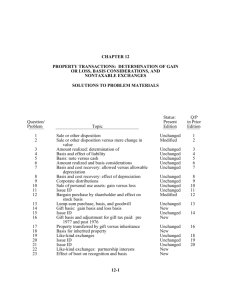

Solutions to Extra Review Problems for Exam 2

advertisement

ACC 2460 – Fall 2003 Solutions to Extra Review Problems for Exam 2 Chapter 7 9. 12. a. Zeron’s taxable income is $88,200 ($87,200 service income + $1,000 ordinary income + $2,400 Section 1231 gain $2,400 capital loss). The $4,600 capital loss in excess of Section 1231 gain is nondeductible in the current year. b. Zeron’s taxable income is $80,600 ($87,200 service income $6,600 Section 1231 loss). The $1,700 capital loss is nondeductible in the current year. c. Zeron’s taxable income is $93,810 ($87,200 service income + $3,900 ordinary income + $1,510 Section 1231 gain + $1,200 capital gain). d. Zeron’s taxable income is $80,900 ($87,200 service income $10,300 Section 1231 loss + $4,000 capital gain). e. Zeron’s taxable income is $88,900 ($87,200 service income + $2,800 Section 1231 gain + $5,200 capital gain $6,300 capital loss). a. EzTech’s gains and losses from sales of business assets are computed and characterized as follows. Amount Adjusted Realized Ordinary Section 1231 Realized Basis Gain/(Loss) Gain Gain/(Loss) Machinery Office equipment Warehouse $87,500 57,500 125,000 $57,840 37,530 141,880 $29,660 19,970 (16,880) $29,660 12,470 0 $42,130 $7,500 (16,880) $(9,380) EzTech’s net capital loss from the sale of its investment assets is computed as follows: Investment securities Investment land Amount Realized Adjusted Basis Capital Gain/(Loss) $83,100 178,000 $72,700 200,000 $10,400 (22,000) (11,600) EzTech’s taxable income is computed as follows. Net income from operations Ordinary gain from sales of business assets Section 1231 loss Taxable income b. $1,219,400 45,130 (9,380) $1,255,150 If EzTech’s land was a Section 1231 asset instead of a capital asset, the $22,000 loss recognized on sale would increase the corporation’s Section 1231 loss to $31,380, and EzTech’s taxable income is computed as follows. Net income from operations Ordinary gain from sales of business assets Section 1231 loss Capital gain from sale of investment securities Taxable income $1,219,400 45,130 (31,380) 10,400 $1,243,550 20. ZEJ’s net book income before tax Excess of book over tax depreciation Book gain on equipment sale Tax gain on equipment sale $270,000 2,700 $(23,000) 38,000 15,000 35,000 $322,700 Nondeductible loss on sale to related party ZEJ’s taxable income The $18,000 gain realized on the securities sale to a related party is taxable and does not cause a book/tax difference. Chapter 8 2. 9. 12. a. Realized loss $15,000; recognized loss $15,000; tax basis in new property $65,000. b. Realized loss $15,000; recognized loss -0-; tax basis in new property $80,000. c. In this case, the old property must be worth only $63,000. Realized loss $17,000; recognized loss $17,000; tax basis in new property $65,000. d. Realized loss $17,000; recognized loss -0-; tax basis in new property $82,000. e. In this case, the old property must be worth $73,000. Realized loss $7,000; recognized loss $7,000; tax basis in new property $65,000. f. Realized loss $7,000; recognized loss -0-; tax basis in new property $72,000. a. PO’s realized gain is $490,000 ($800,000 amount realized [$250,000 FMV of Boardwalk + $550,000 debt relief] $310,000 adjusted basis). PO must recognize the entire $490,000 gain because the $550,000 boot (debt relief) exceeds the realized gain. PO’s tax basis in Boardwalk is $250,000. b. QR’s realized gain is $190,000 ($800,000 amount realized $610,000 adjusted basis [$60,000 adjusted basis in Boardwalk + $550,000 debt assumption]). QR recognizes no gain and takes a $610,000 basis in Marvin Gardens. a. NP must recognize the entire $120,000 realized gain ($650,000 insurance reimbursement $530,000 adjusted basis) on the involuntary conversion. b. NP does not recognize any of the $120,000 realized gain because it spent at least $650,000 on replacement property within two taxable years following the year in which the gain was realized. c. Because NP did not acquire the replacement property within two taxable years following the year in which the gain was realized, it must recognize the entire $120,000 gain. Chapter 9 3. a. BDF’s 2003 payroll tax is $4,590 ($60,000 × 7.65%). b. BDF’s 2003 payroll tax is $8,294 ([$87,000 × 6.2%] + [$200,000 × 1.45%]). 13. Partner X Initial basis in partnership interest Deduction for $21,000 share of loss $50,000 (21,000) Partner Y $10,000* (10,000) Adjusted basis at beginning of next year $29,000 -0- * Adjusted basis of contributed business assets 16. a. b. c. Mrs. Z’s adjusted basis at beginning of 2003 Increased by: 60% share of dividends and interest 60% share of capital gain Basis before loss deduction Decreased by limited deduction for 60% share of business loss Mrs. Z’s adjusted basis at end of 2003 Napa Corporation’s dividend-received deduction is $158,500. KLP dividend $55,000 70% Gamma dividend $120,000 100% 13. (107,480) -0- If Mrs. Z received a $5,000 cash distribution from the partnership, her basis before the loss deduction would be only $102,480, and the deduction for her share of the business loss is limited to $102,480. Chapter 10 3. $95,000 8,760 3,720 $107,480 PT’s taxable income AMT adjustments AMT tax preference AMTI before exemption Exemption ($40,000 [25% $17,000 excess AMTI]) AMT rate Tentative minimum tax Regular tax AMT $38,500 120,000 $158,500 $100,000 45,000 22,000 $167,000 (35,750) $131,250 .20 $26,250 (22,250) $4,000