Lebow College of Business Drexel University

advertisement

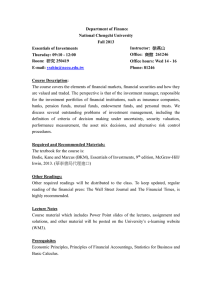

Lebow College of Business Drexel University Finance 626 Investment Management Spring 2011 Matheson 208 Professor Wes Gray Academic Building 209 wgray@drexel.edu 773-230-4727 http://faculty.lebow.drexel.edu/grayw Syllabus for Finance 626—Investment Management 1. Introduction 1.1. Course Description: This course is designed to provide a sound foundation of the fundamental concepts in investments. Students who master the course material will acquire the analytical tools and financial theory necessary for making good investment and asset allocation decisions. *** A primary goal of the course is to provide an opportunity to complete realistic tasks an employer may expect you to complete. The course is CHALLENGING and a few problem sets may take up to 10 hours to complete depending on your level of experience. If you do not have the prerequisites for this class, please DO NOT TAKE THIS CLASS. 1.2 Prerequisites: The course requires an intermediate level of finance knowledge. This course is highly quantitative and relies heavily on analytical tools and economic theory developed throughout the course. Students should be comfortable with probability, statistics, and regression analysis. Use of a spreadsheet package such as Excel will be vital for the homework assignments. Some use of calculus and linear algebra may also be required (familiarity with these concepts is helpful, but not required). 1.3 Grade Curve: Grades in this class are 100% transparent, so students can honestly assess their performance against their peers. The class will be graded on a curve where the average class grade will be a B+ (3.30 curve). 2. Course Requirements and Grading The course requirements are a final exam, five graded homework assignments, and a presentation. Your course grade will be determined by the following table: Grading Schedule Class Participation Weekly Market Report Presentation (1 per group) Problem Sets (5, top 4 graded) 1-page Intelligent Investor Professional Report Final 2.1. Class Participation: Class participation consists of the following: 1 5% 10% 15% 10% 60% Weekly Market Update Presentation peer review forms (see above) Classroom attendance (not showing up to class will influence your participation grade!) Prepared for class Engaged in classroom discussion Your behavior should respect your classmates' desire to learn. Each lecture begins exactly at 6:00 p.m. and ends around 9:00 pm. I understand your busy schedules, but try to be on time. If you carry a cell phone or any other type of `audible alert device', turn it off before entering class. Do not engage in side conversations and debates during the lecture. If you must come late, please let me know beforehand. 2.2. Weekly Market Report Presentation: Starting in the 3rd week, each group will be required to present (1) 20 minute “Weekly Market Update” presentation. The presentation will cover the following topics (this is a guideline only; you may present the material in any sensible way): Global News o What were the past week’s headlines? How will they affect various markets? What assets should we buy/sell? Why? Economic Indicators (domestic focus) o Description of each indicator and its relevance to the market o How did the markets react? Why? Do you agree with the reaction? Stock Market Recap (domestic focus) o How did the indices perform? Why? o What individual companies made news? How did it affect the market? Bond Market Recap (domestic focus) o How did various bond markets perform? How will this affect the economy? o What does the yield curve look like? Why? Following the presentation, selected students in the audience will be required to complete a “peer review” form with constructive feedback on the student presenters’ performance (one form per presenter). 2.3. Problem Sets: Five problem sets will be given, which consist of problems and several applications to real data. The latter are designed to apply techniques learned in the course to real data in a manner similar to what might be applied in practice. Keep in mind that exam questions will be similar to the assigned homework problems. In determining your final grade for the problem sets, I will only count your best four problem sets. You may do the problem sets and presentations in groups that are not to exceed four people. Problem set answers (and honor code attestation) must be submitted hard-copy to the TA at the start of class. Supporting problem set materials must be submitted electronically to the TA before class. Late problem sets will not be accepted. 2.4. Exams: The final exam tests your understanding of the key concepts in the class. The final does not test your ability to memorize or how to use your calculator. Rather the test will probe your deeper understanding of the material. As a result, the final may be more challenging than the exams you are used to. To prepare for this exam, you should work through the problem sets, review the lecture slides together with your own class notes, the required readings, the sample exams, and preferably the suggested problem sets and suggested readings (in that order of importance). The final exam is cumulative. 2 You will be allowed two double-sided pages of notes at the final exam. The sheets must be no larger than 8.5 inch by 11 inch. There are no restrictions on the content of the formula sheets. You will be asked to turn in these formula sheets after the final exam. No laptops or smart-phones are allowed on the exams. Calculators are permitted. 2.5. Professional Report: You are required to read “The Intelligent Investor” by Benjamin Graham. I require this reading to ensure that our academic discussions filled with equations and theories are balanced out by a healthy dose of common sense. I require a 1-2 page professional memo outlining 1) the key learning points from the text, and 2) an outline of a trading strategy discussed in the book (pretend you are writing this for your boss in a workplace setting). 2.6. Honor Code: You are responsible for maintaining Drexel's Honor Code which mandates zero tolerance for cheating and plagiarism. Violations of the honor code will be prosecuted with a minimum penalty of failure for the course, as required by code of conduct rules. If you become aware of any violations of the honor code you must take whatever steps are necessary to stop the violators. You must include a signed statement at the top of each problem set and exam, indicating that you adhere to the honor code. The statement is: `I pledge my honor that I have not violated the Drexel Honor Code in the completion of this exam/problem set.' It is in your best interest that the market place knows that Drexel takes honesty seriously; it adds to the value of your degree. 2.7. Group Work Guidelines: You will be allowed to work on the problem sets and presentations in groups of three to four people. Groups must be determined by the beginning of the second class and cannot change throughout the quarter. You should discuss the problems and presentations only with members of your problems or presentation groups, respectively. In the future, you should not discuss the problem sets with students taking Finance 626. In the end, a majority of your grade (e.g., final exam) is based on your individual efforts so it is in your best interest to learn the material and not to free-ride on your group members. Group sign-up can be completed at the following link: https://spreadsheets.google.com/ccc?key=0AjJBfJ0Yq2btdGNBdk5qekRvWWNUcDNIX1RkbjJ nN3c&hl=en&authkey=COv1xO0F#gid=0 3. Readings 3.1 Handouts: Prior to each class I will post an information sheet with the following information: Handouts for the day Topics for the day Readings for the day To-do for the next class 3.2. Recommended Textbook: The textbook for this class is: [1] “Investments" by Zvi Bodie, Alex Kane, Alan J. Marcus, 8th edition Required reading: [2] “The Intelligent Investor" by Benjamin Graham, any edition You will mainly use [1], abbreviated BKM. If you have an earlier edition of BKM (fifth, sixth, or seventh), you are fine (older editions are typically cheaper). There are only minor changes between 3 editions. Page and chapter numbers may vary slightly. BKM is available at the university bookstore or any online bookseller. The textbook is optional, but recommended. 3.3. Lecture Slides: Lecture slides will be posted in advance on the class web page. You will need to print these out and bring them to class with you. The lectures slides provide an outline of the course discussion and some detail on the topics covered. They are not a substitute for attending class since the class discussion will add value to the notes and texts. Simply reviewing the lecture slides and text material will not be sufficient to succeed in the course. 3.4. Assigned Readings: I will sometimes assign readings and/or notes which are relevant to the lecture. You are responsible for reading and understanding these assigned readings. These readings will be provided via the course website. 3.5. Current News: You are encouraged to follow financial and macroeconomic news in the Financial Times, Wall Street Journal, or The Economist. If you encounter an interesting article that you would like to share with the class, send me an email and I will post it on the class site. 4. Exam Office Hours, Office Hours, Class Material, and TA 4.1. Exam Office Hours: The TA and I will hold extended office hours before exams. 4.2. Office Hours: I will hold office hours Tues 1300-1500. Students who have questions or want to review previous material are encouraged to come to my office hours. If you would like to schedule an individual appointment for another time, please feel free to call or send me an email. My goal is to respond to every question within 24 hours. The TA will hold office hours in Academic Building 216 Wed 1230-1330. 4.3 Class Material: The class web site will be posted on Blackboard at http://drexel.blackboard.edu/. This is the central location where all teaching materials are posted. Class announcements will be posted here. Problem sets will be posted there as well. Solutions to the problem set will be posted no later than one week after the due date; they will not be distributed in paper form in class. 4.4. Teaching Assistant: John (Jack) Vogel, jrv34@drexel.edu. 5. Course Outline 5.1 Detailed Outline: Below is a schedule with topics for the course. More than one topic will typically be covered during a class session (bring coffee!). Week 1 Topics: Statistics, finance boot camp Required Readings: BKM Chapters 1-5, and Statistics Overview. Week 2 Topics: Fixed Income Required Readings: BKM Chapters 14-16. 4 Week 3 Problem Set #1 due at the beginning of class Weekly Market Report #1 Topics: Fixed Income (cont), Asset Allocation, Portfolio Mathematics Required Readings: BKM Chapters 6-7. Week 4 Problem Set #2 due at the beginning of class Weekly Market Report #2 Topics: Asset Allocation, Portfolio Mathematics Required Readings: BKM Chapters 6-7. Week 5 Weekly Market Report #3 Topics: Mean Variance Analysis, Capital Asset Pricing Model Required Readings: BKM Chapter 7-9. Week 6 Problem Set #3 Due at the beginning of class Weekly Market Report #4 Topics: Mean Variance Analysis, Capital Asset Pricing Model Required Readings: BKM Chapter 7-9. Week 7 Problem Set #4 Due at the beginning of class Weekly Market Report #5 Topics: Forwards and Futures, Guest Speaker: Mitch Pinheiro Required Readings: BKM Chapter 20, 22, 23 Week 8 Intelligent Investor Professional Memo Due Weekly Market Report #6 Topics: Forwards and Futures, Introduction to Options (Cont.) Required Readings: BKM Chapter 20, 22, 23 Week 9 Problem Set #5 due at beginning of class Weekly Market Report #7 Topics: The Limits of Arbitrage, Behavioral Finance Required Readings: BKM Chapter 12, “Survey of Behavioral Finance.” Week 10 Weekly Market Report #8 Topics: Market Efficiency and Anomalies, Final Preparation Required Readings: BKM, Chapter 11-12, 24, “What has Worked in Investing.” Week 11 FINAL EXAM 5