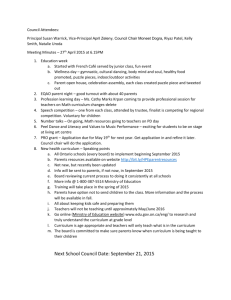

Econ 850 Reading List

advertisement

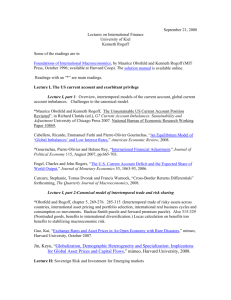

Econ 850 Reading List 1. Exchange Rates Basics *Lucas, Robert E, Jr., 1982, “Interest Rates and Currency Prices in a Two-Country World,” Journal of Monetary Economics, Vol. 10 (3). p 335-59. The first half of the paper develops a simple model with complete markets Meese, and Rogoff, (1983) “The out of sample failure of empirical exchange rate models,” in: J.A. Frenkel, ed., Exchange rates and international macroeconomics (University of Chicago Press, Chicago), chapter 3 *Meese, and Rogoff, (1983) “Empirical Exchange Rate Models of the Seventies: Do They Fit Out of Sample?” Journal of International Economics 14, 3-24. *Mark, N., (1995) “Exchange rates and Fundamentals: evidence on long-horizon predictability,” American Economic Review, March, 201-218 Mark, N. C., and Sul, D. (2001) “Nominal Exchange Rates and Monetary Fundamentals: Evidence from a Small Post-Bretton Woods Panel,” Journal of International Economics 53, 29-52. +Engel, C. and K. West (2005) “Exchange Rates and Fundamentals,” Journal of Political Economy 113, 485-517. +Mark, N. C. (2005) “Changing Monetary Policy Rules, Learning, and Real Exchange Rate Dynamics,” NBER Working Paper 11061. 2. International Business cycles and Exchange Rates Baxter, Marianne, 1996, International Trade and Business Cycles, HB Chapter 35. also in National Bureau of Economic Research Working Paper: 5025. *Backus, David K; Kehoe, Patrick J; Kydland, Finn E., 1992, “International Business Cycles: Theory and Evidence,” Journal of Political Economy 100, 745-75. Also in Cooley, Frontiers of Business Cycle Research. Two-country RBC model explains investment and CA dynamics… +Baxter, M. and M. Crucini (1993) “Explaining Savings-Investment Correlations,” American Economic Review 83, 416-36. An application of the RBC approach to the Feldstein-Horioka puzzle. *Mendoza, E., “Real Business Cycles in a Small Open Economy: The Canadian Case,” AER 1991. +Stockman, Alan C. and Tesar, Linda L., 1995, Tastes and Technology in a Two-Country Model of the Business Cycle: Explaining International Comovements, American Economic Review. Vol. 85 (1). p 168-85. March … but can standard RBC models explain consumption behavior?… 3. Forward Premium Puzzle Karen Lewis, Puzzles in International Finance, HB 1913-1949. *Engel, C. (1996) “The Forward Discount Anomaly and the Risk Premium: A Survey of Recent Evidence,” Journal of Empirical Finance 3, 123-192. Backus, David K; Gregory, Allan W; Telmer, Chris I., 1993, Accounting for Forward Rates in Markets for Foreign Currency,. Journal of Finance. Vol. 48 (5). p 1887-1908. December *Dave Backus, Silverio Foresi Telmer Chris, 2001, “Affine Term Structure Models and the Forward Premium Anomaly,” Journal of Finance 56, 279-304. Fama, Eugene, (1984) Forward and Spot Exchange Rates, Journal of Monetary Economics, 14, 319-338. Bansal, R. (1997) “An Exploration of the Forward Premium Puzzle in Currency Markets,” Review of Financial Studies 10, 369-403. Bansal, R., and M. Dahlquist (2000) “The Forward Premium Puzzle: Different Tales from Developed and Emerging Economies,” Journal of International Economics 51, 115-144. *Alvarez, Fernando, Andy Atkeson and Pat Kehoe, 2002, “Money, Interest Rates, and Exchange Rates with Endogenously Segmented Markets,” Journal of Political Economy 110, 93-112. *Bacchetta, P. and E. Wincoop (2005) “Rational Inattention: Solution to the Forward Discount Puzzle,” NBER 1163. +Frankel & Poonawala (2006) "Forward Market in Emerging Currencies: Less Biased then in Major Currencies" NBER Working paper 12496 +Burnside, Eichenbaum, Kleschchelski and Rebelo (2006) "The Returns to Currency Speculation" NBER Working paper 12489. 4. Purchasing Power parity deviations: goods markets imperfections. +*Rogoff, K., 1996, “The Purchasing-Power Parity Puzzle,” Journal of Economic Literature, 34, 647-668. +Engel, C., 1999, “Accounting for US real Exchange Rate Changes,” Journal of Political Economy, 107, 507-538. 5. Empirical asset pricing *Harvey, C., 1991, “The World Price of Covariance Risk,” The Journal of Finance, 111-158. *Dumas, B. and B. Solnik, 1995, "The World Price of Foreign Exchange Risk," The Journal of Finance, 50, 445-479. Ferson, W. and C. Harvey, 1993, “The Risk and Predictability of International Equity Returns,” Review of Financial Studies, 527-566. De Santis, G. and B. Gérard, 1997, “International Asset Pricing and Portfolio Diversification with Time-varying Risk,” Journal of Finance, 52, 1881-1912. 5. Segmentation/ Limited Participation / Home country bias 5.1. Home bias puzzle Tesar, I. And I. M. Werner, 1995, “Home Bias and High Turnover,” Journal of International Money and Finance. *Lewis, K., 1999, "Trying to Explain Home Bias in Equities and Consumption," Journal of Economic Literature, XXXVII, 571-608. 5.2. International Consumption Puzzle +Lewis, K., 1996, "What Can Explain the Apparent Lack of International Consumption RiskSharing?" Journal of Political Economy, 104, 267-297. 5.3. International Risk Sharing *Obstfeld, M., 1994, "Risk Taking, Global Diversification and Growth," American Economic Review, 84, 1310-1329. +Lewis, K. "Why do stocks and consumption imply such different gains from international risksharing," Journal of International Economics 52, 2000, pp. 1-35. Devereux, M. and G. Smith, “International Risksharing and Economic Growth,” IER Stulz, R., 1999, “Globalization of Equity Markets and the Cost of Capital,” working paper, Ohio State University. 6. Alternative Approach 6.1. Sticky price models *Chari, V V, Kehoe, Patrick J, McGrattan, Ellen R., 2002, Can Sticky Price Models Generate Volatile and Persistent Real Exchange Rates, The Review of Economic Studies *Betts, Caroline; Devereux, Michael B., 1996, “The Exchange Rate in a Model of Pricing-to-Market,” European Economic Review Vol. 40 (3-5). p 1007-21. April 6.2. New Open Macro Model *Obstfeld and Rogoff, “Exchange Rate Dynamics Redux, JPE 1995. +Obstfeld and Rogoff, “The six major puzzles in international macroeconomics: Is there a common cause?” NBER Working Paper 7777, 2000. +Debreux, M., and C. Engel (2002) “Exchange Rate Pass Through, Exchange Rate Volatility, and Exchange Rate Disconnect,” Journal of Monetary Economics 49, 913-40. 6.3. Information and Exchange Rate Bacchetta, P. and E. Wincoop (2004) “Scapegoat Model of Exchange Rate Fluctuations,” American Economic Review 94, 114-8. Bacchetta, P. and E. Wincoop (2005) “Can Information Heterogeneity Explain the Exchange Determination Puzzle?” American Economic Review, forthcoming 7. Exchange Rate Regimes *Frankel, J. (2003) “Experience of and Lessons from Exchange Rate Regimes in Emerging Economies,” NBER Working paper 10032. Levy-Yetani and Strurzennegger (2003) +Dubas, Lee and Mark (2005) 8. Crises/Contagion Morris, S. and H. S. Shin, 1998, “Unique Equilibrium in a Model of Self-Fulfilling Currency Attacks,” American Economic Review, 88, 587-597. +Allen, F. and D. Gale, 2000, "Financial Contagion," Journal of Political Economy, 108, 1-33. +Bae, Karolyi, and Stulz (2003) "A New Approach to Measuring Financial Contagion," Review of Financial Studies 16, 717-63. 9. Global Imbalances +Prasad, E. S., K. Rogoff, S-J. Wei, and M. A. Kose (2003) Effects of Financial Globalization on Developing Countries: Some Empirical Evidence, International Monetary Fund Occasional Paper 220. IMF (2005) World Economic Outlook: Globalization and External Balances. Bernanke, B., 2005, “The Global Saving Glut and the U.S. Current Account Deficit,” Sandridge Lecture, Virginia Association of Economics, Richmond, Virginia, Federal Reserve Board. Dooley, M., D. Folkerts-Landeau, and P. Garber, 2003, “An Essay on the Revised Bretton Woods System,” NBER Working Paper 9971. +Obstfeld, M., and K. Rogoff, 2005, “Global Current Account Imbalances and Exchange Rate Adjustments,” Brookings Papers on Economic Activity 1, 67-146. Ricardo J. Caballero, Emmanuel Farhi and Pierre-Olivier Gourinchas, 2006, “An Equilibrium Model of "Global Imbalances" and Low Interest Rates”