2010 spillback distributions for Natixis Funds

advertisement

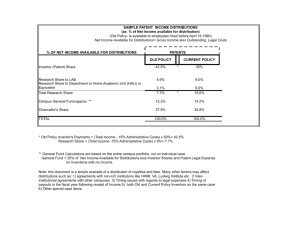

2010 spillback distributions for Natixis Funds Each year, in addition to year-end distributions, some Natixis Funds may be subject to an additional distribution, commonly referred to as a spillback. Spillback distributions are distributions of ordinary income and/or capital gains from the previous fiscal year that were not distributed by the end of that year. Spillback distributions are normal practice for mutual funds with fiscal years ending December 31. View answers to frequently asked questions below. Natixis Funds paid 2010 spillback distributions in April. The bulk of 2010 ordinary income and capital gains were paid in December 2010. Which funds had spillback distributions? See the table below for distribution amounts on a per-share basis: • Record date: 4/11/11 • Ex-dividend date: 4/12/11 • Pay date: 4/12/11 Natixis Funds spillback Distributions Fund Name Ordinary Short-term Long-term Total $0.0019 – – $0.0019 ASG Global Alternatives Fund – Class A, C & Y – $0.0237 $0.0382 $0.0619 Hansberger International Fund – Class A, B & C $0.0117 – – $0.0117 Harris Associates Large Cap Value Fund – Class A, B, C & Y $0.0039 – – $0.0039 N/A $0.0001 $0.0001 $0.0002 ASG Diversifying Strategies Fund – Class A, C & Y Loomis Sayles Absolute Strategies Fund – Class A, C & Y Loomis Sayles Multi-Asset Real Return Fund – Class A, C & Y Natixis Oakmark International Fund – Class A & C Vaughan Nelson Small Cap Value Fund – Class A, B, C & Y Westpeak ActiveBeta Equity Fund – Class A, C & Y 1 – $0.0197 $0.0066 $0.0263 $0.0002 $0.0001 – $0.0003 – $0.2111 $0.6776 $0.8887 $0.0025 $0.0800 $0.0025 $0.0850 1 Any ordinary income spillback distributions for this fund would have been paid out on the March 24, 2011 Ex-Date. u This material must be preceded or accompanied by a prospectus. For current performance, other product information, or to obtain a prospectus, please visit our website at ga.natixis.com, or call 800-225-5478. 2010 spillback distributions for Natixis Funds Q&A (continued) What are spillback distributions? How will shareholders be notified? • Spillback distributions represent ordinary • Shareholders who take distributions in How will it appear on the quarterly statement? income and/or capital gains from the cash will receive checks along with a On the Fund Transaction Detail section, previous fiscal year that were not brief explanatory insert shortly after the detail of each fund transaction will be distributed by the end of that year – payable date. shown as follows: in this case, December 31, 2010. • Shareholders who reinvest distributions What are capital gains distributions? will receive a confirmation of the • A capital gain is the increase in value reinvestment on their normal quarterly statements. of an investment above the original purchase price or basis of the investment. • Distributions of capital gains are taxable to shareholders in taxable (mainly non- When did the Funds pay these distributions? • See the record, ex-dividend and pay dates above. retirement) accounts. • Capital gains are classified as either short- or long-term: What effect do these distributions have on a fund’s share price? – Short-term capital gains are gains • When the distribution is paid, the realized from the disposition of fund’s net asset value per share (NAV) investments held for less than one is reduced by the amount of the year, and are currently taxed at distribution. For example, if a fund’s ordinary income rates. NAV is $5 and the fund pays a $1 – Long-term capital gains are gains distribution, the fund’s NAV would drop realized from the disposition of to $4, assuming there was no other investments held for more than one market activity affecting the share year, and are currently taxed at a price. Shareholders who reinvest their maximum rate of 15%. distributions would receive additional – Taxes on distributions of capital gains are determined by how long a fund held the investments that generated them, rather than how long a shareholder has owned his or her shares. •Shrtterm CG Rein or Shrtterm CG Cash •Cap Gain Reinvest or Cap Gain Cash •Income Reinvest or Income Div Cash In addition, a shareholder’s quarterly statement will contain a message explaining the transaction. What other information should you know about tax-year 2011 distributions? •Spillback distributions are taxable in 2011, even though they represent ordinary income and/or capital gains earned by the funds in 2010. •Spillback distributions will be reported to shareholders on Form 1099-DIV, which will mail to shareholders in January 2012 (February 2012 for AEW Real Estate Fund and Natixis Income Diversified Portfolio Fund). •Fund distributions are taxable currently fund shares equal to the amount of whether shareholders receive them in the distribution. As a result, the cash or reinvest in additional fund shares, shareholder’s total account value unless fund shares are held in a tax- would remain the same. advantaged account. •Shareholders should consult their tax advisor regarding the necessary filings with the IRS. u Before investing, consider the fund’s investment objectives, risk, charges, and expenses. Visit ga.natixis.com or call 800-225-5478 for a prospectus or a summary prospectus containing this and other information. Read it carefully. The mutual funds referred to in this material are offered and sold only to persons who are eligible to purchase U.S. registered investment funds and are offered by prospectus only. Not FDIC Insured • May Lose Value • No Bank Guarantee Natixis Distributors, L.P. (fund distributor) is located at 399 Boylston Street, Boston, MA 02116. 800-862-4863 • ga.natixis.com 303395 SBD10-SH-0411