now in the process of trying to rebuild its infrastructure—admittedly with the help of imported food and materials. What matters

most to North Korea in this situation is reliable sources of imported food and materials, and the means to finance the resulting trade deficit. North Korea does not

publish any trade statistics itself, and it has to be remembered that the import

figures include official development assistance. With these provisos, it would seem

that North Korea has an annual trade deficit of several hundred million dollars.

The lion’s share of this deficit has probably been financed by payments from

South Korea (e.g., the $144 million a year paid by the Hyundai Group for its franchise to develop the area around Mt. Kumgang in North Korea as a tourist resort).

The Hyundai Group is in arrears on these payments, but it has been reported (on 11

North Korea's trade

US$ mil.

3,000

2,500

2,000

Imports

1,500

Trade deficit

1,000

500

Exports

Source:Nomura Research Institute, from KOTRA statistics

North Korea's import

2000

Composition

12.8%

6.3%

12.2%

7.7%

4.8%

12.2%

6.1%

14.6%

10.4%

13.0%

1,413

Grain

Groceries

Mineral / Fuel

Chemicals

Plastics

Textile

Base metals

Machineries

Automobile

Others

Total - mil. US$

YOY

Growth

77.8%

53.1%

22.0%

13.1%

33.2%

35.8%

45.0%

51.9%

43.7%

97.9%

46.5%

Source:Nomura Research Institute, from KOTRA statistics

17

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

2000

1999

1998

1997

1996

1995

1994

1993

1992

1991

1990

0

June) that in negotiations with North Korea the HEC Group has indicated that it is

prepared to pay roughly half of the amount on which it is in arrears (i.e., $40 million) in exchange for being allowed land access to Mt. Kumgang and a reduction in

its franchise payments by linking them to the number of tourists using the resort.

This reflects the realization by North Korea that its economic stability depends

largely on capital inflows from South Korea and that it needs to ensure that payments by the Hyundai Group and by the South Korean government as part of its

assistance program continue.

Reemergence of food problem

Among North Korea’s economic risks, food problem is attracting most attention

at the moment. The Korean Peninsula is suffering from the severest drought in 90

years, and rainfall between March and the middle of June was only 10% to 20% of

the average for that time of the year. As North Korea’s main crop-growing area is in

the center of the peninsula (i.e., the south of the country), where the drought is

worst, and irrigation is inadequate, the rice-planting season appears to have been

quite seriously affected. As a result, the 2001 harvest is almost certain to be a failure, although much will depend on the weather between now and then. Another

cause of concern is the effect of the drought on North Korea’s electricity supplies as

the country depends on hydroelectric power for 59.8% of its needs (as of 1994).

North Korea is suffering from a chronic food shortage, but the situation is likely

to become even worse following two bad harvests in a row (this year and last). So far,

only 300,000-400,000 tons of food assistance (i.e., the amount left over from the

1999-2000 crop year) has been pledged for the 2000-2001 crop year, and the UN Food

and Agricultural Organization estimates that 300,000 tons is urgently needed already. As this year’s failed harvest will affect the amount of food needed in the 20012002 crop year, North Korea is unlikely to be able to make ends meet without a large

increase in imports even if domestic demand is controlled (e.g., by rationing), and

much of this will probably have to be provided in the form of assistance.

North Korea's food supply

1997/98

Domestic Demand(A)

4,130

Food

3,730

Seed/Feed

400

(Unit : 1,000t)

1998/99 1999/2000

4,835

4,765

3,925

3,814

910

951

2000/01

4,785

3,871

914

Domestic Supply (B)

2,160

3,481

3,472

2,920

Shortage (B-A)

1,970

1,354

1,293

1,865

Import

1,970

1,000

970

1,354

300

1,054

1,293

300

300

993

300

Commercial

Aid

Notes:Food year starts November and ends October of next year. Therefore, for food year

2000/01, supply came from calendar year 2000 harvest while consumption is mainly made

in 2001.

Source:Nomura Research Institute, from FAO statistics

18

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

North Korea’s food shortage is therefore likely to become even more chronic, but

the risk to the South Korean economy is limited, provided the countries and international agencies involved take appropriate action. North Korea’s diplomatic relations

are also better than they were when President Bush took office. One example of this

is the reopening of talks with the United States (on 13 June). However, given the

nature of North Korean politics, it is doubtful whether even a serious food shortage

would make North Korea much more willing to compromise over foreign policy. If a

food shortage threatened its economy once again, North Korea might very well prove

uncooperative and try to put the blame on those countries involved in the KEDO

project (to build a light-water nuclear power station in North Korea) by saying that

they were responsible for the delays in the construction causing economic catastrophes.

Meanwhile, the domestic political situation in South Korea is becoming increasingly unclear as next year’s presidential election approaches. President Kim Daejung has tried to take the credit for the improvement in relations with the North

(e.g., last year’s Inter-Korean Summit); but the recent cooling in relations between

the two countries, the economic slowdown at home and the fact that his term in

office ends next year have taken some of the shine off his reputation. Recently, there

have even been calls from within the government party for reform of the party’s

structure.

A worsening of the economic situation in North Korea and of the country’s foreign

relations could therefore (if combined with domestic factors in South Korea) undermine political and economic stability in the South, depending on how the North

chooses to deal with other countries. To that extent, the North’s food shortage should

be regarded as a risk factor.

Hiroyuki Nakai

19

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

Taiwan:Gathering the pace of slow down

Taiwan is currently facing a serious slowdown in both external and domestic

demand. The slowdown in exports is becoming increasingly clear as the US economy

slows and the electronics sector stagnates. During the second quarter of 2001, the

slowdown in both the electronics and non-electronics sectors has accelerated. With

little prospect of short-term recovery in demand for electronic goods and with

demand forecasts still being lowered in some areas, there still remains a downside

risk.

Taiwan: Summary table of forecasts

1999

Real GDP (YoY, %)

Private Consumption

Govt. Consumption

Fixed Capital Formation

(Private Facility Investment)

Stock (Contribution)

Export

Import

CPI (YoY, %)

Current A/C Balance (bil. US$)

(to GDP, %)

Unemployment (%)

3 mths. CP Rate (%)

NT$ / US$

2000

5.4

5.4

-6.5

1.8

-0.7

-0.9

11.9

4.4

0.2

8.4

2.9

2.9

4.9

32.3

6.0

5.5

1.9

7.7

13.7

-1.1

17.3

14.9

1.3

8.9

2.9

3.0

4.9

31.2

2001

(F)

2.8

2.1

-2.3

-3.1

-8.1

0.5

-7.0

-11.5

0.2

11.6

3.9

4.2

4.2

33.8

2002

(F)

4.1

3.8

1.6

2.2

2.5

0.0

5.1

3.3

0.5

11.1

3.8

4.2

3.9

34.5

Source: Department of Statistics, Nomura Research Institute

Export falls down

YoY(%)

40

Contribution by Electronics

Contribution by Others

Export Total

30

20

10

0

-10

-20

Note:US$ nominal base

Source:Nomura Research Institute, from official statistics

20

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

May-01

Apr-01

Mar-01

Feb-01

Jan-01

Dec-00

Nov-00

Oct-00

Sep-00

Aug-00

Jul-00

-30

Domestic demand is even weaker. Sluggish overseas demand and a credit crunch

at home have led to a rapid deterioration in the outlook for so-called “traditional”

industries in Taiwan. This has been the main cause of unemployment. In addition,

export industries (such as electronics) that have been the pillars of the Taiwanese

economic growth are now experiencing negative wage growth. As a result of these

factors, private consumption growth in the first quarter of 2001 stood at 2.0% year

on year, which is much weaker than we had been forecasting and the lowest in

current statistics series. We are therefore lowering our forecast of real GDP growth

for 2001 to 2.8%. (This compares with 4.6% previously, allowing for a 0.5% contribution from fiscal stimulus.) We have revised down the contribution from virtually

all GDP components, but especially that of private consumption and exports. We

have also lowered our forecast of public demand to reflect the low level of budget

expenditure in the first quarter, even though the Legislative Yuan has passed a

supplementary budget designed to boost the economy. Similarly, we have lowered

our forecast of real GDP growth for 2002 to 4.1% (compared with 5.3% previously) to

reflect the fact that the weakness in domestic demand is likely to continue for some

time.

Inflation, the currency and monetary policy

We have lowered our forecast of consumer price inflation for 2001 to 0.2% (compared with 1.2% previously) to reflect the fact that the deflationary impact of weak

domestic demand is likely to offset the inflationary impact of a stubbornly high oil

price and a weaker currency. As far as the currency is concerned, we expect the

Central Bank of China would allow the Taiwanese dollar to depreciate gradually in

order to boost corporate earnings in nominal terms and ease some of the deflationary

pressure in the economy. We also expect monetary policy to be eased in line with the

accommodative stance adopted by the US Federal Reserve.

US - Taiwan interest rate gap and NT$ rate

12.0

34.5

Official Discount Rate

US FF Rate - Taiwan O/N call Rate (L)

NT$ / US$ (R)

10.0

34

8.0

33.5

%

6.0

33

4.0

32.5

2.0

32

0.0

31.5

Source:Nomura Research Institute, from Bloomberg data

21

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

Jun-01

May-01

Apr-01

Mar-01

Feb-01

Jan-01

Dec-00

Nov-00

31

Oct-00

-2.0

However, boost effect to the real economy from a weaker currency and an accommodative monetary policy is likely to be limited. Since Taiwan is such a big player in

the global electronics industry , a weaker currency is unlikely to provide increase of

export volumes. Also, the banking sector’s mountaining non-performing loans suggest that, in spite of the government’s initiative to increase banks’ lending, it is

unlikely to induce them to oblige.

Incomes and employment as a constraint on consumer spending

Consumer spending growth in Taiwan is currently at a historical low. In the

following we shall examine the factors behind this in terms of incomes and employment. We shall consider these factors in terms of whether an industry is, relatively

speaking, in a good shape (e.g., electronics), a neutral situation (especially services)

or in a recession (e.g., traditional industries such as construction and light engineering).

First, employment. Employment is either growing more slowly or actually declining in all sectors of the economy for cyclical reasons, but especially in those that are

in a recession. During the last economic slowdown (1998-1999), employment in those

industries reached a trough of -4.2% year on year (in the fourth quarter of 1998).

During the current slowdown, however, this level has been exceeded in the first

quarter of 2001 (-4.8%). The same applies to industries in a neutral situation. The

trough in employment reached during the previous slowdown (-0.9%) has also been

exceeded during the first quarter of 2001 (-1.6%). Moreover, the fact that 57% of the

workforce is employed in such neutral industries is also probably one of the reasons

why unemployment this time is worse than it was in last time.

Employment growth, classified by business sentiment of each industry

(YoY, %)

6

Recession

Moderate

Good

4

2

0

-2

-4

Source:Nomura Research Institute, from official statistics

22

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

01/1Q

00/4Q

00/3Q

00/2Q

00/1Q

99/4Q

99/3Q

99/2Q

99/1Q

98/4Q

98/3Q

98/2Q

98/1Q

97/4Q

97/3Q

97/2Q

97/1Q

-6

For incomes are concerned, the biggest declines have been in those industries

that are in a good shape (e.g., electronics). The fact that some of wages are paid in

the form of stock distribution would suggest that the actual percentage decline in

income has been even bigger as a result of the recent stock market correction.

As a result,there is a considerable risk of losing one’s job if one works in an

industry in recession or neutral situation, while the biggest declines in income are

shown in industries with relatively good shape. This would suggest that employees

in most sectors, regardless of where those sectors are positioned, are under pressure

to reduce consumption. Although we have consistently pointed out the risk to private consumption from weak business in Taiwan’s traditional industries and a slump

in its electronics industry, the actual effect has been much greater than we expected.

Effect of unstable political situation on the economy

Taiwan’s unstable political situation has also had a negative impact on the economy

in terms of both confidence and actual growth. Public demand was a major negative

contributor (-1.4%) to year-on-year economic growth in the first quarter of 2001,

even though the government was aware of the need for fiscal stimulus. This would

appear to have been the result not only of the fact that spending on reconstruction

work following the September 1999 earthquake has nearly finished, but also of the

fact that the confrontation between the government and the opposition over the

construction of a new nuclear power station have resulted in the budget for fiscal

2001 not being passed until earlier this year. In particular, the 2001 budget is the

first based on a calendar year (previous fiscal years ran from July to the following

June), and delay in passing the budget left little time to plan its implementation

and exacerbated the confusion caused by the change.

Salary growth of employees, classified by business sentiment of

each industry

(YoY, %)

12

Recession

Moderate

Good

10

8

6

4

2

0

-2

-4

-6

-8

Source:Nomura Research Institute, from official statistics

23

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

01/1Q

00/4Q

00/3Q

00/2Q

00/1Q

99/4Q

99/3Q

99/2Q

99/1Q

98/4Q

98/3Q

98/2Q

98/1Q

97/4Q

97/3Q

97/2Q

97/1Q

-10

Confrontations between the government and the opposition brought the Legislative Yuan session to be expired on 7 June with a number of important bills pending.

This has had a negative effect on the real economy. Total amount of fiscal stimulus

proposed by the government in its supplementary budget bill (NT$80.0 billion) was

cut to NT$61.6 billion, and a number of conditions were attached that may further

reduce the amount that would be actually spent. Moreover, all the financial legislation before the Legislative Yuan (e.g., the Financial Holding Company Law and the

Financial Reconstruction Fund Law) had to be shelved.

Although some of financial legislations were passed in the special session at June

end , the next parliamentary election is to be held at the beginning of December,

and there is little prospect of relations between the two sides improving. The political situation has also become confused, since former president Lee Teng-hui has

resumed his political activities after returning from a visit to Japan in April, and

appears to be aiming to realign the political forces in Taiwan by seeking a rapprochement with President Chen Shui-bian.

There is therefore a risk that little progress will be made in the debate on the

remaining financial legislation and other bills related to the economy in next Legislative Yuan session. The process may have to be initiated again when parliament

with new representatives opens after the December election. This unfortunately

means that the current unstable political situation in Taiwan is likely to delay the

process of economic recovery.

Hiroyuki Nakai

Status of bills on economic matters, presented to Legislative Yuan

session ended on June 7

Passed in normal session ended June 7

○

○

○

Additional budget for compensation to 4th Nuclear Power

Plant contractors

Request to Control Yuan to clarify the responsibility of

Prime Minister and Minister of Economic Affairs on 4th

Nuclear Power Plant matters

Budget for fiscal stimulation (Deducted to NT$ 61.6 bln.

from original NT$ 80.0bln., with some additional conditions)

Passed in special session ended June 27

○ Financial Holding Company Act

○

Financial Restructuring Fund Act (Fund for buying Nonperforming Loans from local financial institutions)

○ Amendment for Business Tax Law

○ Amendment for Central Deposit Insurance Corporation Act

Expected to be passed in next session

○

Organization law for Financial Supervisory Commission

(Integration of supervisory functions from Central Bank,

MOF, Securities and Futures Commission)

Source:Nomura Research Institute, from media reports

24

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

Hong Kong:Growth Forecasts lowered

First-quarter growth drops to 2.5%

The slowdown in the Hong Kong economy has become more marked. In the first

quarter of this year real GDP grew by only 2.5% year on year—significantly less

than the 6.9% recorded in the fourth quarter of last year. Although domestic demand has held up quite well, a sharp slowdown in export growth has led to a lower

rate of economic growth.

Hong Kong: Summary table of forecasts

Real GDP

(Contribution of domestic demands)

Private consumption

Government consumption

Gross domestic fixed capital formation

Machinery and equipment

Construction etc. *

Changes in inventories (contribution to GDP)

(Contribution of external demands)

Exports

Imports

Trade balance(US$ billion )

Trade and invisible trade balance (US$ billion )

(as of GDP, %)

Composite CPI

3-month interbank interest rate (period-average, %)

Best lending rate (period-average, %)

98

99

2000

-5.3

(-10.3)

-7.4

0.8

-7.6

-8.2

-6.8

-3.1

(5.0)

-4.0

-6.3

-10.9

-0.3

-0.2

2.8

8.43

9.94

3.1

(-5.1)

0.7

3.3

-17.5

-19.4

-15.3

0.5

(8.1)

3.9

-0.2

-6.0

8.5

5.4

-4.0

5.97

8.50

10.5

(9.3)

5.4

2.1

9.8

25.8

-7.3

3.2

(1.2)

16.7

16.7

-11.4

7.7

4.7

-3.7

6.25

9.22

2001

(F)

3.5

(2.9)

2.6

2.5

8.3

11.6

3.6

-1.1

(0.7)

4.8

4.6

-13.4

7.5

4.5

-0.4

3.91

7.24

(

YOY,%)

2002

(F)

4.8

(3.6)

3.1

2.5

5.4

6.5

3.8

0.1

(1.2)

5.6

5.3

-14.0

8.2

4.5

1.7

3.50

6.75

Note: * including real estate developer's margin, and transfer costs of land and buildings.

Source: Nomura Research Institute, from Hong Kong Census and Statistics Department.

Contribution to real GDP growth

(

YOY,%)

15

10

5

0

-5

Net exports

Change in stocks

Gross fixed capital formation

Government consumption

Private consumption

Real GDP

-10

-15

-20

96

97

98

99

2000

2001

Source: Nomura Research Institute, from Hong Kong Census and Statistics Department.

25

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

On the domestic demand front, consumer and business confidence (as reflected in

consumer spending and private construction investment) has improved as a result

of (1) the three interest rate cuts in the first quarter that took real interest rates

from 11.3% in December to 9.3% in March and (2) measures to boost the property

market (e.g., the government’s decision to reduce the amount of land it releases for

development and to ease some of the restrictions on property speculation). Private

capital investment also grew strongly (by 22.5% year on year) in the first quarter as

a result of strong productivity enhancement demand and the interest rate cuts.

However, there have been no more big inventory increases of the kind seen last year,

and inventories contributed -1.8% to economic growth in the first quarter.

In contrast to domestic demand, the contribution from external demand in the

first quarter was negative (-1.5%)—the first time this has happened since the fourth

quarter of 1997. This reflects (1) the fact that Hong Kong’s re-exports have grown

more slowly as China’s export growth has slowed and (2) the fact that domestic

export growth has declined by 12.8% as a result of slower growth in export markets

and the increase in the effective rate of the Hong Kong dollar that has occurred since

the second half of last year.

Slower export growth

One of the key factor determining the outlook for the Hong Kong economy is the

state of world economy. With world economic growth (especially in the United States)

expected to slow and prices for semiconductors and IT goods and components expected to decline, demand for re-exports from Hong Kong, which account for some

90% of the total exports, is expected to continue to weaken. Most of these re-exports

(61% as of 2000) originate in China and are destined for third countries and regions.

Re-export by country of origin

YOY,%)

(

35

China

25

Japan

Taiwan

15

5

-5

-15

Apr-01

Jan-01

Oct-00

Jul-00

Apr-00

Jan-00

Oct-99

Jul-99

Apr-99

Jan-99

Oct-98

Jul-98

Apr-98

Jan-98

Oct-97

Jul-97

Apr-97

Jan-97

-25

Source: Nomura Research Institute, from Hong Kong Census and Statistics Department.

26

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

The second and third major sources of Hong Kong’s re-exports are Japan and Taiwan (with shares of 9.9% and 6.3%, respectively). Whereas China’s main destination for re-exports is the United States, the main destination for re-exports originating in Japan and Taiwan is China. This is because China imports capital goods from

Japan and Taiwan via Hong Kong, then processes and assembles them as finished

goods, which it exports to the United States—also via Hong Kong. As Taiwanese

electronic companies have accelerated to shift their production base to southern

China since the late 1990’s, Taiwan’s exports to China via Hong Kong have soared.

However, reflecting the decline in prices for semiconductors and IT goods and components from last year, re-exports from Taiwan sharply down by a year-on-year

8.3% in the first quarter of this year.

Domestic exports have also grown more slowly as a result not only of weaker

growth in export markets but also of the high effective rate of the Hong Kong dollar,

which is pegged to the US dollar.

Poor prospects for a recovery in property prices

Another important factor in determining the outlook for the Hong Kong economy

is asset (and especially property) prices, as these are a major determinant of consumer spending and private construction investment. Although there was a brief

pick-up in property transactions in February-March after the rate cut and the

government’s measures to stimulate the property market, this was offset by a sharp

correction in the stock market, which depressed any bullishness among potential

property purchasers as well as sharply reducing liquidity. The problem of “negative

equity” in the residential flats market remains unsolved. In addition, the recent

increase in the number of people purchasing residential property in neighboring

Shenzhen has only delayed any improvement in the balance of demand and supply

in Hong Kong’s own residential property market. There is therefore still no sign of a

sustained recovery in the Hong Kong property market.

Effective exchange rate index for HK dollar

(Nov83=100)

145

140

135

130

125

120

Mar-01

Sep-00

Mar-00

Sep-99

Mar-99

Sep-98

Mar-98

Sep-97

Mar-97

Sep-96

Mar-96

Sep-95

Mar-95

115

Source: Nomura Research Institute, from Hong Kong Census and Statistics Department.

27

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

Nevertheless, there is little risk of a collapse in property prices. First, residential

property prices are already about half of their 1997 peak level. Second, there is room

for a further cut in interest rates in the second half of this year. Third, property

developers have been offering incentives to buyers (e.g., zero deposits).

Property prices

1989=100 )

(

450

400

Residential Flats

Offices

350

300

250

200

150

100

50

90

91

92

93

94

95

96

97

98

99

00

01

Source: Nomura Research Institute, from Hong Kong Census and Statistics

Real interest rate is declining

(%)

11

US Prime rate

HK Prime rate

10

9

8

(%)

16

14

12

10

8

6

4

2

0

97

7

Real interest rate

98

99

00

01

Note: Real interest rate = HK Prime rate - CPI

Source: Nomura Research Institute, from Hong Kong Census and Statistics Department.

28

Copyright (C) 2001 Nomura Research Institute, Ltd. All rights reserved. No reproduction or republication without written permission.

Forecasts for 2001 and 2002 lowered

Given unfavorable factors both at home and abroad, we expect Hong Kong’s

economy to continue to slow until the middle of 2001, but to pick up in the second

half. This recovery is likely to be driven partly by an economic recovery in the

United States and partly by an increase in the number of tourists, following the

decision by China’s State Tourism Bureau to raise its daily limit on the number of

tourists from the mainland from 1,500 to 2,000 from September 2001. This is expected to provide a not insignificant boost to Hong Kong’s economy as tourists from

the mainland account for 30% of Hong Kong’s revenues from tourism.

We have lowered our forecast of real GDP growth for 2001 from 4.6% to 3.5% to

reflect the unexpectedly sharp slowdown in the economy, but are leaving our forecast for 2001 unchanged at 4.8%. However, we are lowering our forecast of Hong

Kong’s current account balance for both 2001 and 2002 from a surplus of $8.8 billion

to $7.5 billion for 2001 and from $9.1 billion to $8.2 billion for 2002.