International Financial Management

advertisement

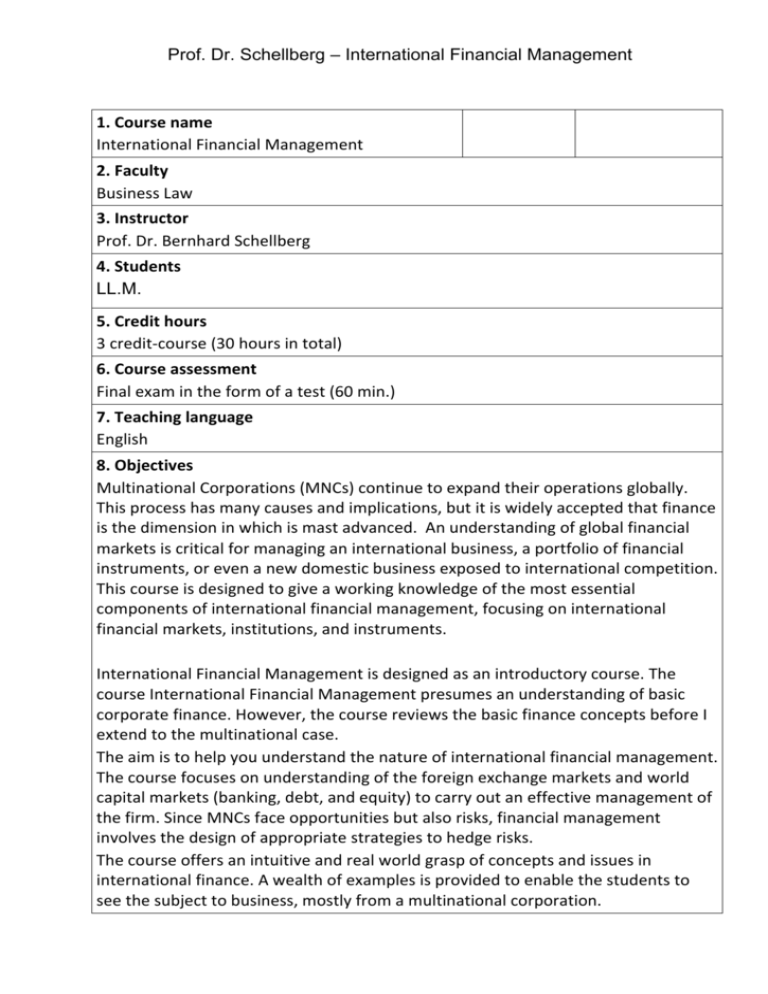

Prof. Dr. Schellberg – International Financial Management 1.Coursename InternationalFinancialManagement 2.Faculty BusinessLaw 3.Instructor Prof.Dr.BernhardSchellberg 4.Students LL.M. 5.Credithours 3credit-course(30hoursintotal) 6.Courseassessment Finalexamintheformofatest(60min.) 7.Teachinglanguage English 8.Objectives MultinationalCorporations(MNCs)continuetoexpandtheiroperationsglobally. Thisprocesshasmanycausesandimplications,butitiswidelyacceptedthatfinance isthedimensioninwhichismastadvanced.Anunderstandingofglobalfinancial marketsiscriticalformanaginganinternationalbusiness,aportfoliooffinancial instruments,orevenanewdomesticbusinessexposedtointernationalcompetition. Thiscourseisdesignedtogiveaworkingknowledgeofthemostessential componentsofinternationalfinancialmanagement,focusingoninternational financialmarkets,institutions,andinstruments. InternationalFinancialManagementisdesignedasanintroductorycourse.The courseInternationalFinancialManagementpresumesanunderstandingofbasic corporatefinance.However,thecoursereviewsthebasicfinanceconceptsbeforeI extendtothemultinationalcase. Theaimistohelpyouunderstandthenatureofinternationalfinancialmanagement. Thecoursefocusesonunderstandingoftheforeignexchangemarketsandworld capitalmarkets(banking,debt,andequity)tocarryoutaneffectivemanagementof thefirm.SinceMNCsfaceopportunitiesbutalsorisks,financialmanagement involvesthedesignofappropriatestrategiestohedgerisks. Thecourseoffersanintuitiveandrealworldgraspofconceptsandissuesin internationalfinance.Awealthofexamplesisprovidedtoenablethestudentsto seethesubjecttobusiness,mostlyfromamultinationalcorporation. 9.CourseSyllabus I. GlobalFinanceEnvironment a. Multinationalcorporations,globalmarketparticipants,international goodsmarkets(1hour) b. Internationalfinancialmarkets(1hour) c. Globalizationasariskfactor,benefitsofinternationaltrade(1hour) d. Comparativeadvantage(1hour) e. Balanceofpaymentsaccounting,internationalcapitalflows(1hour) f. Thedeterminationofglobalratesofreturn(1hour) II. ForeignExchangeTheoryandMarkets a. Bid-askspreads(1hour) b. Marketstructure(1hour) c. Triangulararbitrage(1hour) d. Realexchangerates(1hour) e. Exchangeratesystems,whatisacurrency,(1hour) f. Theroleofcentralbanks(1hour) III. ForeignExchangeExposure a. Hedgingwithexchangeforwards(6hours) b. Exchangerateswaps,and(3hours) c. Exchangeratefutures(3hours) IV. FinancingtheGlobalFirm(Sourcingequityglobally,sourcingdebtglobally)(2 hours) V. ForeignInvestmentDecisions(Internationalportfoliotheoryand diversification,foreigndirectinvestmenttheoryandpoliticalrisk, multinationalcapitalbudgeting)(2hours) VI. ManagingMultinationalOperations(Multinationaltaxmanagement,working capitalmanagement)(2hours) 10.Textbooks Ø Bruner,RobertF.:CaseStudiesinFinance,Boston. Ø Desai,MihirA.:InternationalFinance,Hoboken. Ø Eiteman,DavidK./Stonehill,ArthurI./Moffet,MichaelH./Multinational BusinessFinance,Boston. Ø Erhardt,MichaelC./Brigham,EugeneF.:FinancialManagement. Ø Eun,CheolS./Resnick,BruceG.:InternationalFinancialManagement,Boston. Ø Levi,MauriceD.:InternationalFinance,London. Ø Madura,Jeff/Fox,Roland:InternationalFinancialManagement,London. Ø Moffet,MichaelH./Stonehill,ArthurI./Eiteman,DavidK.:Fundamentalsof MultinationalFinance,Boston.