Saudi International Petrochemical Co.

SIPCHEM

June 2013

KSA | Petrochemical Sector | Event Update

Please read Disclaimer on the back

SIPCHEM & Sahara Petrochemical merger talks

Saudi International Petrochemical Chemical Company (SICPHEM) announced recently for the start of merger talks with Sahara

Petrochemical Company (Sahara). The focus of this update is to highlight the potential opportunities; if the deal will be executed

successfully. Since the disclosure is limited and the deal is in a very early stage so we are not able to translate the impact on our valuation.

However, based on the operational focus of both companies, we believe the successful merger deal will further (i) strengthen operational

synergies in SIPCHEM; and (ii) expand the company’s existing production line to basic olefins and related derivate & polymers.

In addition, it is worthy to mention that one of the affiliates of SIPCHEM, recently, signed a financing agreement of SAR257.5mn to

produce poly butylene terephalate (PBT). It should be noted that we have already incorporated the impact of PBT in our valuation.

A merger could lead to more effective unified management

The successful implementation of the proposed deal will effectively allow the management of the two companies (i.e. SIPCHEM & Sahara)

to better integrate business with their partner companies (Ma’aden, Tasnee and Sadara).

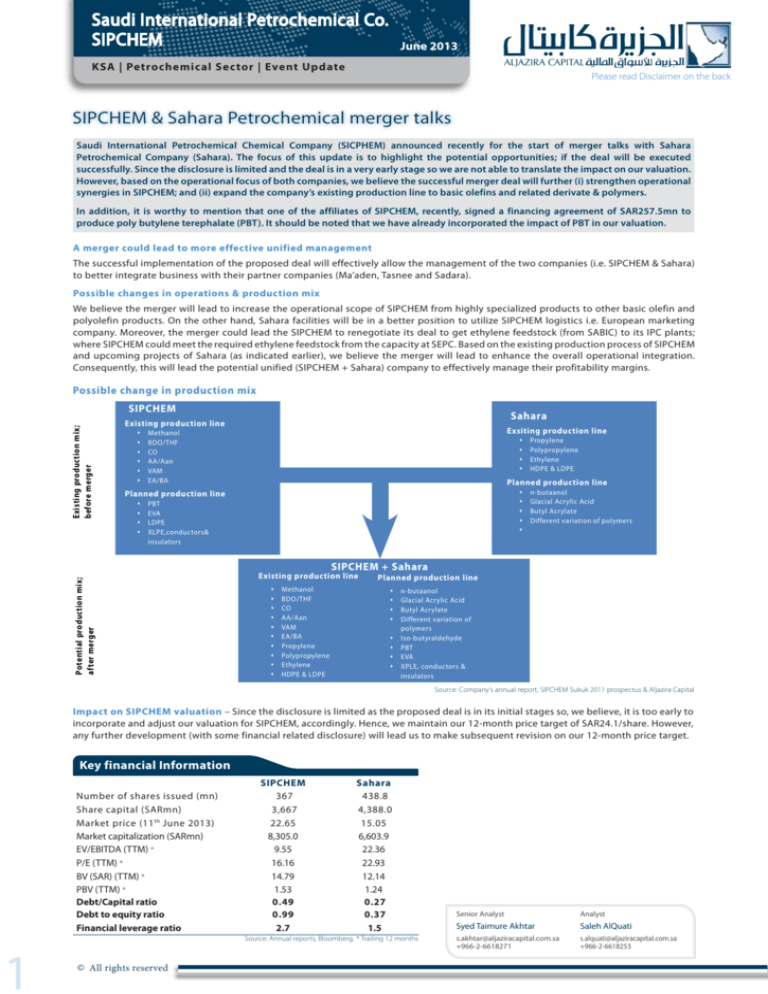

Possible changes in operations & production mix

We believe the merger will lead to increase the operational scope of SIPCHEM from highly specialized products to other basic olefin and

polyolefin products. On the other hand, Sahara facilities will be in a better position to utilize SIPCHEM logistics i.e. European marketing

company. Moreover, the merger could lead the SIPCHEM to renegotiate its deal to get ethylene feedstock (from SABIC) to its IPC plants;

where SIPCHEM could meet the required ethylene feedstock from the capacity at SEPC. Based on the existing production process of SIPCHEM

and upcoming projects of Sahara (as indicated earlier), we believe the merger will lead to enhance the overall operational integration.

Consequently, this will lead the potential unified (SIPCHEM + Sahara) company to effectively manage their profitability margins.

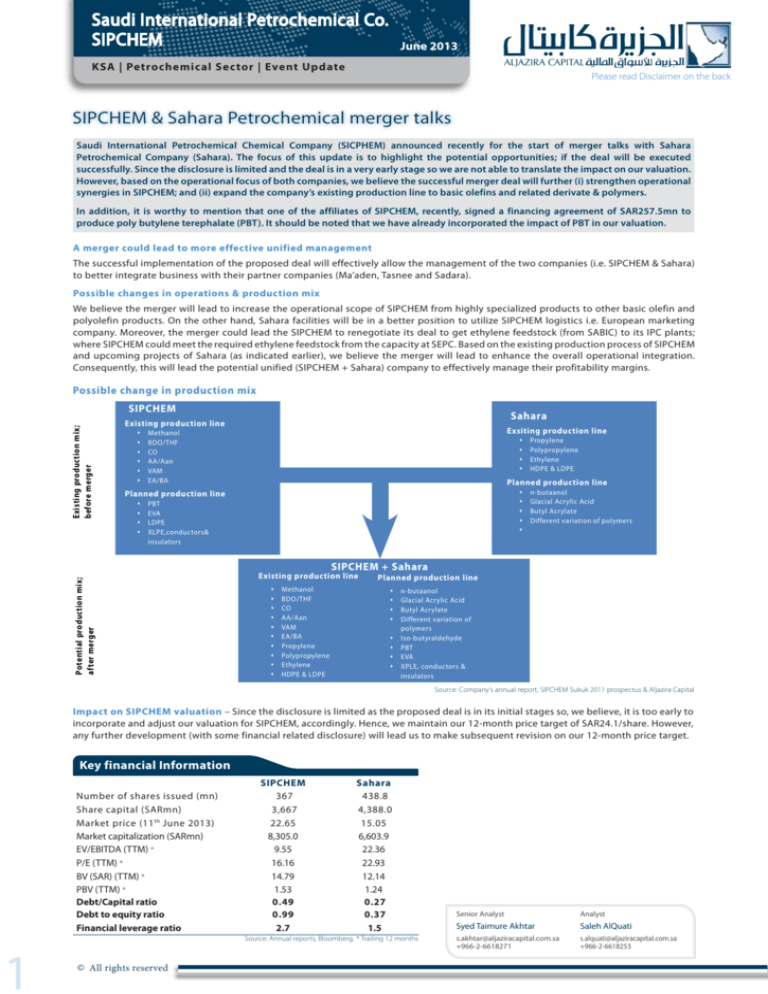

Possible change in production mix

Existing production mix;

before merger

SIPCHEM

Sahara

Existing production line

Exsiting production line

Methanol

BDO/THF

CO

AA/Aan

VAM

EA/BA

Planned production line

Planned production line

Propylene

Polypropylene

Ethylene

HDPE & LDPE

PBT

EVA

LDPE

XLPE,conductors&

insulators

n-butaanol

Glacial Acrylic Acid

Butyl Acrylate

Different variation of polymers

Potential production mix;

after merger

SIPCHEM + Sahara

Existing production line

Methanol

BDO/THF

CO

AA/Aan

VAM

EA/BA

Propylene

Polypropylene

Ethylene

HDPE & LDPE

Planned production line

n-butaanol

Glacial Acrylic Acid

Butyl Acrylate

Different variation of

polymers

Iso-butyraldehyde

PBT

EVA

XPLE, conductors &

insulators

Source: Company’s annual report, SIPCHEM Sukuk 2011 prospectus & Aljazira Capital

Impact on SIPCHEM valuation – Since the disclosure is limited as the proposed deal is in its initial stages so, we believe, it is too early to

incorporate and adjust our valuation for SIPCHEM, accordingly. Hence, we maintain our 12-month price target of SAR24.1/share. However,

any further development (with some financial related disclosure) will lead us to make subsequent revision on our 12-month price target.

Key financial

financial updates

Information

Key

Number of shares issued (mn)

Share capital (SARmn)

Market price (11 th June 2013)

Market capitalization (SARmn)

EV/EBITDA (TTM) *

P/E (TTM) *

BV (SAR) (TTM) *

PBV (TTM) *

Debt/Capital ratio

Debt to equity ratio

Financial leverage ratio

1

SIPCHEM

367

3,667

22.65

8,305.0

9.55

16.16

14.79

1.53

0.49

0.99

2.7

Sahara

438.8

4,388.0

15.05

6,603.9

22.36

22.93

12.14

1.24

0.27

0.37

1.5

Source: Annual reports, Bloomberg, * Trailing 12 months

© All rights reserved

Senior Analyst

Analyst

Syed Taimure Akhtar

Saleh AlQuati

s.akhtar@aljaziracapital.com.sa

+966-2-6618271

s.alquati@aljaziracapital.com.sa

+966-2-6618253

Saudi International Petrochemical Co.

SIPCHEM

KSA | Petrochemical Sector | Event Update

June 2013

Please read Disclaimer on the back

Sahara Petrochemical Company (Sahara) - The company’s principal activities are to invest in the industrial projects; especially

in the petrochemical and chemical fields. By the end of 2012, the company invested in the following key projects;

•

Al Waha Petrochemical Company (Al Waha) – Sahara owns 75% stakes while 25% is owned by Bassel Arabian Investment. The

complex has a designed capacity to produce 467.6 thousand tons of propylene, which will use as a feedstock to produce 450.0

thousand tons polypropylene. The facility started its commercial operation in 2Q2011.

•

Tasnee & Sahara Olefins Company (TSOC) - Sahara has 32.5% stakes; where the remaining 60.5% and 7.0% stakes are owned by

National Industrialization Company (Tasnee) and Government Organization for Social Insurance (GOSI). TSOC was established as a

holding company and has invested in the following complexes;

•

Saudi Ethylene & Polyethylene Company (SEPC) - TSOC owns 75.0% and Basell Moyen Orient Investissements SAS owns

25.0% stakes. The complex is designed to 284.8 thousand per tons of propylene and almost 1.0mn tons of ethylene. According

to the given information, around 80.0% of the designed capacity of ethylene will utilize as a feedstock to produce 0.8mn tons

of different grades of polyethylene. SEPC started its operation in June 2009.

•

Saudi Acrylic Acid Company (SAAC) - The facility is designed to produce acrylic acid and butyl acrylate. SAAC is expected to

start its experimental operations in 2Q2013; where TASCO owns 65.0% and Tasnee owns 13% stakes. It should be noted that

Sahara, indirectly, owns 43.2% stakes in SAAC. In addition, the affiliate of TASCO owns 75.0% stakes in Saudi Acrylic Monomer

Company (SAMCO), Saudi Acrylic Polymer Company (SAPCO). SAMCO is designed to utilize n-butanol form SAAC & propylene

from SEPC and supply freed stock to SAPCO and Butanol plant (a 33.3% JV between SAAC, Saudi Kayan and Sadara; where,

the commercial operation will start in 2015). On the other hand, the SAPCO is designed to produce 80 thousand tons of super

absorbent polymers for sales and expected to start its commercial production in 3Q2014.

•

Sahara & Ma’aden Petrochemicals Company (SAMAPCO) – A 50:50 JV between Sahara and Ma’aden was established to operate an

integrated chlor-alkali designed to produce 227.0 thousand tons of chlorine and 250.0 thousand tons of caustic soda. In addition,

SAMAPCO also has an ethylene dichloride plant capable to produce 300.0 thousand tons of related products.

•

NPG project – Is an upcoming limited JV project between Sahara (expected to own 48%), Chemanol (expected to own 15%) and

Mitsubishi Gas Chemicals & Sojtz Corporation (expected to contribute 37.0%). The project is designed to produce 45 thousand tons

of neopentyl glycol.

Saudi International Petrochemical Company (SIPCHEM) - The principal activities of SIPCHEM are to own, establish, operate

and manage industrial projects especially related to petrochemical and chemical. By the end of 2012; the company’s operation was

mainly based on the following investments;

2

•

International Methanol Company (IMC) - SPCHEM owns 65.0% stakes in IMC; which is designed to produce around 1.0mn tons of

methanol.

•

International Diol Company (IDC) - The production facility at IDC is designed to produce 75 thousand tons of butane diol (BDO) and

Tetrohydrofuran (THF). SIPCHEM owns 53.9% stakes.

•

International Gases Company (IGC) - The complex is designed to produce 340.0 thousand tons of carbon monoxide (CO) which is

utilized to produce acetic acid (AA) and acetic anhydride (Aan). SIPCHEM has 72.0% stakes in IGC.

•

International Acetyl Complex (IAC) – SIPCHEM owns 76.0% stakes and the complex is designed to produce 460.0 thousand AA and

Aan; where, most of AA is used to produce vinyl acetate monomer (VAM) and ethylene/butylene acetate (EA/BA). It is worthy to

mention that the company’s EA/BA facility started its commercial operation, recently.

•

International Vinyl Acetate Company (IVC) – SIPCHEM holds 76.0% stakes in IVC and is designed to produce 330.0 thousand tons of

VAM. At present, IVC is selling entire production of VAM; but the completion of Polymers Complex will lead to generate additional

in-house demand of VAM as a feedstock for IPC.

•

International Polymer Company (IPC) – 75.0% stakes of the IPC is owned by SIPCHEM and the affiliate is expected to produce 200.0

thousand tons of ethylene vinyl acetate (EVA) and low density poly ethylene (LDPE). The project is expected to start its commercial

operation in late 4Q2013.

•

Wire & Cable project – It is a proposed project to produce 20 thousand tons of medium voltage cross-linked polyethylene (XLPE)

and 5.0 thousand tons of medium voltage semi-conductor outer (insulation) and inner (conductor). It is worthy to mention that the

project will require EVA and LDPE as a feedstock.

•

Other affiliates – Beside the mentioned industrial projects, the company has fully-owned marketing company in Europe which is

responsible to carry out the company’s marketing activities in European market.

© All rights reserved

RESEARCH DIVISION

BROKERAGE AND INVESTMENT

CENTERS DIVISION

RESEARCH

DIVISION

Senior Analyst

Abdullah Alawi

Syed Taimure Akhtar

+966 2 6618275

a.alawi@aljaziracapital.com.sa

+966 2 6618271

s.akhtar@aljaziracapital.com.sa

Senior Analyst

Analyst

Analyst

Talha Nazar

Saleh Al-Quati

Jassim Al-Jubran

+966 2 6618603

t.nazar@aljaziracapital.com.sa

+966 2 6618253

s.alquati@aljaziracapital.com.sa

+966 2 6618602

j.aljabran@aljaziracapital.com.sa

General Manager - Brokerage Division

Ala’a Al-Yousef

AGM-Head of international

Regional Manager - West and South Regions

and institutional brokerage

Abdullah Al-Misbahi

+966 1 2256000

a.yousef@aljaziracapital.com.sa

Luay Jawad Al-Motawa

+966 2 6618404

a.almisbahi@aljaziracapital.com.sa

+966 1 2256277

lalmutawa@aljaziracapital.com.sa

Sales And Investment Centers Central Region

Area Manager - Qassim & Eastern Province

Manger

Abdullah Al-Rahit

Sultan Ibrahim AL-Mutawa

+966 6 3617547

aalrahit@aljaziracapital.com.sa

+966 1 2256364

s.almutawa@aljaziracapital.com.sa

AlJazira Capital, the investment arm of Bank AlJazira, is a Shariaa Compliant Saudi Closed Joint Stock company and

operating under the regulatory supervision of the Capital Market Authority. AlJazira Capital is licensed to conduct

securities business in all securities business as authorized by CMA, including dealing, managing, arranging, advisory,

and custody. AlJazira Capital is the continuation of a long success story in the Saudi Tadawul market, having occupied

the market leadership position for several years. With an objective to maintain its market leadership position, AlJazira

Capital is expanding its brokerage capabilities to offer further value-added services, brokerage across MENA and

International markets, as well as offering a full suite of securities business.

1.

RATING

TERMINOLOGY

AGM - Head of Research

2.

3.

4.

Overweight: This rating implies that the stock is currently trading at a discount to its 12 months price target.

Stocks rated “Overweight” will typically provide an upside potential of over 10% from the current price levels

over next twelve months.

Underweight: This rating implies that the stock is currently trading at a premium to its 12 months price target.

Stocks rated “Underweight” would typically decline by over 10% from the current price levels over next twelve

months.

Neutral: The rating implies that the stock is trading in the proximate range of its 12 months price target. Stocks

rated “Neutral” is expected to stagnate within +/- 10% range from the current price levels over next twelve

months.

Suspension of rating or rating on hold (SR/RH): This basically implies suspension of a rating pending further

analysis of a material change in the fundamentals of the company.

Disclaimer

The purpose of producing this report is to present a general view on the company/economic sector/economic subject under research, and not to recommend a buy/sell/hold for any security or

any other assets. Based on that, this report does not take into consideration the specific financial position of every investor and/or his/her risk appetite in relation to investing in the security or any

other assets, and hence, may not be suitable for all clients depending on their financial position and their ability and willingness to undertake risks. It is advised that every potential investor seek

professional advice from several sources concerning investment decision and should study the impact of such decisions on his/her financial/legal/tax position and other concerns before getting

into such investments or liquidate them partially or fully. The market of stocks, bonds, macroeconomic or microeconomic are of a volatile nature and could witness sudden changes without any

prior warning, therefore, the investor in securities or other assets might face some unexpected risks and fluctuations. All the information, views and expectations and fair values or target prices

contained in this report have been compiled or arrived at by AlJazira Capital from sources believed to be reliable, but AlJazira Capital has not independently verified the contents obtained from

these sources and such information may be condensed or incomplete. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on the

fairness, accuracy, completeness or correctness of the information and opinions contained in this report. AlJazira Capital shall not be liable for any loss as that may arise from the use of this report

or its contents or otherwise arising in connection therewith. The past performance of any investment is not an indicator of future performance. Any financial projections, fair value estimates or

price targets and statements regarding future prospects contained in this document may not be realized. The value of the security or any other assets or the return from them might increase or

decrease. Any change in currency rates may have a positive or negative impact on the value/return on the stock or securities mentioned in the report. The investor might get an amount less than

the amount invested in some cases. Some stocks or securities maybe, by nature, of low volume/trades or may become like that unexpectedly in special circumstances and this might increase the

risk on the investor. Some fees might be levied on some investments in securities. This report has been written by professional employees in AlJazira Capital, and they undertake that neither them,

nor their wives or children hold positions directly in any listed shares or securities contained in this report during the time of publication of this report. This report has been produced independently

and separately and no party (in-house or outside) who might have interest whether direct or indirect have seen the contents of this report. It should be also noted that the Research Division of

AlJazira Capital had no information at the time of issuing this report regarding any conflict of interest between the company/companies mentioned in this report and any members of the board /

executives / employees of AlJazira Capital or any of Bank AlJazira Group companies. No part of this document may be reproduced whether inside or outside the Kingdom of Saudi Arabia without

the written permission of AlJazira Capital. Persons who receive this document should make themselves aware, of and adhere to, any such restrictions. By accepting this document, the recipient

agrees to be bound by the foregoing limitations.

Asset Management

Brokerage

Corporate Finance

Custody

Advisory

Head Office: Madinah Road, Mosadia، P.O. Box: 6277, Jeddah 21442, Saudi Arabia، Tel: 02 6692669 - Fax: 02 669 7761

3

© All rights reserved