June 2012 Solutions to Final Exam Review Questions

advertisement

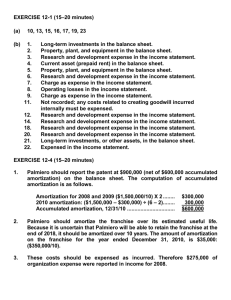

June 2012 Solutions to Final Exam Review Questions Corporate Finance Review Questions 1. Maple Ltd. currently has 10 million common shares outstanding. Maple has just paid a dividend of $0.25 per share and investment analysts have informed you that the dividends are expected to grow by 7% annually for the foreseeable future. The analysts have also informed you that the shares are expected to be selling at a price of $4.50 in 1 year’s time, the beta on the Maple shares is 1.10, the market price of risk is 6%, and the risk-free rate of return is 4%. Hint - The $4.50 does not include the dividend that will be paid in one year’s time. The sum of these amounts must be brought back to time now. What is the current market price for a Maple common share? a) $4.07 b) $4.29 c) $4.31 d) $4.47 e) None of the above 2. At the most recent Treasury bill auction, 182-day Treasury bills (T-bills) with a face value of $100 were selling for $95.60. At this price, what is the yield offered by the T-bills? a) 2.3% b) 4.6% c) 9.4% d) 19.7% e) None of the above 3. Ferny Inc. currently has 60 million common shares outstanding with a current market price of $13 per share. The shares just paid a dividend of $1.50 per share and investment analysts expect the dividends to grow at an average annual rate of 2% for the foreseeable future. What is the cost of Ferny’s common shares if flotation costs on new common shares are expected to be 3% after-tax, Ferny’s tax rate is 30%, and Ferny intends to finance its growth from retained earnings? a) 11.77% b) 13.54% c) 13.77% d) 14.13% e) None of the above Comment that will be $.25 x 1.07 market val time will gi The discou can be obt r = 0.04 + 1 4.7675 FV 1n 0 pmt 10.6 I CPT PV = Comment 182/365 n ‐95.60 PV 100 FV 0 Pmt Cpt i Comment Note that in kre re You are us costs for in ke = 1.50 (1 that is, 13.7 Corporate Finance Review Questions 4. Your company currently purchases its inventory on credit with trade terms of 3/15, net 60. What is the cost of the missed discount if the company decides to delay payment until day 60? a) 3.00% b) 3.09% c) 20.36% d) 28.03% e) None of the above 5. Trail Inc. currently has 5 million preferred shares outstanding. The shares have a par value of $22.50 per share and their current price is $25 per share. Trail’s tax rate is 40% and flotation costs on a new issue of preferred shares are 5% before tax. What per-share dividend are the preferred shares paying if the component cost of the preferred shares in a weighted average cost of capital calculation is 8.25%? Hint – The after tax costs of flotation must be subtracted from the share price to obtain the net proceeds. a) $1.80 b) $1.96 c) $2.00 d) $2.06 e) None of the above Comment 60 – 15 = 4 45/365 n -97 PV 100 FV 0 pmt Cpt i Comment Comment Corporate Finance Review Questions Corporate Finance Review Questions Corporate Finance Review Questions A worldwide cosmetics company can upgrade the quality of one of its products by purchasing new equipment at a cost of $155,000. The new equipment would replace old equipment that has a current market value of $23,000. The old equipment originally cost $180,000 and was three quarters amortized. If the old equipment was used for an additional 12 years, its salvage value at that time would be $5,000. The new equipment has an expected life of 12 years. Its salvage value is estimated at $30,000. By upgrading the quality of this product, the company would be able to increase the sale price. As a result, the operating income before tax will increase by $20,000 per year for the first 3 years, and by $25,000 per year during the last 9 years. The company’s tax rate is 40% and its cost of capital after tax is 15%. The capital cost allowance for the new equipment is 20%. Required Compute the net present value (NPV) for the investment and state whether the company should proceed with the investment. Comment Comment Corporate Finance Review Questions Bad Debt Review Questions The trial balance before adjustment of Rosen Company reports the following balances: Dr. Cr. Accounts receivable $105,000 Allowance for doubtful accounts $ 2,500 Sales (all on credit) 650,000 Sales returns and allowances 40,000 Included in accounts receivable is $5,000 in accounts that must be written off Instructions (a) Calculate the amount of bad debt expense that would be recorded based on the ageing method using seven percent of gross accounts receivable. (b) Calculate the net recoverable amount on the balance sheet based on bad debt expense being calculated based on 2% of net credit sales Comment Comment AR after w 100,000; A 12,200 cr = Bad Debt Review Questions Depreciation Review Questions On March 1, 2012, Sundemon Company purchased snow-making equipment for $840,000 having an estimated useful life of six years with an estimated residual value of $60,000. Amortization is taken for the portion of the year the asset is used. The asset is a Class 8 asset with a maximum CCA rate of 20%. The company has a December 31 year end. Required For each of the following independent assumptions, calculate the depreciation. If you are using a financial calculator show your keystroke for requirement 1 to earn part marks. 1. 2. 3. 4. 5. Straight line - 2012 Sum of the years digits – 2014 Declining balance - 2014 Double declining balance – 2014 Capital cost allowance - 2014 Depreciation Review Questions Bond Review Questions Vaggio Corporation issued $400,000 of 8% bonds on October 1, 2009, due on October 1, 2014. The interest is to be paid four times a year on January 1, April 1, July 1, and October 1. The bonds were sold to yield 12% effective annual interest. Vaggio Corporation closes its books annually on March 31. Required 1. Calculate the amount that Vaggio received from the issue of the bond 2. Calculate the interest expense that would be shown on the income statement for the year ended March 31, 2010. 3. Calculate the interest expense that would be shown on the income statement for the year ended March 31, 2011. If you are using a financial calculator show your keystrokes in order to earn part marks Comment Bond Review Questions Foreign Exchange Review Questions This information pertains to the following questions. FRC Ltd. is a foreign company and is a subsidiary of a Canadian company. At the end of the first fiscal year (December 31), the following balances appeared on FRC Ltd.’s financial statements denominated in the host country’s foreign currency (FC): Accounts receivable (A/R) Inventory (FIFO basis) Capital assets Bonds payable Sales Purchases Amortization expense 85,000 FC 55,000 FC 500,000 FC 250,000 FC 960,000 FC 625,000 FC 45,000 FC Other Information: Accounts receivable (A/R) relates to sales that occurred evenly over the 4th quarter. The goods in inventory at year end were purchased evenly over the 4th quarter. Capital assets were purchased and bonds were issued on January 1. Sales, purchases and expenses occurred evenly throughout the year. Exchange rates were as follows: 1 FC = $ CDN January 1 0.85 December 31 0.70 Average for the year 0.82 Average for the 4th quarter 0.73 1. (+) If FRC Ltd. is financially and operationally dependent on its Canadian parent, the amounts that should appear on the translated year-end financial statements of FRC Ltd. (in Canadian dollars) are a) inventory $40,150, capital assets $425,000, sales $787,200. b) inventory $38,500, capital assets $350,000, sales $672,000. c) inventory $45,100, capital assets $410,000, sales $787,200. d) inventory $40,150, capital assets $350,000, sales $700,800. e) inventory $38,500, capital assets $425,000, sales $672,000. Comment Foreign Exchange Review Questions 2. (+) If FRC Ltd. is financially and operationally independent of its Canadian parent, the amounts that should appear on the current year’s translated financial statements of FRC Ltd. (in Canadian dollars) are a) A/R $59,500, cost of goods sold $472,350, amortization expense $38,250. b) A/R $69,700, cost of goods sold $467,400, amortization expense $36,900. c) A/R $62,050, cost of goods sold $416,100, amortization expense $32,850. d) A/R $59,500, cost of goods sold $467,400, amortization expense $36,900. e) A/R $59,500, cost of goods sold $399,000, amortization expense $31,500. Comment Foreign Exchange Review Questions Foreign Exchange Review Questions This information pertains to the following questions. Another World Inc. (AWI) is a foreign subsidiary of a Canadian company in its second year of operation. The following December 31 year-end balances, denominated in the host country’s foreign currency (FC), appeared in the records of AWI: Cash Accounts receivable Inventory (FIFO basis) Capital assets Accounts payable Capital stock Retained earnings, January 1 Sales Cost of sales Amortization expense Other operating expenses Year 1 30,000 FC 45,000 FC 40,000 FC 190,000 FC 55,000 FC 10,000 FC 0 FC 550,000 FC 200,000 FC 10,000 FC 100,000 FC Year 2 150,000 FC 90,000 FC 75,000 FC 180,000 FC 25,000 FC 10,000 FC 240,000 FC 600,000 FC 250,000 FC 10,000 FC 120,000 FC Other Information: The inventory was purchased evenly over the fourth quarter of each respective year. Capital assets were purchased on January 1, Year 1. Capital stock was issued on January 1, Year 1. Sales, purchases and expenses occurred evenly throughout each year. Exchange rates were as follows: 1 FC = CDN$ Year 1 January 1 December 31 Average for the year Average for the fourth quarter Year 2 0.36 0.30 0.33 0.31 0.30 0.34 0.32 0.35 Foreign Exchange Review Questions 3. If AWI is financially and operationally independent of its Canadian parent, the amounts that should appear on the Year 2 translated year-end financial statements of AWI (in Canadian dollars) are a) inventory $24,000, sales $192,000, amortization expense $3,200 b) inventory $25,500, sales $204,000, amortization expense $3,400 c) inventory $25,500, sales $192,000, amortization expense $3,200 d) inventory $26,250, sales $192,000, amortization expense $3,400 e) inventory $26,250, sales $204,000, amortization expense $3,200 4. If AWI is financially and operationally dependent of its Canadian parent, the amounts that should appear on the Year 2 translated year-end financial statements of AWI (in Canadian dollars) are a) inventory $24,000, sales $192,000, amortization expense $3,200 b) inventory $25,500, sales $204,000, amortization expense $3,400 c) inventory $26,250, sales $192,000, amortization expense $3,200 d) inventory $26,250, sales $192,000, amortization expense $3,400 e) inventory $26,250, sales $192,000, amortization expense $3,600 Comment financially a of its Canad foreign ope should be t method. Un assets and l using the D rate of 0.34 should be t average rat FC x .34 = $ = $192,000; = $3,200. Choice a) – of .32 for al Choice b) – .34 for all. Choice d) – average for Year 2, rate amortizatio Choice e) – average rat Year 2 average ra amortizatio Comment financially a its Canadian foreign ope should be t method. Un monetary, n liabilities sh historical ex statement i historical ra assets Inventory = Sales = 600, Amort relat Foreign Exchange Review Questions Ratio Analysis Review Questions The following partial information has been extracted from the financial statements of Toss Away Ltd., a recycling plant: Current assets Current liabilities Cash and temporary investments Net accounts receivable Net income Sales Cost of goods sold Interest expense Amortization expense Income tax rate Share price Preferred dividends declared and paid Common dividends declared and paid Common shares outstanding throughout the year Preferred shares outstanding throughout the year 2010 $800,000 $450,000 $400,000 $250,000 $300,000 $2,200,000 $1,350,000 $100,000 $150,000 40% $15.00 $50,000 $100,000 2009 $750,000 $430,000 $380,000 $175,000 $220,000 $1,895,000 $1,130,000 $105,000 $145,000 40% $14.50 $50,000 $100,000 25,000 25,000 10,000 10,000 The following industry averages have been obtained: Average collection period Gross margin Times interest earned Price earnings ratio 70 days 34% 10 times 2.15 1. The current ratio for Toss Away Ltd. at December 31, 2010 was: a. 1.44 b. 1.78 c. 2.00 d. 3.22 e. None of the above Comment Ratio Analysis Review Questions 2. The quick ratio for Toss Away Ltd. at December 31, 2010 was: a. b. c. d. e. .89 1.44 1.78 2.00 None of the above 3. The accounts receivable turnover for Toss Away Ltd. at December 31, 2010 was: a. b. c. d. e. 8.80 times 9.64 times 10.35 times 12.57 times None of the above 4. The gross margin for Toss Away Ltd. at December 31, 2010 was (rounded) a. b. c. d. e. 39% 40% 61% 63% None of the above 5. Times interest earned for Toss Away for the year ended December 31, 2010 was a. b. c. d. e. 5 times 5.2 times 6 times 6.2 times None of the above 6. The price earnings ratio for Toss Away for the year ended December 31, 2010 was a. b. c. d. e. 1.25 1.50 2.10 2.50 None of the above Ratio Analysis Review Questions Ratio Analysis Review Questions Review Questions from The Kieso Text Current & Deferred Tax Expense Earnings per Share Post Retirement (Pension) Expense Leases Errors Cash Flow Statements P 18-3 P 17-5 P 19-12 P 20-3 P 21-8 (a) P 22-10 Review Questions from The Kieso Text Review Questions from The Kieso Text Review Questions from The Kieso Text Review Questions from The Kieso Text Review Questions from The Kieso Text Review Questions from The Kieso Text Review Questions from The Kieso Text Page 6: [1] Comment [GLBMC7] Gary L Biggs, MBA, CA 11/11/2010 8:55:00 AM NPV Cost Trade In PV (155,000.00) 23,000.00 (132,000.00) Net Initial Investment PV of CCA Tax Shield Cost CCA Tax RRR 132,000.00 Cdt 2+K 20% 40% 15.0000% d+k 2(1+k) Cash Savings First 3 years Last nine years 20,000.00 - 25,000.00 Tax 20,000.00 40% 25,000.00 40% After tax 12,000.00 15,000.00 C01 / C02 F01 / F02 12,000.00 3.00 15,000.00 9.00 28,203.73 74,460.00 PV of salvage value net of opportunity cost Salvage Value 30,000.00 Opportunity Cost (5,000.00) 25,000.00 PV of Lost Tax Shield 4,672.68 Sn dt (1+k)^n d+k 4,672.68 0.23 Net Present Value Page 10: [2] Comment [GLBMC11] (1,068.04) (25,731.64) Gary L Biggs MBA CA 11/11/2010 8:56:00 AM Straight line - 2009 Cost 840,000.00 SV 60,000.00 780,000.00 130,000.00 per full year 6.00 108,333.33 2nd Depr 2nd set Toggle to Lif M01 Cst Sal YR Dep = Sum of the Years Digits - 2012 Cost 840,000.00 2nd Depr 2nd set Lif M01 Cst Sal YR Dep = Declining Balance - 2012 NBV 840,000.00 723,333.33 602,777.78 502,314.81 2nd Depr 2nd set DB = Lif M01 Cst Sal YR Dep = Double Declining Balance - 2012 NBV 840,000.00 606,666.67 404,444.44 269,629.63 SL 6.00 3.00 840,000.00 60,000.00 1.00 108,333.33 enter enter enter enter enter SV 60,000.00 Toggle to 780,000.00 780,000.00 Down Down Down Down Down Down arrow arrow arrow arrow arrow arrow 4/21, 3/21 Prorate 0.19 1/6 0.14 5/6 SYD 6.00 3.00 840,000.00 60,000.00 4.00 117,619.05 enter enter enter enter enter Rate Down Down Down Down Down Down arrow arrow arrow arrow arrow arrow Prorate 1/6 1/6 1/6 1/6 Toggle to 100.00 6.00 3.00 840,000.00 60,000.00 4.00 83,719.14 140,000.00 120,555.56 100,462.96 83,719.14 DB enter enter enter enter enter enter Rate 5/6 Down Down Down Down Down Down 116,666.67 arrow arrow arrow arrow arrow arrow Prorate 1/3 1/3 1/3 1/3 280,000.00 202,222.22 134,814.81 89,876.54 5/6 233,333.33