NI 43-101 Technical Report

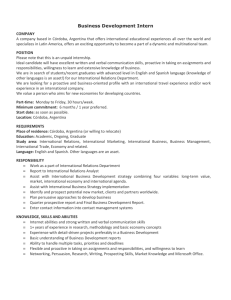

advertisement