Morning Briefing

advertisement

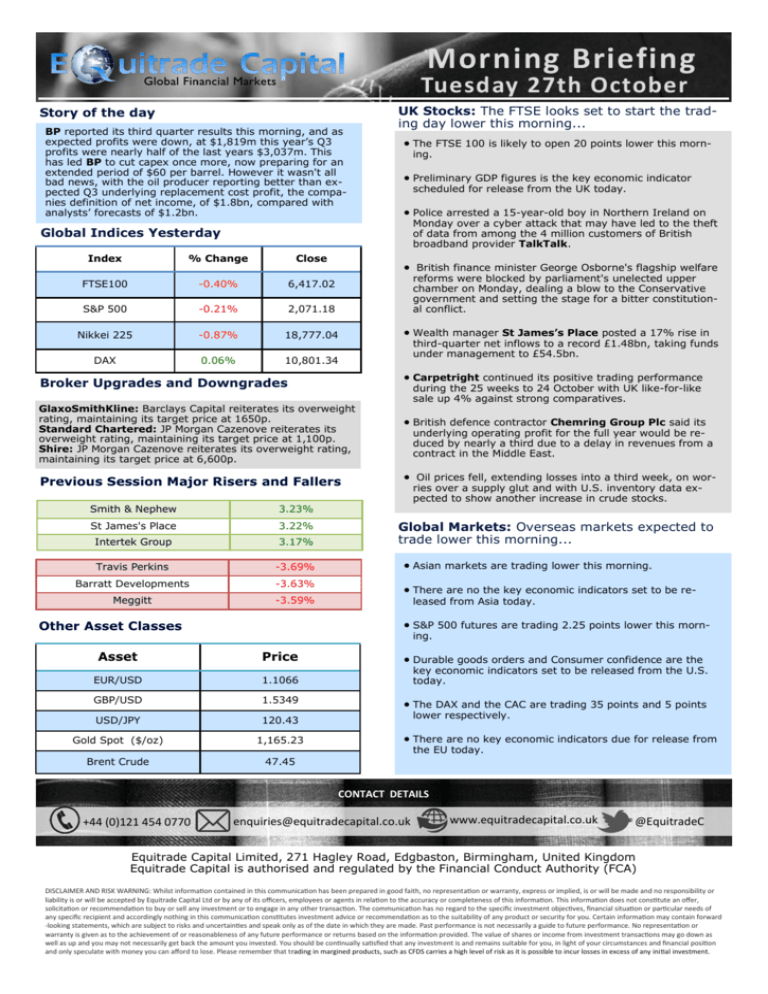

Morning Briefing Tuesday 27th October Story of the day BP reported its third quarter results this morning, and as expected profits were down, at $1,819m this year’s Q3 profits were nearly half of the last years $3,037m. This has led BP to cut capex once more, now preparing for an extended period of $60 per barrel. However it wasn't all bad news, with the oil producer reporting better than expected Q3 underlying replacement cost profit, the companies definition of net income, of $1.8bn, compared with analysts’ forecasts of $1.2bn. UK Stocks: The FTSE looks set to start the trading day lower this morning... The FTSE 100 is likely to open 20 points lower this morning. Preliminary GDP figures is the key economic indicator scheduled for release from the UK today. Police arrested a 15-year-old boy in Northern Ireland on Monday over a cyber attack that may have led to the theft of data from among the 4 million customers of British broadband provider TalkTalk. Global Indices Yesterday Index % Change Close FTSE100 -0.40% 6,417.02 S&P 500 -0.21% 2,071.18 Nikkei 225 -0.87% 18,777.04 DAX 0.06% 10,801.34 British finance minister George Osborne's flagship welfare reforms were blocked by parliament's unelected upper chamber on Monday, dealing a blow to the Conservative government and setting the stage for a bitter constitutional conflict. Wealth manager St James’s Place posted a 17% rise in third-quarter net inflows to a record £1.48bn, taking funds under management to £54.5bn. Carpetright continued its positive trading performance Broker Upgrades and Downgrades GlaxoSmithKline: Barclays Capital reiterates its overweight rating, maintaining its target price at 1650p. Standard Chartered: JP Morgan Cazenove reiterates its overweight rating, maintaining its target price at 1,100p. Shire: JP Morgan Cazenove reiterates its overweight rating, maintaining its target price at 6,600p. Previous Session Major Risers and Fallers during the 25 weeks to 24 October with UK like-for-like sale up 4% against strong comparatives. British defence contractor Chemring Group Plc said its underlying operating profit for the full year would be reduced by nearly a third due to a delay in revenues from a contract in the Middle East. Oil prices fell, extending losses into a third week, on worries over a supply glut and with U.S. inventory data expected to show another increase in crude stocks. Smith & Nephew 3.23% St James's Place 3.22% Intertek Group 3.17% Travis Perkins -3.69% Asian markets are trading lower this morning. Barratt Developments -3.63% Meggitt -3.59% There are no the key economic indicators set to be re- Global Markets: Overseas markets expected to trade lower this morning... leased from Asia today. S&P 500 futures are trading 2.25 points lower this morn- Other Asset Classes ing. Asset Price EUR/USD 1.1066 key economic indicators set to be released from the U.S. today. GBP/USD 1.5349 The DAX and the CAC are trading 35 points and 5 points USD/JPY 120.43 Gold Spot ($/oz) 1,165.23 Brent Crude 47.45 Durable goods orders and Consumer confidence are the lower respectively. There are no key economic indicators due for release from the EU today. CONTACT DETAILS +44 (0)121 454 0770 enquiries@equitradecapital.co.uk www.equitradecapital.co.uk @EquitradeC Equitrade Capital Limited, 271 Hagley Road, Edgbaston, Birmingham, United Kingdom Equitrade Capital is authorised and regulated by the Financial Conduct Authority (FCA) DISCLAIMER AND RISK WARNING: Whilst information contained in this communication has been prepared in good faith, no representation or warranty, express or implied, is or will be made and no responsibility or liability is or will be accepted by Equitrade Capital Ltd or by any of its officers, employees or agents in relation to the accuracy or completeness of this information. This information does not constitute an offer, solicitation or recommendation to buy or sell any investment or to engage in any other transaction. The communication has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient and accordingly nothing in this communication constitutes investment advice or recommendation as to the suitability of any product or security for you. Certain information may contain forward -looking statements, which are subject to risks and uncertainties and speak only as of the date in which they are made. Past performance is not necessarily a guide to future performance. No representation or warranty is given as to the achievement of or reasonableness of any future performance or returns based on the information provided. The value of shares or income from investment transactions may go down as well as up and you may not necessarily get back the amount you invested. You should be continually satisfied that any investment is and remains suitable for you, in light of your circumstances and financial position and only speculate with money you can afford to lose. Please remember that trading in margined products, such as CFDS carries a high level of risk as it is possible to incur losses in excess of any initial investment.