Australia Equity Research

29 August 2014

Overweight

UXC Limited

UXC.AX, UXC AU

Price: A$0.86

FY14 Result: Becoming More Dynamic

▲ Price Target: A$1.15

Previous: A$1.04

UXC’s FY14 underlying PBT was A$25.6m, down 13% on pcp but in line

with guidance. PBT would have increased by 2% if poor execution in

1H14 had not led to project overruns, but pleasingly these issues had been

resolved by 2H14. The company will benefit from 19 new client wins in

FY14 over A$1m and the flow through of acquisitions, particularly in the

Microsoft Dynamics space. We see significant upside based on a valuation

that does not factor in the margin targets to which the company is guiding.

We are Overweight, and raise our Jun-15 PT to A$1.15.

Result in line with Company Guidance. FY14 underlying PBT was

A$25.6m, down 13% on pcp and in line with guidance of A$25.026.5m. Revenue increased 8% to A$643.4m with 1% being organic and

the remainder due to acquisitions.

2H14 showed a recovery from project overruns. In 1H14, UXC was

ill-equipped to handle the complexity of some of its larger projects

resulting in A$4.4m in project overruns, without which FY14 PBT

would have increased by 2%. Positively, UXC has fixed this by

controlling delivery to the tendered margin with set deliverables.

FY15 outlook positive. Management commented that it had seen an

increase in activity in quarter four and reasonable confidence at the start

of the year. It reiterated its FY16 margin targets. Annuity contracts and

the backlog of work yet to be delivered represents 60% of the FY15

revenue target, up from 46% in FY14. The company won 17 new

contracts between A$1-3m and 2 contracts greater than A$3m in FY14.

FY15 to benefit from acquisitions. UXC made five acquisitions in

FY14 which are expected to contribute annualised revenues of ~A$82m.

The Microsoft Dynamics market has accelerated in 2H14 in North

America with the backlog of work increasing, which will benefit FY15.

Retain Overweight. We see better discipline in execution and growth

opportunities within the cloud-based businesses and Microsoft Dynamics

in North America, which will drive earnings for UXC offsetting the

continued subdued Australian market.

UXC Limited (Reuters: UXC.AX, Bloomberg: UXC AU)

Year-end Jun (A$)

FY12A

FY13A

Revenue (A$ mn)

560

598

EBITDA (A$ mn)

34

37

Net Profit (A$ mn)

20

24

EPS (A$)

0.06

0.08

P/E (x)

13.5

11.3

EV/EBITDA (x)

7.0

6.7

DPS (A$)

0.04

0.06

Dividend Yield

4.1%

6.7%

Normalised EPS (A$)

0.06

0.07

Normalised EPS Growth

130.2%

5.1%

Normalised PE

13.5

12.8

Source: Company data, Bloomberg, J.P. Morgan estimates.

FY14A

646

36

16

0.05

17.9

7.7

0.04

4.4%

0.06

(17.0%)

15.4

FY15E

699

44

24

0.08

11.7

6.4

0.05

6.0%

0.07

32.0%

11.7

FY16E

720

47

27

0.08

10.5

5.7

0.06

6.6%

0.08

11.1%

10.5

Australia

eBusiness/IT Services

Armina Soemino

AC

(61-2) 9003-8620

armina.x.soemino@jpmorgan.com

Bloomberg JPMA SOEMINO <GO>

Russell Gill

(61-2) 9003-8625

russell.j.gill@jpmorgan.com

J.P. Morgan Securities Australia Limited

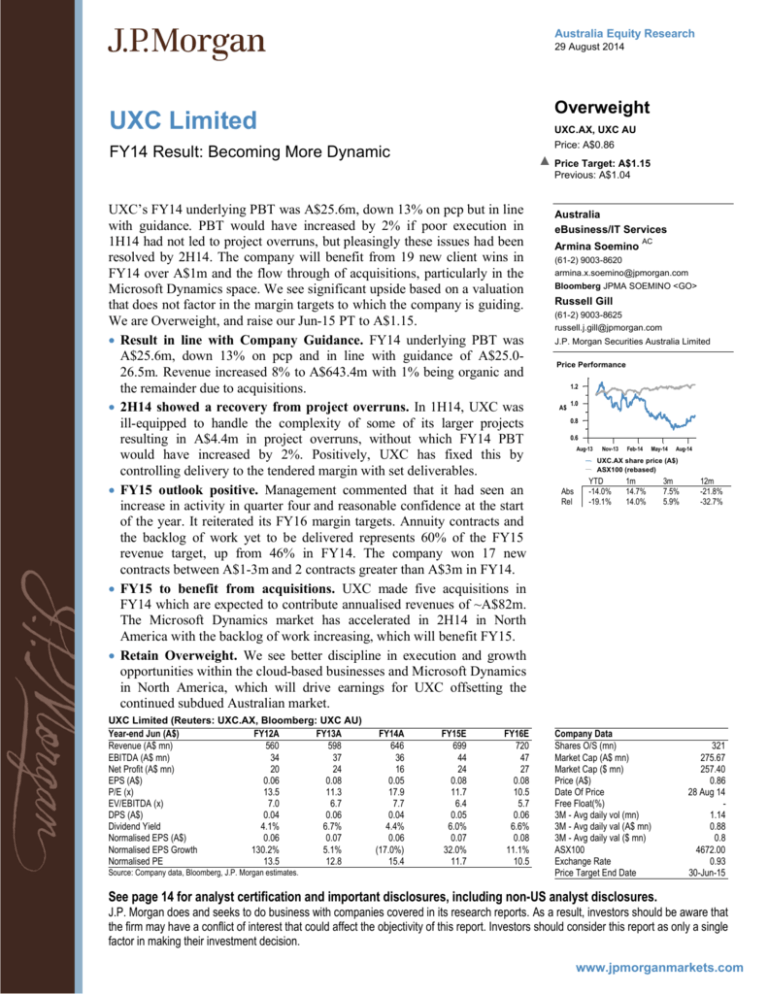

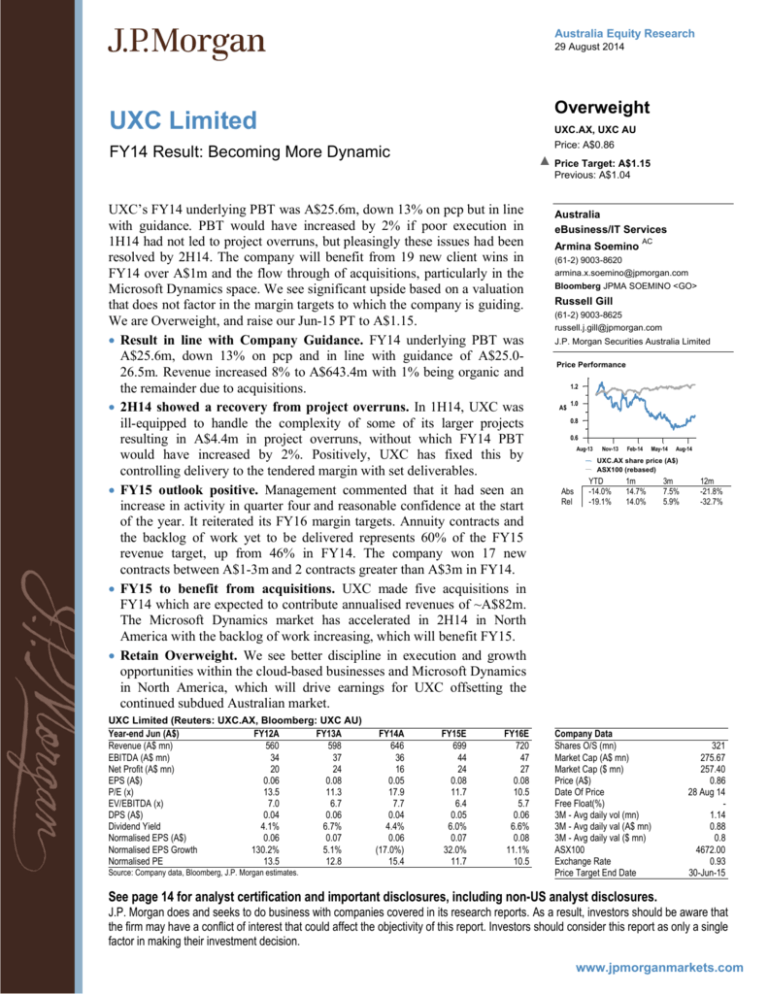

Price Performance

1.2

A$

1.0

0.8

0.6

Aug-13

Nov-13

Feb-14

May-14

Aug-14

UXC.AX share price (A$)

ASX100 (rebased)

Abs

Rel

YTD

-14.0%

-19.1%

1m

14.7%

14.0%

Company Data

Shares O/S (mn)

Market Cap (A$ mn)

Market Cap ($ mn)

Price (A$)

Date Of Price

Free Float(%)

3M - Avg daily vol (mn)

3M - Avg daily val (A$ mn)

3M - Avg daily val ($ mn)

ASX100

Exchange Rate

Price Target End Date

3m

7.5%

5.9%

12m

-21.8%

-32.7%

321

275.67

257.40

0.86

28 Aug 14

1.14

0.88

0.8

4672.00

0.93

30-Jun-15

See page 14 for analyst certification and important disclosures, including non-US analyst disclosures.

J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that

the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single

factor in making their investment decision.

www.jpmorganmarkets.com

Australia Equity Research

29 August 2014

Armina Soemino

(61-2) 9003-8620

armina.x.soemino@jpmorgan.com

Key Numbers from the FY14 Result

UXC reported FY14 underlying PBT of A$25.6m, down 13% on pcp and in line with

guidance of A$25.0-26.5m (JPMf: A$25.8m). FY14 underlying EBITDA was

A$36.4m, down 2% on the pcp (JPMf: A$36.8m). FY14 underlying PBT was

A$25.6m, down 13% on pcp (JPMf: A$25.8m). PBT margins fell 1.0ppt to 4.0%.

Revenue increased 8% to A$643.4m, in line with our estimate. 1% of revenue growth

was derived organically while the balance comes from acquisitions.

A fully franked final dividend of A3.0cps was declared, which equated to a payout

ratio of 76% on reported EPS vs. 74% in FY13. The company’s policy is 60-75% of

reported earnings.

Table 1: Group Earnings

Operating Revenue (A$m)

EBITDA (A$m)

EBITDA Margin

EBIT (A$m)

EBIT Margin

PBT (A$m)

PBT Margin

Reported NPAT (A$m)

Normalised NPAT (A$m)

Reported EPS (c)

Normalised EPS (c)

Dividend (c)

Payout Ratio

1H12

255.9

12.3

4.8%

9.5

3.7%

8.5

3.3%

5.5

6.0

1.8

1.9

1.0

56%

% Change

1H on 1H

1H on 2H

6.2%

-8.7%

-17.1%

-50.8%

-1.2 ppt

-3.5 ppt

-26.5%

-60.3%

-1.2 ppt

-3.6 ppt

-32.3%

-62.6%

-1.5 ppt

-3.7 ppt

-61.9%

-79.5%

-20.5%

-60.4%

-62.8%

-79.9%

-24.3%

-61.1%

-57.1%

-78.9%

2H12

304.2

18.9

6.2%

15.6

5.1%

15.7

5.2%

14.2

10.6

4.7

3.4

2.5

54%

FY12

560.1

31.3

5.6%

25.1

4.5%

24.3

4.3%

19.7

16.6

6.4

5.3

3.5

54%

1H13

274.6

14.4

5.2%

11.0

4.0%

11.0

4.0%

8.4

7.5

2.7

2.4

1.8

64%

2H13

319.6

24.3

7.6%

20.3

6.4%

19.9

6.2%

15.6

15.1

5.1

4.7

3.6

70%

FY13

594.3

38.7

6.5%

31.3

5.3%

30.8

5.2%

24.0

22.7

7.8

7.2

5.3

68%

1H14

291.7

12.0

4.1%

8.1

2.8%

7.4

2.5%

3.2

6.0

1.0

1.8

0.8

74%

1H12

2H12

FY12

1H13

2H13

FY13

1H14

42.0

116.4

98.1

-0.7

255.9

47.9

143.3

120.8

-7.8

304.2

89.9

259.7

218.9

-8.4

560.1

48.9

139.0

92.2

-5.3

274.6

43.8

143.2

137.1

-4.5

319.6

92.7

282.1

229.3

-9.8

594.3

45.6

140.7

111.0

-5.6

291.7

-6.6%

1.3%

20.4%

5.7%

6.2%

4.1%

-1.7%

-19.1%

25.9%

-8.7%

2.7

8.9

1.9

-7.8

5.8

2.5

17.1

5.3

-6.4

18.5

5.2

26.1

7.2

-14.2

24.3

3.9

12.6

1.8

-7.4

11.0

1.5

17.5

7.1

-6.3

19.9

5.4

30.1

9.0

-13.7

30.8

3.7

11.6

-0.2

-7.7

7.4

-5.0%

-8.0%

-109.9%

4.6%

-32.3%

149.7%

-33.9%

-102.5%

22.4%

-62.6%

6.4%

7.7%

1.9%

2.3%

5.2%

12.0%

4.4%

6.1%

5.8%

10.0%

3.3%

4.3%

8.0%

9.1%

2.0%

4.0%

3.4%

12.3%

5.2%

6.2%

5.8%

10.7%

3.9%

5.2%

8.2%

8.2%

-0.2%

2.5%

0.1 ppt

-0.8 ppt

-2.1 ppt

-1.5 ppt

4.8 ppt

-4.0 ppt

-5.4 ppt

-3.7 ppt

Source: J.P. Morgan estimates, Company data.

Table 2: Divisional Earnings

Revenue

Consulting

Applications

IT Infrastructure

Unallocated

Total

Normalised PBT

Consulting

Applications

IT Infrastructure

Unallocated

Total

Normalised PBT margin

Consulting

Applications

IT Infrastructure

Total

Source: J.P. Morgan estimates, company data.

2

% Change

1H on 1H

1H on 2H

Armina Soemino

(61-2) 9003-8620

armina.x.soemino@jpmorgan.com

Australia Equity Research

29 August 2014

Key Issues from the FY14 Result

2H14 showed a recovery from Project Overruns

The 1H14 result showed that a key area of weakness was project execution. It was

impacted by A$4.4m of project overruns from challenges faced in the completion

phase of 4 large projects resulting in unanticipated costs in completing delivery,

rectifying defects under warranty and ensuring customer satisfaction and

referenceability. Though these challenges were faced, only 1 of these 4 projects was

unprofitable.

Though large projects are obviously positive, UXC was ill-equipped to handle the

complexity of some of its larger project wins. The company was not impacted by

these issues in 2H14.

UXC implemented business process changes and renewed its approach to bidding for

fixed price contracts going forward including:

More disciplined Bid and Solution review processes including participation by

independent and specialist technical capabilities on large, complex projects, new

projects and early reviews

Breaking larger projects down into discrete parts for each scope of deliverable

work to manage costing better

Rigorous adoption of more standardised project management methodologies

Improved customer expectation management

Increased focus on achievement of tendered margins

Project dashboard reporting by business unit with KPIs on sold vs. delivered

margin

UXC has had 150+ substantial projects at any point in time with no known major

issues.

Had it not been for these project overruns, underlying PBT would have increased 2%

on FY13 instead of falling 13%. Improved margins can be achieved by making sure

tenders are priced correctly upfront then controlling the delivery to the tendered

margin.

No Quantitative Guidance but Outlook Broadly Positive

UXC commented that FY15 will provide increased opportunity for growth given the

FY impact of the five acquisitions and improved project delivery processes.

Management commented that “market conditions have been both challenging and

variable by industry and region” but it has seen “an increase in activity in quarter

four and have seen reasonable confidence to the start of the year”… “The FY15-17

targets set are realistic and aim to improve earnings growth for the next three years”.

3

Armina Soemino

(61-2) 9003-8620

armina.x.soemino@jpmorgan.com

Australia Equity Research

29 August 2014

Annuity-based revenues increasing as a proportion of the business

Annuity contracts and backlog of work yet to be delivered represents 60% of FY15

revenue target, which has increased from 46% in FY14. The backlog is up 20% on

the pcp while the frontlog, or sales pipeline, is up 13% on pcp.

Annuity revenue increased 29% to A$175m and now comprises ~27% of FY14

revenue. UXC re-signed all FY14 expiring Managed Services contracts which

equated to an annual value of A$25m. This included Melbourne Water, Virgin

Airlines, Shell, Fletchers and others.

Figure 1: FY13 Revenue Breakdown by Type

Figure 2: FY14 Revenue Breakdown by Type

112

123

136

346

345

175

Services

Services

Annuity

Annuity

Products & Licenses

Source: Company data.

Products & Licenses

Source: Company data.

IT market remains weak

During FY14 reporting season, numerous listed ICT services companies noted that

weak economic conditions saw clients pursue cost control and market conditions

were challenging across all industry sectors, with a large number of project deferrals

and delays. These market conditions intensified competition leading to increased rate

pressure and margin squeeze.

However many have expect profit growth in FY15 despite market conditions

remaining challenging. Some of the pent-up demand from deferrals is expected to

begin to come through.

According to UXC, market dynamics appear more positive with increased activity

and decision making over the last five months.

4

Armina Soemino

(61-2) 9003-8620

armina.x.soemino@jpmorgan.com

Australia Equity Research

29 August 2014

Table 3: 1H14 Commentary and Outlook Comments from Key Listed ICT Players

FY14 commentary

SMS Management & Technology (SMX AU)

* Weak market conditions, particularly in Victoria and the ACT have made for

another challenging year. Uncertainty about macroeconomic factors led to project

deferrals and reduced IT spending in many sectors..."

* Performance in the fourth quarter of the year returned to a more traditional pattern

with a seasonal uplift in utilisation and client activity. Furthermore the usual drop-off

in client demand post 30 June has had less of an impact than experienced at the

end of 2013.

Oakton (OKN AU)

* Market conditions during FY14 again remained challenging across all industry

sectors. In particular, there continues to be a large number of project deferrals and

delays by customers.

* It is pleasing to note that outside of NSW and ACT which have been impacted by

reduced Federal Government spending operating performance has shown solid

organic sales

*

Data 3 (DTL AU)

* 2014 has been one of Data #3s more challenging years. With sentiment towards

IT investment remaining flat and in a highly competitive and transforming

technology market,

DWS (DWS AU)

* Trading conditions generally difficult throughout the year with some improvement

observed in 2H (4Q). Clients continue to focus on cost with reductions in capex in

most industries.

Outlook

* Despite ongoing weakness in Victoria and ACT Consulting, improvements in other

regions, recent contract wins and lower costs point to a return to profit growth in

FY15.

* Reasonable revenue growth and improved margins are expected in FY15, subject

to the impact of current market conditions, particularly in the Federal Government.

* Customer demand is expected to continue for digital, cloud, mobility, information

management and core system enhancement solutions increasingly operating "as a

service".

* Customer focus on cost and value for money is resulting in Government and nonGovernment organisations increasing their use of offshore and cloud service

models.

* We see market conditions remaining challenging over FY15. However DTL has

access to a very large marketplace and the company is aiming to drive organic

growth through continued investment in DTL's solutions platform and increased

sales capacity... Overall DTL's goal is for FY15 to increase profit over FY14..

* Having taken costs and capacity out in the previous two years, the 2015 plan

targets growth through market share gain and the introduction of additional

complementary revenues. Our financial objective is to improve on the 2014 result.

* While we expect an overall improvement in FY15 following investment in practices

and partnerships, general demand remains subdued... Solid demand for Digital,

Analytics and Cloud offerings with billable headcount being added in these practice

domains nationally.

Source: Company Reports.

Margin Targets Reiterated

UXC reiterated its medium-term margin targets for each of the divisions.

Margin improvement is targeted post a focus on utilisation, cost control and resource

management. The restructuring changes in FY14 saw a reduction of 50 staff though

30 were added back in key areas for productive contracts.

Table 4: Margin Targets by Segment – Exit Rate for FY16

Consulting

Applications

Infrastructure

FY12

5.8%

10.0%

3.3%

FY13

6.0%

10.0%

4.0%

FY14

7.6%

9.8%

3.2%

FY16 exit

9-10%

11-12%

4.5-5.5%

Source: Company data.

Cash Flow and Balance Sheet

Operating cash flow impacted by seasonality

1H cash flows are usually negative due to seasonal factors affecting the timing of

receipts and the related disbursements around 30 June. Government procurement of

goods and services and certain software license sales to other customers typically

peak in May/June, which produces higher than usual collections.

Prepayments are also received in this period which creates a temporary cash surplus

in 2H which reverses in 1H as the associated disbursement to suppliers is made.

5

Armina Soemino

(61-2) 9003-8620

armina.x.soemino@jpmorgan.com

Australia Equity Research

29 August 2014

Milestone collections have been ahead of terms for successful delivery on key

projects with minimal prepaid receipts.

According to company guidance, cash flow is expected to be equivalent to EBITDA

for FY15 consistent with prior years.

Net Debt decreased substantially from 1H14

Net debt decreased to A$4.1m in FY14 from A$51.9m in 1H14, equating to gearing

(ND/ND+E) of 1.9%. Net Debt to EBITDA is 0.1x and Interest Coverage

(EBITDA/Net Interest) is at 14.1x, well above the covenant of 3.5x.

Customer Sectors and Acquisition

UXC retains a large exposure to Federal and State Government though

unsurprisingly health care has increased markedly. Health care and utilities remain

key areas of focus but there is upside potential in the financial sector.

Figure 3: Customer Sector Exposure

16

14

12

10

8

6

4

2

0

%

FY13

FY14

Source: Company data.

The company has also won 17 new contracts that are between A$1-3m and 2

contracts greater than A$3m.

Acquisitions

UXC made five acquisitions in the Applications segment this year:

Three in Australia to expand emerging growth solutions

One in Australia/SE Asia focused on Oracle Asset Life Cycle Management

One in North America to leverage the Microsoft Dynamics market.

We expect UXC to continue to grow in these areas through a combination of both

organic growth and further acquisitions. Of UXC’s 8% revenue growth in FY14, 1%

was organic with the remainder being derived from acquisitions. We estimate that

this equated to ~A$41m.

Cloud Applications

UXC has cloud-based practices with its partnership with ServiceNow, Apptio and

other providers. Cloud businesses now have combined revenue of over A$40m.

6

Armina Soemino

(61-2) 9003-8620

armina.x.soemino@jpmorgan.com

Australia Equity Research

29 August 2014

Tectura

The integration of Tectura has progressed well and is not fully integrated. It had

minimal contribution to FY14 PBT after integration and acquisition costs but the

company has strong expectations in FY15 and beyond.

UXC is looking to make more acquisitions in this space after 6-12 months to build

the business to over US$100m.

More on these acquisitions can be found in the Appendix at the end of this note.

Divisional Analysis

Consulting (16% of FY14 normalised divisional PBT)

Revenue decreased 6% to A$84.9m but normalised PBT increased from A$5.4m to

A$6.5m driven by 2H14. PBT margins improved notably in 2H14 by 3.4ppts so that

overall the business finished the year at 7.6% PBT margin.

The company commented that margins are still below target but with some

increased revenue anticipated in FY15, further improvements are expected.

UXC is focusing on utilisation, cost control and resource management to this end.

Table 5: Consulting Division Earnings

Revenue

Normalised PBT

Normalised PBT Margin

PBT pre project cost overruns

PBT margin post project cost overruns

1H13

48.9

3.9

8.0%

3.9

8.0%

2H13

41.8

1.5

3.6%

1.5

3.6%

FY13

90.6

5.4

6.0%

5.4

6.0%

1H14

45.6

3.7

8.2%

3.7

8.2%

2H14

39.2

2.7

7.0%

2.7

7.0%

FY14

84.9

6.5

7.6%

6.5

7.6%

1H on 1H

-6.6%

-5.0%

0.1 ppt

-5.0%

0.1 ppt

% Change

2H on 2H

-6.0%

83.8%

3.4 ppt

83.8%

3.4 ppt

FY on FY

-6.4%

19.5%

1.6 ppt

19.5%

1.6 ppt

Source: J.P. Morgan estimates, company data.

Applications (74% of FY14 divisional PBT)

Revenue rose 15% to A$322.1m but normalised PBT increased by only 8% to

A$30.2m due to a 0.6ppt decrease in PBT margins. If we were to normalise PBT for

the project overruns, Applications PBT would have fallen by just 0.2ppts.

Top-line growth was completely driven by acquisitions with a flat organic

revenue performance.

The Applications segment continues to be UXC’s core growth driver and is

characterised by larger and longer duration projects providing the company with

diversification benefits.

UXC RedRock performed strongly and UXC extended its investment in the

Oracle Portfolio to include Asset Life Cycle Management through the acquisition

of Convergence.

The Microsoft Dynamics market accelerated in 2H14 particularly in North

America. The backlog of work is increasing and improvements in 2H14 are

expected to continue.

7

Armina Soemino

(61-2) 9003-8620

armina.x.soemino@jpmorgan.com

Australia Equity Research

29 August 2014

UXC Oxygen, the SAP business, had a difficult year in generating satisfactory

earnings but won and successfully delivered some large and complex SAP

projects during the year. There was a slowdown in the run rate of the business

making resource allocation difficult. While revenue was satisfactory, margins

were lower than anticipated impacting PBT.

ServiceNow contributed seven months.

Table 6: Applications Division Earnings

Revenue

Normalised PBT

Normalised PBT Margin

PBT pre project cost overruns

PBT margin post project cost overruns

1H13

139.0

12.6

9.1%

12.6

9.1%

2H13

141.9

15.4

10.8%

15.4

10.8%

FY13

280.8

28.0

10.0%

28.0

10.0%

1H14

140.7

11.6

8.2%

12.9

9.1%

2H14

181.4

18.6

10.2%

18.6

10.2%

FY14

322.1

30.2

9.4%

31.4

9.8%

1H on 1H

1.3%

-8.0%

-0.8 ppt

2.1%

0.1 ppt

% Change

2H on 2H

27.8%

20.7%

-0.6 ppt

20.7%

-0.6 ppt

FY on FY

14.7%

7.8%

-0.6 ppt

12.3%

-0.2 ppt

Source: J.P. Morgan estimates, company data.

Infrastructure (11% of FY14 divisional PBT)

FY14 revenue grew 6% to A$236.4m but PBT declined 52%. However 2H14

marked a turnaround delivering PBT of A$4.5m vs. -A$0.2m in 1H14. Similar to

Applications, however, if PBT were to be normalised for project overruns, PBT

would have decreased by only 17%.

Experienced a solid 2H from the Queensland Hospital projects.

The division re-signed major outsourcing clients that were ending contract terms

including Melbourne Water, Shell, Virgin Airlines, Fletcher Group and Hudson.

Delivery of margins for the health sector projects were more closely aligned to

sold margins.

Table 7: Infrastructure Division Earnings

Revenue

Normalised PBT

Normalised PBT Margin

PBT pre project cost overruns

PBT margin post project cost overruns

Source: J.P. Morgan estimates, company data.

8

1H13

92.2

1.8

2.0%

1.8

9.1%

2H13

130.7

7.1

5.5%

7.1

10.8%

FY13

222.8

9.0

4.0%

9.0

10.0%

1H14

111.0

-0.2

-0.2%

3.0

9.1%

2H14

125.4

4.5

3.6%

4.5

10.2%

FY14

236.4

4.3

1.8%

7.5

9.8%

1H on 1H

20.4%

-109.9%

-2.1 ppt

62.1%

0.1 ppt

% Change

2H on 2H

-4.0%

-36.7%

-1.9 ppt

-36.7%

-0.6 ppt

FY on FY

6.1%

-51.6%

-2.2 ppt

-16.6%

-0.2 ppt

Armina Soemino

(61-2) 9003-8620

armina.x.soemino@jpmorgan.com

Australia Equity Research

29 August 2014

Earnings Forecasts Revisions

Following the FY14 result, we have adjusted our forecasts which results in increases

to normalised NPAT of 4% in FY15E and 5% in FY16E and 5% in FY17E.

Table 8: Earnings Revisions

Year to 30 June 2015

NPAT (A$m)

Norm NPAT (A$m)

EPS (c)

Norm EPS (c)

DPS (c)

Year to 30 June 2016

NPAT (A$m)

Norm NPAT (A$m)

EPS (c)

Norm EPS (c)

DPS (c)

Year to 30 June 2017

NPAT (A$m)

Norm NPAT (A$m)

EPS (c)

Norm EPS (c)

DPS (c)

Revised

27.1

27.1

8.4

8.2

5.7

Revised

27.9

27.9

8.7

8.4

5.9

Revised

28.7

28.7

8.9

8.7

6.1

Previous

25.9

25.9

8.0

7.7

5.4

Previous

26.6

26.6

8.2

8.0

5.6

Previous

27.2

27.2

8.4

8.1

5.7

% Change

4.7%

4.7%

5.3%

5.7%

5.6%

% Change

4.8%

4.8%

5.4%

5.7%

5.4%

% Change

5.7%

5.7%

6.3%

6.6%

6.1%

Source: J.P. Morgan estimates; Company data.

Investment Thesis, Valuation and Risks

UXC Limited (Overweight; Price Target: A$1.15)

Investment Thesis

UXC has a strong relationship with each of the four key application vendors (Oracle,

SAP, Microsoft Dynamics and ServiceNow), strong balance sheet capacity and a

solid reputation and track record for delivering on large contracts. It is these strengths

that we believe will allow the company to capitalise on three key opportunities for

growth: 1) offering Microsoft AX applications in North America; 2) growth in cloudbased applications and alignment to ServiceNow; and 3) cross-selling opportunities

from applications.

Our Price Target has increased from A$1.04 to A$1.15 as a result of our upward

earnings revisions.

Valuation

Timeframe: 30 June 2015

Derivation: Average of DCF and SOTP valuations, rolled forward at the cost of

equity less dividends.

Key inputs: DCF valuation: WACC 9.9%, TGR 3.0%; Compcos: 7.3x FY15E

EBITDA, which is the market-cap-weighted average of Australian peers.

Risks to Rating and Price Target

Downside risks: Offshoring and increased competition leading to price deflation

in fixed price contracts, cost and duration overruns on contracts, staff attrition

rates increasing, rate of change of technology increasing, slowdown or deferral in

IT spending, acquisition integration risks and legal risks.

9

Armina Soemino

(61-2) 9003-8620

armina.x.soemino@jpmorgan.com

Australia Equity Research

29 August 2014

Appendix: More on Acquisitions

UXC on the Front-foot with Cloud Solutions Offering

UXC has established UXC Cloud Solutions for its Applications division, which is

focused on emerging cloud-based firms including ServiceNow (NYSE: NOW US)

and Netsuite (NYSE: N US).

ServiceNow has 1,443 employees with 1,778 enterprise customers and a 94%

customer retention rate. It is taking market share in the ERP market by offering

features such as:

A cloud-hosted delivery, SaaS platform, that is paid for via subscription

Workflow automation, notification escalation, reporting, 3rd party integration and

administration capabilities

On demand customisation

Customer support

Revenue for ServiceNow is projected to grow from USD$93m in CY11 to

USD$609m in CY14, equating to a 3-year CAGR of 87% using Bloomberg

consensus figures.

Keystone Management Solutions

To aid its participation in this growth, UXC acquired Keystone Management

Solutions in November 2013. Keystone has been a preferred partner for ServiceNow

since 2007 and is an Accredited ServiceNow Training Provider with the largest

number of Certified Implementation consultants. Keystone has undertaken over 120

successful implementations of ServiceNow with over 80% of ServiceNow customers

in Australasia being Keystone customers.

UXC used to sit alongside Keystone for a number of clients where Keystone would

undertake the implementation of ServiceNow and UXC would have a Consulting

role. Now UXC will be able to offer more of the value chain.

Figure 4: Customer Base of Keystone Management Solutions

Services

BPay

Financial & Tech

NAB

RACV

Sedgman

Spotless

Intergraph

Cancer council

Tyco Fire & Security

Veda

BOQ

HBOS

Challenger

Advantedge

Fuji Xerox

CITEC

ZettaServe

Education

University of

Western Aust

Bond University

AUT University

University of Sydney

QLD Education

Griffith University

Government

Australian Sports

Commission

Gold Coast Council

Queensland Govt

Other

Tabcorp

Retail

Metcash

BlueCare

Sands Las Vegas

Thrifty

Visy

Grocon

Lonely Planet

ResMed

Campbell Brothers

Pentana Solutions

Wesfarmers

PlaceMakers

Foodstuffs

Frucor

Target

Kmart

Utility & Energy

Macquarie

Generation

Ausenco

Rio Tinto

Worley Parsons

Oil Search

Citic Pacific

Source: Company reports.

The acquisition of Keystone is expected to cost A$24-28m equating to 4.5-5.0x PBT,

depending on earnout targets. Revenue is A$27m annualised and growing at ~40%

over the past three years. UXC expects to generate revenues from license sales,

10

Armina Soemino

(61-2) 9003-8620

armina.x.soemino@jpmorgan.com

Australia Equity Research

29 August 2014

ongoing SaaS annual revenue, implementation work, customisation work and

ancillary services such as help desk. At least 30% of revenues are recurring.

There are only two implementation partners for ServiceNow in Australia and UXC is

now the only platinum partner globally. This means that UXC is entitled to bigger

discounts and more referrals than other partners.

White-Labelled

In October 2013, UXC acquired White-Labelled, a leading digital and e-commerce

specialist providing integrated digital solutions and implementation capabilities

particularly in Hybris, an SAP business, as well as Oracle commerce, Magento and

IBM WebSphere Commerce. Hybris offers an e-commerce solution with

functionality that includes merchandising, order management, product information

management, multilingual support, analytics and support for both Apple iOS and

Android devices. White Labelled generates A$6m of annualised revenues with

~A$0.5m in PBT. 15% of revenues are recurring.

This allows UXC to offer both back-end ERP solutions and front-end e-Commerce

offerings to its customers increasing the company’s ability to leverage cross-selling

opportunities. Key customers include Australia Post, Target, Harvey Norman,

Jeanswest, Terry White Chemists, Qantas, Pacific Brands, Woolworths, OneSteel,

Aesop and Sigma.

Figure 5: White Labelled and UXC combined offering

Source: Company reports.

Tectura Corporation

In December 2013, UXC acquired Tectura Corporation, an established Microsoft

Dynamics ERP and CRM partner to medium and large companies in the US and

Canada for US$21m, or 4.5-5x PBT. Currently, UXC’s North American business

consists of the acquisition of Cole Systems in December 2012, which generates

US$10m in revenues. The acquisition of Tectura increases revenues from the North

American business to ~US$70m pa, with 1,400 clients and 260 staff. UXC believes

11

Armina Soemino

(61-2) 9003-8620

armina.x.soemino@jpmorgan.com

Australia Equity Research

29 August 2014

the North American business could generate over US$100m in revenues in the next

three years, built mainly through acquisitions. It expects client retention to be 96%

and employee retention to remain above 85% from FY13 to FY16.

Convergence

Convergence is an Oracle based Asset Life Cycle Management consultancy which

was acquired in late June 2014. It has 23 consultants in Australia and Singapore and

extends UXC’s Red Rock Oracle functional capability and broadens the customer

base.

Clarity

Clarity is a niche SAP consultancy that has been integrated into UXC Oxygen. It has

12 staff which will form part of the various functional SAP practices.

12

Australia Equity Research

29 August 2014

Armina Soemino

(61-2) 9003-8620

armina.x.soemino@jpmorgan.com

UXC Limited

A$ in millions, year end Jun

Profit And Loss

Revenue

Revenue growth

COGS

Operating Expenses

EBITDA

EBITDA growth

EBITDA margin

Amortisation

Depreciation

EBIT

Other Income

Other Expenses

Net Interest

Pre-Tax Profit

Tax

Tax Rate

Minorities

Abnormals (post tax)

Reported NPAT

Normalised NPAT

Growth

End of Period Shares

EFPOWA

Relative recommendation:

FY13

598

6.9%

(561)

37

9.2%

6.2%

(4)

(4)

30

(0)

29

(8)

27.9%

0

3

24

FY14 FY15E FY16E FY17E

646

699

720

742

8.0% 8.2% 3.0% 3.0%

(610) (655) (673) (694)

36

44

47

47

(2.4%) 20.7% 7.2% 0.5%

5.6% 6.3% 6.5% 6.4%

(4)

(4)

(4)

(4)

(4)

(4)

(4)

(4)

28

37

40

40

(3)

(3)

(2)

(1)

26

34

38

39

(7)

(9)

(11)

(11)

28.8% 28.0% 28.0% 28.0%

0

0

0

0

(3)

0

0

0

16

24

27

28

21

18

24

27

6.9% (13.8%) 33.4% 11.2%

322

331

322

331

0.08

0.05 0.08 0.08

0.07

0.06 0.07 0.08

5.1% (17.0%) 32.0% 11.1%

0.09

0.08

3.0%

DPS ($)

Growth

0.06

0.04 0.05 0.06

64.3% (34.8%) 37.3% 10.7%

0.06

3.5%

DPS/EPS payout

75.6%

78.1% 70.0% 69.7% 70.1%

FY13

30

7

3

(15)

(5)

20

FY14 FY15E FY16E FY17E

28

37

40

40

8

7

7

7

(4)

1

1

1

10

(10)

0

0

(11)

(12)

(12)

(12)

31

23

36

36

Reported EPS ($)

Normalised EPS ($)

Growth

Cash Flow Statement

Net Profit for Cashflow

Depreciation & Amortisation

Non Cash Items

Working Capital Changes

Other Operating Cashflows

Cashflow from Operating Activities

309

316

321

327

322

331

28

3.0%

Capex

Net Acquisitions

Other Investing cashflows

Investing Cash Flow

(13)

(9)

0

(23)

(7)

(42)

0

(49)

(7)

0

0

(7)

(7)

0

0

(7)

(7)

0

0

(7)

Inc/(Dec) in Borrowings

Equity Issued

Dividends Paid

Other Financing Cashflows

Financing Cash Flow

8

(0)

(12)

0

(4)

15

(0)

(12)

0

3

1

0

(18)

0

(16)

(12)

0

(17)

0

(29)

(10)

0

(19)

0

(29)

(6)

(15)

(0)

0

(0)

Net Cash Flow

Valuation Summary

Current mkt capitalisation

A$m

275.67

Price Target

Capital growth to price target

Trading Multiples

PE Pre-abnormals

PE Reported

EV/EBITDA

EV/EBIT

Overweight

A$ps

0.86

1.15

33.4%

FY13

12.8

11.3

6.7

8.4

FY14 FY15E FY16E FY17E

15.4

11.7

10.5

10.2

17.9

11.7

10.5

10.2

7.7

6.4

5.7

5.5

10.0

7.7

6.8

6.5

Key Ratios

Dividend Yield

Franking

Return on Assets (%)

Return on Equity (%)

ROIC (%)

FY13 FY14 FY15E FY16E FY17E

6.7%

4.4%

6.0%

6.6%

6.9%

100.0% 100.0% 100.0% 100.0% 100.0%

5.8%

4.5%

5.7%

6.4%

6.5%

11.0%

8.8% 11.1% 11.9% 11.8%

10.9%

8.9% 10.9% 11.7% 11.8%

Leverage

Gearing (Net Debt / Equity)

Gearing (ND / (ND + E))

Net Debt / EBITDA

EBIT Interest Cover (x)

FY13

(12.8%)

(14.7%)

(69.3%)

68.7

FY14 FY15E FY16E FY17E

1.9%

2.4% (2.9%) (7.1%)

1.9%

2.3% (3.0%) (7.6%)

11.3% 11.9% (14.4%) (36.0%)

10.9

12.8

17.6

29.9

FY13

34

92

6

48

180

12

175

15

202

383

87

0

7

25

44

163

9

0

6

4

18

181

167

0

3

32

0

202

(26)

FY14 FY15E FY16E FY17E

20

20

20

20

107

97

100

103

3

3

3

3

39

46

47

49

169

165

169

174

13

13

13

13

223

222

222

222

22

22

22

22

257

257

257

257

426

422

426

431

101

87

90

92

11

25

13

3

4

5

5

6

28

29

30

32

45

45

46

47

189

190

184

180

13

0

0

0

0

0

0

0

5

6

6

6

3

4

4

4

21

9

10

10

211

200

194

190

180

180

180

180

0

(0)

(0)

0

2

2

2

2

33

39

50

59

0

0

0

0

215

222

232

241

4

5

(7)

(17)

Balance Sheet

Cash

Receivables

Investments

Inventories

Other Current Assets

Total Current Assets

Net PPE

Total Intangibles

Other Non Current Assets

Total Non Current Assets

Total Assets

Creditors

Current Borrowings

Current Tax Provisions

Other Current Provisions

Other Current Liabilities

Total Current Liabilities

Non Current Creditors

Non Current Borrowings

Deferred Tax Liabilities

Other Non Current Provisions

Other Non Current Liabilities

Total Non Current Liabilities

Total Liabilities

Equity

Other Equity

Reserves

Retained Profits

Outside Equity Interests

Total Shareholders Equity

Net Debt

Source: Company reports and J.P. Morgan estimates.

13

Armina Soemino

(61-2) 9003-8620

armina.x.soemino@jpmorgan.com

Australia Equity Research

29 August 2014

Analyst Certification: The research analyst(s) denoted by an “AC” on the cover of this report certifies (or, where multiple research

analysts are primarily responsible for this report, the research analyst denoted by an “AC” on the cover or within the document

individually certifies, with respect to each security or issuer that the research analyst covers in this research) that: (1) all of the views

expressed in this report accurately reflect his or her personal views about any and all of the subject securities or issuers; and (2) no part of

any of the research analyst's compensation was, is, or will be directly or indirectly related to the specific recommendations or views

expressed by the research analyst(s) in this report. For all Korea-based research analysts listed on the front cover, they also certify, as per

KOFIA requirements, that their analysis was made in good faith and that the views reflect their own opinion, without undue influence or

intervention.

Important Disclosures

Company-Specific Disclosures: Important disclosures, including price charts, are available for compendium reports and all J.P. Morgan–

covered companies by visiting https://jpmm.com/research/disclosures, calling 1-800-477-0406, or e-mailing

research.disclosure.inquiries@jpmorgan.com with your request. J.P. Morgan’s Strategy, Technical, and Quantitative Research teams may

screen companies not covered by J.P. Morgan. For important disclosures for these companies, please call 1-800-477-0406 or e-mail

research.disclosure.inquiries@jpmorgan.com.

UXC Limited (UXC.AX, UXC AU) Price Chart

2

OW A$1.2

OW A$1.146OW A$1.036

1.5

OW A$1.159 OW A$1.023

Date

Price(A$)

1

0.5

Rating Share Price Price Target

(A$)

(A$)

20-Dec-13 OW

1.07

1.16

16-Jan-14

OW

1.06

1.15

28-Feb-14 OW

0.98

1.20

18-Jun-14

OW

0.76

1.02

29-Jul-14

OW

0.75

1.04

0

Dec

10

Sep

11

Jun

12

Mar

13

Dec

13

Sep

14

Source: Bloomberg and J.P. Morgan; price data adjusted for stock splits and dividends.

Initiated coverage Dec 20, 2013.

The chart(s) show J.P. Morgan's continuing coverage of the stocks; the current analysts may or may not have covered it over the entire

period.

J.P. Morgan ratings or designations: OW = Overweight, N= Neutral, UW = Underweight, NR = Not Rated

Explanation of Equity Research Ratings, Designations and Analyst(s) Coverage Universe:

J.P. Morgan uses the following rating system: Overweight [Over the next six to twelve months, we expect this stock will outperform the

average total return of the stocks in the analyst’s (or the analyst’s team’s) coverage universe.] Neutral [Over the next six to twelve

months, we expect this stock will perform in line with the average total return of the stocks in the analyst’s (or the analyst’s team’s)

coverage universe.] Underweight [Over the next six to twelve months, we expect this stock will underperform the average total return of

the stocks in the analyst’s (or the analyst’s team’s) coverage universe.] Not Rated (NR): J.P. Morgan has removed the rating and, if

applicable, the price target, for this stock because of either a lack of a sufficient fundamental basis or for legal, regulatory or policy

reasons. The previous rating and, if applicable, the price target, no longer should be relied upon. An NR designation is not a

recommendation or a rating. In our Asia (ex-Australia) and U.K. small- and mid-cap equity research, each stock’s expected total return is

compared to the expected total return of a benchmark country market index, not to those analysts’ coverage universe. If it does not appear

in the Important Disclosures section of this report, the certifying analyst’s coverage universe can be found on J.P. Morgan’s research

website, www.jpmorganmarkets.com.

Coverage Universe: Soemino, Armina: Ardent Leisure Group (AAD.AX), Breville Group Limited (BRG.AX), CSG Limited

(CSV.AX), Corporate Travel Management (CTD.AX), Domino's Pizza Enterprises Ltd (DMP.AX), Flight Centre Ltd (FLT.AX), GUD

Holdings (GUD.AX), Helloworld Ltd (HLO.AX), Retail Food Group Limited (RFG.AX), Salmat (SLM.AX), Tassal Group (TGR.AX),

UXC Limited (UXC.AX), Village Roadshow Limited (VRL.AX), Webjet Limited (WEB.AX), Wotif.com Holdings (WTF.AX)

14

Armina Soemino

(61-2) 9003-8620

armina.x.soemino@jpmorgan.com

Australia Equity Research

29 August 2014

J.P. Morgan Equity Research Ratings Distribution, as of June 30, 2014

J.P. Morgan Global Equity Research Coverage

IB clients*

JPMS Equity Research Coverage

IB clients*

Overweight

(buy)

45%

55%

46%

75%

Neutral

(hold)

43%

49%

47%

66%

Underweight

(sell)

11%

34%

7%

54%

*Percentage of investment banking clients in each rating category.

For purposes only of FINRA/NYSE ratings distribution rules, our Overweight rating falls into a buy rating category; our Neutral rating falls into a hold

rating category; and our Underweight rating falls into a sell rating category. Please note that stocks with an NR designation are not included in the table

above.

Equity Valuation and Risks: For valuation methodology and risks associated with covered companies or price targets for covered

companies, please see the most recent company-specific research report at http://www.jpmorganmarkets.com, contact the primary analyst

or your J.P. Morgan representative, or email research.disclosure.inquiries@jpmorgan.com.

Equity Analysts' Compensation: The equity research analysts responsible for the preparation of this report receive compensation based

upon various factors, including the quality and accuracy of research, client feedback, competitive factors, and overall firm revenues.

Registration of non-US Analysts: Unless otherwise noted, the non-US analysts listed on the front of this report are employees of non-US

affiliates of JPMS, are not registered/qualified as research analysts under NASD/NYSE rules, may not be associated persons of JPMS,

and may not be subject to FINRA Rule 2711 and NYSE Rule 472 restrictions on communications with covered companies, public

appearances, and trading securities held by a research analyst account.

Other Disclosures

J.P. Morgan ("JPM") is the global brand name for J.P. Morgan Securities LLC ("JPMS") and its affiliates worldwide. J.P. Morgan Cazenove is a marketing

name for the U.K. investment banking businesses and EMEA cash equities and equity research businesses of JPMorgan Chase & Co. and its subsidiaries.

All research reports made available to clients are simultaneously available on our client website, J.P. Morgan Markets. Not all research content is

redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your sales

representative.

Options related research: If the information contained herein regards options related research, such information is available only to persons who have

received the proper option risk disclosure documents. For a copy of the Option Clearing Corporation's Characteristics and Risks of Standardized Options,

please contact your J.P. Morgan Representative or visit the OCC's website at http://www.optionsclearing.com/publications/risks/riskstoc.pdf

Legal Entities Disclosures

U.S.: JPMS is a member of NYSE, FINRA, SIPC and the NFA. JPMorgan Chase Bank, N.A. is a member of FDIC. U.K.: JPMorgan Chase N.A., London

Branch, is authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and to limited regulation by

the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from J.P. Morgan on

request. J.P. Morgan Securities plc (JPMS plc) is a member of the London Stock Exchange and is authorised by the Prudential Regulation Authority and

regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registered in England & Wales No. 2711006. Registered Office 25

Bank Street, London, E14 5JP. South Africa: J.P. Morgan Equities South Africa Proprietary Limited is a member of the Johannesburg Securities

Exchange and is regulated by the Financial Services Board. Hong Kong: J.P. Morgan Securities (Asia Pacific) Limited (CE number AAJ321) is regulated

by the Hong Kong Monetary Authority and the Securities and Futures Commission in Hong Kong and/or J.P. Morgan Broking (Hong Kong) Limited (CE

number AAB027) is regulated by the Securities and Futures Commission in Hong Kong. Korea: J.P. Morgan Securities (Far East) Ltd, Seoul Branch, is

regulated by the Korea Financial Supervisory Service. Australia: J.P. Morgan Australia Limited (JPMAL) (ABN 52 002 888 011/AFS Licence No:

238188) is regulated by ASIC and J.P. Morgan Securities Australia Limited (JPMSAL) (ABN 61 003 245 234/AFS Licence No: 238066) is regulated by

ASIC and is a Market, Clearing and Settlement Participant of ASX Limited and CHI-X. Taiwan: J.P.Morgan Securities (Taiwan) Limited is a participant

of the Taiwan Stock Exchange (company-type) and regulated by the Taiwan Securities and Futures Bureau. India: J.P. Morgan India Private Limited

(Corporate Identity Number - U67120MH1992FTC068724), having its registered office at J.P. Morgan Tower, Off. C.S.T. Road, Kalina, Santacruz - East,

Mumbai – 400098, is a member of the National Stock Exchange of India Limited (SEBI Registration Number - INB 230675231/INF 230675231/INE

230675231) and Bombay Stock Exchange Limited (SEBI Registration Number - INB 010675237/INF 010675237) and is regulated by Securities and

Exchange Board of India. Telephone: 91-22-6157 3000, Facsimile: 91-22-6157 3990 and Website: www.jpmipl.com. For non local research reports, this

material is not distributed in India by J.P. Morgan India Private Limited. Thailand: This material is issued and distributed in Thailand by JPMorgan

Securities (Thailand) Ltd., which is a member of the Stock Exchange of Thailand and is regulated by the Ministry of Finance and the Securities and

Exchange Commission and its registered address is 3rd Floor, 20 North Sathorn Road, Silom, Bangrak, Bangkok 10500. Indonesia: PT J.P. Morgan

Securities Indonesia is a member of the Indonesia Stock Exchange and is regulated by the OJK a.k.a. BAPEPAM LK. Philippines: J.P. Morgan Securities

Philippines Inc. is a Trading Participant of the Philippine Stock Exchange and a member of the Securities Clearing Corporation of the Philippines and the

Securities Investor Protection Fund. It is regulated by the Securities and Exchange Commission. Brazil: Banco J.P. Morgan S.A. is regulated by the

Comissao de Valores Mobiliarios (CVM) and by the Central Bank of Brazil. Mexico: J.P. Morgan Casa de Bolsa, S.A. de C.V., J.P. Morgan Grupo

Financiero is a member of the Mexican Stock Exchange and authorized to act as a broker dealer by the National Banking and Securities Exchange

Commission. Singapore: This material is issued and distributed in Singapore by or through J.P. Morgan Securities Singapore Private Limited (JPMSS)

15

Armina Soemino

(61-2) 9003-8620

armina.x.soemino@jpmorgan.com

Australia Equity Research

29 August 2014

[MCI (P) 199/03/2014 and Co. Reg. No.: 199405335R] which is a member of the Singapore Exchange Securities Trading Limited and is regulated by the

Monetary Authority of Singapore (MAS) and/or JPMorgan Chase Bank, N.A., Singapore branch (JPMCB Singapore) which is regulated by the MAS. This

material is provided in Singapore only to accredited investors, expert investors and institutional investors, as defined in Section 4A of the Securities and

Futures Act, Cap. 289. Recipients of this document are to contact JPMSS or JPMCB Singapore in respect of any matters arising from, or in connection

with, the document. Japan: JPMorgan Securities Japan Co., Ltd. is regulated by the Financial Services Agency in Japan. Malaysia: This material is issued

and distributed in Malaysia by JPMorgan Securities (Malaysia) Sdn Bhd (18146-X) which is a Participating Organization of Bursa Malaysia Berhad and a

holder of Capital Markets Services License issued by the Securities Commission in Malaysia. Pakistan: J. P. Morgan Pakistan Broking (Pvt.) Ltd is a

member of the Karachi Stock Exchange and regulated by the Securities and Exchange Commission of Pakistan. Saudi Arabia: J.P. Morgan Saudi Arabia

Ltd. is authorized by the Capital Market Authority of the Kingdom of Saudi Arabia (CMA) to carry out dealing as an agent, arranging, advising and

custody, with respect to securities business under licence number 35-07079 and its registered address is at 8th Floor, Al-Faisaliyah Tower, King Fahad

Road, P.O. Box 51907, Riyadh 11553, Kingdom of Saudi Arabia. Dubai: JPMorgan Chase Bank, N.A., Dubai Branch is regulated by the Dubai Financial

Services Authority (DFSA) and its registered address is Dubai International Financial Centre - Building 3, Level 7, PO Box 506551, Dubai, UAE.

Country and Region Specific Disclosures

U.K. and European Economic Area (EEA): Unless specified to the contrary, issued and approved for distribution in the U.K. and the EEA by JPMS plc.

Investment research issued by JPMS plc has been prepared in accordance with JPMS plc's policies for managing conflicts of interest arising as a result of

publication and distribution of investment research. Many European regulators require a firm to establish, implement and maintain such a policy. This

report has been issued in the U.K. only to persons of a kind described in Article 19 (5), 38, 47 and 49 of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons"). This document must not be acted on or relied on by persons

who are not relevant persons. Any investment or investment activity to which this document relates is only available to relevant persons and will be

engaged in only with relevant persons. In other EEA countries, the report has been issued to persons regarded as professional investors (or equivalent) in

their home jurisdiction. Australia: This material is issued and distributed by JPMSAL in Australia to "wholesale clients" only. This material does not take

into account the specific investment objectives, financial situation or particular needs of the recipient. The recipient of this material must not distribute it to

any third party or outside Australia without the prior written consent of JPMSAL. For the purposes of this paragraph the term "wholesale client" has the

meaning given in section 761G of the Corporations Act 2001. Germany: This material is distributed in Germany by J.P. Morgan Securities plc, Frankfurt

Branch and J.P.Morgan Chase Bank, N.A., Frankfurt Branch which are regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht. Hong Kong: The

1% ownership disclosure as of the previous month end satisfies the requirements under Paragraph 16.5(a) of the Hong Kong Code of Conduct for Persons

Licensed by or Registered with the Securities and Futures Commission. (For research published within the first ten days of the month, the disclosure may

be based on the month end data from two months prior.) J.P. Morgan Broking (Hong Kong) Limited is the liquidity provider/market maker for derivative

warrants, callable bull bear contracts and stock options listed on the Stock Exchange of Hong Kong Limited. An updated list can be found on HKEx

website: http://www.hkex.com.hk. Japan: There is a risk that a loss may occur due to a change in the price of the shares in the case of share trading, and

that a loss may occur due to the exchange rate in the case of foreign share trading. In the case of share trading, JPMorgan Securities Japan Co., Ltd., will be

receiving a brokerage fee and consumption tax (shouhizei) calculated by multiplying the executed price by the commission rate which was individually

agreed between JPMorgan Securities Japan Co., Ltd., and the customer in advance. Financial Instruments Firms: JPMorgan Securities Japan Co., Ltd.,

Kanto Local Finance Bureau (kinsho) No. 82 Participating Association / Japan Securities Dealers Association, The Financial Futures Association of Japan,

Type II Financial Instruments Firms Association and Japan Investment Advisers Association. Korea: This report may have been edited or contributed to

from time to time by affiliates of J.P. Morgan Securities (Far East) Ltd, Seoul Branch. Singapore: JPMSS and/or its affiliates may have a holding in any of

the securities discussed in this report; for securities where the holding is 1% or greater, the specific holding is disclosed in the Important Disclosures

section above. India: For private circulation only, not for sale. Pakistan: For private circulation only, not for sale. New Zealand: This material is issued

and distributed by JPMSAL in New Zealand only to persons whose principal business is the investment of money or who, in the course of and for the

purposes of their business, habitually invest money. JPMSAL does not issue or distribute this material to members of "the public" as determined in

accordance with section 3 of the Securities Act 1978. The recipient of this material must not distribute it to any third party or outside New Zealand without

the prior written consent of JPMSAL. Canada: The information contained herein is not, and under no circumstances is to be construed as, a prospectus, an

advertisement, a public offering, an offer to sell securities described herein, or solicitation of an offer to buy securities described herein, in Canada or any

province or territory thereof. Any offer or sale of the securities described herein in Canada will be made only under an exemption from the requirements to

file a prospectus with the relevant Canadian securities regulators and only by a dealer properly registered under applicable securities laws or, alternatively,

pursuant to an exemption from the dealer registration requirement in the relevant province or territory of Canada in which such offer or sale is made. The

information contained herein is under no circumstances to be construed as investment advice in any province or territory of Canada and is not tailored to

the needs of the recipient. To the extent that the information contained herein references securities of an issuer incorporated, formed or created under the

laws of Canada or a province or territory of Canada, any trades in such securities must be conducted through a dealer registered in Canada. No securities

commission or similar regulatory authority in Canada has reviewed or in any way passed judgment upon these materials, the information contained herein

or the merits of the securities described herein, and any representation to the contrary is an offence. Dubai: This report has been issued to persons regarded

as professional clients as defined under the DFSA rules. Brazil: Ombudsman J.P. Morgan: 0800-7700847 / ouvidoria.jp.morgan@jpmorgan.com.

General: Additional information is available upon request. Information has been obtained from sources believed to be reliable but JPMorgan Chase & Co.

or its affiliates and/or subsidiaries (collectively J.P. Morgan) do not warrant its completeness or accuracy except with respect to any disclosures relative to

JPMS and/or its affiliates and the analyst's involvement with the issuer that is the subject of the research. All pricing is as of the close of market for the

securities discussed, unless otherwise stated. Opinions and estimates constitute our judgment as of the date of this material and are subject to change

without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any

financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not

intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipient of this report must make its own

independent decisions regarding any securities or financial instruments mentioned herein. JPMS distributes in the U.S. research published by non-U.S.

affiliates and accepts responsibility for its contents. Periodic updates may be provided on companies/industries based on company specific developments or

announcements, market conditions or any other publicly available information. Clients should contact analysts and execute transactions through a J.P.

Morgan subsidiary or affiliate in their home jurisdiction unless governing law permits otherwise.

"Other Disclosures" last revised June 21, 2014.

16

Armina Soemino

(61-2) 9003-8620

armina.x.soemino@jpmorgan.com

Australia Equity Research

29 August 2014

Copyright 2014 JPMorgan Chase & Co. All rights reserved. This report or any portion hereof may not be reprinted, sold or

redistributed without the written consent of J.P. Morgan. #$J&098$#*P

17