February 28, 2016

NASDAQ: NFLX

NETFLIX INC

BUY

A+

A

A-

HOLD

B+

B

Annual Dividend Rate

NA

B-

C+

C

Annual Dividend Yield

NA

SELL

C-

D+

D

Beta

1.66

Sector: Consumer Goods & Svcs

NFLX BUSINESS DESCRIPTION

Netflix, Inc., an Internet television network,

engages in the Internet delivery of television (TV)

shows and movies on various Internet-connected

screens. The Company operates in three segments:

Domestic streaming, International streaming and

Domestic DVD.

D-

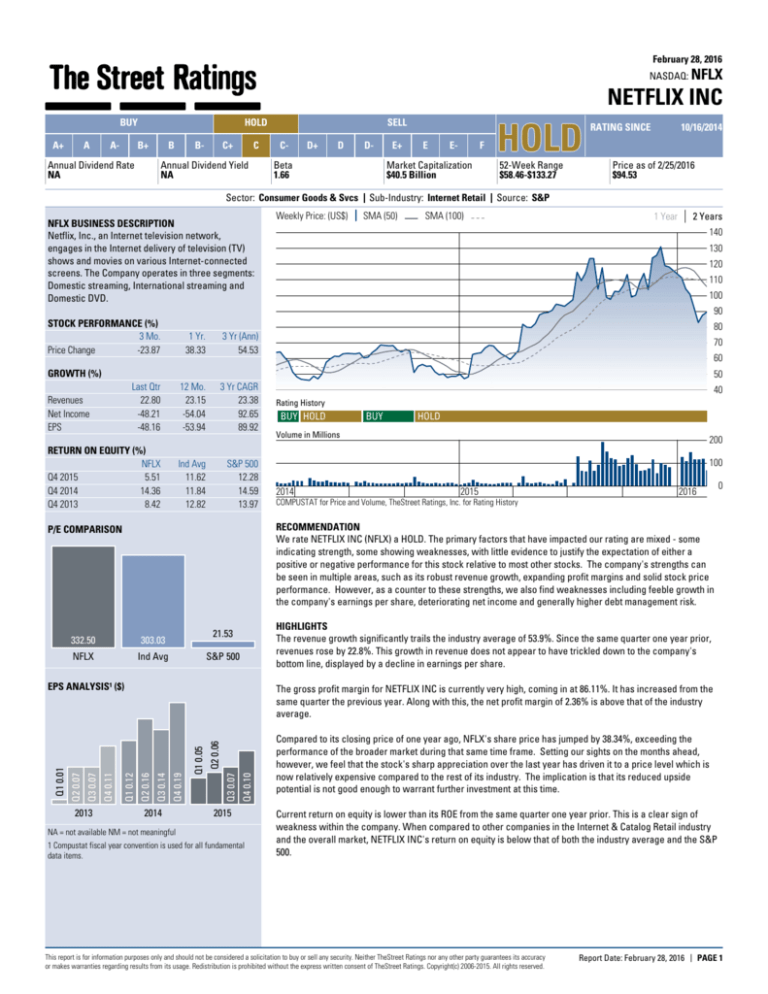

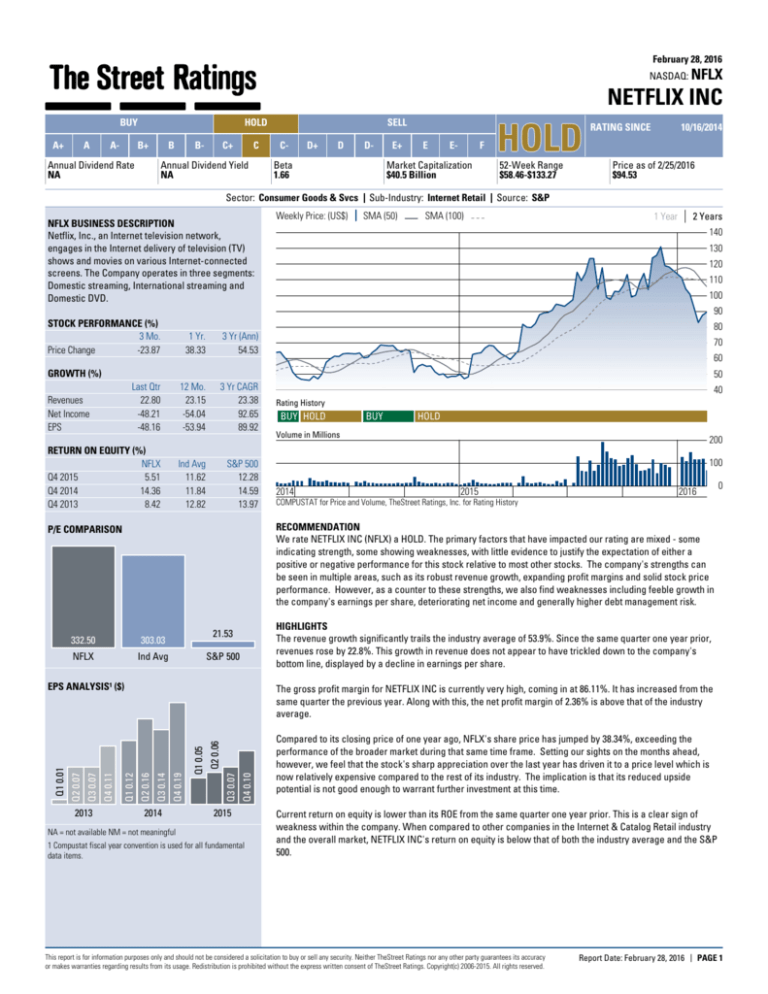

Weekly Price: (US$)

E+

E

E-

F

Market Capitalization

$40.5 Billion

Sub-Industry: Internet Retail

SMA (50)

HOLD

52-Week Range

$58.46-$133.27

RATING SINCE

10/16/2014

Price as of 2/25/2016

$94.53

Source: S&P

SMA (100)

1 Year

2 Years

140

130

120

110

100

90

STOCK PERFORMANCE (%)

3 Mo.

Price Change

-23.87

80

1 Yr.

38.33

3 Yr (Ann)

54.53

12 Mo.

23.15

-54.04

-53.94

3 Yr CAGR

23.38

92.65

89.92

70

60

GROWTH (%)

50

Last Qtr

22.80

-48.21

-48.16

Revenues

Net Income

EPS

RETURN ON EQUITY (%)

NFLX

Q4 2015

5.51

Q4 2014

14.36

Q4 2013

8.42

Ind Avg

11.62

11.84

12.82

S&P 500

12.28

14.59

13.97

332.50

303.03

NFLX

Ind Avg

HOLD

Volume in Millions

200

100

2014

2015

0

2016

COMPUSTAT for Price and Volume, TheStreet Ratings, Inc. for Rating History

S&P 500

2014

Q4 0.10

Q2 0.06

Q3 0.07

Q1 0.05

Q4 0.19

Q3 0.14

Q2 0.16

The gross profit margin for NETFLIX INC is currently very high, coming in at 86.11%. It has increased from the

same quarter the previous year. Along with this, the net profit margin of 2.36% is above that of the industry

average.

Q1 0.12

Q4 0.11

Q3 0.07

Q1 0.01

BUY

HIGHLIGHTS

The revenue growth significantly trails the industry average of 53.9%. Since the same quarter one year prior,

revenues rose by 22.8%. This growth in revenue does not appear to have trickled down to the company's

bottom line, displayed by a decline in earnings per share.

21.53

EPS ANALYSIS¹ ($)

Q2 0.07

BUY HOLD

RECOMMENDATION

We rate NETFLIX INC (NFLX) a HOLD. The primary factors that have impacted our rating are mixed - some

indicating strength, some showing weaknesses, with little evidence to justify the expectation of either a

positive or negative performance for this stock relative to most other stocks. The company's strengths can

be seen in multiple areas, such as its robust revenue growth, expanding profit margins and solid stock price

performance. However, as a counter to these strengths, we also find weaknesses including feeble growth in

the company's earnings per share, deteriorating net income and generally higher debt management risk.

P/E COMPARISON

2013

40

Rating History

2015

NA = not available NM = not meaningful

1 Compustat fiscal year convention is used for all fundamental

data items.

Compared to its closing price of one year ago, NFLX's share price has jumped by 38.34%, exceeding the

performance of the broader market during that same time frame. Setting our sights on the months ahead,

however, we feel that the stock's sharp appreciation over the last year has driven it to a price level which is

now relatively expensive compared to the rest of its industry. The implication is that its reduced upside

potential is not good enough to warrant further investment at this time.

Current return on equity is lower than its ROE from the same quarter one year prior. This is a clear sign of

weakness within the company. When compared to other companies in the Internet & Catalog Retail industry

and the overall market, NETFLIX INC's return on equity is below that of both the industry average and the S&P

500.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 28, 2016

PAGE 1

February 28, 2016

NASDAQ: NFLX

NETFLIX INC

Sector: Consumer Goods & Svcs Internet Retail Source: S&P

Annual Dividend Rate

NA

Annual Dividend Yield

NA

PEER GROUP ANALYSIS

Market Capitalization

$40.5 Billion

52-Week Range

$58.46-$133.27

Price as of 2/25/2016

$94.53

INDUSTRY ANALYSIS

The internet and catalog retailing industry includes 16,000 companies with combined annual revenue of over

$160 billion. Major companies include Lands’ End, LL Bean, Amazon.com (AMZN), Overstock.com (OSTK) and

Hanover Direct. The top 50 companies account for approximately 60% of total industry revenue. The catalog

retail sector consists of mail order, television and catalog channels while internet retail includes all services

through online channels. Demand is driven by consumer spending, which ties the profitability of companies to

their active customer base.

125%

REVENUE GROWTH AND EBITDA MARGIN*

QUNR

V

FA

AB

OR

JD

Beta

1.66

UN

R

VO

FA

0%

LE

AB

Revenue Growth (TTM)

LE

Over the past five years, the industry pattern has shifted from catalog to internet sales. Internet sales have

been the driver for overall health of the internet & catalog industry as internet use has increased to over 70%

of US households. The evolution of secure user interfaces and the increased convenience of online shopping

are expected to drive growth in the coming quarters. In order to increase online sales, companies offer

reduced prices, free shipping and more variety. Although the broader retail industry is expected to remain

sluggish during the slow recovery from the US economic slowdown, the internet will help drive sales.

TRIP

-60%

AMZN

NFLX

EXPE

PCLN

60%

EBITDA Margin (TTM)

Companies with higher EBITDA margins and

revenue growth rates are outperforming companies

with lower EBITDA margins and revenue growth

rates. Companies for this scatter plot have a market

capitalization between $4.7 Billion and $261.4 Billion.

Companies with NA or NM values do not appear.

*EBITDA – Earnings Before Interest, Taxes, Depreciation and

Amortization.

US online retail has evolved from a fledgling industry to a mature, mainstream, and integrated industry with

multiple offline channels. However, the next phase of e-commerce growth will require retailers to innovate

and invest in technologies that optimize the connection between online and offline elements. Failure to

address risks associated with payment methods, credit card fraud and other consumer fraud could hamper

sales growth.

Catalog retailing has witnessed a dynamic shift in its business model from call-centers to websites. Many

catalog retailers have adapted their operations to the web as a result of a change in customer preferences.

Companies such as L.L. Bean and Lands’ End have succeeded with this strategy while also maintaining their

catalog operations. By doing so, they provide services to traditional catalog shoppers and enjoy a web

operation that helps keep fixed-costs down while attracting new customers. Catalogs are currently driving

more than half of internet sales.

The catalog industry shows a trend of sustained growth in multi-channel retailing. The two main channels,

namely direct-to-consumer (DTC) and store, will emerge from the convergence of catalog and internet sales.

The industry is expected to experience higher sales growth in the direct-to-consumer segment.

125%

REVENUE GROWTH AND EARNINGS YIELD

QUNR

V

FA

PEER GROUP: Internet & Catalog Retail

AB

OR

JD

LE

CTRP

UN

R

VO

FA

0%

LE

AB

Revenue Growth (TTM)

VIPS

-12%

AMZN NFLXTRIP

EXPE

PCLN

6%

Earnings Yield (TTM)

Companies that exhibit both a high earnings yield

and high revenue growth are generally more

attractive than companies with low revenue growth

and low earnings yield. Companies for this scatter

plot have revenue growth rates between 9.3% and

123.3%. Companies with NA or NM values do not

appear.

Ticker

NFLX

TRIP

PCLN

VIPS

LVNTA

LVNTB

QUNR

JD

AMZN

CTRP

EXPE

Recent

Company Name

Price ($)

NETFLIX INC

94.53

TRIPADVISOR INC

62.05

PRICELINE GROUP INC

1,263.41

VIPSHOP HOLDINGS LTD -ADR

11.33

LIBERTY VENTURES

36.05

LIBERTY VENTURES

35.55

QUNAR CAYMAN ISLANDS -ADR 37.12

JD.COM INC -ADR

24.93

AMAZON.COM INC

555.15

CTRIP.COM INTL LTD

41.22

EXPEDIA INC

105.13

Market

Cap ($M)

40,467

8,219

62,687

5,655

5,111

5,111

4,714

27,787

261,388

18,560

14,485

Price/

Earnings

332.50

45.63

25.42

29.82

22.67

22.36

NM

NM

447.70

45.55

18.28

Net Sales

TTM ($M)

6,779.51

1,492.00

9,223.99

5,567.91

1,147.00

1,147.00

541.83

25,854.79

107,006.00

1,586.70

6,672.32

Net Income

TTM ($M)

122.64

198.00

2,551.36

230.10

194.00

194.00

-468.22

-353.64

596.00

346.19

764.47

The peer group comparison is based on Major Internet Retail companies of comparable size.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 28, 2016

PAGE 2

February 28, 2016

NASDAQ: NFLX

NETFLIX INC

Sector: Consumer Goods & Svcs Internet Retail Source: S&P

Annual Dividend Rate

NA

Annual Dividend Yield

NA

COMPANY DESCRIPTION

Netflix, Inc., an Internet television network, engages in

the Internet delivery of television (TV) shows and movies

on various Internet-connected screens. The Company

operates in three segments: Domestic streaming,

International streaming and Domestic DVD. It offer

members with the ability to receive TV shows and

movies streaming content, including original series,

documentaries, and feature films through a host of

Internet-connected screens, such as TVs, digital video

players, TV set-top boxes, and mobile devices. The

company also provides DVDs-by-mail membership

services. It serves approximately 75 million members in

190 countries. Netflix, Inc. was founded in 1997 and is

headquartered in Los Gatos, California.

NETFLIX INC

100 Winchester Circle

Los Gatos, CA 95032

USA

Phone: 408-540-3700

http://www.netflix.com

Beta

1.66

Market Capitalization

$40.5 Billion

52-Week Range

$58.46-$133.27

Price as of 2/25/2016

$94.53

STOCK-AT-A-GLANCE

Below is a summary of the major fundamental and technical factors we consider when determining our

overall recommendation of NFLX shares. It is provided in order to give you a deeper understanding of our

rating methodology as well as to paint a more complete picture of a stock's strengths and weaknesses. It is

important to note, however, that these factors only tell part of the story. To gain an even more comprehensive

understanding of our stance on the stock, these factors must be assessed in combination with the stock’s

valuation. Please refer to our Valuation section on page 5 for further information.

FACTOR

SCORE

2.0

Growth

out of 5 stars

weak

Measures the growth of both the company's income statement and

cash flow. On this factor, NFLX has a growth score better than 30% of

the stocks we rate.

strong

4.0

Total Return

out of 5 stars

weak

Measures the historical price movement of the stock. The stock

performance of this company has beaten 70% of the companies we

cover.

strong

3.0

Efficiency

out of 5 stars

weak

Measures the strength and historic growth of a company's return on

invested capital. The company has generated more income per dollar of

capital than 50% of the companies we review.

strong

4.0

Price volatility

out of 5 stars

weak

Measures the volatility of the company's stock price historically. The

stock is less volatile than 70% of the stocks we monitor.

strong

5.0

Solvency

out of 5 stars

weak

Measures the solvency of the company based on several ratios. The

company is more solvent than 90% of the companies we analyze.

strong

0.5

Income

out of 5 stars

weak

Measures dividend yield and payouts to shareholders. This company

pays no dividends.

strong

THESTREET RATINGS RESEARCH METHODOLOGY

TheStreet Ratings' stock model projects a stock's total return potential over a 12-month period including both

price appreciation and dividends. Our Buy, Hold or Sell ratings designate how we expect these stocks to

perform against a general benchmark of the equities market and interest rates. While our model is

quantitative, it utilizes both subjective and objective elements. For instance, subjective elements include

expected equities market returns, future interest rates, implied industry outlook and forecasted company

earnings. Objective elements include volatility of past operating revenues, financial strength, and company

cash flows.

Our model gauges the relationship between risk and reward in several ways, including: the pricing drawdown

as compared to potential profit volatility, i.e.how much one is willing to risk in order to earn profits; the level of

acceptable volatility for highly performing stocks; the current valuation as compared to projected earnings

growth; and the financial strength of the underlying company as compared to its stock's valuation as

compared to projected earnings growth; and the financial strength of the underlying company as compared

to its stock's performance. These and many more derived observations are then combined, ranked, weighted,

and scenario-tested to create a more complete analysis. The result is a systematic and disciplined method of

selecting stocks.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 28, 2016

PAGE 3

February 28, 2016

NASDAQ: NFLX

NETFLIX INC

Sector: Consumer Goods & Svcs Internet Retail Source: S&P

Annual Dividend Rate

NA

Annual Dividend Yield

NA

Consensus EPS Estimates² ($)

IBES consensus estimates are provided by Thomson Financial

0.03

0.25 E

1.10 E

Q1 FY16

2016(E)

2017(E)

Beta

1.66

Market Capitalization

$40.5 Billion

52-Week Range

$58.46-$133.27

Price as of 2/25/2016

$94.53

FINANCIAL ANALYSIS

NETFLIX INC's gross profit margin for the fourth quarter of its fiscal year 2015 is essentially unchanged when

compared to the same period a year ago. Even though sales increased, the net income has decreased,

representing a decrease to the bottom line. NETFLIX INC has weak liquidity. Currently, the Quick Ratio is 0.65

which shows a lack of ability to cover short-term cash needs. The company's liquidity has increased from the

same period last year.

During the same period, stockholders' equity ("net worth") has increased by 19.68% from the same quarter last

year. Overall, the key liquidity measurements indicate that the company is in a position in which financial

difficulties could develop in the future.

STOCKS TO BUY: TheStreet Quant Ratings has identified a handful of stocks that can potentially TRIPLE in the

next 12-months. To learn more visit www.TheStreetRatings.com.

INCOME STATEMENT

Net Sales ($mil)

EBITDA ($mil)

EBIT ($mil)

Net Income ($mil)

Q4 FY15

1,823.33

1,056.04

59.89

43.18

Q4 FY14

1,484.73

829.89

65.05

83.37

Q4 FY15

2,310.72

10,202.87

2,400.36

2,223.43

Q4 FY14

1,608.50

7,056.65

929.60

1,857.71

Q4 FY15

86.11%

57.91%

3.28%

0.66

1.20%

5.51%

Q4 FY14

83.20%

55.89%

4.38%

0.78

3.78%

14.36%

Q4 FY15

1.54

0.52

35.43

1.69

Q4 FY14

1.48

0.33

13.35

4.87

Q4 FY15

428

0.00

0.10

5.20

NA

19,421,988

Q4 FY14

423

0.00

0.19

4.39

NA

20,027,062

BALANCE SHEET

Cash & Equiv. ($mil)

Total Assets ($mil)

Total Debt ($mil)

Equity ($mil)

PROFITABILITY

Gross Profit Margin

EBITDA Margin

Operating Margin

Sales Turnover

Return on Assets

Return on Equity

DEBT

Current Ratio

Debt/Capital

Interest Expense

Interest Coverage

SHARE DATA

Shares outstanding (mil)

Div / share

EPS

Book value / share

Institutional Own %

Avg Daily Volume

2 Sum of quarterly figures may not match annual estimates due to

use of median consensus estimates.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 28, 2016

PAGE 4

February 28, 2016

NASDAQ: NFLX

NETFLIX INC

Sector: Consumer Goods & Svcs Internet Retail Source: S&P

Annual Dividend Rate

NA

Annual Dividend Yield

NA

RATINGS HISTORY

Our rating for NETFLIX INC has not changed since

10/16/2014. As of 2/25/2016, the stock was trading at

a price of $94.53 which is 29.1% below its 52-week

high of $133.27 and 61.7% above its 52-week low of

$58.46.

$150

HOLD: $51.67

BUY: $61.58

HOLD: $49.84

2 Year Chart

$100

$50

2014

2015

MOST RECENT RATINGS CHANGES

Date

Price

Action

10/16/14

$51.67 Downgrade

7/22/14

$61.58

Upgrade

4/8/14

$49.84 Downgrade

2/25/14

$64.72 No Change

From

Buy

Hold

Buy

Buy

To

Hold

Buy

Hold

Buy

Price reflects the closing price as of the date listed, if available

RATINGS DEFINITIONS &

DISTRIBUTION OF THESTREET RATINGS

(as of 2/25/2016)

32.19% Buy - We believe that this stock has the

opportunity to appreciate and produce a total return of

more than 10% over the next 12 months.

35.29% Hold - We do not believe this stock offers

conclusive evidence to warrant the purchase or sale of

shares at this time and that its likelihood of positive total

return is roughly in balance with the risk of loss.

32.52% Sell - We believe that this stock is likely to

decline by more than 10% over the next 12 months, with

the risk involved too great to compensate for any

possible returns.

TheStreet Ratings

14 Wall Street, 15th Floor

New York, NY 10005

www.thestreet.com

Research Contact: 212-321-5381

Sales Contact: 866-321-8726

Beta

1.66

Market Capitalization

$40.5 Billion

52-Week Range

$58.46-$133.27

Price as of 2/25/2016

$94.53

VALUATION

HOLD. NETFLIX INC's P/E ratio indicates a significant premium compared to an average of 303.03 for the

Internet & Catalog Retail industry and a significant premium compared to the S&P 500 average of 21.53. For

additional comparison, its price-to-book ratio of 18.19 indicates a significant premium versus the S&P 500

average of 2.56 and a significant premium versus the industry average of 14.18. The price-to-sales ratio is well

above both the S&P 500 average and the industry average, indicating a premium. Upon assessment of these

and other key valuation criteria, NETFLIX INC proves to trade at a premium to investment alternatives within

the industry.

Price/Earnings

1

2

3

premium

4

5

NFLX 332.50

Peers 303.03

• Average. An average P/E ratio can signify an

industry neutral price for a stock and an average

growth expectation.

• NFLX is trading at a valuation on par with its peers.

Price/Projected Earnings

1

2

3

premium

4

5

1

2

3

premium

4

5

Price/Sales

1

2

premium

3

4

5

Price to Earnings/Growth

4

5

discount

1

2

3

premium

4

5

discount

NFLX NM

Peers 1.32

• Neutral. The PEG ratio is the stock’s P/E divided by

the consensus estimate of long-term earnings

growth. Faster growth can justify higher price

multiples.

• NFLX's negative PEG ratio makes this valuation

measure meaningless.

Earnings Growth

1

2

3

4

lower

5

higher

NFLX -53.94

Peers 198.29

• Lower. Elevated earnings growth rates can lead to

capital appreciation and justify higher

price-to-earnings ratios.

• However, NFLX is expected to significantly trail its

peers on the basis of its earnings growth rate.

Sales Growth

discount

NFLX 5.97

Peers 3.43

• Premium. In the absence of P/E and P/B multiples,

the price-to-sales ratio can display the value

investors are placing on each dollar of sales.

• NFLX is trading at a significant premium to its

industry.

3

NFLX NM

Peers 20.41

• Neutral. The P/CF ratio, a stock’s price divided by

the company's cash flow from operations, is useful

for comparing companies with different capital

requirements or financing structures.

• NFLX's P/CF is negative making the measure

meaningless.

discount

NFLX 18.19

Peers 14.18

• Premium. A higher price-to-book ratio makes a

stock less attractive to investors seeking stocks

with lower market values per dollar of equity on the

balance sheet.

• NFLX is trading at a significant premium to its

peers.

2

premium

discount

NFLX 86.33

Peers 108.49

• Premium. A higher price-to-projected earnings ratio

than its peers can signify a more expensive stock

or higher future growth expectations.

• NFLX is trading at a significant premium to its

peers.

Price/Book

1

Price/CashFlow

discount

1

2

3

lower

4

5

higher

NFLX 23.15

Peers 24.75

• Average. Comparing a company's sales growth to

its industry helps to determine if the company is

adding or losing market share.

• NFLX is keeping pace with its peers on the basis of

sales growth.

DISCLAIMER:

The opinions and information contained herein have been obtained or derived from sources believed to be reliable, but

TheStreet Ratings cannot guarantee its accuracy and completeness, and that of the opinions based thereon. Data is provided

via the COMPUSTAT® Xpressfeed product from Standard &Poor's, a division of The McGraw-Hill Companies, Inc., as well as

other third-party data providers.

TheStreet Ratings is a division of TheStreet, Inc., which is a publisher. This research report contains opinions and is provided

for informational purposes only. You should not rely solely upon the research herein for purposes of transacting securities or

other investments, and you are encouraged to conduct your own research and due diligence, and to seek the advice of a

qualified securities professional, before you make any investment. None of the information contained in this report constitutes,

or is intended to constitute a recommendation by TheStreet Ratings of any particular security or trading strategy or a

determination by TheStreet Ratings that any security or trading strategy is suitable for any specific person. To the extent any of

the information contained herein may be deemed to be investment advice, such information is impersonal and not tailored to the

investment needs of any specific person. Your use of this report is governed by TheStreet, Inc.'s Terms of Use found at

http://www.thestreet.com/static/about/terms-of-use.html.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 28, 2016

PAGE 5