www.pwc.lu/tax

Flash News

Luxembourg – New tax measures for

2013 – Clarification in relation to the

minimum corporate income tax

On 13 December 2012, the Luxembourg Parliament enacted bill n°6497 (the

“Tax Bill”), introducing new tax measures for corporations and individuals

that are effective as from tax year 2013. Please refer to our NewsAlert dated

17 December 2012 for further details in this respect.

Further to the numerous discussions held between the Government and

various stakeholders since the introduction of the draft tax bill, on

21 December the tax authorities issued further guidance as to how the

provisions in relation to the minimum corporate income tax are to be

interpreted, with a positive outcome for real estate owning companies.

27 December 2012

PwC welcomes this guidance, which re-affirms the willingness of the

Luxembourg Government to remain business-friendly despite the current

difficult economic environment in Europe, including in Luxembourg.

As a reminder, two different minimum corporate income taxes will apply as from tax

year 2013 as follows:

A minimum corporate income tax of EUR 3,000 (i.e., EUR 3,210 taking into

account the solidarity surtax) applicable to all corporate entities having their

statutory seat or central administration in Luxembourg, and for which the sum

of fixed financial assets, transferable securities and cash at bank exceeds 90%

of their total assets; and

A new minimum corporate income tax, ranging from EUR 500 to EUR 20,000

(increased by the solidarity surtax) depending on a company’s total assets,

applicable to all other corporations having their statutory seat or central

administration in Luxembourg, as follows:

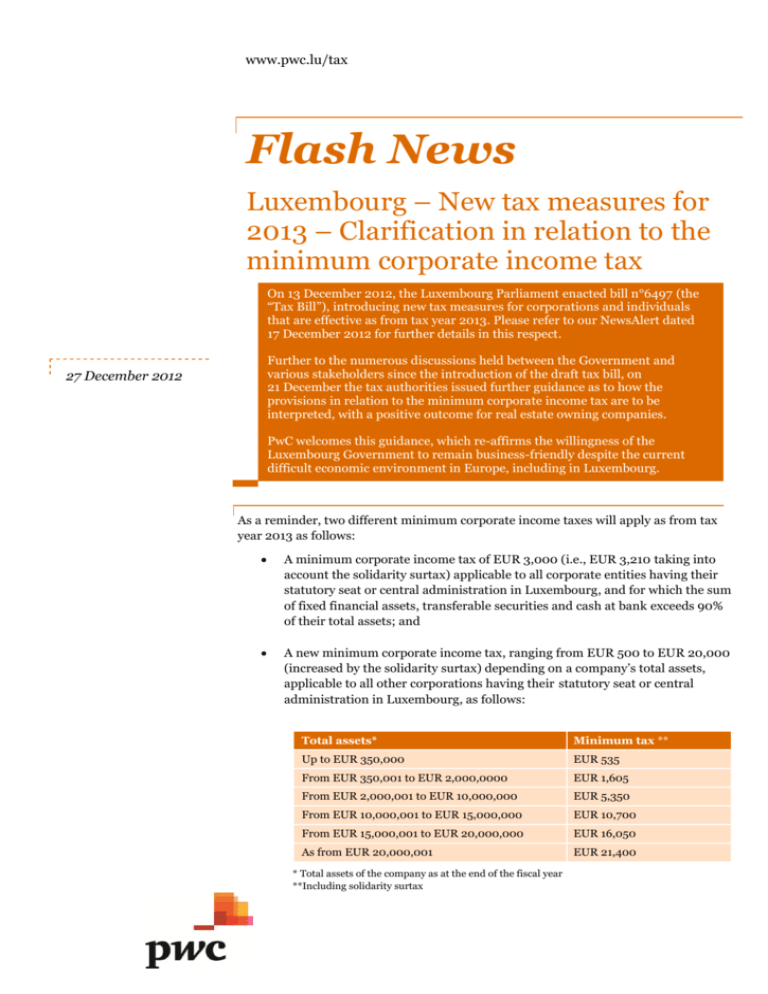

Total assets*

Minimum tax **

Up to EUR 350,000

EUR 535

From EUR 350,001 to EUR 2,000,0000

EUR 1,605

From EUR 2,000,001 to EUR 10,000,000

EUR 5,350

From EUR 10,000,001 to EUR 15,000,000

EUR 10,700

From EUR 15,000,001 to EUR 20,000,000

EUR 16,050

As from EUR 20,000,001

EUR 21,400

* Total assets of the company as at the end of the fiscal year

**Including solidarity surtax

To avoid breaches of EU Directives or tax treaties, and following an

amendment proposed by the Luxembourg Council of State, the Tax Bill already

provided that the minimum corporate income tax is to be considered as an

advance tax payment of any present or future corporate income tax that will be

due by the corporation. As an exception to article 154 of the Luxembourg

income tax law, this minimum corporate income tax will not be reimbursed to

the taxpayer.

The question of the compatibility of this minimum tax with double tax treaties

however remained open insofar as it concerned taxpayers only deriving

income which is excluded from the Luxembourg taxable basis due to the

allocation of taxation rights to the other Contracting State.

The debate is now closed as the tax authorities have issued an official

commentary (see their Newsletter dated 21 December 2012), in which they

have confirmed that the net value of assets whose taxation rights are

exclusively allocated to the other Contracting State of a double tax treaty

entered into by Luxembourg is not to be taken into account when determining

the total assets of the company.

This means notably that companies whose principal asset is a real estate

property located in a double tax treaty country should not be subject to the

EUR 21,400 minimum tax (assuming the value of the property exceeds EUR

20 million) but to a lower amount, as the value of their other assets should be

quite nominal.

This official interpretation is warmly welcomed both by the marketplace and

by practitioners, who, since the release of the draft bill in November, have

expressed major concerns about both the potential incompatibility of the new

provisions with double tax treaties and their major impact on the competitivity

of the Luxembourg marketplace. The publication of an official interpretation,

so shortly after the vote on the law, is therefore a positive sign that the

Government and the tax authorities remain open to responding to comments

expressed by stakeholders.

For more information, please contact your local PwC tax service provider or one of the

contacts below:

…………………………………………………………………………………………………………………….

Wim Piot

Partner

+352 49 48 48 5773

wim.piot@lu.pwc.com

Fabien Hautier

Partner

+352 49 48 48 3178

fabien.hautier@lu.pwc.com

…………………………………………………………………………………………………………………….

…………………………………………………………………………………………………………………….

PwC Luxembourg (www.pwc.lu) is the largest professional services firm in Luxembourg with 2,200 people employed from 57 different countries. It provides audit, tax and

advisory services including management consulting, transaction, financing and regulatory advice to a wide variety of clients from local and middle market entrepreneurs to

large multinational companies operating from Luxembourg and the Greater Region. It helps its clients create value they are looking for by giving comfort to the capital markets

and providing advice through an industry focused approach.

The global PwC network is the largest provider of professional services in audit, tax and advisory. We’re a network of independent firms in 158 countries and employ more

than 180,000 people. Tell us what matters to you and find out more by visiting us at www.pwc.com and www.pwc.lu.

This publication has been prepared for general guidance on matters of interest only, and does not constitute professional advice. You should not act upon the information

contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of

the information contained in this publication, and, to the extent permitted by law, PricewaterhouseCoopers, Société coopérative, its members, employees and agents do not

accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in

this publication or for any decision based on it.

© 2012 PricewaterhouseCoopers, Société coopérative. All rights reserved.