Presentation

advertisement

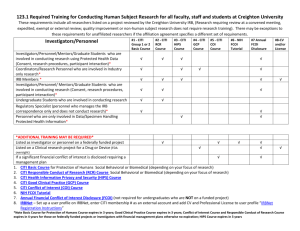

Citi | Investor Relations Global Financial Conference 2013 November 19, 2013 Stephen Bird CEO, Citi Asia Overview Citi’s focus on its unique historical strengths showing momentum – Focused on 3 core businesses: Global Consumer Banking, Securities & Banking and Transaction Services – Continuing to simplify organization and exit non-core assets Strategy well aligned with global trends and needs of our target client base – Unique ability to serve clients with global needs – Global network becoming more valuable and increasingly difficult to replicate Asia continues to be a large driver of global GDP growth Citi Asia’s franchise should provide attractive growth over time – Focused on serving the urban-based, globally-minded consumer – Well positioned as multinational corporates expand into Asia – Unparalleled ability to help EM champions grow outside the region 2 Agenda Citi’s Financial Progress • Citi’s Strategy is Well Aligned with Global Trends • Citi Asia Citigroup Results Showing Momentum(1) (YTD, $B) Citicorp Citi Holdings Earnings Before Tax Revenue 2% 23% $58.4 5.2 $57.7 2.7 $58.8 3.2 $13.2 $16.3 $11.6 53.2 YTD'11 4 55.0 YTD'12 55.5 YTD'13 16.0 17.9 (4.4) (4.7) YTD'11 YTD'12 18.8 (2.5) YTD'13 Note: Totals may not sum due to rounding. (1) Year-to-date results through September for each period. Adjusted results, which exclude, as applicable, CVA / DVA in all periods and gains/(losses) on minority investments in 2Q’11, 1Q’12, 2Q’12 and 3Q’12. Please refer to Slides 23 and 24 for a reconciliation of this information to reported results. Citicorp – Geographically Diversified(1) Asia North America YTD’13 Revenues Latin America EMEA EOP Loans & Deposits(2) YTD’13 Citicorp: $55.4B 21% 44% $895.6 Asia: $11.5B 28% 19% $561.4 16% 12% 28% YTD’13 Net Income YTD’13 Citicorp: $13.6B 22% Asia: $157.3B 22% 14% 12% 45% 38% 46% 18% 15% 5 Asia: $3.0B Loans Deposits Note: Totals may not sum due to rounding. (1) Year-to-date results through September 2013. Adjusted results, which exclude CVA / DVA and the Corporate / Other segment (revenues of $127MM, net income of $(992)MM, and EOP deposits of $18.1B). Please refer to Slide 24 for a reconciliation of this information to reported results. (2) As of 9/30/2013. Asia: $250.8B Agenda • Citi’s Financial Progress Citi’s Strategy is Well Aligned with Global Trends • Citi Asia Citi’s Strategy is Well Aligned with Global Trends • Globalization is increasing the need for seamless, global Global Trends • • Transaction Services financial institutions Urbanization is concentrating GDP and populations in major cities Digitization is changing the way clients and banks interact • Unparalleled, seamless network in nearly 100 countries • Leading cash management, trade finance and securities & • fund services provider Helping corporates expand internationally and serving the EM champions as they globalize • A leading institutional bank for multi-national clients Securities & Banking Global Consumer Banking 7 • requiring global services Leveraging our global network for benefit of corporate and institutional clients • Retail banking focused on urban-based, globally minded • consumer segment # 1 credit card issuer globally Citi’s Integrated Global Business Model Network Market(1) Broader Institutional Market Major Consumer Banking Cities 8 Note: (1) Network markets represent predominately Citi Transaction Services, local markets FX and corporate lending. Rise of Emerging Markets is a Clear Trend (%) EM Driving Global GDP Growth 2013E-16E CAGR as of (1): 2010-12 CAGR Nov-12 Oct-13 Developed Market GDP Growth remains low but expectations have stayed broadly stable EM forecasts have fallen but remain well above DM 6.3 5.5 5.0 4.1 3.3 3.1 2.6 2.3 2.0 1.8 3.2 1.9 0.9 0.7 0.3 Developed Total 9 Euro Area Source: IMF, Citi Investment Research (1) GDP estimates taken as of November 2012 and October 2013. US Emerging Total World GDP Asia Remains a Major Driver of Global GDP Growth Short-term GDP Growth Expectations(1) Mid-Term GDP Growth Expectations (YoY Growth %) (Constant $T, % Global GDP) 2013E Asia ex-Japan 2014E 7.6 Rest of World Global CAGR: 3% Asia CAGR: 6% 7.2 $6.8 5.6 $80.9 $5.3 $68.6 4.8 27% 24% 21% 3.8 2.6 3.7 3.6 3.5 2.9 3.4 3.0 3.0 Asia to contribute ~40% of Global 2012-17E GDP Growth 2.5 2012 GDP Asia ExJapan 10 Source: Citi Investment Research (1) Asia ex-Japan GDP growth rates shown for those countries where Citi generates more than $1B in annual revenue. Rest of World 2017E GDP Growth & Wealth Driven by Asia’s Urban Centers Asia’s Urban Population Growth Urban Asia’s Urban GDP Growth Rural All of Asia’s population growth expected to come from urban areas $24.5T 4.4B 3.9B 0.6 CAGR: 8% (0.1) $8.0T 52% 43% 2010 11 Urban Growth Rural Growth 2025 Source: McKinsey Global Institute Cityscope 2.0, United Nations: Department of Economic and Social Affairs 2010 2025 Mobile-Oriented Asian Consumer Base Mobile Usage & Banking(1) Mobile Penetration Hong Kong / Singapore Monthly Usage(3) Branch Visits Using Mobile Banking (26)% 153% 1.9 1.4 120% 110% Telephone 98% 81% 2007 1.6 2011 (25)% 1.2 69% 47% 42% 38% 37% 32% 24% 2007 Internet & Mobile 2011 36% 3.2 2.4 South Korea China Singapore India Thailand US 1.0 4.9 Average Monthly Mobile Banking Uses(2) 4.1 12 Notes: (1) (2) (3) 1.9 1.9 1.6 2007 2011 Mobile penetration defined as mobile devices divided by total population. Mobile penetration data taken from the World Bank online database. Mobile banking usage data from Bain & Company Customer Loyalty in Retail Banking 2012 report. Average monthly usage data averaged from three month survey ended September 2012. Industry-wide data taken from Mckinsey Personal Financial Services Survey, 2012. Rise of Asian Corporates Developed Market M&A in Asia(1) Asian Companies in Fortune Global 500(2) Asian Companies in BCG 100 Global Challengers(3) China India 58 2.9x 8 3.2x 20 $32B $11B 2002 120 30 37 2012 2005 2013 2013 Note: (1) Source: Citi estimates. Deals above $500MM where the target was located in Asia (ex-Japan) and the acquirer in a developed market. (2) Asia, excludes Japan and Australia. 13 (3) Source: BCG Global Challengers Report, January 2013. Global challengers are companies from developing economies that are both growing and globalizing quickly. Other Agenda • Citi’s Financial Progress • Citi’s Strategy is Well Aligned with Global Trends Citi Asia Citi Asia Institutional Market (ICG) Consumer Branches(1) Major Consumer Banking Cities (GCB) Citi Asia Today • Citi Asia spans 18 countries Korea 210 Taiwan 63 China 56 Hong Kong 43 India 42 Thailand 40 Japan 32 Indonesia 20 Philippines 16 Singapore 13 Australia 13 Malaysia 11 Vietnam 2 • >18% share of FX volumes(2) Guam 1 • #2 Asia completed M&A YTD(3) • 8 countries generate >$1B in annual revenue • Retail banking and cards in 14 countries • ~560 retail branches • Transaction services network in 18 countries, with seamless global connectivity • Trading desks in 17 countries • Best Asian Investment Bank(4) Note: (1) (2) 15 (3) (4) Branches as of September 30, 2013. Source: Euromoney FX Survey, May 2013. Source: Dealogic, 2013 YTD volume rankings. Source: Euromoney 2013 Awards for Excellence, July 2013. Citi Asia – Diversified Business Model(1) YTD’13 Revenues Global Consumer Banking Securites & Banking YTD Earnings Before Taxes(2) Transaction Services Asia Ex-Japan & Korea Japan & Korea YTD’13 $11.5B Total: 9% 32% $4.2 50% $4.3 $4.6 0.4 0.3 0.6 18% YTD’13 Net Income Global Consumer Banking Securites & Banking Transaction Services 3.6 4.0 4.2 YTD'12 YTD'13 YTD’13 $3.0B 34% 41% YTD'11 25% Note: Totals may not sum due to rounding. Excludes Corporate / Other segment. (1) Adjusted results for Citicorp Asia, which exclude CVA / DVA. Please refer to Slide 24 for a reconciliation of this information to reported results. 16 (2) In constant dollars. Please refer to Slide 24 for a reconciliation of this information to reported results. Growth in Asia ex-Japan & Korea: 15% Citi Asia – Consumer Banking Changing Consumer Needs Citi’s Offerings • Financial products integrated with customers’ lifestyle Convenience • Increased usage of self service channels Citibank Express • Customer centric tailored Personalization product offerings • Increased focus on service 3 Citi Wallet Simpler Solutions • User-friendly interface Smart Banking Branches • Automation and digitization Mobile Banking 17 Octopus Card / Citi SMRT Card Citi Asia – Wealth Management 1/3 2 14 218 450 677,000 1/3 of Asia’s billionaires(1) bank with Citi The 2nd largest wealth manager in Asia Pacific 14 markets in Asia Pacific $218B in assets under management(2) Wealth management centers Provides wealth management services to over 677,000 clients Citi’s Wealth Management Centers(3) South Korea China Japan 191 48 Targeted Product Offerings 26 Taiwan India 51 31 Hong Kong Thailand 3 29 Philippines Up to $1MM Up to $10MM Above $10MM 10 Malaysia 11 Indonesia Singapore 20 Three distinct wealth management propositions to cater to three distinct investing needs 26 Australia 4 Note: (1) Excludes Japan. 18 (2) Includes Private Bank assets under management, reported within Securities & Banking. (3) Citigold, Citigold Private Client and Citi Private Bank centers as of June 30, 2013. Citi Asia - Corporate Banking Corporate Banking Client Example Depth of Relationship Lead Arranger for Bank Guarantee Payments Management (EMEA) Payments Management (Asia) FX Services (EMEA) FX Services (Asia) FX Advisory Bond Issuance M&A Advisory Global Credit Facility Global Corp T&E Card Global Multi Currency Pooling Global USD Pooling Cash Back Promotion Card (EMEA) Corp T&E Card (Western Europe) Export Financing Liquidity Management (EMEA) GDR Depositary Bank 2007 Global Liquidity Management Supplier Financing 2008 Payments Management 2009 Global T&E Card 2010 Cash Management 2011 FX & Liquidity Advisory 2012 DCM Book Runner 2013 M&A & Trade Finance Relationships span many products across Securities & Banking and Transaction Services 19 Conclusions Citi has transformed itself over the past five years – Simplified our organization and re-focusing on our core historical strengths Our unparalleled Emerging Markets franchise is critical to our strategy – Long-established franchises with local market expertise and global capabilities Asia remains a significant growth driver for the global economy and Citi We continue to invest in the region to capture these growth opportunities Focused on serving our target customers in a responsible manner 20 Certain statements in this document are “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are based on management’s current expectations and are subject to uncertainty and changes in circumstances. These statements are not guarantees of future results or occurrences. Actual results and capital and other financial condition may differ materially from those included in these statements due to a variety of factors, including the precautionary statements included in this document and those contained in Citigroup’s filings with the U.S. Securities and Exchange Commission, including without limitation the “Risk Factors” section of Citigroup’s 2012 Form 10-K. Any forward-looking statements made by or on behalf of Citigroup speak only as to the date they are made, and Citi does not undertake to update forward-looking statements to reflect the impact of circumstances or events that arise after the date the forwardlooking statements were made. 21 Non-GAAP Financial Measures – Reconciliations ($MM) 23 Citigroup YTD'11 YTD'12 YTD'13 Citi Holdings Reported Revenues (GAAP) Impact of: CVA/DVA MSSB HDFC Akbank SPDB Adjusted Revenues $60,413 $51,211 $58,586 1,846 199 $58,368 (1,845) (4,684) 1,116 (1,605) 542 $57,687 (178) $58,764 Reported Revenues (GAAP) Impact of: CVA/DVA MSSB Adjusted Revenues Reported Expenses (GAAP) Impact of: HDFC Adjusted Expenses $37,197 $36,265 $36,062 $37,197 4 $36,261 $36,062 Reported EBT (GAAP) Impact of: CVA / DVA MSSB HDFC Akbank SPDB Adjusted EBT $13,605 $6,730 $16,082 1,846 199 $11,560 (1,845) (4,684) 1,112 (1,605) 542 $13,210 (178) $16,260 Reported EBT (GAAP) Impact of: CVA / DVA MSSB Adjusted EBT YTD'11 YTD'12 YTD'13 $5,215 $(1,859) $3,245 40 $5,175 132 (4,684) $2,693 2 $3,243 $(4,389) ` $(9,206) ` $(2,491) 40 $(4,429) 132 (4,684) $(4,654) 2 $(2,493) Non-GAAP Financial Measures – Reconciliations ($MM) 24 Citicorp YTD'11 YTD'12 YTD'13 Citicorp Asia YTD'11 YTD'12 YTD'13 Reported Revenues (GAAP) Impact of: CVA/DVA HDFC Akbank SPDB Adjusted Revenues $55,198 $53,070 $55,341 $11,706 $11,495 $11,518 1,806 199 $53,193 (1,977) 1,116 (1,605) 542 $54,994 (180) $55,521 Reported Revenues (GAAP) Impact of: CVA/DVA Adjusted Revenues 195 $11,511 (154) $11,649 (13) $11,531 $4,524 $4,154 $4,572 Reported Expenses (GAAP) Impact of: HDFC Adjusted Expenses $32,593 $32,626 $31,633 $32,593 4 $32,622 $31,633 Reported EBT (GAAP) Impact of: CVA/DVA Adjusted EBT Impact of FX Translation Adjusted EBT in Constant Dollars 195 $4,329 (103) $4,226 (154) $4,308 (21) $4,287 (13) $4,585 $4,585 $2,999 $3,011 $17,994 1,806 199 $15,989 $15,936 (1,977) 1,112 (1,605) 542 $17,864 $18,573 (180) $18,753 Reported Net Income (GAAP) Impact of: CVA/DVA Adjusted Net Income $3,318 Reported EBT (GAAP) CVA/DVA HDFC Akbank SPDB Adjusted EBT 121 $3,197 (94) $3,093 (8) $3,019 Reported Net Income (GAAP) Impact of: CVA/DVA HDFC Akbank SPDB Tax Benefit Adjusted Net Income $12,995 $11,827 $12,685 1,122 128 $11,745 (1,226) 722 (1,037) 349 582 $12,437 (114) 176 $12,623