Infographic - oracle

advertisement

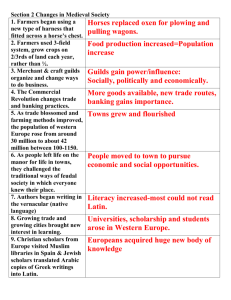

Self-Service Banking in 2013 More power to the customer! IDC Financial Insights believes that 2013 will be a milestone year for self-service as banks provision for more self-directed transactions and give customers a choice on the method, type, and style of their channel experience. This IDC Infographic throws the spotlight on four regions – Asia/Pacific excluding Japan, Latin America, Europe, Middle East and Africa – all primed for more self-service banking in 2013 and beyond. B r anc h B an k in g The Old and New of Branches Old fact Traditional assisted channels like branches* have seen the lowest rates of growth in years. New fact Branches are seeing more self-service elements. 4.5% As Pa ia ci / fi c Af ri ca L Amati er n ic a Highest growth in branches MI Ea d st dle Eu rope % growth in branch numbers 2013/2010 2.2% -0.5% 2.6% 3.2% More self-service in branches means... More selfdirection to reduce branch operating costs Less Express assisted branches space, more and mobile self-directed branch channels models in branch footprint Nextgeneration branch formats, ATM refresh *Asia/Pacific excludes Japan ** Note: Includes sub-branches and branch-type kiosks D i g ital e x plosion Consumer appetite for digital devices continues to grow, year on year 2012 actual and 2013 forecast for digital device penetration 140% 132% 141% Europe 77% 71% 82% 76% 133 % Latin America ASIA/PAciFIC Middle East 47% 44% Highest device penetration Africa *Note: Digital devices include portable PCs, desktop PCs, smartphones, feature phones and tablets. The data is for year ending 2012 and 2013, respectively. Estimate of smartphones as % of total mobile phones by end-2013 35 % By end of this year, 1 in 2 mobile phones in Europe will be a smartphone Europe 25 % Asia/Pacific 18 % 14 % Latin America MIddle east Africa *Asia/Pacific excludes Japan M O bile - t h e ne w face of en g ag ement The power shifts to the customer who now owns, manages and controls the device Average % of customer base who are “active users” of mobile banking apps by the end of 2013 16% 17% 20% 25% 29% Asia/ Pacific Latin America Banks in Europe Lead the Pack Africa Middle East Europe Daily transaction Transactions/Day Transactions/Day 2 4 5 AFRICA, Latin America Europe Transactions/Day Average number of daily transactions on mobile phones per customer Users in Asia/Pacific, Middle East Lead the Pack Asia/Pacific, Middle East * Note: Includes all customer interactions by phone, whether through SMS banking or account transfers on smartphones Wo r ld t r ends Digital self-service banking gaining momentum EUROPE New iterations of wholly virtual banks Latin America Digital transactions grew 5x over last 3 years MIddle EAST & Africa Usage rates growing 50% YOY PC-based online banking Asia/ Pacific Active users to exceed 500 million EUROPE Latin America Mobile banking M-banking users growing by a constant 20% YoY EUROPE Gamification employed for customer engagement The ratio of PC-based to mobile-based bank access is 1:5 MIddle EAST & Africa High wireless penetration to drive m-banking initiatives in key countries 20% of customers in Tier 1 markets are active m-banking users Asia/ Pacific Online banking can already be MIddle EAST Focus for done securely & Africa tier 1 banks in the social Among the world’s media banks, Turkish banks have some of the highest platform itself “likes” on Facebook Latin America Asia/ Pacific Social banking S elf - se r v ice f u nctionalities What’s in store in 2013 Asia/ Pacific Latin America Middle East & Africa Europe Next-generation branches Going beyond baseline mobile banking functionalities of account views and fund transfers Express branch or mobile branch operating models Personal financial management tools with gamification elements Social channel as a service platform Enhanced customer care tools for mobile Functionalities that rely on mobile phone cameras Social channel as a service platform Geo-location services through mobile Marketing aided by locational intelligence Marketing aided by locational intelligence Different mobile formats, depending on the market: SMS banking, online banking, and downloadable apps Marketing campaigns and product offers aided by Big Data analytics Mobile payments Mobile payments Spend analysis in personal management tools Mobile payments Deposit capabilities through mobile New services and applications designed specifically for tablets Social CRM S tando u t B an k s Leaders in Self-Service Europe Bankinter, BBVA Latin America TBanc, BCI Asia/ Pacific Middle East & Africa Equity Bank, HSBC, RAKBANK, ABSA Bank, FNB, Nedbank, Wizzit, Finansbank, Garanti, BLC Bank, Ecobank ANZ, Commonwealth Bank, UBank, Westpac, DBS, HDFC Bank, Citi Research Team: Michael Araneta, Alex Kwiatkowski, Roberto Gutierrez, Sui-Jon Ho, Kiranjeet Kaur, Melissa Chau Source: IDC Financial Insights IDC Worldwide Quarterly PC Tracker 2012 Q4 - Installed Base IDC Worldwide Quarterly Tablet Tracker 2012 Q4 - Installed Base IDC Worldwide Quarterly Mobile Phone Tracker 2012 Q4 - Installed Base This IDC Infographic was produced by IDC Asia/Pacific Go-to-Market Services. The opinion, analysis, and research results presented herein are drawn from more detailed research and analysis independently conducted and published by IDC Financial Insights. Any IDC Financial Insights information or reference to IDC Financial Insights that is to be used in advertising, press releases, or promotional materials requires prior written approval from IDC. For more information, visit: www.ap.idc.asia or contact: gmsap@idc.com Brought to you by