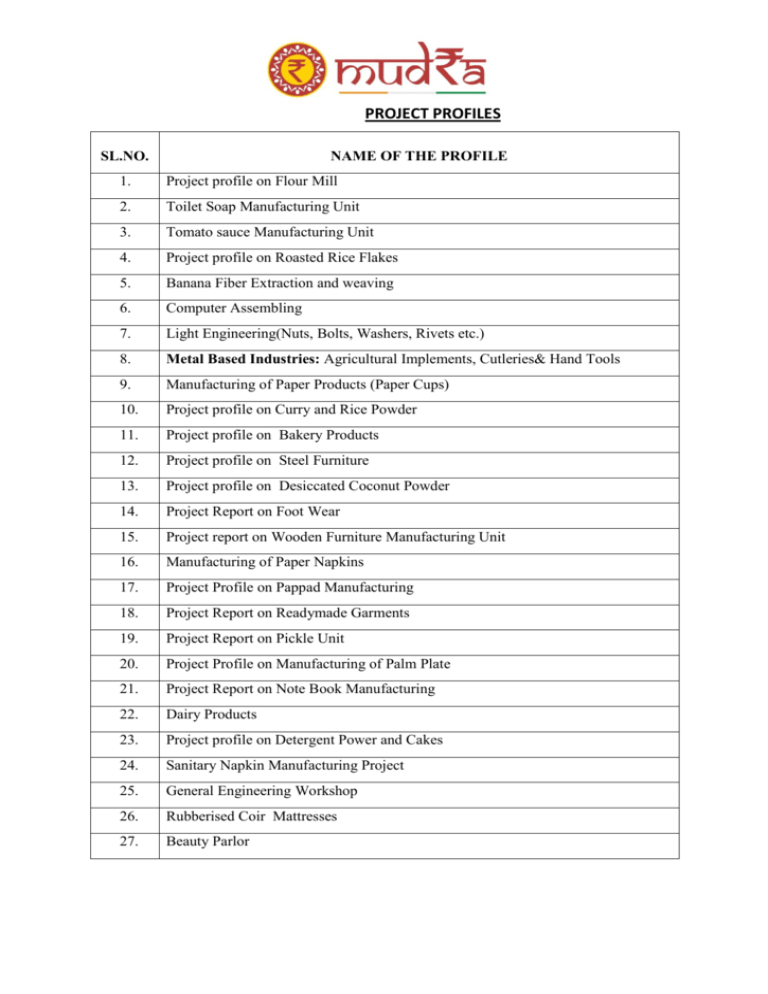

Project Profiles: Small Business Manufacturing & Services

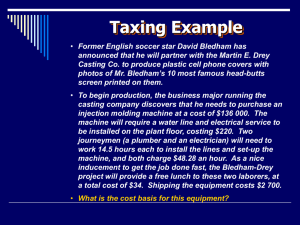

advertisement