Drill 7-D1 Preparing an Income Statement From the work sheet

advertisement

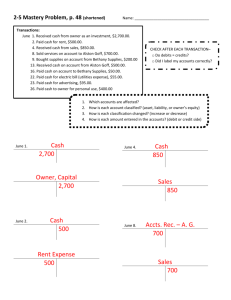

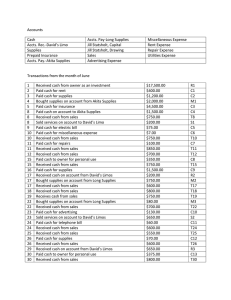

Drill 7-D1 Preparing an Income Statement From the work sheet below, prepare an income statement for The Sound of Stone. INSTRUCTIONS: Complete the following. 1. Total all columns of the work sheet 2. Calculate and record the amount of net income or net loss. 3. Using the form on the next page, prepare an income statement for the month ended September 30, 20--. 4. Calculate and record the component percentages for total expenses and net income. Round percentages to the nearest 0.1% 1 2 Trial Balance Account Title 1. Cash 2. Petty Cash 3. Accts. Rec.—HartCo 4. Accts. Rec.—Starlite Club 5. Supplies 6. Prepaid Insurance 7. Accts. Pay.—First Audio 8. Accts. Pay.—Office Supply Co. 9. Shannon Stone, Capital 10. Shannon Stone, Drawing 11. Income Summary 12. Sales 13. Advertising Expense 14. Insurance Expense 15. Miscellaneous Expense 16. Rent Expense 17. Supplies Expense 18. Utilities Expense 20. Debit Credit 3 4 Adjustments Debit 8,272 200 100 720 4,051 1,200 Credit 5 6 Income Statement Debit Credit 7 Debit Credit 8,272 200 100 720 1,487 1,100 2,564 100 1,360 20 10,000 1,360 20 10,000 600 600 4,411 4,411 273 100 10 250 2,564 115 8 Balance Sheet 273 100 10 250 2,564 115 Drill 7-D1 Preparing an Income Statement (continued) The Sound of Stone Income Statement For the Month Ended September 30, 20- % of Sales Revenue: Sales Expenses: Advertising Expense Insurance Expense Miscellaneous Expense Rent Expense Supplies Expense Utilities Expense Total Expenses Net Income Drill 7-D2 Preparing a balance sheet INSTRUCTIONS: From the work sheet in Drill 7-D1, prepare the September 30, 20-- balance sheet for The Sound of Stone using the form below. Assets Liabilities