Gauteng Music Strategic Framework 2009

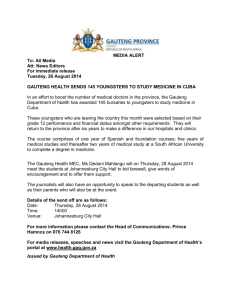

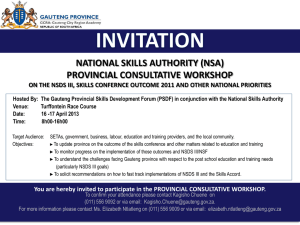

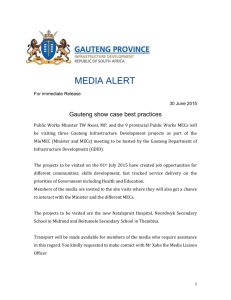

advertisement