THE OPTIONS CLEARING CORPORATION DISCLOSURE

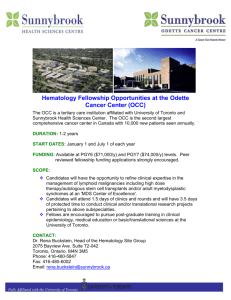

advertisement