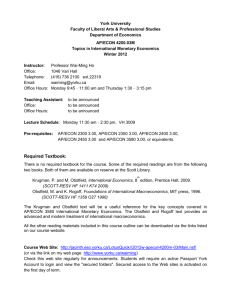

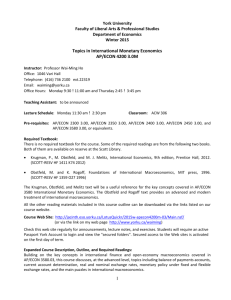

Economics 2010c

advertisement

September 21, 2008 Lectures on International Finance University of Kiel Kenneth Rogoff Some of the readings are in Foundations of International Macroeconomics, by Maurice Obstfeld and Kenneth Rogoff (MIT Press, October 1996; available at Harvard Coop). The solution manual is available online. Readings with an “*” are main readings. Lecture I, The US current account and exorbitant privilege Lecture I, part 1: Overview, intertemporal models of the current account, global current account imbalances. Challenges to the canonical model. *Maurice Obstfeld and Kenneth Rogoff, The Unsustainable US Current Account Position Revisited”, in Richard Clarida (ed.), G7 Current Account Imbalances: Sustainability and Adjustment University of Chicago Press 2007. National Bureau of Economic Research Working Paper 10869, “ Cabellero, Ricardo, Emmanuel Farhi and Pierre-Olivier Gourinchas, “An Equilibrium Model of ‘Global Imbalances’ and Low Interest Rates,” American Economic Review, 2008. *Gourinchas, Pierre-Olivier and Helene Rey, “International Financial Adjustment,” Journal of Political Economy 115, August 2007, pp.665-703. Engel, Charles and John Rogers, “The U.S. Current Account Deficit and the Expected Share of World Output,” Journal of Monetary Economics 53, 1063-93, 2006. Curcuru, Stephanie, Tomas Dvorak and Francis Warnock, “Cross-Border Returns Differentials” forthcoming, The Quarterly Journal of Macroeconomics, 2008. Lecture I, part 2:Canonical model of intertemporal trade and risk sharing *Obstfeld and Rogoff, chapter 5, 269-276. 285-315 (Intertemporal trade of risky assets across countries, international asset pricing and portfolio selection, international real business cycles and consumption co-movements. Backus-Smith puzzle and forward premium puzzle). Also 315-329 (Nontraded goods, benefits to international diversification.) Lucas calculation on benefits ton benefits to stabilizing macroeconomic risk. Guo, Kai, “Exchange Rates and Asset Prices in An Open Economy with Rare Disasters,” mimeo, Harvard University, October 2007. Jin, Keyu, “Globalization, Demographic Heterogeneity and Specialization: Implications for Global Asset Prices and Capital Flows,” mimeo, Harvard University, 2008. Lecture II: Sovereign Risk and Investment for Emerging markets Lecture II, part 1: Theory of sovereign risk *Obstfeld and Rogoff, chapter 6, 379-401, 407-419 *Bulow, Jeremy and Kenneth Rogoff, “Sovereign Debt: Is to Forgive to Forget?” American Economic Review 79 (March 1989), 43-50. Michael Kremer and Seema Jayachandran), “Odious Debt,” American Economic Review 96 (March 2006), 82-92. Lecture II, part 2: Empirics *Reinhart, Carmen and Kenneth Rogoff, “This Time Is Different: A Panoramic View of Eight Centuries of Financial Crises,” manuscript, Harvard University, March 12, 2008. Also available as NBER working paper 13882, March 2008. Lecture III: Bank Runs and Speculative Exchange Rate Attacks Lecture III, part 1 Bank Runs and the Persistence of the Great Depression *Diamond, Douglas and Philip H. Dybvig, "Bank Runs, Deposit Insurance, and Liquidity." Journal of Political Economy 91(3): 401-19, June 1983. *Bernanke, Ben, “Nonmonetary Effects of the Financial Crisis in the Propagation of the Great Depression,” American Economic Review 73 (June 1983): 257-76. Also: International transmission of the Great Depression via faults in the inter-war gold standard. Obstfeld and Rogoff: pp. 626-630. Eichengreen, Barry and Jeffrey Sachs, “Exchange Rates and Economic Recovery in the 1930s,” Journal of Economic History, vol. XLV, no. 4, December 1985, also NBER working paper 1498 May 1986. Lecture III, part 2: Speculative Attacks on Exchange Rates *Obstfeld and Rogoff, chapter 8.pp. 526-530, 538-547, 554-569, chapter 9, 648-653. *Stephen Morris and Hyun Song Shin, "Unique Equilibrium in a Model of Self-Fulfilling Currency Attacks," American Economic Review 88 (June 1998), 587-97. Atkeson, Andrew, “Comment,” in NBER Macroeconomics Annual 2000 (Ben Bernanke and Kenneth Rogoff, eds.), MIT Press. Hellwig, C., A. Mukherji and Aleh Tsyvinski, “Self-fulfilling Currency Crisis: The Role of Interest Rates", American Economic Review. (2006) vol. 96, no.5. Roberto Chang and Andres Velasco, “A Model of Financial Crises in Emerging Markets, Quarterly Journal of Economics 116(2) 2001, 489-517. Lecture IV: empirics of capital market integration and exchange rates Lecture IV, part 1: Capital market integration in practice *Maurice Obstfeld and Kenneth Rogoff "The Six Major Puzzles in International Macroeconomics: Is there a Common Cause?" , in Ben Bernanke and Kenneth Rogoff (eds.), NBER Macroeconomics Annual 2000 (Cambridge: MIT Press). 339-390. The Feldstein-Horioka paradox, the consumption correlations paradox, the home bias puzzle, the PPP puzzle and others. *Kose, Ayhan, Eswar Prasad, Kenneth Rogoff, and Shang-Jin Wei, “ Financial Globalization, A Reappraisal”, December 2006 (revised version of International Monetary Fund, Working Paper WP/06/189, August 2006). “ Aguirre, Mark and Gita Gopinath, Emerging Market Business Cycles: The Cycle is the Trend Journal of Political Economy, February 2007, Volume 115(1). Lecture IV, part 2: Exchange Rate Modelling Chen, Yu-chen, Kenneth Rogoff and Barbara Rossi, “Can Exchange Rates Forecast Commodity Prices?” National Bureau of Economic Research Working Paper, March 2008. Rogoff, Kenneth and Vania Stavrakeva, “The Continuing Puzzle of Short-Horizon Exchange Rate Forecastings,” NBER Working Paper 14071, June 2008. Engel, Charles, Nelson Mark and Kenneth West, "Exchange Rate Models are Not as Bad as You Think," (including comment by Kenneth Rogoff.) forthcoming in Daron Acemoglu, Kenneth Rogoff, and Michael Woodford (eds.) NBER Macroeconomics Annual 2007 (Chicago: University of Chicago Press, 2008)