The Dynamics of Contract Evolution

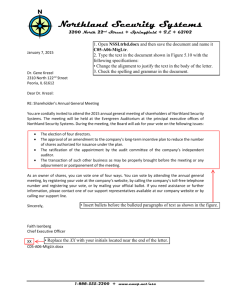

advertisement