Private Equity News

advertisement

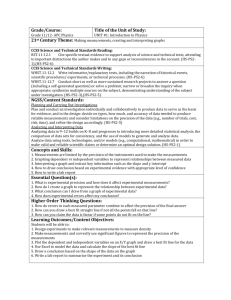

hen 2012 Private Equity News Table of Content Glencore seen in hunt for grain handler Viterra Youku to buy Tudou, creating China online video giant Asahi Kasei sags after says to buy U.S. Zoll Medical Hyundai E&C says wins $1.5 billion Saudi alumina project Express Scripts, Medco to delay closing Exxon eyeing Turkish shale gas prospects: TPAO CEO SHANGHAI FIRST VENTURE | SFV Glencore seen in hunt for grain handler Viterra Reuters Glencore (GLEN.L) is one of a handful of parties eyeing a takeover bid for Viterra (VT.TO), Canada's largest grain handler, a Swiss-based industry source said on Monday, and Ottawa signaled it was keeping an open mind on any possible deal. Viterra, with a current market value of around $5 billion, said on Friday it had received expressions of interest from unnamed third parties for a possible takeover, sending its shares up more than 20 percent. Shares of the Regina, Saskatchewan-based company gained a further 6 percent on Monday in Toronto, reaching their peak after Canada's industry minister suggested he was open to a possible foreign takeover. "Unlike the opposition, our government understands the importance of attracting foreign investments to our economy," Industry Minister Christian Paradis said in the House of Commons. "Foreign investments help Canadian companies to grow and innovate and provide new opportunities to connect our firms to the world. Our government will continue to welcome investment that benefits Canada." Paradis was responding to a question from an opposition legislator who asked if the government would intervene if it can't clearly prove a takeover of Viterra was in Canadians' best interests. Agriculture Minister Gerry Ritz was more guarded about Viterra, when asked about the government's stance by the House of Commons' agriculture committee, saying: "I will not speculate on any takeover at this point." Taking control of Viterra would give Swiss-based Glencore access to Canada's prized canola, spring wheat, oats and durum wheat supplies. Canada, the world's leading exporter of each crop, is due to end a grain marketing monopoly in August that could give a big lift to Viterra's business. "It's a very attractive asset, but it's also very large - so there aren't a lot of players who can write big checks," said Greg Pearlman, head of BMO Capital Markets food and consumer group, at the Reuters Global Food and Agriculture Summit in Chicago. "It's hard to handicap right now." A non-Canadian bid for Viterra, which also owns almost all the grain terminal space at ports in South Australia, could face regulatory hurdles in Ottawa, with its reputation for resource nationalism. That could discourage prospective suitors. Glencore, which is also pursuing a 23 billion pound ($36 billion) takeover of miner Xstrata (XTA.L), already markets and produces crops, as well as metals, minerals and oil. The trading house - the world's largest diversified commodities trader - has long said it planned to expand in agricultural commodities. It held unsuccessful talks last year with Louis Dreyfus, a leading player in the farm sector. It was also named earlier this month as one of several suitors circling Gavilon Group, a U.S. March. 16, 2012 2 SHANGHAI FIRST VENTURE | SFV energy and grains trader. "Glencore clearly want to fill that hole in their portfolio. When things didn't seem to be going well with Dreyfus, they had to look around," the source said. Glencore would have little trouble paying for Viterra, Pearlman said, adding that U.S.-based Cargill, Canada's third-largest grain handler, Archer Daniels Midland, Bunge, as well as Wilmar International Ltd and Mitsui in Asia, and Louis Dreyfus in France also have ample means. A much smaller list could afford to buy both Viterra and Gavilon, and Glencore would be on it, Pearlman said. Depending on what premiums to shares are offered, Viterra could go for $6 billion to $7 billion, while Gavilon, which is accepting bids, might fetch $3 billion to $4 billion, he said. Buying both would be roughly the equivalent of Bunge's market capitalization, for example, he said. Even though Cargill and ADM are cutting costs following weaker quarters, Pearlman said he doubts such conditions would dissuade any company from making a strategic buy like Viterra. "This is a very, very unique asset, it's publicly held and has lots of elements that are not replicable." Interest in Viterra comes as the Canadian Wheat Board's 69-year-old marketing monopoly over Western Canadian wheat and barley is set to end in August. A law passed by Parliament last year to end the CWB monopoly would allow Viterra and others to buy grain directly from western farmers for the first time in decades, likely fattening their earnings. GOVERNMENT REVIEW Still, a non-Canadian bid for Viterra, which has its roots as the farmer co-operative Saskatchewan Wheat Pool, may trigger political opposition. As well, any foreign takeover of a Canadian company with an asset value of C$330 million ($333.72 million) or more is subject to a government review to determine whether it is of "net benefit" to the country. Brad Wall, premier of Viterra's home province of Saskatchewan, told reporters in Regina that if there were a foreign bid, his government would do an "aggressive" study of whether the takeover would benefit Saskatchewan, and make a recommendation to Ottawa. "We don't have a position. If there is a takeover (attempt) we would take a very thorough analysis and the measure we would use is: Is this a net benefit to Canada and to Saskatchewan? Period." Saskatchewan's opposition to a foreign bid for Potash Corp of Saskatchewan (POT.TO) in 2010 is widely seen as convincing Ottawa to block that takeover. Wall said he would consider the fiscal impact on the Saskatchewan government and economic impact on the province more generally, but does not consider Viterra a "strategic March. 16, 2012 3 SHANGHAI FIRST VENTURE | SFV resource," as it did Potash Corp. "This doesn't fit our own definition of a strategic resource." Because of Viterra's size, a takeover - whether by a domestic or foreign concern - would also face a review by the federal Competition Bureau, although monopoly concerns would likely be more acute if domestic players Cargill or Richardson International were to bid. Viterra owns nearly half of the grain-handling capacity in Western Canada. Louis Dreyfus, which has said it is expanding its grain handling capacity in Canada, last year downplayed talk of acquisitions. It declined to comment on Viterra. U.S. agribusinesses Archer Daniels Midland (ADM.N) and Bunge (BG.N) could also make offers, although any non-Canadian suitor must take into account Ottawa's 2010 decision to block a bid by Anglo-Australian miner BHP Billiton for Potash Corp, the world's largest fertilizer maker, said Robert Winslow, an analyst at National Bank Financial, in a note to clients. Because of that high-profile rebuff, foreign suitors for Viterra will likely involve Ottawa in their plans early, Winslow said. "We argue there is risk of the federal government complicating any potential deal," Winslow said. BMO analyst Joel Jackson said Canada's Agrium Inc (AGU.TO), the largest North American agricultural products retailer, may emerge as a suitor. Viterra's farm-supply assets might make a neat addition to Agrium's own retail network, he said. Agrium has a large retail footprint in the United States, but a fairly small presence in the farm belt in Western Canada where Viterra owns more than 250 stores. The two companies both have retail outlets in Australia. Jackson said he would expect Agrium to bid only for Viterra's agri-products business or sell off the grain handling side if it acquired the entire company. Agrium and Bunge were not immediately available for comment, while ADM has said it would not comment. EYE ON NORTH AMERICA Glencore is one of the leading exporters of grain from Europe, the former Soviet Union and Australia. It commanded almost 9 percent of the global market for grains at the time of its initial public stock offer last May. It has looked to North America as an area for growth, particularly for agricultural infrastructure, such as country elevators to buy grain. "Viterra would fit this infrastructure-heavy criteria and would give it a dominant entry point in North American agriculture, a market where it currently has negligible presence," analysts at Liberum said in a morning note. Glencore began trading agricultural commodities three decades ago with the acquisition of a Dutch trading company. Its farm products arm now deals in wheat, maize and barley to oilseeds, cotton and sugar. For Western Canadian farmers, a foreign takeover of Viterra - whose roots date back to 1924 - would evoke some "sentimental" reaction, said Alberta farmer Humphrey Banack, a March. 16, 2012 4 SHANGHAI FIRST VENTURE | SFV vice-president of the Canadian Federation of Agriculture. The more pressing fear on the farm is that a Viterra takeout by an existing Canadian player could lead to consolidation of the grain-handling sector, leaving farmers fewer options of where to sell their crops, he said. "Hopefully we don't see much more consolidation because we're already moving grain a lot farther than we had to in the distant past, and we're hoping those costs don't come back to us today," Banack said. Glencore shares were up 0.7 percent at 409.08 pence in London, while Viterra stock added 6.4 percent to C$14.45 in Toronto on Monday afternoon.($1=0.6372 British pounds), ($1=$0.99 Canadian) Youku to buy Tudou, creating China online video giant Reuters China's top two online video companies are joining forces, with Youku.com buying smaller rival Tudou Holdings Ltd in an all-stock deal worth over $1 billion, creating an industry leader with more than a one third share of a market that is losing money as it battles rising costs. The two U.S.-listed firms have been bitter rivals, locking horns in courtroom battles over alleged copyright infringement and unfair competitive practices. Both companies have this month reported a net loss for last year, pinched by rising costs for Internet bandwidth, content and mobile video services. But bringing the two together is a good move for a highly competitive industry with many players fighting over more than 450 million Internet users, analysts said. "This creates China's biggest video site, but it doesn't create a YouTube - they still have less than 50 percent market share," said Bill Bishop, an independent analyst based in Beijing. Youku currently leads the fragmented Chinese online video market with a 21.8 percent share, ahead of Tudou's 13.7 percent, according to Internet research firm Analysys International. "We know online video is way too competitive. There are 10 players, where there should be only one to two," said Michael Clendenin, managing director of Shanghai-based RedTech Advisors. "After this merger there are still too many players in the industry," he said, noting others in the market such as Sohu.com Inc, Baidu Inc, and Tencent Holdings Ltd, which is trying to develop an online video platform. "These are not small, insignificant players. So even though this is a step in the right direction in terms of consolidation, there's still a long way to go," Clendenin added. Far from stifling competition, though, one rival even welcomed the move. "From an industry perspective, Youku and Tudou's deal is conducive for the healthy March. 16, 2012 5 SHANGHAI FIRST VENTURE | SFV development of the sector," iQiyi, Baidu's online video platform, said in an email to Reuters. "The cost of purchasing copyrights in the market will be more effectively controlled with fewer ... online video companies. It will also reduce the competition for bandwidth and market talent." TUDOU SHARES JUMP Once the deal is completed, the combined entity will be named Youku Tudou Inc, and headed by Youku chairman and CEO Victor Koo. Tudou's CEO Gary Wang will join the new entity's board of directors. As of Friday's close, Youku's market value of around $2.85 billion was six times that of Tudou. Under the terms of the deal, Youku stock and ADS holders will own around 71.5 percent of the new company, with the rest held by Tudou shareholders and ADS holders. In pre-market trading on Monday, shares of Tudou, which is 9 percent owned by Sina Corp, more than doubled to $33.52 from Friday's $15.39 close. Partly reflecting the tough competition, Tudou shares, which debuted in August, had consistently traded below their IPO price of $29 each. "It (the deal) is a sign of how difficult this market is and both companies have probably realized how hard the road ahead would be if they went the independent route," said Bishop. "It should help them get to profitability. Tudou's earnings were released last week and were horrible." "I imagine this will help other companies in the sector that are trying to list, by reviving interest in the sector. It will also pull up other stocks such as Renren, which could now become takeover targets," he added. The two firms have sparred publicly in recent months, with Youku filing a lawsuit against Tudou earlier this year seeking 4.8 million yuan ($762,000) in compensation, saying it incurred losses because of claims by its smaller rival that Youku had misused copyrighted material, the official Xinhua news agency reported in February. The row began in December when the two firms traded accusations of stealing and reposting videos from each other's sites. Goldman Sachs, Allen & Company LLC and China Renaissance Holdings Ltd are financial advisers for Youku, the two companies said in statement. Morgan Stanley acted as lead financial adviser and Credit Suisse as co-financial adviser for Tudou on this deal, they said. Asahi Kasei sags after says to buy U.S. Zoll Medical Reuters Shares of Asahi Kasei Corp (3407.T) sagged 3.7 percent in early trade on Tuesday after it said it would buy U.S. medical equipment maker Zoll Medical Corp (ZOLL.O) for $2.21 billion as it looks to reduce reliance on its chemicals and fibres operations. March. 16, 2012 6 SHANGHAI FIRST VENTURE | SFV Hyundai E&C says wins $1.5 billion Saudi alumina project Reuters South Korea's Hyundai Engineering & Construction Co Ltd said on Monday that it has been awarded an about $1.5 billion order to build an alumina refinery in Saudi Arabia. Hyundai said in a regulatory filing that it would carry out engineering, procurement, construction and pre-commissioning work for the 1.8 million-tonne-per-year refinery, confirming an earlier announcement by Saudi Arabia's state-run Maaden. Express Scripts, Medco to delay closing Reuters Pharmacy benefits managers Express Scripts (ESRX.O) and Medco (MHS.N) will delay closing their $29 billion deal, giving antitrust regulators more time to finish assessing the deal, Medco said in a Securities and Exchange Commission filing. The companies had said in February that they had complied with the Federal Trade Commission's requests for information about the deal. Legally, this meant that the FTC had until Monday to decide whether to approve the proposed transaction or litigate to stop it. But the companies said Monday that they would give the FTC more time. "Medco and Express Scripts continue to work with the FTC and expect that the mergers will be completed by the earlier part of the second quarter of 2012," Medco said in its filing. It was not clear if a new deadline had been set. Critics of the deal have said allowing the merger of two of the three largest pharmaceutical benefit managers would lead to higher prices and worse service for patients. The extension could mean many things, said Michael Knight, an antitrust expert with Jones Day law firm. "It's quite normal for parties to grant the FTC more time," he said. "It signals that they're still having some discussions but it's hard to read much more into it than beyond that." Exxon eyeing Turkish shale gas prospects: TPAO CEO Reuters Exxon Mobil (XOM.N) has held talks with state energy company TPAO on exploring for shale gas in Turkey, the head of TPAO said on Monday. According to analysis released by the U.S. government in early 2011, Turkey has 15 trillion cubic feet of technically recoverable shale gas, reserves that Exxon could help TPAO tap. "We have carried out our studies ... We have big shale gas potential ... This attracts a lot of March. 16, 2012 7 SHANGHAI FIRST VENTURE | SFV foreign firms, Exxon Mobil in particular," TPAO Chief Executive Mehmet Uysal told Reuters. "They are currently considering the potential in Trakya (western Turkey) and they're going to make up their mind whether or not to become partners with us." TPAO signed an accord in November for Europe's largest energy company Shell (RDSa.L) to look for oil and gas in the Mediterranean and southeastern Turkey and said other major international firms were interested in exploring nearby. Shell hopes to develop shale gas deposits near the southeastern city of Diyarbakir. Exxon, the largest oil company in the world by market capitalization, is one of the most active drillers for shale gas in Europe, and is already exploring in Poland and Germany. A U.S. shale gas production boom over the last few years has turned the U.S. market from shortage to glut, driving down gas prices around the world. But Exxon sought to cool predictions of a similar European shale gas revolution, saying commercial production was at least five years away. An April 2011 study by Advanced Resources International (ARI) for the U.S. government of global shale gas prospects identified Turkey - along with France, Poland, Ukraine, South Africa, Morocco and Chile - as countries whose future supply could be significantly boosted by shale. The ARI study identified the Anatolian Basin in the southeast and Thrace Basin to the west of Istanbul as the main areas of potential shale gas production in the country. TPAO needs North American companies' expertise in horizontal drilling and fracturing equipment needed to extract gas trapped in Turkish soil and a number of them, including Canada's TransAtlantic Petroleum Ltd (TNP.TO), are already looking. "Shale gas has a difficult production process," Uysal said. "There aren't a lot of companies with enough infrastructure to drill that many wells at the same time." Shanghai First Venture Co., Ltd. Industry Research Center of SSCW Add: 2/F Haige Bldg, 370 Huashan Rd, Shanghai (200040) Tel:86 21 62494578 Fax:86 21 62498448 Email:information@sfv.com.cn The information contained in this report has been obtained from public sources believed by SFV to be reliable, but SFV makes no representation as to their accuracy or completeness or renewal and accepts no liability for changing the advices in this report. At any time, any opinions and expressions in the report should not be understood as the bid or order of the deal of SFV. The copyright of this report is owned by SFV. Any one, replication in any forms, no matter in whole or in part is forbidden without the written authorization offered by SFV. Whenever any quotation or publication in any relation to this report is needed, the indication - Source: “SHANGHAI FIRST VENTURE” or “SFV” - must be made, and any abridgement or modification unconformable to the spirit in the report is not allowed. March. 16, 2012 8