investment review - MLC Financial Planning

advertisement

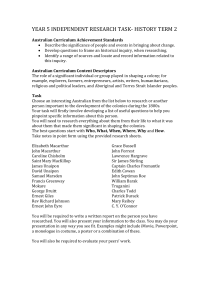

I NVES TME NT R E V I E W & Outlook Australian economy The Reserve Bank of Australia left the cash rate at 6.75% following the two 25 basis points increases in August and November despite economic data, released through December, continuing to point towards a solid domestic economy. Australian shares The Australian equity market declined 2.7% in December as investors continued to shift to less risky assets. In particular, investor reduced their level of exposure to leveraged equities as a result of renewed credit concerns with re-financing as demonstrated by Centro Property Group (CNP) and its retail trust (CER). Global economy As the US economic backdrop continued to deteriorate, the Federal Open Markets Committee lowered the federal funds rate at its 11 December meeting by 25 basis points to 4.25%. There was disappointment that the Fed only lowered the discount rate by 25 basis points when the market was expecting a more aggressive reduction. International shares Global Share markets again slumped in December with most major indices recording losses. The All Ords, Nikkie Dow Jones and MSCI World disappointed with all posting losses for the month. It would seem that the liquidity crisis, stemming from the US sub-prime market collapse, is still very much a concern to investors and lenders alike. Other major asset classes AUD/USD recovered to 0.8751 at the end of December, supported by improved investor risk-appetite as money market yields fell in response to central bank cash injections. Australian bond markets had a poor December. AUS-US spreads widened and as a result of the US bond yields rising, but much more modestly with the 10 year Treasury yield up 9 basis points to 4.02%. Financial Planning January 2008 December market performance Equity Markets – Price Indices Australia Japan Hong Kong UK Germany US EMU* World** Property – Price Index Listed Trusts Index All Ordinaries Nikkei Hang Seng FTSE 100 DAX Dow Jones Euro 100 MSCI – Ex Aus At Close % Change % Change 31/12/07 1 Month 12 Months 6421.00 –2.6% 13.8% 15307.78 –2.4% –11.1% 27812.65 –2.9% 39.3% 6456.90 0.4% 3.8% 8067.32 2.5% 22.3% 13264.82 –0.8% 6.4% 3167.39 –1.3% 2.4% 1131.59 –0.8% 2.6% Index ASX LPT At Close % Change % Change 31/12/07 1 Month 12 Months 2111.20 –8.0% –13.2% At Close 31/12/07 7.24 Interest Rates Aust 90 day Bank Bills Australian 10 year Bonds US 90 day T Bill US 10 year Bonds Currency US dollar A$/US$ British pound A$/STG Euro*** A$/euro Japanese yen A$/yen Trade-weighted Index Point Change 1 Month 12 Months –0.01 0.80 6.33 0.33 0.46 3.23 0.08 –1.78 4.03 0.08 –0.67 At Close % Change % Change 31/12/07 1 Month 12 Months 0.8752 –1.0% 10.9% 0.4409 0.6000 97.74 68.70 2.6% –0.7% –0.6% –0.3% 9.6% 0.5% 4.1% 5.9% Source : Iress Market Technology Past performance is not a reliable indicator of future performance. * Top 100 European stocks trading on the FTSE ** Source : www.msci.com *** The euro was launched by European Monetary Union members on 1/1/99. The advice contained herein does not take into account any persons particular objectives, needs or financial situation. Before making a decision regarding the acquisition or disposal of a Financial Product persons should assess whether the advice is appropriate to their objectives, needs or financial situation. Persons may wish to make this assessment themselves or seek the help of an adviser. No responsibility is taken for persons acting on the information provided. Persons doing so, do so at their own risk. Before acquiring a financial product a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product. Past performance is neither a reliable indicator of nor guide to future performance. No responsibility is taken for persons acting on the information provided. Persons doing so, do so at their own risk. GWM Adviser Services Limited ABN 96 002 071 749, trading as MLC Financial Planning, registered office 105-153 Miller Street North Sydney NSW 2060, is an Australian Financial Services licensee and a member of the National group of companies. From time to time GWM Adviser Services, members of the National group of companies, associated employees or agents may have an interest in or receive pecuniary and non pecuniary benefits from the financial products and services mentioned herein. January 2008 Investment Review & Outlook Australian economy and markets Australian shares The Australian equity market declined 2.6% in December as investors continued to shift to less risky assets. In particular, investor reduced their level of exposure to leveraged equities as a result of renewed credit concerns with re-financing as demonstrated by Centro Property Group (CNP) and its retail trust (CER). The essentials: • The Reserve Bank of Australia left the cash rate at 6.75% following the two 25 basis points increases in August and November. • The Australian equity market declined 2.6% in December as investors continued to shift to less risky assets following Centro’s difficulty in refinancing its debt. • Australian bond markets had a poor December, with the 10 year government bond yield rising 33 basis points to 6.33%. • AUD/USD recovered to 0.8751 at the end of December, supported by improved investor risk-appetite as money market yields fell in response to central bank cash injections. Australian dollar AUD/USD recovered to 0.8751 at the end of December, supported by improved investor risk-appetite as money market yields fell in response to central bank cash injections. Chart: AUD/USD Exchange Rate 0.95 0.90 0.85 The economy at a glance 0.80 Australian data released through December continue to point towards a solid domestic economy. GDP grew by 1.0% in the September quarter, for annual growth of 4.3%, while domestic demand rose even faster at 5.5% year on year. 0.75 Dec-07 Nov-07 Oct-07 Sep-07 Aug-07 Jul-07 Jun-07 May-07 Apr-07 Mar-07 8 The USD strengthened over the first few weeks of December in response to better-than-expected economic news which suggested the US economy was not in recession. Speculative investors halved the size of their short USD position sending the US Dollar index to its highest in two months by December 20. 6 4 2 Domestic spending Feb-07 Source: NAB) 10 0 Jan-07 Chart: Australian domestic demand remains strong Growth: GDP and spending 0.70 GDP Sep-07 Sep-06 Sep-05 Sep-04 Sep-03 Source: nab Capital (NAB) The level of business conditions remains solid, consumer confidence improved after the November decline, while the labour market remains tight with unemployment at 4.5% and a further 52,600 jobs created in November. Interest rates Australian bond markets had a poor December, with the 10 year government bond yield rising 33bps to 6.33% as economic data indicated the Australian economy was continuing to grow at a rapid pace despite the global credit market squeeze and increased uncertainty about global growth. Despite the strong data, the Reserve Bank of Australia left the cash rate at 6.75% following the two 25 basis points increases in August and November. Aus-US spreads widened and as a result of the US bond yields rising, but much more modestly with the 10 year Treasury yield up 9 basis points to 4.02%. The Aus-US 10 year spread pushed to 231 basis points at the end of December, its widest level since April 1996. The width of this spread confirms that the majority of investors think that Australia can decouple almost entirely from the troubles in the US. The December minutes showed the RBA maintains a clear tightening bias, and that the decision to maintain the cash rate at 6.75% in December was a ‘finely balanced decision.’ December finally saw some easing in the widening pressure on swap spreads. The 3 year swaps narrowed a dramatic 23 basis points as some liquidity returned to short bonds and swaps. January 2008 Investment Review & Outlook Global economies and markets The essentials: • Central bank easing was a feature of December with the US cutting its interest rates. • US housing markets remain a key focus with house prices continuing to fall. • The Bank of England also cut its base rate by 25 basis points to 5.5% concerned that growth is slowing and that the tightening in credit poses downside risks to the outlook for both output and inflation. • Global Share markets again slumped in December with most major indices recording losses. US Central bank easing was a feature of December with the US cutting its interest rates, US housing markets remain a key focus. US house prices keep falling and activity data keep slowing. President Bush announced a plan to bail out stressed mortgage borrowers, whereby sub-prime borrowers will have their starter interest rates frozen for 5 years, but to qualify for assistance under the plan, borrowers must have rates scheduled to reset between January 2008 and July 2010, and must be current on payments. As the US economic backdrop continued to deteriorate, the Federal Open Markets Committee lowered the federal funds rate at its 11 December meeting by 25 basis points to 4.25%. There was disappointment that the Fed only lowered the discount rate by 25 basis points when the market was expecting a more aggressive reduction. The Fed maintained concern on inflation and this was brought into sharper relief later in the month as the latest core CPI rose 0.3% in November or 2.3% year on year, But the downside risks to growth are rapidly outweighing the upside risks to inflation. NAB‘s view is that the Fed is likely to keep cutting the federal funds rate at coming meetings and expect the fed funds rate to fall to 3.5% by mid-2008 to stem a looming recession. Europe The Bank of England also cut its base rate by 25 basis points to 5.5% in December, concerned that growth is slowing and that the tightening in credit poses downside risks to the outlook for both output and inflation. NAB expects rates to remain on hold at 5.5% until February 2008 before making a further 25 basis points cut and anticipate a further 25 basis points after that; most likely in May. While the UK cut interest rates, the European Central Banks’ policy is moving away from a further rate hike. The ECB injected a large amount of liquidity into the system, as part of the coordinated central bank action to ease the global liquidity squeeze. Global share markets Global Share markets again slumped in December with most major indices recording losses. For the second month in a row, after several consecutive months of gains, the Heng Seng shed a further 2.9% while Germany continued its progression with a further 2.5% gain, 22.3% for the 12 month period ending December 2007; second only to China. The All Ords, Nikkie Dow Jones and MSCI World disappointed with all posting losses for the month. It would seem that the liquidity crisis, stemming from the US sub-prime market collapse is still very much a concern to investors an lenders alike.