DOCUMENTARY

COLLECTIONS

A documentary collection is a flexible solution to secure and mitigate

risks between trade partners who experience a long-term stable business

relationship.

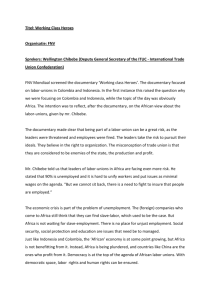

Principle

A documentary collection is a process in which the exporter

instructs their bank to forward documents, related to the

export of goods, to the importer’s bank with a request to

present these documents to the importer for payment,

indicating when and on what conditions these documents

can be released to the importer.

When a sales contract is concluded whereby both parties

agree that the payment is to be made by means of a

documentary collection, it is the supplier who initiates the

documentary collection.

The liability of the buyer’s bank is limited to presenting and

releasing documents according to the instructions received

(i.e. against payment or against acceptance of a bill of

exchange) and the URC 522 (Uniform Rules for Collections).

The buyer’s bank does not accept any liability if the buyer

is unwilling or unable to honour their commitments. Banks

only act as a channel for the documents and do not issue

any payment covenants. The bank that has received a

documentary collection may debit the buyer’s account and

make the payment only if authorized by the buyer.

Credit, political and transfer risks are not covered. In other

words, the supplier has no certainty of being paid, as no bank

obligation is involved. On the other hand, a documentary

collection involves moderate costs but also less time and

effort for settlement.

A documentary collection can

involve the following parties:

n Principal: the party that requests the processing of a

documentary collection, i.e. the supplier/exporter.

n Drawee: the party to whom the documents are finally

presented to, i.e. the buyer/ importer.

n Remitting bank: which is instructed by the principal to

process his documentary collection.

n Presenting bank: which presents the documents to

the drawee/buyer, i.e. the buyer’s bank.

3. Handing

over transport

documents

SUPPLIER

CARRIER

2. Delivering

goods

4. Sending

documents

for collection

accompanied by

an instruction letter

REMITTING

BANK

BUYER

1. Closing the

sales contract

PRESENTING

BANK

5. Forwarding the documentary collection (i.e.

instruction letter and documents), after having

added their own instructions

6. Notification

that documents

are available for

collection and

release method

Type of documentary collections

n Documents against payment = D/P

(also called Cash against Documents = C.a.D)

The presenting bank may only release the documents

against immediate payment.

8b. Handing

over transport

documents

CARRIER

SUPPLIER

8c. Delivering

goods

BUYER

7. Payment

10. Payment

8a. Handing

over all

documents

PRESENTING

BANK

REMITTING

BANK

n Documents against acceptance = D/A

The presenting bank may only release the documents

against acceptance of a draft by the importer, e.g. 180 days

after the goods shipping date.

CARRIER

8c. Delivering

goods

8b. Handing over

transport docments

BUYER

7. Accepting

bill of

exchange

13. Payment

REMITTING

BANK

9. Notice of

acceptance of

bill of exchange

12. Payment

n The importer:

A documentary collection is convenient for the importer as

it can be a way to avoid an advanced payment. Payment

for goods is made when shipping documents have been

received. Moreover, in case of documents released against

acceptance, the importer could have had the possibility to

previously negotiate a deferred payment with the exporter.

Key advantages

9. Payment

SUPPLIER

n The exporter:

A documentary collection is suitable if the exporter has

no doubt about the buyer’s ability to meet his payment

obligations and if the buyer`s country is politically and

economically stable with no foreign restrictions in the

exporter`s country.

It is understood that the buyer should not be able to take

possession of the delivery without having previously had

to accept the payment within the documentary collection

process. Indeed, there is no interest of using documentary

collection when the Incoterm is Ex Works or when the

goods are shipped by truck and delivered at the buyer’s

warehouse.

8a. Handing over

all documents

10. Presenting bill

of exchange for

payment on due date

PRESENTING

BANK

11. Paying bill

of exchange

n Universal means of payment:

Through an easy and recognised procedure, you benefit

from a means of payment subject to international uniform

rules (International Chamber of Commerce – Publication

522, otherwise called Uniform Rules for Collections 522).

Alongside this set of rules, which governs the rights

and obligations of the parties involved, local legislation

governing documentary collections also remains

important.

n A simple way to secure international transactions:

When sending the documents representing the transaction,

the exporter is certain that the bank would not release

them to the importer before specific conditions are

fulfilled. On the other hand, the importer is always free to

refuse the documents and then not take possession of the

goods without having to provide a justification.

n A dedicated e-platform Connexis Trade: to manage and

monitor all your import or export documentary collections

online.

Engaging your BNP Paribas local Trade Centre up-stream

of your transactions, will allow you to:

lstay informed and control your costs

lcheck the feasibility of your transaction

For further additional information, please contact:

Your BNP Paribas Trade Center

The information contained in this document is correct as at the date of printing. It is distributed for information purposes only, it does not constitute a prospectus and is not

and should not be construed as an offer document or an offer or solicitation to buy or sell any product or solution, to subscribe any service or to enter into any transaction

described in that document. This document does not and is not intended to constitute any investment or financial advice, and nothing contained herein shall be construed as

an inducement or recommendation of any form whatsoever. Recipient should contain independant legal, financial and other professional advice as regards its decision to buy or

sell any product or solution, to subscribe any service or to enter into any transaction described herein. BNP Paribas will not be responsible for the consequences of any use of or

reliance upon any information contained herein or for any omission or error. This document is distributed to selected recipients only. It may not be reproduced or disclosed (in

whole or in part) to any other person nor be quoted or referred to in any document without the prior written permission of BNP Paribas. © 2013 BNP Paribas. All rights reserved.