LA FARGE FEBRUARY 2009 - john keells stock brokers

advertisement

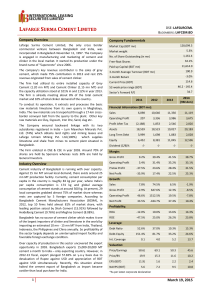

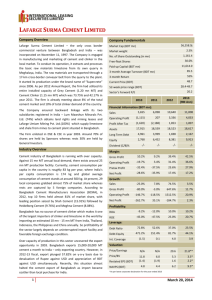

BDT 490.00 Lafarge Surma Cement Ltd Price-Volume Graph 700 450,000 Volume Price 400,000 600 350,000 500 300,000 400 250,000 Financial Revenue NPAT EPS Year (Dec) BDT' mn BDT' mn BDT' mn 2006 153 (580) (9.99) 2007 2,400 (1,096) (18.88) 2008E 6,383 770 13.26 2009E 9,534 1,586 27.32 2010E 10,804 2,024 34.85 a Lafarge Surma Cement Limited’s (LSC) integrated cement manufacturing plant has an annual capacity of 1.5 million tonnes of grey cement and 1.15 million tonnes of clinker. The Company extracts and processes the basic raw materials like limestone & shale from its own quarry in Meghalaya, India. A 17km cross-border conveyor belt links the quarry with the cement plant for transportation of raw materials. A separate 30 MW gas engine power generation plant has been setup to supply uninterrupted power to the cement plant. The company is now operating at full capacity after a court injunction in India resulted in a temporary halt to the production of clinker in 2007. Legal proceedings are however ongoing over a dispute over quarrying on forest land. a The annual per capita consumption of cement in Bangladesh is around 55.75 kg, with an installed capacity of 15 million tonnes per year and a cement demand of 8 million tonnes per year. Local producers account for as much as 60% of current cement production in the country while foreign manufacturers account for 40% of market share. Consumption of cement in Bangladesh is expected to increase further in the coming years following a newly elected government that is likely to oversee a roll out of government infrastructure projects along with an upturn in private sector led construction activity. We expect a volume growth rate of around 8% per year for the sector over the next few years a The company benefits from higher gross margins on account of having its own supply source for clinker and is presently operating at full capacity. The company’s sales revenue is expected to rise during 2008-2010 at a CAGR of 30.1% with total grey cement sales volume growth at a CAGR of 30.25% and surplus clinker sales volume growth at a CAGR of 19.52% in the same period. EBITDA margins are expected to be maintained at 41.18% to 37.79%. for the years 2008 and 2009 respectively. a Expected earnings growth of 170% and 106% for the year 2008 and 2009 correspond to a P/E 36.95x and 17.94x for 2008E and 2009E. respectively. 150,000 100,000 100 50,000 - 01-Jan-06 28-Feb-06 27-Apr-06 25-Jun-06 20-Aug-06 16-Oct-06 19-Dec-06 18-Feb-07 12-Apr-07 11-Jun-07 01-Aug-07 25-Sep-07 22-Nov-07 22-Jan-08 13-Mar-08 08-May-08 02-Jul-08 25-Aug-08 22-Oct-08 21-Dec-08 LAFARGE SURMA CEMENT BD (LAFSURCEML) 58.07 Ordinary Shares (mn) 15.40% Free Float 639.00 / 419.75 12 mth High/Low (BDT) 28,454 Market Capitalization(BDT mn) 58,640 Average Daily Volume (Shares) Price Performance 1 mth 6 mth 12 mth DSI 13.19% -10.77% -8.94% LAFSURCEML 11.40% -1.91% 6.71% Farzana Hoque farzana@lbsbd.com LankaBangla Securities Ltd DSE Annex building (1st Floor) 9/E, Motijheel C/A, Dhaka-1000 Bangladesh. 880 29561868, 880 27174256 880 27174315, 880 29570496 Fax: 880 29555384 Email: lbsldhk@accesstel.net Tel: John Keells Stock Brokers (Pvt) Ltd Company No. PV 89 130, Glennie Street, Col. 2 Sri Lanka. Tel: Fax: 941 244 6694/5, 941 234 2066/7, 941 2342 068 Email: jkstock@keells.com February 2009 6.60 8.74 7.04 5.04 3.70 Lafarge Surma Cement (LSC), incorporated in January 2003 is the first multinational cement manufacturer in the country with a fully integrated cement plant set up at a cost of US$ 225mn at Sunamgong in the North East of the country. The company is promoted by Lafarge of France and Cementos Molins the concrete & construction aggregates manufacturer in Spain. The company commenced commercial production in October of 2006 and has a 10% market share of the domestic cement market excluding its supply of clinker to other local manufacturers. 200 0 P/BV a 200,000 300 EPS EV/Sales EV / Growth (x) EBITDA (x) (49.03) -43% 248.95 (1977.7) (25.95) 89% 15.60 200.2 36.95 170% 5.54 13.5 17.94 106% 3.58 9.5 14.06 28% 3.05 8.1 P/E(x) An LBSL / JKSB Research Publication LAFARGE SURMA CEMENT LTD Page 1 of 5 Bangladesh Equities PROFILE a Lafarge Surma Cement Limited (LSC) is the first multinational cement manufacturer in the country with a fully integrated cement plant where cement and the basic raw material clinker are manufactured in the same facilities at Chhatak, Sunamganj in the North East of Bangladesh. Major shareholders of the company include Lafarge of France and Spanish cement producer Cementos Molins. Lafarge Group with years of experience in the production of construction materials is one of the leading cement producers worldwide while Cementos Molins is renowned in concrete, aggregates, mortar and pre-cast product production in Spain. a Lafarge Surma Cement Limited (LSC) is the only integrated clinker and cement producer in Bangladesh incorporated in January 2003 as a public limited company in Bangladesh, starting its commercial operations in 2006. Its only cement brand “Supercrete” currently holds a market share of 10%. a The annual per capita consumption of cement in Bangladesh is around 55.75 kg, which ranks as one of the lowest in the world with its neighbor India having a per capital cement consumption estimated at 150 kg. The dominant type of cement used in the country is Ordinary Portland Cement (OPC), with a 95% to 5% mix of clinker and gypsum. Clinker, is primarily imported from countries like India, Thailand, Malaysia, Philippines, Indonesia and China and is therefore susceptible to fluctuating global raw material costs. The country lacks cement plants that are integrated with clinker production and as a result is forced to import clinker for its entire cement production. Lafarge Cement is currently the only integrated cement producer in Bangladesh with a clinker production capacity of 1.15mn MT that is sourced via a cross border conveyer belt originating from the Indian State Meghalaya. a The country has an installed capacity of 15 million tonnes per year and a cement demand of 8 million tonnes per year, with a wide gap in capacity and demand fueling severe competition in the market. This has resulted in an increase in consolidation in the sector among local producers. Local producers account for as much as 60% of current cement production in the country while foreign manufacturers like Lafarge, HCBL, Cemex and Holcim accounting for 40% of the market. a Among the local manufacturers Shah Cement, Fresh Crown, Seven Circle, Royal and Aramit are the main players, many of whom lost market share initially but subsequently enhanced their supply chain management and their marketing and distribution capability in order to remain competitive. Shah Cement was the market leader in 2007 with a market share of 22% a A slowdown in the local construction sector seen over the last year as a result of political uncertainty, the recent anti-corruption drives as well as a downturn in large government infrastructure projects has led to widening of the installed capacity to demand gap. Consumption of cement in Bangladesh has however seen an increase in the last quarter and is expected to increase further in coming years following a newly elected government that is likely to oversee a roll out of government infrastructure projects along with an upturn in private sector lead construction activity. We expect a volume growth rate of around 8% per year for the sector over the next few years. Page 2 of 5 CEMENT INDUSTRY IN BANGLADESH PLANT AND PRODUCTION a Lafarge Surma Cement Limiteds’ (LSC) integrated cement manufacturing plant of US$ 255m has an annual installed capacity of 1.5 million tones of Grey cement and 1.15 million tones of clinker at Chhatak under the Sunamganj district. The Company extracts and processes the basic raw materials like limestone & shale from its own quarry in Meghalaya. A 17km cross-border conveyor belt links the quarry with the cement plant for transportation of raw materials. A separate 30 MW gas engine power generation plant has been setup to supply uninterrupted power to the plant. a The Lafarge Surma Cement Limited (LSC) project encompasses quarrying, crushing and marketing activities through its subsidiaries, Lum Mawshun Minerals Private Limited (LMMPL) in Meghalaya and Lafarge Umiam Mining Private Limited (LUMPL) in Bangladesh with a 74% and 100% ownership by LSC respectively. a The Company started its production from October 2006 but failed to operate at full capacity in 2007 due to disruptions in the supply of limestone. Lafarge Umiam Mining Private Limited (LUMPL), a subsidiary of LSC owning the quarry was charged of environmental degradation as the sites of the quarries were allegedly on forestland and not wasteland as claimed. This resulted in a disruption of mining activities following a court directive in India. During this period, the company continued its Grey cement production in a limited scale importing its requirement of clinker. However, in September 2007, the closure order was lifted temporarily by the court and the company started to produce cement from its own clinker since December 2007. Production now continues unhindered although the legal dispute is still ongoing. The company may end up having to pay compensation as settlement of the issue. a Currently, the Company has an annual installed capacity 1.5 million tones of grey cement and 1.15 million tones of clinker but it could utilize only 22% and 23% of its capacity of grey cement and clinker production in 2007, but is expected to have increased its capacity utilization to 55% in grey cement production and 70% in clinker production in 2008. With consumption of cement expected to increase in the coming years for large infrastructure development plans by the newly elected government, in addition to fresh private sector lead projects we expect the company to utilize 100% capacity of clinker production and between 90%-100% capacity in grey cement production in the coming years being the main contributor to a sharp rise in expected earnings in 2009. The company has not disclosed any plans to enhance capacity in the short to medium term. While the necessity for capacity expansion is on the cards in 2010 we have not factored any enhancement in capacity in our forecasts. a Lafarge Cement has the distinct advantage of being the only integrated cement manufacturer in the country with competitors forced to import its raw materials for production thus contributing to wider gross margins. a Lafarge Surma Cement Limited (LSC) produces its own clinker for its cement production with the surplus clinker being sold to local cement manufacturers in the country. Import dependency of major cement manufacturers in Bangladesh for the supply of clinker is not only expensive due to high freight cost, duties, handling/re-handling charges but sourcing a consistent quality and uninterrupted supply of clinker is also a challenge. The control over costs, quality and uninterrupted supply of clinker ensures Page 3 of 5 COST STRUCTURE a competitive advantage over other local and multi-national cement manufacturers in the country. The company benefits from superior advantages over its cost of clinker which is significantly lower than other local manufacturers. a The gross margin for the year 2007 does not represent a true reflection of its profitability as the company produced a limited scale of grey cement by importing clinker from the international market due to the interruption in supply of limestone from India as a result of litigation against the company. With business operations expected to stabilize fully in the current and subsequent years, the company is expected to retain healthy gross margins a Gross margins for 2008 are expected to amount to 39% declining to 37% in 2009 as a result of a reduction in clinker and gery cement prices in line with a decline in market prices. The decline in imported clinker prices have forced a reduction in prices of clinker sold by La Frage Surma Cement Ltd thus reducing margins. Margins would further moderate as a result of an expected reduction in retail grey cement prices in line with a reduction in prices witnessed in the market that has resulted from delcien in raw material costs for the industry. FINANCIAL PERFORMANCE a The Company’s sales revenue includes sales revenue from grey cement and the sale of surplus clinker to local cement manufacturers. The sales revenue is expected to rise during 2008-2010 at a CAGR of 30.1% with total grey cement sales volume growth at a CAGR of 30.25% and surplus clinker sales volume growth at a CAGR of 19.52% in the same period. An increasing trend in capacity utilization with a stable cost structure is expected to result in earnings growth of 106% and 28% for years 2009 and 2010. a EBITDA of BDT 3.06bn for the year 2009 is an expected increase of 37% over 2008, with EBITDA margins declining from 41.18% to 37.79%. ROE is expected at 20.54% and 38.25% for the years 2008 and 2009 respectively. The company has an accumulated loss of BDT 2.71bn in 2007 and is expected to be reversed to a surplus by 2009. VALUATIONS Full capacity utilization is expected to result in a stable growth in earnings over the next few years also enhanced by a decline in finance expense. Healthy earnings in 2008 and a 106% earnings growth expected in 2009 correspond to a P/E of 36.95x and 17.94x respectively at a market price of BDT 490/-. Income Statement For the year ended 31st December 2006 BDT 'mn 2007 BDT 'mn 2008E BDT 'mn 2009E BDT 'mn 2010E BDT 'mn Revenue Cost of Sales Gross Profit 153 111 42 2,400 2,372 28 6,383 3,880 2,503 9,534 5,999 3,535 10,804 6,756 4,048 General and administrative expenses Selling and distribution expenses Operating (Loss)/Profit (164) (35) (158) (264) (109) (344) (303) (125) 2,074 (349) (125) 3,062 (401) (125) 3,522 Exchange gain/(loss) in foreign currency translation Finance Expenses Other (expense)/Income Contribution to WPPF Net Profit/(Loss) before tax Income tax income / (expense) Net Profit/(Loss) after tax (363) (165) 1 (685) 105 (580) 110 (1,138) (5) (1,378) 281 (1,096) (50) (917) 8 (53) 1,062 (292) 770 (4) (773) 12 (108) 2,188 (602) 1,586 (5) (625) 37 (138) 2,791 (768) 2,024 Page 4 of 5 a 2006 BDT 'mn 2007 BDT 'mn 2008E BDT 'mn 2009E BDT 'mn 2010E BDT 'mn 15,224 172 106 15,502 15,494 178 394 16,066 15,090 178 394 15,662 14,708 178 394 15,280 14,345 178 394 14,916 Total Assets 990 74 669 18 1,751 17,253 851 56 728 30 1,665 17,730 764 448 511 218 1,940 17,602 650 284 763 385 2,082 17,361 600 519 702 618 2,439 17,356 Share Capital Foreign currency translation Accumulated loss Shareholders' Equity 5,807 113 (1,612) 4,308 5,807 155 (2,708) 3,254 5,807 170 (1,938) 4,039 5,807 187 (352) 5,643 5,807 206 1,672 7,685 8,292 8,292 8,113 8,113 5,724 5,724 4,530 4,530 3,056 3,056 595 318 2,348 1,392 4,653 12,945 17,253 340 415 4,720 888 6,364 14,476 17,730 957 766 4,920 1,194 7,838 13,562 17,602 1,430 1,144 3,420 1,194 7,189 11,719 17,362 972 648 3,520 1,474 6,615 9,671 17,356 Current Assets Inventories Trade Receivables Advances,deposits and prepayments Cash and cash equivalents Non-Current Liabilities Long-term debt Current Liabilities Trade payables Other payables Bank overdrafts Current portion of long term debt Total Liabilities Total Equity and Liabilities Cash Fow Statement As at 31st December Cash Flows from Operating Activities Cash Flows from Investing Activities Acquisition of property,plant and equipement Intangible assets Cash Flows from Financing Activities Long term debt Short term debt Dividend Paid Share capital & deposits for shares Net Increase/(Decrease) in cash & cash equivalents Cash & Cash Equivalents at Beginning of the Year Cash & Cash Equivalents at End of the Year 2006 BDT 'mn 2007 BDT 'mn 2008E BDT 'mn 2009E BDT 'mn 2010E BDT 'mn (946) (1,199) 2,203 3,012 1,487 (2,258) (11) (2,269) (605) (25) (630) (150) (150) (160) (160) (170) (170) 268 1,882 2,150 (574) 2,415 1,840 (2,075) 210 (1,865) (1,194) (1,490) (2,684) (1,194) 110 (1,084) (1,065) 1,082 17 12 17 29 188 29 217 167 217 384 233 384 617 This document is published by LankaBangla Securities Ltd and John Keells Stock Brokers (Pvt) Ltd for the exclusive use of their clients. All information has been compiled from available documentation and LBSL's and JKSB’s own research material. Whilst all reasonable care has been taken to ensure the accuracy of the contents of this document, neither LBSL or JKSB nor its employees can accept responsibility for any decisions made by investors based on information herein. Page 5 of 5 Balance Sheet As at 31st December Assets Non-Current Assets Property, plant and equipment Intangible assets Deffered income tax assets