Department of Finance - National Chengchi University

advertisement

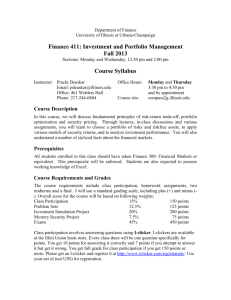

Department of Finance National Chengchi University Fall 2013 Instructor: 徐燕山 Essentials of Investments Office: 商館 261246 Thursday: 09:10 - 12:00 Room: 研究 250419 Office hours: Wed 14 - 16 E-mail: ysshiu@nccu.edu.tw Phone: 81246 Course Description: The course covers the elements of financial markets, financial securities and how they are valued and traded. The perspective is that of the investment manager, responsible for the investment portfolios of financial institutions, such as insurance companies, banks, pension funds, mutual funds, endowment funds, and personal trusts. We discuss several outstanding problems of investment management, including the definition of criteria of decision making under uncertainty, security valuation, performance measurement, the asset mix decisions, and alternative risk control procedures. Required and Recommended Materials: The textbook for the course is: Bodie, Kane and Marcus (BKM), Essentials of Investments, 9th edition, McGraw-Hill/ Irwin, 2013. (華泰書局代理進口) Other Readings: Other required readings will be distributed to the class. To keep updated, regular reading of the financial press: The Wall Street Journal and The Financial Times, is highly recommended. Lecture Notes Course material which includes Power Point slides of the lectures, assignment and solutions, and other material will be posted on the University’s e-learning website (WM3). Prerequisites Economic Principles, Principles of Financial Accountings, Statistics for Business and Basic Calculus. Course Requirements The course requirements consist of a final exam and three group projects and one individual project. The final exam is comprehensive, in-class, with problems probably from the projects we have discussed in classes. For the group (or individual) projects, groups should consist of no more than 3 students. Each group (or individual) will be responsible for preparing the three projects (or one individual project), writing a short analysis and presenting their findings. Write-ups should be limited to three pages, plus appendices with spreadsheet printouts, etc. All the project reports must be sent to my e-mail account, ysshiu@nccu.edu.tw, before/at the midnight (pm 12:00) preceding the due date (i.e., a class meeting day). If you send in your report within three hours late after the due time (i.e., the report is sent in between 12:00pm and 3:00am), 20 points will be subtracted from your grade you get for your project. If there is another three hours delay (i.e., the report is sent in between 3:00am and 6:00am), an additional 20 points will be subtracted. If there is another three hours delay (i.e., the report is sent in between 6:00am and 9:00am), an additional 20 points will be subtracted. If you still do not send in your report before 9:00am, you will receive NO grade point on your project. In addition, you must also hand in a hardcopy of your report at the beginning of the class. If you do not hand in the hardcopy, 10 points will be subtracted from your grade. All students will need to have a calculator for this class. It is an advantage to have a financial calculator, but not a requirement. Every student in investment courses is expected to be comfortable with EXCEL tools. This course is challenging and cumulative in nature. For this reason, it is important not to fall behind, as it is difficult to catch up. Class attendance is mandatory. Students are expected to arrive to class on time and stay to the end of the class period. Chronically arriving late or leaving class early will have an impact on a student’s grade. Unexcused absence from more than two classes will materially affect your grade. To be qualified for this class, you MUST show up at our first class meeting on September 26. Any student who fails to show up will be demanded to drop this course. Grading policy The final grade will be determined as follows: Class participations and presentations 10% Group and individual projects 50% Final exam 40% 2 Class Schedule Readings should be done prior to the class week in which the material is discussed. BKM 1.1: Chapter 1, sec. 1; BKM 2: the whole 2nd chapter. Week Topics Readings Problems 1 9/26 Overview of class Financial instruments and why we need them BKM 1.1-1.6, BKM 2 2 10/3 Financial markets: How securities are traded? BKM 3.1-3.7 BKM 3.6 3 Time value of money: FV, Review Groups’ stock list due this 10/17 PV, annuities, perpetuities 4 10/24 Measures of return, Statistics review, Risk and expected returns BKM 5.1-5.3 BKM 5.1, 5.4,5.5 5 10/31 Portfolio selection with two risky securities BKM 6.1-6.2 Excel example: Portfolio selection BKM 6.5,6.6 6 Portfolio selection with BKM 5.5, 6.3, 6.4 BKM 6.7-10,6.13 11/7 multiple risky securities Excel example: Portfolio optimizer 7 11/14 Capital Asset Pricing Models BKM 6.5, 7.1-7.3 BKM7.3,7.15,7.17-18 Group project 1 due next week 8 11/21 Capital Asset Pricing Models, continued BKM7.2-7.3 Excel example: Beta estimation BKM 7.8-12 Presentations on project 1 Group project 2 due next week 9 11/28 Equity valuation 10 12/5 Arbitrage BKM 13 BKM 13.1,13.3 Presentations on project 3 11 12/12 Fixed income securities BKM 10.1-10.4 BKM 10.2,10.4,10.22 12 Management of interest BKM 10.6, BKM 10.30,11.1-4 week Presentations on project 2 Group project 3 due next week 3 12/19 rate risk 11.1-11.4 Individual project 1 due Excel example: Immunization next week 13 12/26 Options basics and strategies BKM 15.1-15.2 BKM 15.5,15.25,15.26 Presentations on individual project 1 14 1/2 Option pricing BKM 16.1-16.4 Excel example: Binomial model BKM 16.7,16.27 15 1/9 Market efficiency Conclusion & Final review BKM 8 BKM 8.3,8.17,8.20 16 1/16 Final exam 4 Assignment 1: Investments Student Data Sheet To be returned by October 3, 2013. Name Student ID # Major Minor Email address Reasons for taking this course: Please include below a small photo of yourself. 5