bristol-myers squibb co

BUY

A+ A AB+

Annual Dividend Rate

$1.52

HOLD

B BC+

Annual Dividend Yield

2.41%

C CD+

Beta

0.53

D D-

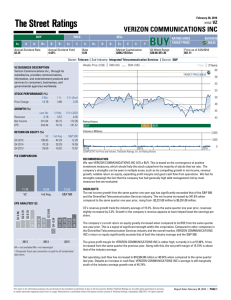

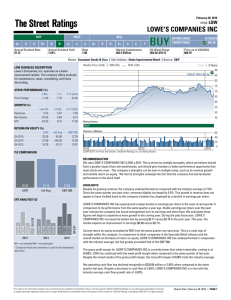

February 28, 2016

NYSE:

BMY

BRISTOL-MYERS SQUIBB CO

SELL

E+ E E-

Market Capitalization

$105.2 Billion

F

52-Week Range

$51.82-$70.87

Sector: Health Care Sub-Industry: Pharmaceuticals Source: S&P

Weekly Price: (US$) SMA (50) SMA (100)

BMY BUSINESS DESCRIPTION

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide.

RATING SINCE

1 Year

01/29/2016

Price as of 2/25/2016

$63.03

STOCK PERFORMANCE (%)

3 Mo.

Price Change -7.42

1 Yr.

3 Yr (Ann)

2.95

20.15

GROWTH (%)

Revenues

Net Income

EPS

Last Qtr

0.68

-1,615.38

-1,300.00

12 Mo.

3 Yr CAGR

4.28

-2.05

-21.91

-22.50

-7.23

-6.84

RETURN ON EQUITY (%)

BMY Ind Avg

Q4 2015

Q4 2014

Q4 2013

10.97

13.49

16.91

14.12

18.29

16.91

S&P 500

12.28

14.59

13.97

Rating History

BUY

Volume in Millions

HOLD BUY

2014 2015

COMPUSTAT for Price and Volume, TheStreet Ratings, Inc. for Rating History

HOLD BUY

2 Years

70

68

65

63

60

58

55

53

50

48

45

2016

75

50

25

0

P/E COMPARISON

67.77

BMY

EPS ANALYSIS¹ ($)

28.63

Ind Avg

21.53

S&P 500

RECOMMENDATION

We rate BRISTOL-MYERS SQUIBB CO (BMY) a HOLD. The primary factors that have impacted our rating are mixed - some indicating strength, some showing weaknesses, with little evidence to justify the expectation of either a positive or negative performance for this stock relative to most other stocks. The company's strengths can be seen in multiple areas, such as its revenue growth, largely solid financial position with reasonable debt levels by most measures and good cash flow from operations. However, as a counter to these strengths, we also find weaknesses including deteriorating net income, disappointing return on equity and feeble growth in the company's earnings per share.

HIGHLIGHTS

BMY's revenue growth has slightly outpaced the industry average of 6.4%. Since the same quarter one year prior, revenues slightly increased by 0.7%. This growth in revenue does not appear to have trickled down to the company's bottom line, displayed by a decline in earnings per share.

2013 2014 2015

NA = not available NM = not meaningful

1 Compustat fiscal year convention is used for all fundamental data items.

The current debt-to-equity ratio, 0.47, is low and is below the industry average, implying that there has been successful management of debt levels. Along with the favorable debt-to-equity ratio, the company maintains an adequate quick ratio of 1.05, which illustrates the ability to avoid short-term cash problems.

The gross profit margin for BRISTOL-MYERS SQUIBB CO is currently very high, coming in at 81.53%.

Regardless of BMY's high profit margin, it has managed to decrease from the same period last year. Despite the mixed results of the gross profit margin, BMY's net profit margin of -4.59% significantly underperformed when compared to the industry average.

The company, on the basis of change in net income from the same quarter one year ago, has significantly underperformed when compared to that of the S&P 500 and the Pharmaceuticals industry. The net income has significantly decreased by 1615.4% when compared to the same quarter one year ago, falling from $13.00

million to -$197.00 million.

The company's current return on equity has slightly decreased from the same quarter one year prior. This implies a minor weakness in the organization. When compared to other companies in the Pharmaceuticals industry and the overall market, BRISTOL-MYERS SQUIBB CO's return on equity is below that of both the industry average and the S&P 500.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 28, 2016 PAGE 1

Annual Dividend Rate

$1.52

Annual Dividend Yield

2.41%

PEER GROUP ANALYSIS

REVENUE GROWTH AND EBITDA MARGIN*

FA

VO

RA

BL

E

February 28, 2016

NYSE:

BMY

BRISTOL-MYERS SQUIBB CO

Sector: Health Care Pharmaceuticals Source: S&P

Beta

0.53

Market Capitalization

$105.2 Billion

52-Week Range

$51.82-$70.87

Price as of 2/25/2016

$63.03

INDUSTRY ANALYSIS

US pharmaceutical companies are involved in the discovery, manufacturing, distribution, and research of generic and branded drugs. The industry accounts for 27.3% of the healthcare sector and is capital-intensive with exorbitant R&D costs. Most companies are mature and characterized by high margins and higher dividend pay-outs. Major players include Pfizer (PFE), Bristol-Myers Squibb (BMY), Abbott Laboratories (ABT), and Eli Lilly (LLY). The industry employs more than 400,000 in the US. The 50 largest companies control over

80% of the market.

The industry faces unprecedented challenges from stringent environmental regulations and patent expirations on billion-dollar products. Industry experts believe that generic competition will wipe out more than $60 billion from US industry sales over the next five years as more than three dozen drugs lose patent protection. Merck lost a $3 billion patent protection for its osteoporosis drug Fosamax in 2008 while Eli Lilly lost an estimated 90% of Zyprexa sales. The FDA is rejecting more drugs on safety concerns and a lack of compelling evidence of definite advancement from existing drugs.

UN

FA

VO

RA

BL

E

5% 55%

EBITDA Margin (TTM)

Companies with higher EBITDA margins and revenue growth rates are outperforming companies with lower EBITDA margins and revenue growth rates. Companies for this scatter plot have a market capitalization between $28.9 Billion and $188.8

Billion. Companies with NA or NM values do not appear.

*EBITDA – Earnings Before Interest, Taxes, Depreciation and

Amortization.

REVENUE GROWTH AND EARNINGS YIELD

The industry depends on federal subsidies for cost reductions. The US government enacted the Medicare

Prescription Drug, Improvement, and Modernization Act (MMA) in 2003 to provide prescription drug benefits to the elderly and disabled. Medicare Part D, a component of MMA, which came into effect in 2006, altered the revenue model of pharma companies. Revenue from such programs is expected to reach $724 billion by

2015 as federal subsidies will lower co-payments and deductibles for specialty drugs.

Horizontal and vertical integration has created health maintenance organizations (HMOs) and pharmacy benefit management firms (PBMs). In order to cut costs and remain competitive, the US pharma majors have been outsourcing research to low-cost service providers in India and China.

The promising era of personalized medicine has begun. Dozens of exciting new drugs for the treatment of dire diseases such as cancer, AIDS, Parkinson's, and Alzheimer's are either on the market or are very close to regulatory approval. The industry has shifted its focus from blockbuster drugs (chemistry-based drugs) to specialized products, geared towards specific disorders. According to government estimates, American drug purchases may reach $497 billion by 2016, supported by a rapidly aging population, inflation, and the introduction of expensive new drugs.

FA

VO

RA

BL

E

UN

FA

VO

RA

BL

E

-3%

SHPG

NVO

SNY

5%

Earnings Yield (TTM)

Companies that exhibit both a high earnings yield and high revenue growth are generally more attractive than companies with low revenue growth and low earnings yield. Companies for this scatter plot have revenue growth rates between -8.3% and

79.8%. Companies with NA or NM values do not appear.

Ticker

BMY

LLY

AZN

TEVA

SHPG

VRX

PFE

PEER GROUP: Pharmaceuticals

Company Name

BRISTOL-MYERS SQUIBB CO

LILLY (ELI) & CO

Recent

Price ($)

63.03

74.82

ASTRAZENECA PLC

TEVA PHARMACEUTICALS

29.64

57.58

SHIRE PLC

VALEANT PHARMACEUTICALS INT

162.77

84.71

PFIZER INC 30.59

MRK

AGN

NVO

SNY

MERCK & CO

ALLERGAN PLC

NOVO NORDISK A/S

SANOFI

51.00

296.34

52.02

40.30

Market

Cap ($M)

105,231

82,758

74,940

58,814

32,152

28,902

188,847

142,471

121,789

107,295

105,239

The peer group comparison is based on Major Pharmaceuticals companies of comparable size.

Price/

Earnings

67.77

33.11

26.58

31.64

24.08

48.13

24.67

32.69

NM

26.54

20.25

Net Sales Net Income

TTM ($M) TTM ($M)

16,560.00

19,958.70

1,565.00

2,408.40

26,208.00

19,652.00

6,416.70

9,990.10

48,851.00

2,825.00

1,588.00

1,303.40

605.10

7,745.00

39,498.00

15,071.00

15,704.64

37,855.56

4,442.00

3,915.20

5,072.54

4,655.25

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 28, 2016 PAGE 2

February 28, 2016

NYSE:

BMY

BRISTOL-MYERS SQUIBB CO

Annual Dividend Yield

2.41%

Sector: Health Care Pharmaceuticals Source: S&P

Beta

0.53

Market Capitalization

$105.2 Billion

52-Week Range

$51.82-$70.87

Price as of 2/25/2016

$63.03

Annual Dividend Rate

$1.52

COMPANY DESCRIPTION

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide. It offers chemically-synthesized drug or small molecule, and biologic in various therapeutic areas, including virology comprising human immunodeficiency virus infection

(HIV); oncology; immunoscience; cardiovascular; and neuroscience. Its products include Baraclude for the treatment of chronic hepatitis B virus infection; Daklinza and Sunvepra for the treatment of hepatitis C virus infection; Reyataz and Sustiva for the treatment of HIV;

Empliciti, a humanized monoclonal antibody for the treatment of multiple myeloma; Erbitux, an IgG1 monoclonal antibody that targets and blocks the epidermal growth factor receptor; Opdivo, a fully human monoclonal antibody for non-small cell lung cancer, renal cell cancer, and melanoma; Sprycel, a multi-targeted tyrosine kinase inhibitor for the treatment of adults with

Philadelphia chromosome-positive chronic myeloid leukemia; Yervoy, a monoclonal antibody for the treatment of patients with metastatic melanoma; Abilify, an antipsychotic agent for adult patients with schizophrenia, bipolar mania disorder, and major depressive disorder; Orencia to treat rheumatoid arthritis; and Eliquis, an oral factor Xa inhibitor targeted at stroke prevention in atrial fibrillation, and the prevention and treatment of venous thromboembolic disorders. Its products pipeline includes Beclabuvir, a non-nucleoside NS5B inhibitor that is in regulatory review for the treatment of HCV; BMS-663068, an investigational compound that is being studied in HIV-1; and Prostvac, a Phase III prostate-specific antigen to treat asymptomatic or minimally symptomatic metastatic castration-resistant prostate cancer. The company was formerly known as Bristol-Myers Company and changed its name to Bristol-Myers Squibb Company in 1989. The company was founded in 1887 and is headquartered in

New York, New York.

BRISTOL-MYERS SQUIBB CO

345 Park Avenue

New York, NY 10154

USA

Phone: 212-546-4000 http://www.bms.com

STOCK-AT-A-GLANCE

Below is a summary of the major fundamental and technical factors we consider when determining our overall recommendation of BMY shares. It is provided in order to give you a deeper understanding of our rating methodology as well as to paint a more complete picture of a stock's strengths and weaknesses. It is important to note, however, that these factors only tell part of the story. To gain an even more comprehensive understanding of our stance on the stock, these factors must be assessed in combination with the stock’s valuation. Please refer to our Valuation section on page 5 for further information.

FACTOR SCORE

Growth

1.0

out of 5 stars

Measures the growth of both the company's income statement and cash flow. On this factor, BMY has a growth score better than 10% of the stocks we rate.

weak

Total Return

4.5

out of 5 stars

Measures the historical price movement of the stock. The stock performance of this company has beaten 80% of the companies we cover.

weak

Efficiency

4.0

out of 5 stars

Measures the strength and historic growth of a company's return on invested capital. The company has generated more income per dollar of capital than 70% of the companies we review.

weak

Price volatility

4.5

out of 5 stars

Measures the volatility of the company's stock price historically. The stock is less volatile than 80% of the stocks we monitor.

weak

Solvency

5.0

out of 5 stars

Measures the solvency of the company based on several ratios. The company is more solvent than 90% of the companies we analyze.

weak

Income

4.0

out of 5 stars

Measures dividend yield and payouts to shareholders. The company's dividend is higher than 70% of the companies we track.

weak

THESTREET RATINGS RESEARCH METHODOLOGY strong strong strong strong strong strong

TheStreet Ratings' stock model projects a stock's total return potential over a 12-month period including both price appreciation and dividends. Our Buy, Hold or Sell ratings designate how we expect these stocks to perform against a general benchmark of the equities market and interest rates. While our model is quantitative, it utilizes both subjective and objective elements. For instance, subjective elements include expected equities market returns, future interest rates, implied industry outlook and forecasted company earnings. Objective elements include volatility of past operating revenues, financial strength, and company cash flows.

Our model gauges the relationship between risk and reward in several ways, including: the pricing drawdown as compared to potential profit volatility, i.e.how much one is willing to risk in order to earn profits; the level of acceptable volatility for highly performing stocks; the current valuation as compared to projected earnings growth; and the financial strength of the underlying company as compared to its stock's valuation as compared to projected earnings growth; and the financial strength of the underlying company as compared to its stock's performance. These and many more derived observations are then combined, ranked, weighted, and scenario-tested to create a more complete analysis. The result is a systematic and disciplined method of selecting stocks.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 28, 2016 PAGE 3

BALANCE SHEET

Cash & Equiv. ($mil)

Total Assets ($mil)

Total Debt ($mil)

Equity ($mil)

PROFITABILITY

Gross Profit Margin

EBITDA Margin

Operating Margin

Sales Turnover

Return on Assets

Return on Equity

DEBT

Current Ratio

Debt/Capital

Interest Expense

Interest Coverage

Annual Dividend Rate

$1.52

Consensus EPS Estimates² ($)

IBES consensus estimates are provided by Thomson Financial

February 28, 2016

NYSE:

BMY

BRISTOL-MYERS SQUIBB CO

Annual Dividend Yield

2.41%

Sector: Health Care Pharmaceuticals Source: S&P

Beta

0.53

Market Capitalization

$105.2 Billion

52-Week Range

$51.82-$70.87

Price as of 2/25/2016

$63.03

FINANCIAL ANALYSIS

BRISTOL-MYERS SQUIBB CO's gross profit margin for the fourth quarter of its fiscal year 2015 is essentially unchanged when compared to the same period a year ago. Even though sales increased, the net income has decreased, representing a decrease to the bottom line. BRISTOL-MYERS SQUIBB CO has average liquidity.

Currently, the Quick Ratio is 1.05 which shows that technically this company has the ability to cover short-term cash needs. The company's liquidity has decreased from the same period last year.

0.64

Q1 FY16

2.37 E

2016(E)

3.06 E

2017(E)

During the same period, stockholders' equity ("net worth") has remained virtually unchanged only decreasing by 3.94% from the same quarter last year. Together, the key liquidity measurements indicate that it is relatively unlikely that the company will face financial difficulties in the near future.

STOCKS TO BUY: TheStreet Quant Ratings has identified a handful of stocks that can potentially TRIPLE in the next 12-months. To learn more visit www.TheStreetRatings.com.

INCOME STATEMENT

Net Sales ($mil)

EBITDA ($mil)

EBIT ($mil)

Net Income ($mil)

Q4 FY15

4,287.00

256.00

106.00

-197.00

Q4 FY14

4,258.00

966.00

771.00

13.00

Q4 FY15

4,270.00

31,748.00

6,689.00

14,266.00

Q4 FY15

81.53%

5.97%

2.47%

0.52

4.92%

10.97%

Q4 FY15

1.30

0.32

43.00

2.47

Q4 FY14

7,435.00

33,749.00

7,832.00

14,852.00

Q4 FY14

82.62%

22.68%

18.11%

0.47

5.93%

13.49%

Q4 FY14

1.73

0.35

53.00

14.55

SHARE DATA

Shares outstanding (mil)

Div / share

EPS

Book value / share

Institutional Own %

Avg Daily Volume

Q4 FY15

1,669

0.38

-0.12

8.55

NA

6,813,492

Q4 FY14

1,661

0.73

0.01

8.94

NA

7,158,156

2 Sum of quarterly figures may not match annual estimates due to use of median consensus estimates.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 28, 2016 PAGE 4

February 28, 2016

NYSE:

BMY

BRISTOL-MYERS SQUIBB CO

Annual Dividend Yield

2.41%

Sector: Health Care Pharmaceuticals Source: S&P

Beta

0.53

Market Capitalization

$105.2 Billion

52-Week Range

$51.82-$70.87

Price as of 2/25/2016

$63.03

Annual Dividend Rate

$1.52

RATINGS HISTORY

Our rating for BRISTOL-MYERS SQUIBB CO was recently downgraded from Buy to Hold on

1/29/2016. As of 2/25/2016, the stock was trading at a price of $63.03 which is 11.1% below its 52-week high of $70.87 and 21.6% above its 52-week low of

$51.82.

VALUATION

HOLD. BRISTOL-MYERS SQUIBB CO's P/E ratio indicates a significant premium compared to an average of

28.63 for the Pharmaceuticals industry and a significant premium compared to the S&P 500 average of 21.53.

Conducting a second comparison, its price-to-book ratio of 7.37 indicates a significant premium versus the

S&P 500 average of 2.56 and a premium versus the industry average of 6.98. The price-to-sales ratio is well above the S&P 500 average, but well below the industry average. After reviewing these and other key valuation criteria, BRISTOL-MYERS SQUIBB CO proves to trade at a premium to investment alternatives within the industry.

2 Year Chart

$70

2014 2015

$60

$50

MOST RECENT RATINGS CHANGES

Date

1/29/16

Price Action

$62.16 Downgrade

10/28/15

7/24/15

4/29/15

3/5/15

2/25/14

$67.59

$64.29

$53.68

Upgrade

$65.98 Downgrade

Upgrade

$66.05 Downgrade

No Change

From To

Buy Hold

Hold Buy

Buy Hold

Hold Buy

Buy Hold

Buy Buy

Price reflects the closing price as of the date listed, if available

RATINGS DEFINITIONS &

DISTRIBUTION OF THESTREET RATINGS

(as of 2/25/2016)

32.19% Buy - We believe that this stock has the opportunity to appreciate and produce a total return of more than 10% over the next 12 months.

35.29% Hold - We do not believe this stock offers conclusive evidence to warrant the purchase or sale of shares at this time and that its likelihood of positive total return is roughly in balance with the risk of loss.

Price/Earnings

1 2 3 4 5 premium discount

Peers 28.63

BMY 67.77

• Premium. A higher P/E ratio than its peers can signify a more expensive stock or higher growth expectations.

• BMY is trading at a significant premium to its peers.

Price/Projected Earnings

1 2 3 4 5 premium discount

Peers 14.85

BMY 20.62

• Premium. A higher price-to-projected earnings ratio than its peers can signify a more expensive stock or higher future growth expectations.

• BMY is trading at a significant premium to its peers.

Price/Book 1 2 3 4 5 premium discount

Peers 6.98

BMY 7.37

• Average. A lower price-to-book ratio makes a stock more attractive to investors seeking stocks with lower market values per dollar of equity on the balance sheet.

• BMY is trading at a valuation on par with its peers.

Price/Sales 1 2 3 4 5 premium discount

Peers 14.06

BMY 6.35

• Discount. In the absence of P/E and P/B multiples, the price-to-sales ratio can display the value investors are placing on each dollar of sales.

• BMY is trading at a significant discount to its industry on this measurement.

Price/CashFlow

1 2 3 4 5 premium discount

Peers 28.80

BMY 57.42

• Premium. The P/CF ratio, a stock’s price divided by the company's cash flow from operations, is useful for comparing companies with different capital requirements or financing structures.

• BMY is trading at a significant premium to its peers.

Price to Earnings/Growth 1 2 3 4 5 premium discount

Peers 0.64

BMY 0.44

• Discount. The PEG ratio is the stock’s P/E divided by the consensus estimate of long-term earnings growth. Faster growth can justify higher price multiples.

• BMY trades at a significant discount to its peers.

Earnings Growth

1 2 3 4 5 lower higher

Peers 14.97

BMY -22.50

• Lower. Elevated earnings growth rates can lead to capital appreciation and justify higher price-to-earnings ratios.

• However, BMY is expected to significantly trail its peers on the basis of its earnings growth rate.

Sales Growth

1 2 3 4 5 lower higher

Peers 9.44

BMY 4.28

• Lower. A sales growth rate that trails the industry implies that a company is losing market share.

• BMY significantly trails its peers on the basis of sales growth

32.52% Sell - We believe that this stock is likely to decline by more than 10% over the next 12 months, with the risk involved too great to compensate for any possible returns.

TheStreet Ratings

14 Wall Street, 15th Floor

New York, NY 10005 www.thestreet.com

Research Contact: 212-321-5381

Sales Contact: 866-321-8726

DISCLAIMER:

The opinions and information contained herein have been obtained or derived from sources believed to be reliable, but

TheStreet Ratings cannot guarantee its accuracy and completeness, and that of the opinions based thereon. Data is provided via the COMPUSTAT® Xpressfeed product from Standard &Poor's, a division of The McGraw-Hill Companies, Inc., as well as other third-party data providers.

TheStreet Ratings is a division of TheStreet, Inc., which is a publisher. This research report contains opinions and is provided for informational purposes only. You should not rely solely upon the research herein for purposes of transacting securities or other investments, and you are encouraged to conduct your own research and due diligence, and to seek the advice of a qualified securities professional, before you make any investment. None of the information contained in this report constitutes, or is intended to constitute a recommendation by TheStreet Ratings of any particular security or trading strategy or a determination by TheStreet Ratings that any security or trading strategy is suitable for any specific person. To the extent any of the information contained herein may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Your use of this report is governed by TheStreet, Inc.'s Terms of Use found at http://www.thestreet.com/static/about/terms-of-use.html.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 28, 2016 PAGE 5