American University in Dubai

advertisement

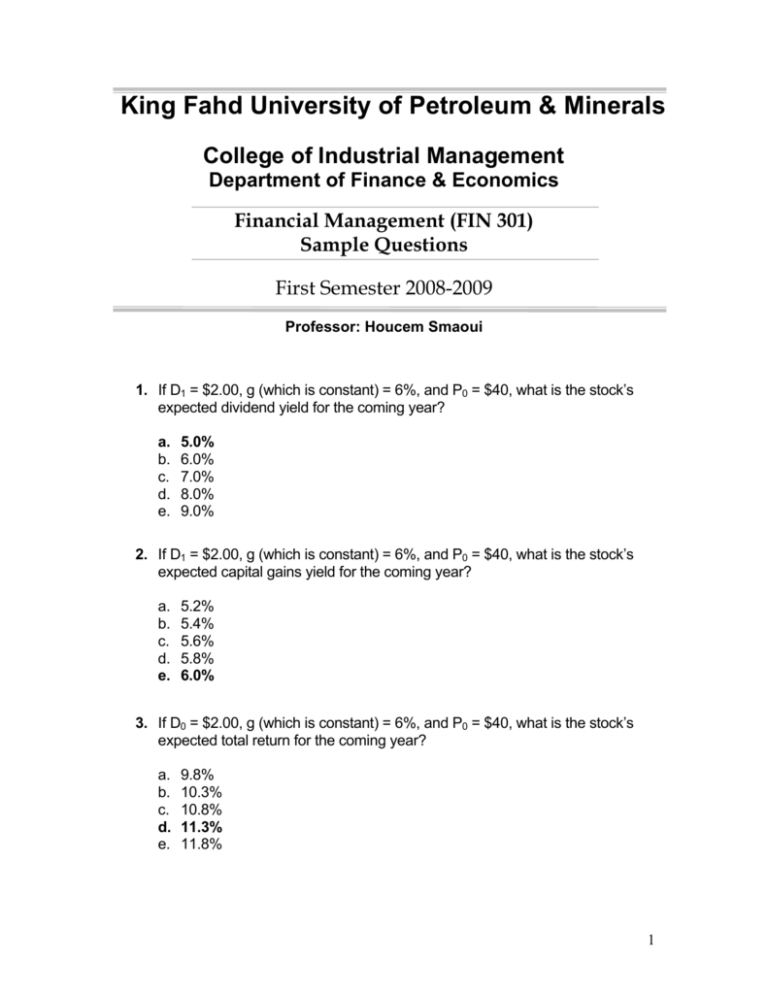

King Fahd University of Petroleum & Minerals College of Industrial Management Department of Finance & Economics Financial Management (FIN 301) Sample Questions First Semester 2008-2009 Professor: Houcem Smaoui 1. If D1 = $2.00, g (which is constant) = 6%, and P0 = $40, what is the stock’s expected dividend yield for the coming year? a. b. c. d. e. 5.0% 6.0% 7.0% 8.0% 9.0% 2. If D1 = $2.00, g (which is constant) = 6%, and P0 = $40, what is the stock’s expected capital gains yield for the coming year? a. b. c. d. e. 5.2% 5.4% 5.6% 5.8% 6.0% 3. If D0 = $2.00, g (which is constant) = 6%, and P0 = $40, what is the stock’s expected total return for the coming year? a. b. c. d. e. 9.8% 10.3% 10.8% 11.3% 11.8% 1 4. A share of preferred stock pays a quarterly dividend of $1.00. If the price of the stock is $50, what is the nominal (not effective) annual rate of return? a. b. c. d. e. 8.0% 8.5% 9.0% 9.5% 10.0% 5. Wald Inc's stock has a required rate of return of 10%, and it sells for $40 per share. Wald's dividend is expected to grow at a constant rate of 7% per year. What is the expected year-end dividend, D1? a. b. c. d. e. $0.90 $1.00 $1.10 $1.20 $1.30 6. The Ehrhardt Company's last dividend was $2.00. The dividend growth rate is expected to be constant at 3% for 2 years, after which dividends are expected to grow at a rate of 8% forever. Erhardt’s required return (rs) is 12%. What is Erhardt's current stock price? a. b. c. d. e. $49.20 $51.40 $53.80 $55.10 $57.30 7. If a stock’s expected return exceeds its required return, this suggests that a. b. c. d. e. The stock is experiencing supernormal growth. The stock should be sold. The company is probably not trying to maximize price per share. The stock is probably a good buy. Dividends are not being declared. 8. If a stock’s dividend is expected to grow at a constant rate of 5% a year, which of the following statements is CORRECT? 2 a. b. c. d. e. The expected return on the stock is 5% a year. The stock’s dividend yield is 5%. The stock’s price one year from now is expected to be 5% higher. The stock’s required return must be equal to or less than 5%. The price of the stock is expected to decline in the future. 9. Stock X has a required return of 12% and a dividend yield of 5%, and its dividend is expected to grow at a constant rate forever. Stock Y has a required return of 10%, a dividend yield of 3%, and its dividend is expected to grow at a constant rate forever. Both stocks currently sell for $25 per share. Which of the following statements is CORRECT? a. b. c. d. e. Stock X pays a higher dividend per share than Stock Y. Stock Y pays a higher dividend per share than Stock X. One year from now, Stock X should have the higher price. Stock Y has a lower expected growth rate than Stock X. Stock Y has the higher expected capital gains yield. 10. Assume that you are a consultant to Morton Inc., and you have been provided with the following data: D1 = $1.00; P0 = $25.00; and g = 6% (constant). What is the cost of equity from retained earnings based on the DCF approach? a. b. c. d. e. 9.79% 9.86% 10.00% 10.20% 10.33% 11. Tapley Dental Associates is considering a project that has the following cash flow data. What is the project's payback? Year: Cash flows: a. b. c. d. e. 0 1 -$1,000 2 $300 3 $310 4 $320 5 $330 $340 2.11 years 2.50 years 2.71 years 3.05 years 3.21 years 3 12. Edison Electric Systems is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that a project's projected NPV can be negative, in which case it will be rejected. WACC = 10% Year: 0 Cash flows: -$1,000 a. b. c. d. e. 1 $450 2 $460 3 $470 $142.37 $151.59 $166.51 $173.26 $189.94 13. Edison Electric Systems is considering a project that has the following cash flow and WACC data. What is the project's MIRR? Note that a project's projected MIRR can be less than the WACC (and even negative), in which case it will be rejected. WACC = 10% Year: 0 Cash flows: -$1,000 a. b. c. d. e. 1 $350 2 $370 3 $390 4.90% 5.18% 5.72% 6.23% 6.87% 14. Two mutually exclusive projects have the following projected cash flows: Project A Project B Year Cash Flow Cash Flow 0 -$50,000 -$50,000 1 15,625 0 2 15,625 0 3 15,625 0 4 15,625 0 5 15,625 99,500 If the required rate of return on these projects is 10%, which would be chosen and why? 4 a. b. c. d. e. Project B because it has the higher NPV. Project B because it has the higher IRR. Project A because it has the higher NPV. Project A because it has the higher IRR. Neither, because both have IRRs less than the cost of capital. 15. The cash flows for two non-repeatable, mutually exclusive projects are shown below. If your firm’s WACC is 10%, how much value is sacrificed if your firm selects the project with the higher IRR? Project S: 0 r = 10% 1 2 3 | | | | -1,000 500 500 500 Project L: 0 1 2 3 4 5 | | | | | | -2,000 668.76 668.76 668.76 668.76 668.76 a. b. c. d. e. r = 10% $243.43 $291.70 $332.50 $481.15 $535.13 16. Braun Industries is considering an investment project that has the following cash flows: Year Cash Flow 0 -$1,000 1 400 2 300 3 500 4 400 The company’s WACC is 10%. What is the project’s payback, IRR, and NPV? a. b. c. d. e. Payback = 2.4, IRR = 10.00%, NPV = $600. Payback = 2.4, IRR = 21.22%, NPV = $260. Payback = 2.6, IRR = 21.22%, NPV = $300. Payback = 2.6, IRR = 21.22%, NPV = $260. Payback = 2.6, IRR = 24.12%, NPV = $300. 5 17. Two mutually exclusive projects have the following projected cash flows: Year 0 1 2 3 Project A Cash Flow -$100,000 39,500 39,500 39,500 Project B Cash Flow -$100,000 0 0 133,000 Based only on the information given, which of the two projects would be preferred, and why? a. b. c. d. Project A, because it has a higher NPV. Project B, because it has a higher IRR. Indifferent, because the projects have equal IRRs. Include both in the capital budget, since the sum of the cash inflows exceeds the initial investment in both cases. e. Choose neither, since their NPVs are negative. 18. Assume a project has normal cash flows. All else equal, which of the following statements is CORRECT? a. b. c. d. e. The project’s IRR increases as the WACC declines. The project’s NPV increases as the WACC declines. The project’s MIRR is unaffected by changes in the WACC. The project’s regular payback increases as the WACC declines. The project’s discounted payback increases as the WACC declines. 19. Which of the following statements is CORRECT? a. The regular payback method recognizes all cash flows over a project’s life. b. The discounted payback method recognizes all cash flows over a project’s life, and it also adjusts these cash flows to account for the time value of money. c. The regular payback method was, years ago, widely used, but virtually no companies even calculate the payback today. d. The regular payback is useful as an indicator of a project’s liquidity because it gives managers an idea of how long it will take to recover the funds invested in a project. e. The regular payback does not consider cash flows beyond the payback year, but discounted payback overcomes this defect. 6 20. Which of the following statements is CORRECT? a. If a project has “normal” cash flows, then its IRR must be positive. b. If a project has “normal” cash flows, then its MIRR must be positive. c. If a project has “normal” cash flows, then it will have exactly two real IRRs. d. The definition of “normal” cash flows is that the cash flow stream has one or more negative cash flows followed by a stream of positive cash flows and then one negative cash flow at the end of the project’s life. e. If a project has “normal” cash flows, then it can have only one real IRR, whereas a project with “nonnormal” cash flows might have more than one real IRR. 21. Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows. a. A project’s NPV is found by compounding the cash inflows at the IRR to find the terminal value (TV), then discounting the TV at the WACC. b. The lower the WACC used to calculate it, the lower the calculated NPV will be. c. If a project’s NPV is less than zero, then its IRR must be less than the WACC. d. If a project’s NPV is greater than zero, then its IRR must be less than zero. e. The NPV of a relatively low risk project should be found using a relatively high WACC. 7 Formulas N NPV = ∑ t =0 CFt ( 1 + r )t IRR N 0=∑ t =0 CFt ( 1 + IRR ) t MIRR N ∑ t =0 N COF t CIF t ( 1 + r ) N - t = ∑ ( 1 + r ) t t = 0 ( 1 + MIRR ) N Cost of capital WACC = wdrd(1-T) + wprp + wcrs Dividend Growth Model ^ P0 = D0 (1 + g) D1 = rs - g rs - g Dividend yield DY= D1 / P0 Capital gains yield CGY= (P1 – P0) / P0 Total return (rs) = Dividend Yield + Capital Gains Yield • FV • PV • FV of a lump sum N = PV .( 1 + I ) N PV of a lump sum = FV N (1 + I ) N Interest rate of a lump sum 8 ⎛ FV N ⎞ I = ⎜ ⎟ ⎝ PV ⎠ 1 N − 1 • FV of an ordinary annuity ⎡ (1 + I ) N − 1 ⎤ FVA N = PMT . ⎢ ⎥ I ⎣ ⎦ • FV of an annuity due ⎡ (1 + I ) N − 1 ⎤ = PMT .( 1 + I ). N , due ⎢ ⎥ I ⎣ ⎦ • PV of an ordinary annuity ⎡ 1 − (1 + I ) − N ⎤ PVA N = PMT . ⎢ ⎥ I ⎣ ⎦ • PV of an annuity due ⎡ 1 − (1 + I ) − N ⎤ PVA N , due = PMT .( 1 + I ). ⎢ ⎥ I ⎣ ⎦ • PMT- FV of an ordinary annuity FVA PMT ⎡ FVA = ⎢ ( 1 + I) ⎣ N N ⎤ .I ⎥ − 1 ⎦ • PMT- PV of an ordinary annuity ⎡ PVA N . I ⎤ PMT = ⎢ ⎥ − N ⎣ 1 − (1 + I ) ⎦ • PV of perpetuity PMT I • Effective annual rate (EFF%) I EFF % = ( 1 + NOM ) M − 1 M • Rate of return PVP = r = r* + IP + DRP + LP + MRP • Price of bond ⎡ 1 − (1 + r ) − P = INT ⎢ r ⎣ • N ⎤ M ⎥ + (1 + r ) N ⎦ Price of bond (semiannual compounding) 9 r −2N ⎤ ⎡ ⎢ 1 − (1 + 2 ) ⎥ M + ⎢ ⎥ r r 2N ⎢ ⎥ (1 + ) 2 2 ⎣ ⎦ Price of bond (quarterly compounding) INT P = 2 • r −4N ⎡ ⎢ 1 − (1 + 4 ) ⎢ r ⎢ 4 ⎣ INT P = 4 Current yield (CY) = ⎤ ⎥ M ⎥ + r 4N ⎥ (1 + ) 4 ⎦ Annual coupon payment Current price Capital gains yield (CGY) = Change in price Beginning price ⎛ Expected ⎞ ⎛ Expected ⎞ ⎟⎟ ⎟⎟ + ⎜⎜ Expected total return = YTM = ⎜⎜ ⎝ CY ⎠ ⎝ CGY ⎠ • Expected return ^ r= N ∑ i =1 • ri Pi Standard deviation σ= N ∑ (r − r̂) i i =1 • 2 Pi Historical standard deviation N σ= ∑ (r t =1 t − rAvg ) 2 N −1 10 • Coefficient of variation CV = • ^ Standard deviation σ = Expected return r̂ Portfolio return rp = N ∑w i =1 • ^ i ri Capital Asset Pricing Model ri = rRF + (rM – rRF) bi • Portfolio beta bp = N ∑ i =1 w i bi 11