First quarter report

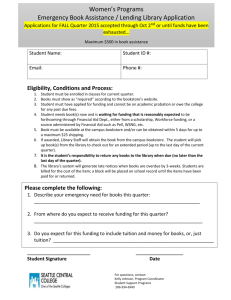

advertisement