annual report

advertisement

- -1

. ;..';~~

..:

,/~&~

..

'r,

.'

~.:.'.,-,;

'~>,:

-,,- '

eport and Account

'"

erywhere viti

..•

r

/

)

,,

e -er ~igeria P

~~~~_-----=-

_------c~~

~

__

'~~-~-

~~_~_~=-"--,

~~

C RC

1 3

~

Turnover

Profit/(Loss) before income -~

5. =.. rao

inary item

Income tax expense

Extraordinary

item (net

Profit/(Loss) for

he

]C2'

-,

2~~-

;::'-:::::-:::i

ary item

Proposed di ~Qen:::

Capital em

I ::~

Capital

Deprecia'i

,",,,,,':::::-:::~:~: : :=-: :=~::: ec ipment

Cash and cas

2:r

J

_ _

_

Earnings per s are

Dividend per sha

Net assets per share

NSE share price at 3

s: ec

2007 ~-

E

to- .:.,npual Report and Accounts

IIIDI

Our relationships with our trade

customers are stronger than ever

5efore and we will continue to

build on these to ensure that we

can sustain the heritage of the

business ..

II

II

Apostle H.I. Alile

Chairman

I

a~d~lig t~in,""':--:-:-=::-:=-=::-2"

antobeabletoinfor_

-: ~s-a'~ oldersthatUnilever

Niqeria Pic IS 0 se -:: =_::=-=-= -::,

ore than ever before.

c - ~a'1 a results for the year

2007 speak for, en--= es ==: :---9 ery strong sales gro v: r:

--'~...

improvement in

underlying margins, dis; ';)... - :=-:;:=~ inistrative costs remai '

der control. This is

in line with the quarte J ==_

,2 -::Le reported during the year,

~~ -I ancial results also

demonstrate clearly "he ~-:~~ _ ...~ s.renqth of the business or:: '2- ec:: the effort of the

management to build 0 -:-:""'2 -:: =-:_'e that the company has e~2'=2:'=-'

he challenges of

2005 and 2006 stronge a-::; ==-=2'::: :=-~ "'0serve the Nigeria c -:~ -2-,

.J""""

-=

Every year presents i

- _-:= 2-;;£'5, competition gets S1'~2' aM:: - '" e are particular

uncertainties caused ' ~"'e ;t _== :::-:::_omic environment

': S:'~-~-:::--essionaryand credit

pressures in certain glo a ~2"

e also face inflationary

.~~'== especially in the food

sectorandinallcrudeoi

~e ~_ 2::cts. However/in2008:2s-:=

::::--'-...<o-'-oleverageour

local operational strer: _--:

_ bal benefits of Unile e' tc 2-:_ 2 ',e 0 er the best

proposition to cons

c':. --= 3-:;"':: 0' Unilever Nigeria PI 5'" --'::2C -:

anage these

uncertainties and ress..•·:=:: z . ::--...2-- seeking to become

n suring that we

offerthebestq

ali:)~,a es:: :=----:

rconsumers.

=-~ ..

Our brands particularly r",r.~'-:::-- -: and in high demand, -re := 2 a sc :o·-er1enced increased

market shares in most ca

'25. - e significant changes

ace - --2 ::::~ a y's distribution

and sales structures ha e e a ~ ...•- serve our customers a:l ::::-=_ -2-: ~ "e effectively and

more efficiently. Our rela io s is,'

our trade customers a e --:-;2'--a- ever before and we

will continue to build on t Ese - ::: sure that we can sustai- -:-2 -2 -=;= .: -: e business and

createfurthervalueforallo

r51 e olders-the shareholders.

.::::_:::~: _

r consumers.and

our employees.

..>

eport and Accounts

lal

7

~ o er

~s: 0 sales

-=-:_

:lrofit

- ~··on costs

--- rative expenses

- :..=- -; orofit /(1055)

-

=--= - sts

-

==

Defore income tax & =

-~ -=: =xpense

==

2006

00

N'OOO

48

945)

25,554,415

(18,422,205)

2903

7,132,210

4,367)

5,743)

(1,405,206)

(6,879,824)

552,793

39,645)

(1,152,820)

(967,413)

013,148

716,615)

(2,120,233)

745,870

,296,533

(1,374,363)

::~er tax and before

(219,037)

_ ::-=:ertax and extraorc -=

1,077,496

(1,617,263)

0.28

(0.43)

__ :~are (Naira)

~=-<::r:

significant acco --:=gral part of these --=

~

al Report and A

(242,900)

:=:~and the

notes on pages 36 to

Balance Sheet

As at 31st December, 2007

Notes

2007

2006

N'OOO

N'OOO

Non-current assets

Property, plant and equipme ~

9

8,640,971

7,772,471

Current assets

Inventories

Receivablesand prepayme Cashand bank balance

10

11

12

5,083,483

5,066,930

1,561,548

5,332,200

3,860,709

1,657,095

11,711,961

10,850,004

8,215,777

490,042

4,035,570

6,594,013

954

5,515,813

12,741,389

12,110,780

(1,029,428)

(1,260,776)

7,611,543

6,511,695

747,248

1,833,451

613,594

1,944,753

2,580,699

2,558,347

5,030,844

3,953,348

1,891,649

45,717

237,262

1,910,392

945,824

1,891,649

45,717

237,262

1,778,720

5,030,844

3,953,348

Current liabilities

Payablesand accr eo <:

Current income ax

Bank overdraft and other ::-~::

-

13

5

12

Net current (liabilities) assets

Total assets less current liab{~!":::es

Non-current liabilities

Deferred income tax

Retirement benefits obliqation

14

15

Net assets

CAPITALEMPLOYED

Share capital

Share premium

Revaluation reserves

Retained earnings

Proposed dividend

7

7

8

8

8

Shareholders' funds

The financial statements on paces ~ :048 were approved for issue by the Board of Directors on

12th March 2008 and signed 0

::: a f by:

Chairman

Director

2 07 Un' ever Annual Report and Accounts

Iml

Cash Flow Statement

For the year ended 31 st December, 2007

2007

Notes

Operating activities

Cashgenerated from operations

Taxpaid

Retirement benefits paid

18

5

15

Netcashgeneratedfrom/(used in) operating activities

Cash flow investing activities

Purchase of fixed assets

Proceedson disposal of fixed assets

Interest received

Net cash used in investing activities

9

4

N'OOO

4,877,875

2006

#'000

(773,523)

5,259,184

(65,897)

(363,472)

4,104,352

4,829,815

(2,193,846)

14,656

106,195

(1,286,290)

7,748

44,189

(2,072,995)

(1,234,353)

Cash flow from financing activities

Dividends paid

Interest paid

(822)

(645,840)

(1,011,602)

Net cash used in investing activities

(646,662)

(1,011,602)

Increase in cash and cash equivalents

1,384,695

2,583,860

At start of year

Increase

(3,858,718)

1,384,695

(6,442,578)

2,583,860

Attheend oftheyear

(2,474,023)

(3,858,718)

Movement in cash and cash equivalents

The statement of significant accounting policies 0

form an integral part ofthese financial statemen .

lEI

2007 Unilever Annual Report and Accounts

ages 33 to 35 and the notes on pages 36 to 46

Statement of Value Added

07

00

2007

%

N'OOO

2006

2006

N'OOO

N'OOO

25,554,415

33,990,848

Turnover

Bought in materials and se

- Local

- Imported

%

C25

17,289,44

70

r8

6,086,153

(27,523,939)

(23,375,597)

6,466,909

2,178,818

44,189

106,195

Finance income

6,573,105·

Value added

100

2,223,007

100

3,403,006

52

2,889,689

130

824,021

622,742

945,824

645,840

131,672

13

9

14

10

2

6,573,105

100

Applied as follows:

To pay employees sa a '25

and fringe benefits InG v

terminal benefits

n

-==-:::x;:~- _

To provide for maintena == ..--:. =--s.==:

To pay taxes to qovernmer.:

To pay dividends to shar€l G=""::

To pay interest on borrowr-qs

Retained for Company's 9ro.'.--

~-= ==-==~:=

2007

u-

788,949

(849,970)

35

(38)

1,011,602

(1,617,263)

46

(73)

2,223,007

100

ever Annual Report and Accounts

Iml

~

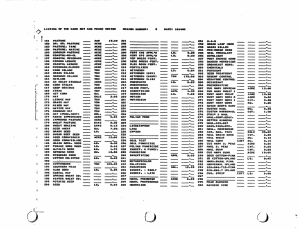

2007

N'OOO

2005

2004

2003

N'OOO

N'OOO

N'OOO

Turnover

33,990,848

33,390,940

23,693,923

19,003,356

Gross Profit

11,412,903

11,760,282

10,714,136

Net operating expenses

(8,860,110

(8,659,938)

(7,128,125)

9,144,239

(5,880,404)

Operating profit

2,552,793

3,100,344

3,586,010

3,263,835

Profit before tax

2,013,148

2,281,416

2,970,047

2,778,115

(716,615

Tax expense

(664,959)

(802,798)

(907,857)

Profit after tax and before

extraordinary item

Extraordinary item (net of tax)

Profit for the year

1,296,533

1,616,457

2,167,249

1,870,258

1,616,457

2,167,249

1,870,258

(219,037

1,077,496

Earnings per share (Naira)

- adjusted

0.28

Dividends per share (Naira)

0.25

-

-

0.43

0.57

0.49

0

0.70

0.60

Capital employed

Share capital

1,891,649

-

Reserves

-

Proposed Dividend

2,193,37

945,824

Shareholders interests

5,030,844

5,570,611

6,072,800

1,846,249

5,751,800

8,640,97

(1,029,428

7,645,186

6,179,653

4,822,861

(Iiabilities)/assets

852,989

liabilities

(2 ,580'699

,

1,982,608

(2,089,461)

795,732

(1,713,043)

6,072,800

5,751,800

Employment

Non-current

1,513,319

4,057,292

1,513,319

4,559,481

2,118,646

1,513,319

2,392,232

of Capital

Fixed Assets

Net current

:--.:::

5,030,84

,927,564)

-- -----

- -

-

-570,611

Net assets per share (Naira)

- Adjusted

Iml

1.33

2007 Unilever Annual Report and Accou

.47

1.61

1.03