Key Points for August 24, 2006

advertisement

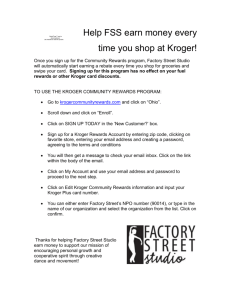

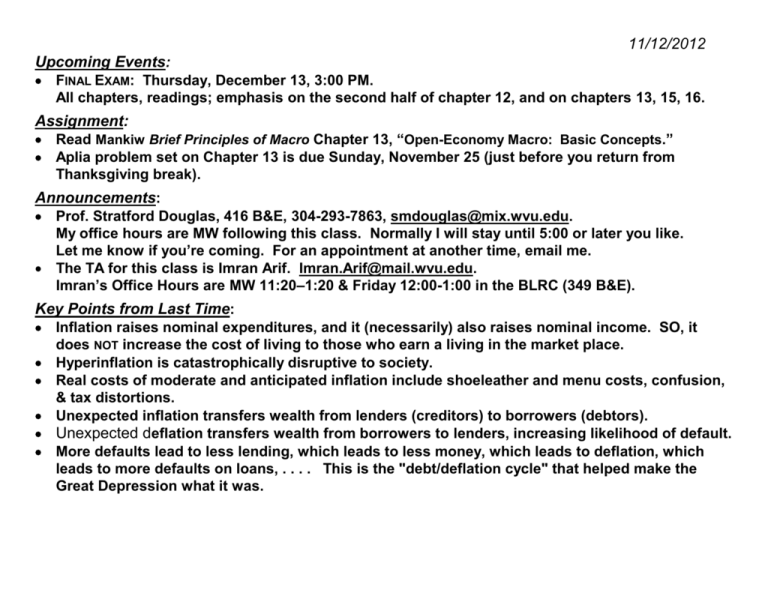

11/12/2012 Upcoming Events: FINAL EXAM: Thursday, December 13, 3:00 PM. All chapters, readings; emphasis on the second half of chapter 12, and on chapters 13, 15, 16. Assignment: Read Mankiw Brief Principles of Macro Chapter 13, “Open-Economy Macro: Basic Concepts.” Aplia problem set on Chapter 13 is due Sunday, November 25 (just before you return from Thanksgiving break). Announcements: Prof. Stratford Douglas, 416 B&E, 304-293-7863, smdouglas@mix.wvu.edu. My office hours are MW following this class. Normally I will stay until 5:00 or later you like. Let me know if you’re coming. For an appointment at another time, email me. The TA for this class is Imran Arif. Imran.Arif@mail.wvu.edu. Imran’s Office Hours are MW 11:20–1:20 & Friday 12:00-1:00 in the BLRC (349 B&E). Key Points from Last Time: Inflation raises nominal expenditures, and it (necessarily) also raises nominal income. SO, it does NOT increase the cost of living to those who earn a living in the market place. Hyperinflation is catastrophically disruptive to society. Real costs of moderate and anticipated inflation include shoeleather and menu costs, confusion, & tax distortions. Unexpected inflation transfers wealth from lenders (creditors) to borrowers (debtors). Unexpected deflation transfers wealth from borrowers to lenders, increasing likelihood of default. More defaults lead to less lending, which leads to less money, which leads to deflation, which leads to more defaults on loans, . . . . This is the "debt/deflation cycle" that helped make the Great Depression what it was. NX = Net Exports = Exports Imports = Trade Balance Trade Surplus occurs when NX > 0. Trade Deficit occurs when NX < 0. The US is ran a trade deficit of 3.8% of GDP in 2011. It has been running a trade deficit most of the past 40 years. A U.S. trade deficit indicates that foreigners are sending more goods and services to the US than the US is sending to foreigners. Why do we usually assume this is a bad thing? Current Class Outline: XIII. Open-Economy Macro: Basic Concepts A. The International Flows of Capital and Goods B. International Prices: Real and Nominal Exchange Rates C. Purchasing Power Parity (PPP) Link to GDP Components Spreadsheet Trading Partners: Census Bureau Data Trading Partners Imports, Exports, Deficit by Month Trade Data: St. Louis Fed, Balance of Payments Where does Santa live? Foreign Holdings of US Treasury Securities; Federal Debt Outstanding Nominal Exchange Rates (CNN Money) Exchange Rate Data: St. Louis Fed Exchange Rates (CNN) Burgernomics Quarterly trade surplus as a percentage of annual GDP, 1970 to present. Today's iClicker Questions These questions will raise your grade if you answer correctly, and may lower your grade if you don’t answer at all. Wrong answers neither hurt nor help. You may go ahead and answer the first question below right now. 1) Suppose that the country of Appalachee imports $500 billion in goods and services and exports $750 billion in goods and services. We would say that Appalachee has a _______ trade balance, or a trade ______, and its net exports are $_______. a) negative, deficit, -$250 Billion. b) positive, surplus, $250 Billion. c) positive, deficit, $250 Billion. d) positive, surplus, $750 Billion. e) negative, surplus, $250 Billion. 2) Over the last ten years, U.S. exports of goods and services have a) increased steadily. b) declined steadily. c) declined steadily, except during the world financial collapse of 2008. d) increased steadily, except during the world financial collapse of 2008. 3)Think of yourself as a country, and Kroger as another country. If your monthly grocery bill at Kroger is $300, then you are running a a) trade deficit of $300 with Kroger, which benefits both you and Kroger. b) trade surplus of $300 with Kroger, which benefits both you and Kroger. c) trade deficit of $300 with Kroger, which benefits Kroger but hurts you. d) trade deficit of $300 with Kroger, which benefits you but hurts Kroger. e) trade deficit of $300 with Kroger, which hurts both you and Kroger. 4) Think of yourself as a country, and Kroger as another country. If your monthly grocery bill at Kroger is $300 and you earn $1000 per month working at Kroger then you are running a a) trade deficit of $700 with Kroger, which benefits both you and Kroger. b) trade surplus of $700 with Kroger, which benefits both you and Kroger. c) trade deficit of $700 with Kroger, which benefits Kroger but hurts you. d) trade deficit of $700 with Kroger, which benefits you but hurts Kroger. e) trade deficit of $1300 with Kroger, which benefits both you and Kroger. NCO = Your acquisition of Kroger’s Financial Assets minus Kroger’s Acquisition of Your Financial Assets 5) Think of yourself as a country, and Kroger as another country. If your monthly grocery bill at Kroger is $300 and you earn $1000 per month working at Kroger then your Net Capital Outflow to Kroger is a) -$700, since that is the net INflow of dollars to you from Kroger. b) $300. c) $1000. d) the $700 of your paycheck that you do not spend at Kroger. ANSWERS: 1) B 2) D 3) A 4) B 5) D