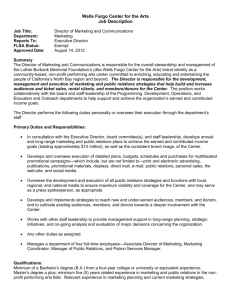

White paper

Political risks: A growing uncertainty for

international operational risks

By John Scales, International Specialty Group

August 2015

According to Wells Fargo’s 2015 International Business

Indicator, 80% of respondents agree that for longterm revenue growth, U.S. companies should consider

expanding internationally.1 When considering new

markets to enter, the survey shows U.S. businesses focus

most on political stability, with 89% saying political

stability is somewhat or very important.

In light of continued interest in international expansion,

managing political risk is an area of increasing importance

to multinational businesses as they face a steadily

increasing breadth and severity of operational risk. From

a geopolitical and governance standpoint, the world is

an ever-changing place. One need not look further than

the country of Cuba to see how the climate for business

is always dynamically changing as well. While today’s

multinational companies face the same operational perils

that existed 50 years ago, the changing international

landscape requires managing these risks in different ways.

In fact, according to the World Economic Forum Global

Risks 2015 report, the biggest threat to the stability of

the world in the next 10 years comes from the risk of

international conflict, exceeding the threat from extreme

weather events.2

What is political risk and what are the

potential impacts?

According to OPIC, the U.S. Government’s development

finance institution, political risks can include3:

• War, civil strife, coups and other acts of politicallymotivated violence, including terrorism

• Expropriation, including abrogation, repudiation and/or

impairment of contract and other improper host

government interference

• Restrictions on the conversion and transfer of localcurrency earnings

The impacts of these types of events can range from

the temporary disruption of companies’ operations and

supply chains to the nationalization of company assets

or, events that threaten the physical safety of a company’s

employees. Business can sustain damage to property, and

also incur difficulty with a host of financial transactions.

While businesses often consider underdeveloped

countries as being at highest risk for political risk, the risk

for developed nations can pose uncertainty as well. When

the Ukraine-Russia conflict arose in Crimea in 2014,

Western operations in the Ukraine were severely impacted

not only by the conflict, but also the various governmental

and U.N. sanctions that were imposed on certain parts of

the country.

According to Verisk Maplecroft’s annual 2015 Political

Risk Analysis, Russia has been flagged as “high risk”

and a grave source of political risk uncertainty in 2015,

and ranks 21st out of 198 countries in the company’s

Dynamic Political Risk Index.4 The analysis notes that in

2014, Russia’s actions in Ukraine contributed to the latter

experiencing the biggest deterioration in the Dynamic

Political Risk Index, falling from 82nd to 20th highest risk

during the year. The report states that “Resulting Western

sanctions have effectively shut major Russian corporations

out of international financial markets and barred energy

firms from further operations in Russia’s oil sector.”

How concerned are companies about

political risk?

Managing political risk is of increasing importance to

multinational businesses. Consider these recent survey

findings:

• In the Multilateral Investment Guarantee Agency’s

2013 World Investment and Political Risk report (MIGA

report), political risk took second place among possible

impediments to foreign direct investment, behind

microeconomic instability.5 Within the category of

political risk, breach of contract and regulatory risks

topped survey respondents’ concerns. “Survey results

showed that these concerns are based on actual

experience, as well as sentiment, with respondents

rating these factors as the key political risks that

resulted in actual losses over the past three years.”

• The Association for Financial Professionals and Oliver

Wyman Risk Survey 2015 showed that political risk

ranked in sixth place among 20 factors expected to

have the greatest impact on organizations’ earnings

over the next three years.6

Wells Fargo Insurance white paper: Political risks: A growing uncertainty for international operational risks | August 2015

2

• While not measured in the 2015 report, the Association

for Financial Professionals and Oliver Wyman Risk

Survey 2013 report7 cited political risk as ranking in

fourth place in terms of its difficulty to forecast, behind

natural catastrophe, regulatory risk and product liability.

The study noted that 62 percent of survey respondents

cited political risk as a risk, yet relatively few

organizations are forecasting political risk.

Specific examples of political risk impacts

Several recent examples highlight the array and impact

involved with political risks.

War and political unrest: As result of the 2014 RussiaUkraine conflict over Crimea, Western countries

implemented political sanctions against Russia, and the

supply chains for European companies that import energy,

grain, titanium, palladium, and nickel from Russia and

Ukraine have been affected. Most seriously impacted was

Germany’s automobile manufacturing industry, which is

one reason that Germany opposed imposing many of the

sanctions. U.S.-based multinational companies could also

feel pressure to withdraw from the Russian marketplace

not as a result of the deteriorating economy, but also

because of the sanctions imposed.

Currency impacts: In the Wells Fargo survey, 63% of

companies said currency and exchange rates play a major

role in their company’s international business decisions.

However, host country currency exchange restrictions

can have a disastrous impact on the commercial viability

of a project, preventing a business from converting and

transferring profits from the project and return of capital,

and ability to meet debt obligations.

Venezuela is a prime example. Since 2003, the

government has maintained strict currency controls,

operating with a multi-tier exchange rate system for the

sale of dollars to private sector firms and individuals, with

rates based on the government’s import priorities, which

has gone through various iterations. The latest iteration in

February 2015 was an effective devaluation of Venezuela’s

bolivar currency that threatened to dramatically reduce

the value of Venezuelan monetary assets held by 10 large

American companies.8

Expropriation: Expropriatory acts and other forms of

unlawful interference by the host government can deprive

companies of their fundamental rights in a business or

project. According to OPIC, government interference in a

project can take many forms, among them3:

• Abrogation, repudiation, and/or impairment of contract,

including forced renegotiation of contract terms

• Imposing of confiscatory taxes

• Confiscation of funds and/or tangible assets

• Outright nationalization of a project

The utility, mining and metal industries have increasingly

been seeing resource nationalization over the years.

Increasing royalties and taxes offers a means for

governments to get more money, and in the more rare case

of outright expropriation or nationalization of companies,

some also view it as a way to expand employment. A

country’s political and economic environment has a direct

impact on resource nationalism, meaning outcomes of

local elections often come into play and are important to

monitor.

As one example, in 2012, Argentina moved to nationalize

an energy company YPF, which was majority-owned by

a Spanish energy company, Repsol YPF.9 Similarly, in

Russia, authorities determined Yukos Oil Company to be

an attractive strategic asset and expropriated it in 2003.

The company was one of the 10 largest in Russia and had

quickly grown from a $320 million company in equivalent

U.S. dollars in 1999 to $21 billion by 2003.10

A January 2015 article in the New York Times noted that

in the current environment in Crimea, confiscations of

businesses in various industries are “being carried out

in a widespread, systematic fashion that has no recent

precedent.” It noted that in 10 months, business owners

estimate they have lost more than $1 billion in real estate

and other assets to government seizure.11

Wells Fargo Insurance white paper: Political risks: A growing uncertainty for international operational risks | August 2015

3

Political risk insurance as a complementary

tool for risk management

Given examples such as those above, along with the

general market turbulence, high-profile expropriations,

persistent resource nationalism, capital constraints, and

regulation, the MIGA report shows that the last several

years have seen a dramatic increase in political risk

insurance (PRI) issuance, noting that PRI issuance has

exceeded the pace of increase in foreign direct investment

flowing into developing economies over the same period.12

Political risk insurance helps cover losses to tangible

assets, investment value, and earnings that result from

political perils. It not only covers transactions with

private sector obligors for confiscation, expropriation,

nationalization, currency inconvertibility, and political

violence, but also transactions with public sector obligors

and state-owned enterprises for not honoring promissory

notes, sovereign guarantees, or letters of credit from a

sovereign entity.

The risk is real — a foreign government’s action, or

inaction, can result in a company’s loss of property,

income, or financial assets. However, along with good

risk management practices, political risk insurance can

help investors, financial institutions, and corporate clients

protect their investments in overseas markets against

unpredictable losses caused by specified political risk

perils.

Sources:

1. Wells Fargo 2015 International Business Indicator survey

https://www.wellsfargo.com/com/focus/international-business-indicator

2. World Economic Forum Global Risks 2015 report. Accessed July 7, 2015.

http://reports.weforum.org/global-risks-2015/press-releases/

3. OPIC (Overseas Private Investment Corporation)

https://www.opic.gov/who-we-are/overview

4. Verisk Maplecroft’s annual 2015 Political Risk Analysis

http://maplecroft.com/portfolio/new-analysis/2014/12/10/volatile-elections-instabilityand-rising-violence-leave-investors-facing-turbulent-2015-emerging-markets-veriskmaplecroft-political-risk-atlas/

5. World Investment and Political Risk 2013. Washington, DC: MIGA, World Bank Group.

DOI: 10.1596/978-1-4648-0039-9 License: Creative Commons Attribution CC BY 3.0.

Accessed July 7, 2015.

http://viewer.zmags.com/publication/1ea4e02d#/1ea4e02d/1

6. Association for Financial Professionals and Oliver Wyman Risk Survey 2015. Accessed

July 7, 2015.

http://www.oliverwyman.de/content/dam/oliver-wyman/global/en/2015/

jan/2015RiskSurveyReport-FINAL.pdf

7. Association for Financial Professionals and Oliver Wyman Risk Survey 2013 survey.

Accessed July 7, 2015.

http://www.oliverwyman.com/content/dam/oliver-wyman/global/en/files/

archive/2013/2013_AFP_Risk_Survey_-_Final.pdf

8. “Venezuela’s currency devaluation set to further hurt U.S. companies’ profits.” Accessed

July 7, 2015.

http://www.reuters.com/article/2015/02/14/

us-venezuela-economy-currency-analysis-idUSKBN0LI00W20150214

9. “Argentina to Seize Control of Oil Company.” Accessed July 7, 2015.

http://www.nytimes.com/2012/04/17/business/global/argentine-president-tonationalize-oil-company.html?_r=0

10. Yukos Oil Company and Russian Expropriation. Accessed July 13, 2015.

http://expropriationnewsrussia.com/en/prominent-russian-expropriation-cases/

yukos-oil-company/

11. “Seizing Assets in Crimea, From Shipyard to Film Studio,” Jan. 10, 2015, New York Times.

http://www.nytimes.com/2015/01/11/world/seizing-assets-in-crimea-from-shipyard-tofilm-studio.html?_r=2

12. “World Bank Sees Record Demand for Political Risk Insurance,” Dec. 5, 2013,

Bloomberg Business

http://www.bloomberg.com/news/articles/2013-12-05/

world-bank-sees-record-demand-for-political-risk-insurance

For more information, contact your Wells Fargo Insurance

sales executive or:

John Scales

404-923-3636 | john.scales@wellsfargo.com

Wells Fargo Insurance Services USA, Inc. does not provide insurance products and services outside of the United States. Insurance products and services may be provided outside of the

United States by foreign brokers licensed within their home venue.

Foreign brokers are not employed by any Wells Fargo legal entity. Foreign brokers are individual insurance brokers responsible for compliance with all regulatory requirements of their

home venue.

In the United States, products and services are offered through Wells Fargo Insurance Services USA, Inc. and Safehold Special Risk, Inc., dba Safehold Special Risk & Insurance Services,

Inc. in California, non-bank insurance agency affiliates of Wells Fargo & Company.

Products and services are underwritten by unaffiliated insurance companies except crop and flood insurance in the United States, which may be underwritten by an affiliate, Rural

Community Insurance Company. Some services require additional fees and may be offered directly through third-party providers. Banking and insurance decisions are made

independently and do not influence each other.

© 2015 Wells Fargo Insurance Services USA, Inc. All rights reserved. WCS- 1267414

Wells Fargo Insurance white paper: Political risks: A growing uncertainty for international operational risks | August 2015

4