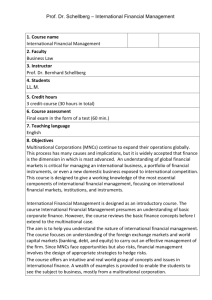

International Financial Management

advertisement

INTERNATIONAL FINANCIAL MANAGEMENT 1 International Financial Management Lecturer: Marie-Ann Betschinger Course description The course is a one-semester course for second-year students of the ICEF Master of Science program in financial economics. It is taught in English. The course provides an overview of international financial markets and the tools and concepts financial managers can use to address challenges arising in the international context such as the multiplicity of currencies, differences in costs of capital across the world, various tax jurisdictions, differences in accounting standards, and levels of investor protection. The first two parts of the course discuss the market for foreign exchange, the markets for forward contracts, and the international capital markets. The students will learn how to manage exchange risk exposure and gain insights into the global cost of capital, differences in capital structures, and various sources of global financing. The third part addresses the financial management of multinational enterprises with regard to international investment decisions and multinational operations. The emphasis is on the assessment of global operations, multinational capital budgeting, and the management of intra-corporate fund flows. Prerequisites Students are expected to be familiar with principles of corporate finance and basicstatistics and econometrics. Teaching objectives 1. To give an overview of current trends on international financial markets. 2. To familiarize the students with the challenges arising in the international context for financial managers. 3. To provide the students with tools and concepts to answer these challenges. 4. To prepare students for the ‘international sections’ of the Chartered Financial Analyst (CFA) and Certified International Investment Analyst CIIA exams. Career Focus: 2 IFM is intended for students who will be involved in cross-border investment and financing decisions ranging from large multinational firms to transaction advisors (investment bankers, commercial bankers, or consultants). Teaching methods The following methods and forms of study are used in the course: • lectures • written home assignments in form of case studies and exercises The course is taught during the summer semester of the second year of education at ICEF MSc program. The lectures are designed to help students to understand the main concepts of the course. A substantial part of the lectures is devoted to discussions of cases to enhance problem solving skills. The home assignments have two goals: They prepare the students for the exams, and they are used to monitor the students’ progress in the course. Grade determination The grade is based on the homework assignments results (20%), class participation (10%), the midterm test (20%) and a final examination (50%). Main reading • Eiteman, Stonehill and Moffett, Multinational Business Finance, AddisonWesley, 2007, 11th edition (ESM) • Bruno Solnik, Global Investments, Addision-Wesley, 2008, 6th Edition (SOL) Additional reading Further recommended literature is indicated for each topic. Course outline The Foreign Currency Environment & Exposure Management INTERNATIONAL FINANCIAL MANAGEMENT 3 1. The Foreign Currency Environment 1. Foreign Exchange Markets 2. Foreign Exchange Parity Relations 3. Foreign Exchange Rate Determination and Forecasting Required literature: ESM 4-6; SOL 1-3 Additional articles: • Bank for International Settlements (2007), “Triennial Central Bank Survey: Foreign Exchange and Derivatives Market Activity in 2007”. • Rogoff, Kenneth (1996): The Purchasing Power Parity Puzzle, Journal of Economic Literature, Vol. 34 (2), pp. 647-668. 2. Identifying, Measuring, and Hedging Currency Exposure 1. Transaction Exposure 2. Operating Exposure 3. Translation Exposure Required literature: ESM 7-10; SOL 10-11 Additional articles: • Nance, Deanna R., Clifford W. Smith Jr. and Charles W. Smithson (1993): On the Determinants of Corporate Hedging, • The Journal of Finance, Vol. 48 (1), pp. 267-284. International Capital Markets & Financing of the Global Firm 3. International Portfolio Diversification and the International Cost of Capital 1. Globalization of Capital Markets 2. International CAPM 3. Country differences in Capital Structures 4. Cost of Capital of Multinationals Required literature: ESM 11, 15; SOL 4, 9 Additional articles: 4 • Booth, Laurence, Varouj Aivazian, Asli Demirgüc-Kunt and Vojislav Maksimovic (2001): Capital Structures in Developing Countries, Journal of Finance, Vol. 56 (1); pp. 87-130. • Desai, M. A., F. C. Foley and J. R. J. Hines (2008). “Capital Structure with Risky Foreign Investment”. Journal of Financial Economis 88: 53453. • Kwok, Chuck C.Y and David M Reeb (2000): Internationalization and Firm Risk: An Upstream-Downstream Hypothesis, Journal of International Business Studies, Vol. 31 (4), pp.611-630. 4. Sourcing equity abroad 1. Cross-listings 2. Depository Receipts 3. Alternative instruments Required literature: ESM 12; SOL 5, 6 Additional articles: • Pagano, Marco, Ailsa A. Röell and Josef Zechner (2002): The Geography of Equity Listing: Why Do Companies List Abroad?, The Journal of Finance, Vol.57 (6); pp. 2651-2694. • Eleswarapu, Venkat R. and Kumar Venkataraman (2006): The Impact of Legal and Political Institutions on Equity Trading Costs: A CrossCountry Analysis, Review of Financial Studies, Vol. 19 (3); pp. 10811111. 5. Sourcing debt abroad 1. International bond markets 2. Syndicated loans 3. Project finance 4. Islamic finance Required literature: ESM 13, SOL 7, 8 Additional articles: • Esty, Benjamin C (2003): The Economic Motivations for Using Project Finance, Working Paper, Harvard Business School. • Zaher, Tarek S. and M. Kabir Hassan (2001): A Comparative Literature Survey of Islamic Finance and Banking, Financial Markets, Institutions & Instruments, Vol. 10 (4); pp. 155-199. INTERNATIONAL FINANCIAL MANAGEMENT 5 International Investment Decisions and the Management of Multinational Operations 6. Foreign Direct Investment 1. FDI trends 2. Greenfield investments & Cross-Border M&As Required literature: ESM 16 Additional articles: UNCTAD: World Investment Reports. 7. Analysis of Global Operations 1. International harmonization of accounting standards 2. Major differences in international financial reporting standards (IFRS, US GAAP) 3. Accounting for Foreign Currency Transactions 4. Translation exposure & Translation methods Required literature: • ESM 10; SOL 6 (204–217) • Doupnik, Timothy S. (2008): Multinational Operations, in Robinson, T.R. et al. (2008): International Financial Statement Analysis, New Jersey: John Wiley & Sons, pp. 657–721. 8. International Investment Decisions 1. Multinational Capital Budgeting 2. Valuation of M&A targets across borders 3. Real Options Approach Required literature: ESM 17-19; SOL 6 (232–251) Additional articles: • Damodaran, Aswath (2003): Country Risk and Company Exposure: Theory and Practise, Journal of Applied Finance, Vol. 13 (2); pp. 63-76. • Keck, Tom, Eric Levengood, and Al Longfield (1998): Using Discounted Cash Flow Analysis in an International Setting: A Survey of Issues in Modeling the Cost of Capital, in: Journal of Applied Corporate Finance, 11 (3); pp. 82–99. 6 9. Management of Multinational Operations 1. Tax systems and deferral principle 2. Transfer pricing Required literature: ESM: 21, 22 Additional articles: Brickley, James, Clifford Smith, and Jerold Zimmerman (1995): Transfer Pricing and the Control of Internal Corporate Transactions, Journal of Applied Corporate Finance, Vol. 8 (2); pp. 60–67. Distribution of hours # Topic Total Contact hours hours Lectures Seminars International Capital Markets & Financing of the Global Firm 1. The Foreign Currency Environ- 12 4 ment 2. Identifying, Measuring, and 12 4 Hedging Currency Exposure International Capital Markets & Financing of the Global Firm 3. International Portfolio Diversi- 14 4 fication and the International Cost of Capital 4. Sourcing equity abroad 12 4 5. Sourcing debt abroad 12 4 Self study 8 8 10 8 8 International Investment Decisions and the Management of Multinational Operations 6. Foreign Direct Investment 14 4 10 7. Analysis of Global Operations 12 4 8 8. International Investment Deci- 10 2 8 sions 9. Management of Multinational 10 2 8 Operations Total: 108 32 0 76