market_update_office_2014_mid year_LFB_Layout 1

advertisement

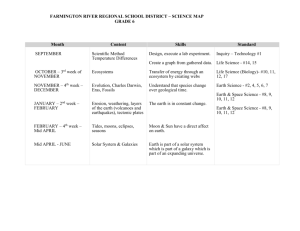

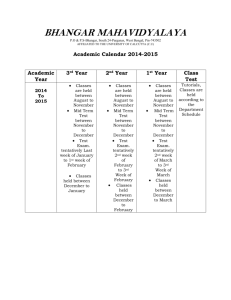

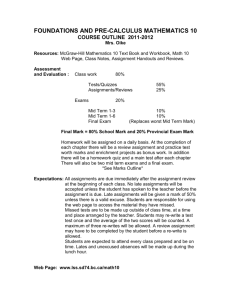

OFFICE MARKET UPDATE ATLANTA OFFICE MARKET :: MID YEAR 2014 MARKET INDICATORS INVENTORY 210,348,158 SF OVERALL VACANCY 16.9% ABSORPTION * 2,227,958 SF CONSTRUCTION 776,642 SF DELIVERIES * 177,000 SF OVERALL DIRECT AVG. LEASE RATE $19.62 MARKET HIGHLIGHTS Leasing activity continues to propel the Metropolitan Atlanta Office Market in 2014. Our region registered almost 2.3 million SF of positive absorption for the first six months of the year, making the thirteenth straight quarter of net leasing gains. Our research indicates corporate expansions are driving this occupancy momentum; in part a reflection of the recovering economy and ramped up hiring practices. While relocations such as PulteGroup and growth from Airwatch, Fiserv and State Farm make headlines, as illustrated herein many firms are expanding and pushing absorption levels past expectations. Our firm has recognized the leasing velocity trends moving northward on Peachtree/GA 400 starting in 2011 (Midtown), 2012 (Buckhead), 2013 (Central Perimeter), now reaching North Fulton this year. Fiserv’s (376,300 SF) and Kimberly Clark’s (187,700 SF) lease committents at Cobalt Center and 5405 Windward Parkway respectively illustrate this point and we project more significant announcements during the next six months. Does this momentum suggest we will see new construction in these submarkets? There is plenty of chatter on this subject but no starts announced at the time of this report. Institutional interest in Atlanta is back, with investors eager to add metropolitan assets to their portfolio. While the region has seen fewer offerings hit the market during the first half of 2014, a number of significant transactions occurred. Notable trades include Centrum at Glenridge ($152.93/SF), One Live Oak ($113.06/SF), Northlake Office Park ($39.92/SF), Gwinnett Center ($59.88/SF), and 730 Peachtree ($90.27/SF). These transactions represent value play opportunities, serveral in submarkets which have not seen material absorption gains over the past three years. On a smaller scale there have been twelve owner occupant purchases over the past six months continuing a trend that generally benefits our markets region-wide. METRO ATLANTA REPRESENTATIVE SALES ACTIVITY INVESTMENT SALES OWNER/USER SALES Centrum at Glenridge 186,360 SF $152.93/SF Purchased by Origin Capital Partners on 02/24/14 6375 Hospital Parkway 101,991 SF Purchased by Ebix, Inc. on 06/13/14 One Live Oak Center 201,400 SF $113.06/SF Purchased by Highbrook Investment on 01/03/14 1975 West Oak Circle 60,000 SF $112.00/SF Purchased by Vanderlande Industries on 06/25/14 730 Peachtree Street 213,041 SF $90.27/SF Purchased by Harbert Management on 01/10/14 5519 Spalding Drive 50,000 SF $84.50/SF Purchased by United Arab Shipping on 03/27/14 * Figures reflected throughout this report for ABSORPTION and DELIVERIES are cumulative for mid-year and year end as appropriate. $122.56/SF Lavista Associates, Inc. - Atlanta, Georgia ATLANTA OFFICE MARKET :: MID-YEAR 2014 KEY METRO ATLANTA SUBMARKETS BUCKHEAD CATEGORY VACANT SF CURRENT QTR 3,023,456 SF UNDER CONSTRUCTION 125,000 RENTAL RATE $24.66 ABSORPTION SF 315,431 DELIVERIES 0 PREVIOUS TIME PERIODS CHANGE Year End 2013 3,338,887 ‐9.45% Mid‐Year 2013 3,805,894 ‐20.56% Year End 2013 125,000 0 Mid‐Year 2013 125,000 0 Year End 2013 $24.39 +$0.27 Mid‐Year 2013 $23.87 +$0.79 Year End 2013 467,007 (151,576) Mid‐Year 2013 118,286 197,145 Year End 2013 0 0 Mid‐Year 2013 47,500 (47,500) . Robust leasing activity continues in Buckhead as it posted 315,431 SF of absorption in the first half of 2014. . As of second quarter, the vacancy rate dropped to 14.8%; down 8.3% in three years. . With few developments under construction (already preleased) rental rates will continue to climb. ACTIVITY: Blue Cross Blue Shield of Georgia expanded to 228,400 SF at One Capital City Plaza; CoStar Group expanded into 43,800 SF at Phipps Tower; PulteGroup relocated into 108,000 SF at One Capital City Plaza as well. CENTRAL PERIMETER . Atlanta’s most active submarket registered 685,456 SF of net absorption in the first six months of 2014. CATEGORY . Central Perimeter’s vacancy rate dropped to 15.1%; down from 24.2% three years ago. . KDC has started construction of Phase I of State Farm’s regional headquarters, the only development in this submarket currently. ACTIVITY: CH2M Hill Companies relocated into 97,400 SF at Embassy Row; First Data continues to expand (194,000 SF) at Glendridge Highlands II; Hughes Telematics has expanded into 116,000 SF at 2002 Perimeter Summit. CURRENT QTR VACANT SF 4,386,507 SF UNDER CONSTRUCTION 0 RENTAL RATE $21.50 ABSORPTION SF 685,456 DELIVERIES 0 PREVIOUS TIME PERIODS CHANGE Year End 2013 5,071,963 ‐13.51% Mid‐Year 2013 5,710,105 ‐23.18% Year End 2013 0 0 Mid‐Year 2013 0 0 Year End 2013 $21.02 +$.048 Mid‐Year 2013 $20.76 +$0.74 Year End 2013 597,142 88,314 Mid‐Year 2013 623,286 62,170 Year End 2013 0 0 Mid‐Year 2013 0 0 DOWNTOWN CATEGORY CURRENT QTR VACANT SF 4,212,928 SF UNDER CONSTRUCTION 0 RENTAL RATE $17.78 ABSORPTION SF 244,728 DELIVERIES 0 PREVIOUS TIME PERIODS CHANGE Year End 2013 4,457,656 ‐5.49% Mid‐Year 2013 4,851,759 ‐13.17% Year End 2013 0 0 Mid‐Year 2013 0 0 Year End 2013 $18.54 ‐$0.76 Mid‐Year 2013 $18.40 ‐$0.62 Year End 2013 394,103 (149,375) Mid‐Year 2013 13,679 231,049 Year End 2013 0 0 Mid‐Year 2013 0 0 Lavista Associates, Inc. - Atlanta, Georgia . Downtown Atlanta’s leasing improvement is evidenced by the 244,728 SF of absorption through mid-year. . Accordingly, vacancy rates continue to drop and reached 16.0% through the first six months of 2014. . Given the 4+ million square feet still available, rental rate increases will be difficult for this submarket to achieve. ACTIVITY: Office of the Public Defender leased 48,000 SF at 100 Peachtree Street; Coca-Cola Company completed its relocation into 275,800 SF at SunTrust Plaza Garden Offices; Habitat for Humanity expanded at 270 Peachtree Street by 8,200 SF. ATLANTA OFFICE MARKET :: MID-YEAR 2014 KEY METRO ATLANTA SUBMARKETS MIDTOWN . Midtown’s net absorption through mid-year 2014 totaled 333,850 SF; it’s best six month period in two years. . This submarket’s vacancy rate continues to drop (notice a theme here), ending the first two quarters at 16.0%. . With Ponce City Market opening, no new office development is planned at this point. ACTIVITY: Swift, Currie, McGhee & Hiers, LLP has expanded to 106,900 SF at 1355 Peachtree Street; Purchasing Power leased 46,200 SF at Two Midtown Plaza; Athenahealth & Cardlytics began relocating to Ponce City Market. NORTH FULTON CATEGORY VACANT SF CURRENT QTR 4,214,259 SF UNDER CONSTRUCTION 109,958 RENTAL RATE $19.00 ABSORPTION SF 275,233 DELIVERIES 100,000 PREVIOUS TIME PERIODS CHANGE Year End 2013 4,389,492 ‐3.99% Mid‐Year 2013 4,558,651 ‐7.55% Year End 2013 209,958 (100,000) Mid‐Year 2013 209,958 (100,000) Year End 2013 $18.69 +$0.31 Mid‐Year 2013 $18.40 +$0.60 Year End 2013 169,159 106,074 Mid‐Year 2013 68,639 206,594 Year End 2013 0 100,000 Mid‐Year 2013 0 100,000 . Northeast Atlanta posted disappointing performance numbers at mid-year with negative (73,042) SF of absorption. . This submarket’s vacancy rate is 22.8%, virtually unchanged for four years. . Despite no new speculative development, the 5+ million SF of vacant space will challenge any improvements, especially in Peachtree Corners. ACTIVITY: Career Builder expanded into 98,500 SF at The Summit; Encompass Insurance renewed in 20,600 SF at Sugarloaf Office III; United Arab Shipping purchased 50,000 SF at 5515 Spalding Drive. * Figures reflected throughout this report for ABSORPTION and DELIVERIES are cumulative for mid-year and year end as appropriate. CATEGORY VACANT SF CURRENT QTR 3,257,909 SF UNDER CONSTRUCTION 487,034 RENTAL RATE $23.84 ABSORPTION SF 333,850 DELIVERIES 0 PREVIOUS TIME PERIODS CHANGE Year End 2013 3,591,759 ‐9.29% Mid‐Year 2013 3,747,075 ‐13.05% Year End 2013 487,034 0 Mid‐Year 2013 487,034 0 Year End 2013 $24.65 ‐$0.81 Mid‐Year 2013 $25.32 ‐$1.48 Year End 2013 155,316 178,534 Mid‐Year 2013 (11,336) 345,186 Year End 2013 0 0 Mid‐Year 2013 0 0 . As projected, North Fulton’s time has arrived as evidenced by the 275,233 SF of net absorption posted for the first half of 2014. . The second quarter 2014 marked the fourth consecutive period the vacancy rate has dropped . Despite two significant recent commitments, North Fulton still offers three alternatives with over 100,000 SF contiguous availabilities. ACTIVITY: McKesson Corporation leased 34,000 SF at Royal Center Three; Kimberly Clark committed to 187,700 SF at 5405 Windward Parkway; Fiserv, Inc. executed a lease for 376,300 SF at 2900 and 2950 Westside Parkway. NORTHEAST CATEGORY CURRENT QTR VACANT SF 5,060,996 SF UNDER CONSTRUCTION 0 RENTAL RATE $16.52 ABSORPTION SF (73,042) DELIVERIES 0 PREVIOUS TIME PERIODS CHANGE Year End 2013 4,987,954 +1.46% Mid‐Year 2013 4,990,775 +1.41% Year End 2013 0 0 Mid‐Year 2013 60,000 (60,000) Year End 2013 $16.33 +$0.19 Mid‐Year 2013 $16.34 +$0.18 Year End 2013 62,821 (135,863) Mid‐Year 2013 121,215 (194,257) Year End 2013 60,000 (60,000) Mid‐Year 2013 344,476 (344,476) Lavista Associates, Inc. - Atlanta, Georgia ATLANTA OFFICE MARKET :: MID-YEAR 2014 KEY METRO ATLANTA SUBMARKETS NORTHWEST CATEGORY CURRENT QTR VACANT SF 5,806,021 SF UNDER CONSTRUCTION 16,650 RENTAL RATE $19.24 ABSORPTION SF 72,689 DELIVERIES 0 PREVIOUS TIME PERIODS CHANGE Year End 2013 5,878,710 ‐1.24% Mid‐Year 2013 5,792,304 +0.24% Year End 2013 16,650 0 Mid‐Year 2013 116,650 (100,000) Year End 2013 $18.83 +$0.41 Mid‐Year 2013 $18.49 +$0.75 Year End 2013 13,594 59,095 Mid‐Year 2013 159,413 (86,724) Year End 2013 100,000 (100,000) Mid‐Year 2013 0 0 . The Northwest submarket continues to bounce around, posting 72,689 SF of absorption through June 2014. . This submarket’s vacancy rate remains virtually unchanged at 18.5%. . Atlanta’s largest submarket also offers the most available space (5.8 million SF), more than 1.5 million more than Central Perimeter. ACTIVITY: CP Kelko expanded again in Cumberland Center II, taking 68,300 SF; Sterling Risk Advisors relocated into 25,000 SF at 2500 Cumberland Parkway; N3,LLC committed to 24,400 SF at The Dupree Building. LAVISTA ASSOCIATES, INC. REPRESENTATIVE OFFICE TRANSACTIONS SALE TRANSACTIONS LEASE TRANSACTIONS . John Cape and Ed O’Connor represented the Seller in the sale of the Gates at Sugarloaf project in Suwanee. . Rob Binion represented Ignite Communications on their 20,000 SF lease renewal at 11145 Johns Creek Parkway in Johns Creek. . Representing the Seller, Don Perry brokered the sale of 4121 - 4181 Steve Reynolds Boulevard in Norcross. . Charlie Fiveash assisted Hotel Systems Pro with their 10,500 SF lease transaction at 280 Interstate North in Atlanta. . Rob Binion represented the Seller in the disposition of a 17,100 SF building at 882 North Main Street in Conyers. . Representing Booster Enterprises, Will Grogan brokered a 15,200 SF lease at Woodside Center in Alpharetta. Sources include: CoStar Office Report: Mid‐Year 2014 and Lavista Associates, Inc. No warranty or representation, expressed or implied, is made as to the accuracy of information contained herein. In consideration of the within information, all parties agree to rely solely on their right, and assume the duty to independently obtain and analyze all information. Lavista Associates, Inc. 3475 Piedmont Road, NE | Suite 1150 Atlanta, Georgia 30305 770.448.6400 www.lavista.com Lavista Associates, Inc. - Atlanta, Georgia 08.01.14

![20 Newsletter Term 2 Wk 5 2015 Week 21 [doc, 6 MB]](http://s3.studylib.net/store/data/008023078_1-d43f4e297d723ece5fe4fb96794f8419-300x300.png)