The Business Process

advertisement

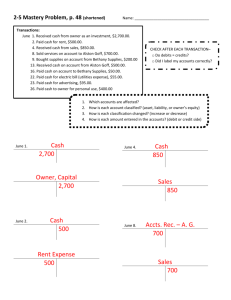

The Business Planning Process Business Planning and Execution Market Analysis- TAM, SAM and competitive environment How to keep score: A=L+OE Product Costing Building the Plan Measuring the Results The Business Process Start Up Capital, Friends and family, Angel investors Venture Capital, round 1, 2 and 3 Business structures – Prop.,LLP, Corp. A=L+OE The Business Plan – year to year Standard Cost Accounting The Marketing Plan Target market Market Size and trends Competition Estimated Market Share Marketing Strategy: Sales, Distribution, Pricing, Advertising and promotions. Marketing Challenge You are in the cell phone business. The TAM(Total Available Market) is $2 Billion in 2002 and your SAM(Share of the Available market) is 5 % each year. Your CAGR (Compound Annual Growth rate ) is projected to be 10% per year. The overall market is growing at 15% each year. What is your current dollar volume goal for 2003? Assets=Liabilities+Owners Equity Double entry Accounting- debits and credits. Assets: cash, inventory, accts Rec., Prepaids , Eqpt., Supplies, property Liabilities: AP’s, Notes Payable Owners’ Equity: Investment, retained earnings, Revenue and Expense accts. Balance Sheet, Income Statement, Cash Flow Statement Accounting Process Accounting Ledger and chart of accounts Trial Balance for EOP Income Closing Entries to period ( PPV, cutoff, inventory valuation changes). Performance vs. Budget or Plan. Double Entry Accounting – The Balance Sheet Assets Debit (+) Credit (-) Cash Accts Rec. Equipment Property = Liabilities + Owners Equity Debit (-) Credit (+) Accts Pyble Notes Pyble Bank Debt Other Debt Debit Credit (-) (+) Investment Retained Earnings Revenue &Expense A=L+OE Challenge $1000 is invested in your new company. Describe the balance sheet. ______= ______+________ You borrow $500 to expand further, describe the balance sheet. ______=______+_________ The company made a profit in year 1 of $100. Describe the balance sheet after year end. ______=______+_________ Terms to Know and Understand EBITDA- Earnings before Interest, Taxes, Depreciation or Amortization Income Statement- P&L- covers a period in time, Month, Quarter, or year Balance Sheet is a point in time picture of A=L+OE Cash Flow shows EBITDA and changes in working capital ( AR, AP, Inventory) for a period. Business Structures Proprietorship Limited Liability Partnership Subchapter S Corporation Corporation Public Company ( Corporation) SEC rules Outline of a Business Plan Executive Summary- Brief Highlights Company Description Product or Service Market Analysis Strategy and Implementation Management Team Financial Plan The Planning Process- Sales and Marketing Sales and marketing projects volume of sales by product by month or quarter. Also project price increases and declines. The timing of new product introductions is included. Changes to selling cost: additions /deletions to sales force, changes in commission structure. Product Costing- Variable Cost Material cost= standard quantity at standard cost. (adjust for usage variance at end of period). Labor cost= standard hours at standard rate. (adjust for rate variance and efficiency variance at end of period). Variable Overhead= absorb at standard rate per hour. (adjust for actual at end of period) includes indirect labor, utilities, supplies, etc. Fixed Cost- Overhead Building Lease or rent Salaries of all support staff ( typically excludes the “selling, general and administrative” cost.) Utilities, Inform. Systems cost including software leases. BreakEven Analysis Selling Cost per Unit less VC per unit= Contribution per unit Fixed Cost per month= rent, utilities, Salaries, taxes, insurance. FC divided by Contribution per unit =Units needed to Break even. Selling, General and Admin Cost is an additional Fixed Cost Category(S,G,&A). Breakeven Analysis Challenge Product A sells for $5 per unit. Variable cost is $3 per unit. Fixed Cost including S, G &A is $80,000 per year. What is the breakeven point? You just had a 10% price decline. Now what is breakeven point? BE Point= FC/Contribution per Unit Planning Process - Operations Converts sold units to a manufacturing plan by product line or process. Loads volume into a capacity plan by standard units or hours. Cost reduction process- Material purchasing( Part of supply chain mgmt.),material usage, labor cost, overhead. Capital expenditure plan to meet volume and cost goals. The Plan- Income Statement Sales by product by month= revenue. Variable cost of goods sold by month. Fixed cost of goods by month. Adjust for cost variance in M, L, OH.(in Actual not Plan) Gross Profit. S,G, and A. Operating Profit( sometimes EBITDA). Net Profit (after ITDA) by month. The Plan – Cash Flow Cash from Operations Changes in Working Capital- Inventory, Accounts Payable and Receivable and Capital Expenditures(Capex). Interest Cost Taxes due The Balance Sheet Point in time-End of Period Changes in Assets, Liabilities, and Owners equity as a result of funding, operations, etc. Defines borrowing capability and health of company in details. Business Plan Marketing Plan-“nothing happens until something is sold” Operating plan or budgets Cash Flow projection Knowing your cost Capital allocation- A limited resource Business Systems - Other Quality Systems. ( TQM, ISO, SPC) Information Systems ( client server, real time, web based). Human resources management. Global marketing – know the global competition first. Supply Chain management.( Partnering, Blanket PO’s, joint research, eqpt. Leases) Top Mistakes in Business Plans Too Long Unable to explain the market position well. Lack of Focus- “Swiss Army Knife” Plans Lack real world Market analysis No Business “ gauges” to monitor with. Unclear Business Model- How will you make money? Weak Team Formation