File - Mrs. Goeldner Chapin 2012-2013

advertisement

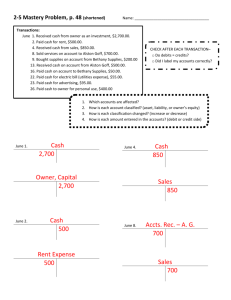

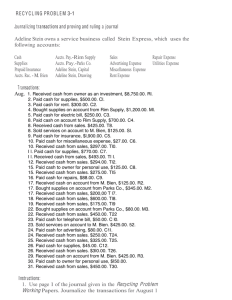

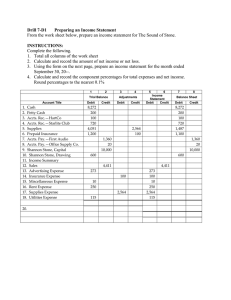

Accounts Cash Accts. Rec.-David’s Limo Supplies Prepaid Insurance Accts. Pay.-Akita Supplies Accts. Pay-Long Supplies Jill Statsholt, Capital Jill Statsholt, Drawing Sales Advertising Expense Miscellaneous Expense Rent Expense Repair Expense Utilities Expense Transactions from the month of June 1 2 3 4 5 8 8 8 9 10 10 11 11 12 15 15 16 17 17 17 18 19 22 22 23 23 24 24 25 26 26 29 30 30 Received cash from owner as an investment Paid cash for rent Paid cash for supplies Bought supplies on account from Akita Supplies Paid cash for insurance Paid cash on account to Akita Supplies Received cash from sales Sold services on account to David’s Limo Paid cash for electric bill Paid cash for miscellaneous expense Received cash from sales Paid cash for repairs Received cash from sales Received cash from sales Paid cash to owner for personal use Received cash from sales Paid cash for supplies Received cash on account from David’s Limos Bought supplies on account from Long Supplies Received cash from sales Received cash from sales Receives cash from sales Bought supplies on account from Long Supplies Received cash from sales Paid cash for advertising Sold services on account to David’s Limos Paid cash for telephone bill Received cash from sales Received cash from sales Paid cash for supplies Received cash from sales Received cash on account from David’s Limos Paid cash to owner for personal use Received cash from sales $17,500.00 $400.00 $1,200.00 $2,000.00 $4,500.00 $1,500.00 $750.00 $200.00 $75.00 $7.00 $750.00 $100.00 $850.00 $700.00 $350.00 $750.00 $1,500.00 $200.00 $750.00 $600.00 $800.00 $750.00 $80.00 $700.00 $130.00 $650.00 $60.00 $600.00 $550.00 $70.00 $600.00 $650.00 $375.00 $800.00 R1 C1 C2 M1 C3 C4 T8 S1 C5 C6 T10 C7 T11 T12 C8 T15 C9 R2 M2 T17 T18 T19 M3 T22 C10 S2 C11 T24 T25 C12 T26 R3 C13 T30 1. Create one spreadsheet file and include all work in one workbook SAVE AS Journalizing Transactions. 2. Use TACCTS file found in MISCELLANEOUS folder from downloads to complete T Account exercises. Name worksheet 4-6 T Accounts 3. Prepare a T account for each account. 4. Analyze each transaction into its debit and credit parts. Write the debit and credit amounts in the proper T accounts to show how each transaction changes account balances. 5. Write the date of the transaction in parentheses before each amount. 6. Use JRNL5 file found in JOURNALS folder from downloads to complete Journalizing Transactions exercises. Name the worksheet 4-6 Journal Page 1. 7. Make a copy of the sheet and add to the same workbook. Name the sheet 4-6 Journal Page 2. 8. Use Page 1 to journalize the transactions for June 1 through June 19. 9. Prove and rule Page 1 of the journal. 10. Carry the column forward to Page 2 of the journal. 11. Use Page 2 to journalize the transactions for June 22 through June 30. 12. Prove and rule Page 2 of the journal.